The Wet AMD Gene Therapy Race - Adverum Biotechnologies Vs. Regenxbio

by Sage AdvisorsSummary

- RGNX and ADVM are both developing gene therapy products to treat wet AMD.

- Wet AMD is a serious disease that can cause blindness. The market for treatments is expected to grow to $10 billion by 2024.

- RGNX stock is valued as if RGX-314 will be an inferior product, and ADVM is valued for perfection.

- Data available currently is Phase I/IIa data with small cohorts of patients, making it difficult to ascertain the efficacy profiles.

Regenxbio (NASDAQ:RGNX) and Adverum (NASDAQ:ADVM) are both developing gene therapies for wet AMD. Phase I data is now available that shows both companies may have viable products. It is still very early, and small cohorts make it challenging to evaluate whether RGX-314 or ADVM-022 will be superior. Adverum's stock is priced as if it will deliver a product that is far superior to Regenxbio's. That outcome is far from certain. Investors should consider that Regenxbio's stock provides a wide margin of safety while offering tremendous upside if future data is positive.

Wet age-related macular degeneration, wet AMD, usually occurs in the elderly and accounts for 90 percent of the cases of legal blindness. In this condition, abnormal blood vessels in the retina begin to leak fluid. This results in scarring of the macula and vision loss. Symptoms include wavy, spotted or blurred vision. According to the Mayo Clinic, medications may help stop the growth of new blood vessels by blocking the effects of growth signals the body sends to generate new blood vessels. A protein called VEGF causes these abnormal blood vessels to grow. The current treatments are injections of anti-VEGF proteins into the eye which stop the growth of new blood vessels. These injections are required every four to eight weeks, and patients tend not to adhere to this difficult schedule and thus suffer vision loss.

These drugs are considered the first line treatment for all stages of wet macular degeneration. The most commonly prescribed injections are Avastin (Genentech) (OTCQX:RHHBY), Lucentis (Genentech) and Eylea (Regeneron (REGN)). A longer acting version that can last 12 weeks, brolucizumab, was approved in 2019, but it may cause occlusive retinal vasculitis, a rare but serious complication that can cause vision loss, which may make ophthalmologists hesitant to use it.

Wet AMD is a disease where the biology is well understood. More specifically, it is well understood that anti-VEGF proteins such as Avastin, Lucentis and Eylea are effective at preventing these "bad blood vessels" from growing. There is extensive proof that if you maintain anti-VEGF activity in the eye, which gene therapy seeks to achieve, you can prevent a loss of vision in wet AMD. Both Regenxbio and Adverum have gene therapy candidates in clinical trials which seek to provide a consistent level of anti-VEGF activity.

Wet AMD is not thought to be caused by a genetic defect but a one time gene therapy injection can provide a treatment option. This involves inserting a transgene, which would produce the anti-VEGF proteins, into a viral vector which can be delivered to the eye. The result is that the eye turns into a factory that produces the needed protein. Since the cells in the eye make their own protein, patients have no need or a reduced need for repeated injections. The goal is for these treatments to be durable enough to last a lifetime and reduce the enormous treatment burden of requiring frequent injections. A report in Science Daily, citing the American Academy of Ophthalmology as their source, noted that researchers believe that, "It's not just about convenience; a more consistent treatment may also help people keep more of their vision." Gene therapy seeks to achieve this by delivering a steady daily dose of anti-VEGF.

Globally, $10 billion is expected to be spent on treatments for this disorder by 2024. There are more than 1.2 million patients with wet AMD in the US and a total of 3 million globally. There is a large market opportunity for both players, but it is important to note that gene therapy is unlikely to take over the entire market as there are long acting anti-VEGF treatments in clinical trials that may also reduce the treatment burden. In addition, patients may have the option of a port delivery systems that can be refilled. Given these potential options, gene therapy may take a large market share, but it is unlikely to be one hundred percent of the market. According to Dr. Peter Campochiaro, MD, Director of the Retinal Cell and Molecular Laboratory at Johns Hopkins, who is a RGX-314 investigator, the main competitor to gene therapy will be ports.

