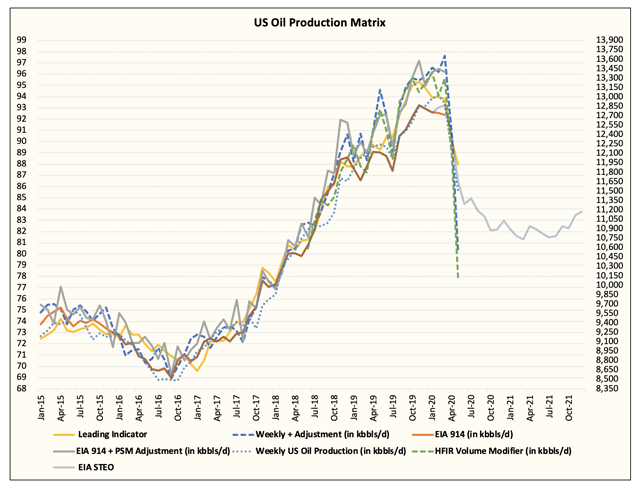

U.S. Oil Production Rebound Off The Lows With May To Average 10 Mb/D

by HFIRSummary

- Shut-in oil production will start to return in June as producers receive better pricing.

- May production is likely to average somewhere around ~10 mb/d.

- Q3 2020 will see US oil production gradually decline as a lack of activity in Q2 will eat into existing production base.

- If our oil price projection pans out, US oil production should be able to recover ~11 mb/d by Q4.

- Balancing point for the market will be 13.5 mb/d US oil production, which is quite a ways off considering we would need to see 400+ frac spread count again.

Welcome to the US oil production edition of Oil Markets Daily!

As WTI stays above $30/bbl, more and more US shale producers will start turning back on the taps. For the time being, we don't actually believe producers have restarted wells, but instead have started selling down inventories from storage. Because of the way EIA is top-heavy in the way it calculates storage and all other aspects of its weekly report (e.g. only collecting 90% of the data, and ignoring the remaining 10%), it can easily overlook producer level storage which is very minimal at best.

And as producers start selling down storage, we should see implied US oil production volume pick-up. Similarly, when producers were stockpiling up their storage, implied US oil production may have dipped lower than actual levels.

Source: EIA, HFI Research

High-frequency data suggest US oil production has already started to recover back above ~10 mb/d. The current level is around ~10.3 mb/d, and we expect this to gradually pick-up in the coming weeks.

US oil production could average closer to 10.5 mb/d in June with July averaging back closer to 11.3 to 11.5 mb/d.

The trajectory after that will depend a lot on how oil prices react to production restarting. By our estimate, if WTI averages $52.50 in Q3, then we expect US oil production to decline only slightly to 10.5 mb/d from the lack of drilling. And in Q4, we are expecting $65/bbl WTI, which should see producers complete wells and drive production back to ~11 mb/d.

The market being the discount machine will start assessing the trajectory of the oil market balance by watching closely on US oil production recovery. The figure to watch will be ~13.5 mb/d US oil production. What we mean by this is that this is likely a balancing point for the market, so anything below that, the market will keep driving higher oil prices until it believes US oil production will grow back to that level.

Unfortunately for the market, we don't see a scenario where US oil production could reach its previous peak, not unless frac spread count skyrockets back to 400, which will take a considerable amount of time. If any past layoffs in the energy sector have been an indicator, the time it takes to ramp back up completion crews will take 18 months at a minimum.

Not to mention by the time US shale does start drilling and completing new wells to boost production, the global conventional production decline from the last 6 years of malinvestments will eat away any growth delta.

We think the market will more likely test the demand ceiling (via price-driven demand destruction) than incentivize supply growth.

Over the weekend, we published our global oil supply and demand outlook. We see a major deficit taking shape for 2021 and 2022 in the oil market. Our oil price projection along with our supply and demand model suggests very good days ahead for the energy industry. For those interested, we are now offering a 2-week free trial for you to see for yourself. See here for more info.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.