India paves way for Apple, others to increase domestic production by removing a clause

Govt has dropped irritants from its PLI scheme, paving way for phone-makers to ramp up production in India.

by Anandita Singh Mankotia

The government has dropped contentious clauses including the evaluation of plant and machinery to be brought from China and South Korea, which had been opposed mainly by Apple, paving the way for the iPhone maker and others like Samsung, Foxconn, Oppo, Vivo, and Flextronics to make a larger play in local production using the production-linked incentive (PLI) scheme.

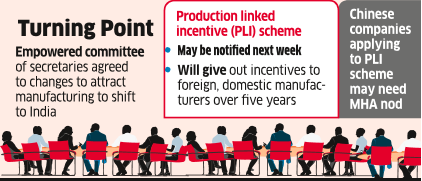

“The empowered committee of secretaries met on Friday and decided to remove the clause, which evaluated plant and machinery brought into India at 40% of its value, and has agreed to a few other changes so that manufacturing could shift to India in a big way,” an official aware of the discussions at the meeting told ET.

ET had reported in its May 11 edition that Apple through its contract manufacturers Wistron and Foxconn could shift a significant portion of its manufacturing facility to India under the proposed PLI scheme. However, the iPhone manufacturer had raised concerns regarding certain clauses, including valuation of plant and machinery with the government. The government is also in discussions with a third Apple contract manufacturer, Pegatron, to relocate part of its manufacturing to India, the official said.

“The irritants have been resolved,” the official added. Through the scheme, India is trying to attract American investment with pressure on US companies now to diversify manufacturing out of China under the ‘China plus one strategy’.

Among the changes agreed to on Friday were to include the industry in discussions before making any changes to the PLI scheme once these companies have invested and started producing in the country. “Earlier, a clause permitted only the empowered committee to be able to unilaterally change the rules but investors had voiced concerns with this clause,” the official said.

The other changes made include removal of various caps, including another clause which said the government would release the incentive despite the industry meeting its targets only if it had the money to do so. Instead, a clause on force majeure, which permits the companies to seek relief from the targets in time of natural calamities such as Covid-19, has been added.

The government hopes to attract large-scale smartphone manufacturing to India and raise exports out of India to over $100 billion by 2025 from under $3 billion right now.

“Also, the proposed investors had raised concerns on the excessive business information sought by the government, which has been further watered down,” the official said.

The official added that depending upon the production targets achieved by the companies in subsequent years, the government could alter the benefits depending upon the performance of companies.

To avail the graded incentives ranging between 4% and 6% over a five-year period, foreign manufacturers will have to produce high-end phones (with freight on board value of more than $200) of more than Rs 4,000 crore over and above their production level in the base year.

In the second, third, fourth and fifth years, manufacturers will have to produce phones worth Rs 8,000 crore, Rs 15,000 crore, Rs 20,000 crore and Rs 25,000 crore over the base year production value to avail the incentives.

The scheme, which is likely to be notified next week, will give out incentives to both foreign as well as domestic manufacturers over a period of five years. While the eligibility for foreign investors as well as domestic investors varies, a total of Rs 40,951 crore has been earmarked as incentives for companies, which achieve the production and minimum incentive targets.