RGX-314 vs ADVM-022 - The Basics

Regenxbio has their own internal pipeline, including RGX-314 in the treatment of wet AMD. In an article published in Retina Today, Drs. Allen Ho and Robert Avery describe the nature of the treatment.

"RGX-314 is a non-replicating, recombinant AAV serotype 8 (AAV8) vector encoding for a soluble anti-VEGF Fab protein, which binds to retinal pigment epithelial cells to produce a therapeutic anti-VEGF protein. The gene encodes for an anti-VEGF fragment of an antibody that is similar to ranibuzumab."

Simply put, RGX-314 is a harmless virus which will direct the eye to produce an anti-VEGF medication, which is similar to an FDA approved drug.

Regenxbio has been using subretinal injections which require a surgical procedure in their Phase I studies to date. Going forward, they will also concurrently be testing a micro injector that targets the suprachoroidal space. This approach is being tested based on research done at Johns Hopkins that indicates that this approach, which could be done in the office, could be equally effective. From the physician and patient's standpoint, an in-office delivery would be superior to a surgical procedure.

Regenxbio is licensing the micro injector for suprachoroidal injections from Clearside Biomedical (CLSD) and will begin testing it in a Phase II trial of RGX-314. Regenxbio will be advancing both the subretinal and suprachoroidal approach into Phase II during the second half of 2020. In an article published in Molecular Therapy, researchers noted differences in the cells that have shown transduction depending on the route of administration.

"We found that suprachoroidal AAV8 delivery produced diffuse, peripheral transduction of mostly RPE, while subretinal injection using transscleral microneedles led to a robust, but localized area of gene transfer to multiple retinal cell types."

An article written by Peter Campochiaro, MD of Johns Hopkins noted that,

"Total transgene expression after a single suprachoroidal injection of AAV8 vector is comparable to that seen after subretinal injection of the same vector dose, and can be increased by multiple suprachoroidal vector injections."

This research supports that the more convenient suprachoroidal administration can be effective at producing the needed protein. Clearside Biomedical has a product through Phase 3 trials that validates the efficacy of suprachoroidal administration.

Adverum has a competing gene therapy product in the clinic. According to the company,

"ADVM-022 uses a proprietary capsid (AAV.7m8) to deliver a proprietary expression cassette which expresses aflibercept. ADVM-022 is administered as a single intravitreal injection and is designed to minimize the treatment burden of repeated anti-VEGF injections."

This gene therapy can be a straightforward one time injection which can be performed in the office. According to Dr. David Brown of Baylor College of Medicine, some studies show aflibercept is probably the best drying agent. However, intravitreal injections of AAVs can have negative side effects. Research published in the journal Molecular Therapy noted that

"Intravitreal AAV causes more intraocular inflammation and elicits a more potent humoral immune response than does subretinal administration."

This inflammation has been managed with oral and topical steroids which have not been required thus far for patients receiving RGX-314.

Regenxbio and Adverum are using different AAV's, different methods of administration and different transgenes. The transgenes used in RGX-314 and ADVM-022 differ in which anti VEGF protein they deliver. In a clinical study of 965 eyes that compared aflibercept (ADVM-022's transgene) to ranibizumab (RGX-314's transgene), they were equally effective in wet AMD. Therefore, it is likely both transgenes are equally effective.

Progress

Regenxbio has released two year data on cohorts 1-3 showing safety and efficacy as well as the durability of the treatment. They have dosed all 5 cohorts but long term data is not yet available for cohorts 4 and 5. Adverum has data out to 64 weeks for their first two cohorts and has early data on cohort 3. The last group, cohort 4, was recently dosed. These Phase I/IIa studies are two years in length so Regenxbio has the lead by at least 10 months. Should both treatments show efficacy and safety, RGX-314 is likely to be first to market.

Physicians often use a new product which is first in its class and become comfortable with the risks, benefits, side effects and administration. Unless there is a perception that other products of the same class offer a benefit, they often continue to use the first in class product. If RGX-314 proves to have a favorable profile, the first to market advantage will be significant. It should be acknowledged that gene therapy may be slightly different as these are one time administration products and physicians may wait if they believe a product (such as ADVM-022) that is coming soon will be superior.

Data comparison in the need for rescue injections

Adverum reported that 14/17 patients have not needed rescue injections reflecting an impressive 82 percent rescue free injection rate for patients in cohorts 1-3.

For Regenxbio's cohorts 1 and 2, the dosage used appears to be suboptimal, so it is logical they would not choose these doses going forward. The doses in Cohort 3-5 appear to be more effective. Cohort 3 had 4/5 patients rescue free if you remove data from a patient who had a procedure that failed to deliver a full dosage of the drug. Another patient who initially required rescue injections but later became rescue free can be considered a responder in this cohort. Cohort 4 had 5/12 patients rescue free and cohort 5 currently has 8/11 patients rescue free. The overall rescue free rate for Regenxbio's cohorts 3-5 is 17/28 or only 61 percent.

Adverum's data is clearly better in terms of the number of patients who did not require rescue injections, 82% vs 61%. Adverum had less stringent criteria for when a rescue injection can be given - the loss of 10 letters due to fluid rather than 5 letters which Regenxbio used. Adverum previously guided that no patient would have required rescue injections had the criteria been 5 letters. If larger studies replicate these rescue free rates, it is questionable whether RGX-314 will be competitive.

Some of this differential in the percentage of patients requiring rescue injections could be due to the variability in response to anti-VEGF therapy between individual patients. Dr. Charles Wykoff of Retina Consultants of Houston commented on this variability. Dr. Wykoff noted that

"it's rare to find an individual who has no response to anti-VEGF therapy." However, "a significant number of wet AMD patients are recalcitrant," "We inject them repeatedly, but they continue to show fluid. However, that's not the same as being a 'non responder.'"

In Regenxbio's cohort, 4 only 5/12 patients were rescue free. Some of these patients may be what Dr. Wykoff calls recalcitrant in that even though they have high anti-VEGF protein levels, they still have fluid. The high protein levels in this cohort would support that these particular patients may be very difficult to "dry out." Given that the protein levels were higher in cohort 4 than 3, and cohort 3 patients had an 80 percent rescue free rate, this seems to support that patients in cohort 4 had a very high anti-VEGF demand.

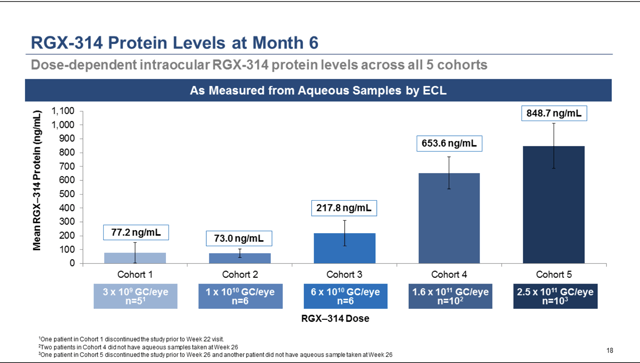

Figure 1: Regenxbio Corporate Presentation

For some patients, gene therapy may be a one time solution. For others, gene therapy may be an adjunctive therapy that reduces the number of injections. The fact that some patients will still need injections will likely be a subject insurers wish to discuss when considering pricing.

Data comparison in BCVA

Adverum has data for 3 cohorts which included a total of 21 patients at two doses. Of those twelve patients for whom there is at least one year data, only 3 of the 12 had any improvement in BCVA. Looking at the individual data for BCVA gives us a clearer picture. BCVA through December 1, 2019, for Cohort 1 was: +7, -6, -7, +5, -2, -3. BCVA for Cohort 2 was -4, -1, -19, -14, -7, +16. For patients who required very few rescue injections, this is disappointing data for visual acuity. Cohort one and two lost 2.7 and 2.8 letters, respectively, at the last update provided. Short-term results (up to 20 weeks) for cohort 3 showed an increase of 6.8 letters. The lack of individual patient data makes it hard to assess whether the general trend was an improvement in visual acuity. If you average this across all cohorts, there is approximately a 1.3 letter improvement. Cohort 2 and 3 used the same dosage but Cohort 3 used topical steroid drops rather than oral steroids so perhaps this accounts for the improvement in BCVA. Although cohort 3's data is greatly improved in comparison to cohorts 1 and 2, it remains an unanswered question whether Phase II patients will show a similar improvement in vision.

Regenxbio took the approach of 5 cohorts with increasing dosages. For cohort 3, in considering BCVA figures, it is reasonable to remove results from a patient who had a procedure error and did not receive a full dosage of the study drug. That leaves 5 patients with BCVA changes of (+32, +17, +6, +7 and +25). Cohort 4 for which Regenxbio has not released individual patient data had a BCVA improvement of +2 for the twelve patients. The lack of individual patient data makes it hard to assess whether the general trend was an improvement in visual acuity. Early data from Cohort 5 showed that responders saw a +5 letter improvement in BCVA. Combining the Regenxbio data from Cohorts 3-5, with the limitation that we don't have BCVA for those who required rescue injections in cohort 5, gives an approximately +6 letter improvement.

The general trend is that BCVA is superior for RGX-314 when compared to ADVM-022. Visual acuity data for RGX-314 more closely parallels what is seen with the standard of care treatments. Studies of the standard of care drugs such as ranibizumab (RGX-314 transgene) showed a +7.2 mean letter change in BCVA after a year. The same study found that aflibercept (ADVM-022 transgene) produced a +4.9 mean change in BCVA letter score. For context, Adverum's data on BCVA (+1.34 letters) is worse than the data from standard of care studies. Most studies show a maximum of 8-11 letter improvement for wet AMD patients treated with anti-VEGF medications. In this context, Adverum's 1.3 letter improvement is concerning.

It is also possible that some of Adverum's patients fall into the category some retinal specialists call "treatment disappointments," where the fluid is removed but patients fail to have any improvement in vision. Given the small number of patients, it is difficult to extrapolate whether this trend in visual acuity would persist in studies with a large number of patients. Another factor to be considered is that "intravitreal AAVs causes more intraocular inflammation and elicits a more potent humoral immune response than does subretinal administration." It is unknown if this inflammation has any impact on vision but cohort 3, where inflammation was managed with steroid drops, did show an improvement in visual acuity.

Another explanation for the difference in outcome in visual acuity between RGX-314 and ADVM-022 may be that "baseline BCVA is one of the strongest predictors of visual acuity gains." Specifically, patients with "the highest baseline BCVA had lowest BCVA gains." Adverum's patients across all three cohorts had a baseline mean BCVA of approximately 65.5 vs 55.7 for Regenxbio. This could partially explain a difference in gains - Adverum's patients had less to gain. However, 5 of the patients in cohorts 1 and 2 had significant vision loss (-6, -7, -19, -14, -7), and this is highly concerning. There was no patient specific data released for cohort 3, and this is also a concern as one patient with a very impressive gain can conceal the pattern of most patients losing vision. It is encouraging to see positive data for cohort 3, but it is not prudent to ignore the data from the other two cohorts.

Most studies in wet AMD for the standard of care define success as a stabilization of vision loss. However, an article published in Review of Ophthalmology written by ophthalmologists at Barnes Retina Institute of Washington University commented on the evolving goals of treatment. They wrote that "as standards for treatment success are raised, more attention should be focused on visual acuity gains as the primary endpoint." One of the outcomes sought by developers of gene therapy is to provide a continual dose of anti-VEGF therapy that results in improved vision rather than the gradual decline in vision seen in real world studies of standard of care treatments. In this context, ADVM-022's results in visual acuity fall short.

ADVM vs RGNX stock

Adverum shares are trading around $20, and the company has a market cap of approximately 1.6 billion reflecting a rich valuation even considering that the company has cash on hand to fund operations through 2022. ADVM-022 is a "one hit wonder", and the company has no other products in clinical trials should ADVM-022 fail or fail to deliver an extraordinary safety and efficacy profile. The current share price of Adverum assumes a very low risk of failure for a product, which is still in Phase I/IIa trials. This valuation also reflects expectations that ADVM-022 will be a superior gene therapy treatment and capture a large percentage of the gene therapy market.

RGNX is trading around $41 and has a market cap of approximately $1.6 billion, the same market cap that Adverum has. Just as Adverum, Regenxbio has cash on hand sufficient to fund their internal pipeline costs through 2022, so dilution is not a near-term risk. Regenxbio is a much more diverse company than Adverum, and the value of their other assets is substantial. Their internal pipeline has 4 products in clinical trials, although RGX-314 has by far the greatest commercial opportunity.

In addition to an internal pipeline, Regenxbio licenses intellectual property to partners who are engaged in 26 different gene therapy programs. This revenue stream is significant and should grow with time. Novartis (NYSE:NVS) sells a gene therapy, Zolgensma, for SMA which uses one of Regenxbio's AAVs. Regenxbio reported that Novartis, which started selling Zolgensma in the second quarter of 2019, has reached $530 million in sales as of the first quarter of 2020. Regenxbio receives approximately ten percent of sales as a royalty payment. This product is likely to exceed a billion dollars in sales by 2021 and perhaps have peak sales as high as $2.5 billion annually providing a secure revenue stream for Regenxbio to pursue their internal pipeline.

Regenxbio is also investing in manufacturing which "will allow for production of NAV Technology-based vectors at scales up to 2,000 liters using REGENXBIO's platform suspension cell culture process." Manufacturing capability is a very undervalued asset considering that "Thermo Fisher paid $1.7 billion last year to buy viral vector contract manufacturer Brammer Bio" and is further investing $180 million to build a new gene therapy plant. Catalent (NYSE:CTLT) last year paid $1.2 billion for Paragon Bioservices to bolster its manufacturing capacity for gene therapies further validating the value of gene therapy manufacturing infrastructure. The licensing revenue, three other products in the pipeline and the intrinsic value of the manufacturing infrastructure provide a margin of safety if RGX-314 disappoints in clinical trials.

Conclusions

There are concerning aspects of both Regenxbio's data (the need for rescue injections) and Adverum's data (the poor outcomes in visual acuity). Should ADVM-022 not prove to give vision improvements, the benefit of reduced rescue injections will not be as meaningful. Wet AMD is treated to prevent blindness and to improve vision. Therefore, it is logical that vision improvement is a goal and perhaps the most important metric of all. Along a similar line of reasoning, if only 60 percent of the patients are rescue injection free, it brings into question whether physicians would administer RGX-314 if ADVM-022 provided a much greater chance of requiring no rescue injections.

Assessing early data is extremely difficult. Trends that appear in Phase I can completely disappear in Phases II and III which involve larger cohorts with a more diverse set of patient characteristics. There is a wide range of responses from individual patients to the same treatment which makes it essential to see responses in large groups. Some side effects or efficacy patterns are not revealed until after FDA approval when a medication is used in even larger patient populations. These truths highlight the difficulty of drawing conclusions based on sample sizes as small as 6 patients in a cohort. Thirty percent of drugs fail in Phase 2 further reinforcing that early data that looked very promising can be misleading when larger cohorts are studied.

In this case, it is so early that NO data is yet available in the suprachoroidal administration of RGX-314. The lack of data in this administration makes it particularly difficult to compare RGX-314 to ADVM-022. Given this would be the preferred route of administration, this data is what is most important to assess in comparison to ADVM-022. In addition, both companies are still assessing varying dosages so it is far from clear at this moment what the final product that physicians would choose from would look like.

Larger data sets will be forthcoming in the next twelve to eighteen months which will provide greater clarity about whether RGX-314, ADVM-022 or both will be viable commercial products. Investors should keep a close eye on larger data sets and critically evaluate how these products compare. Investors considering diving into the wet AMD gene therapy market should also consider the wide margin of safety that Regenxbio's more diverse pipeline, secure licensing revenue and manufacturing assets provide.

Disclosure: I am/we are long ADVM, RGNX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is for information purposes only and does not constitute a recommendation to buy or sell any security.