Here Is Why The S&P 500 Could Be Headed For 3,700

by Bill GundersonSummary

- Very few authors on this site have been as outspoken about a market rebound than I have.

- I have written eight very bullish articles since March 18th. Every one of them has been right on the money.

- I hope that they made you money. This is my main purpose for being a regular on this site, to help make you money.

- Just wait until you hear my latest marketprediction. I am hoping for eight on-the-money articles in a row.

It would seem at times that the market seems to defy all logic. But, after 23 years as a professional money manager and analyst, I have found the market to be quite logical, most of the time. Once you learn a few simple rules, I think that they could help you to make sense of it too.

My aim is not to sound “preachy or condescending,” instead I would like to share with you a few very important concepts that may radically change the way that you look at the markets. I have found that following these simple rules have helped me to rack up some pretty good performance numbers over the years. There are no guarantees going forward, however.

What good are concepts and rules if they don’t lead to performance or alpha? You can look up my overall ranking as a writer/blogger on this site (top 1.5%) and my ranking against my peers/experts (top 4.5%) in the industry. You can also check out the performance of the four portfolios that I publish here on this site weekly.

We have nailed some big winners like Dexcom (DXCM), Teladoc (TDOC), Shopify (SHOP), ServiceNow (NOW), Draft kings (DKNG), etc., so far this year. Our portfolios are doing quite well against year-to-date against the difficult COVID-19 backdrop and we are constantly on the search for more winners like the ones previously mentioned.

So, here we go with several of the most useful observations that I have made and put into practice over the years.

Rule Number One

The market is not going to do what you want it to do. You cannot invest in your opinion, your bias, or in the headlines that you agree with.

I have seen numerous articles this year with dramatic doomsday headlines. That seemed to be the popular opinion that pervaded the market from late February to even today. I saw headlines predicting everything from the worst depression since 1929, to the pandemic that would never end, and just about everything in-between.

Based on the facts that we knew at the time, there seemed to be a major disconnect between the doomsday articles and what was really taking place at the time. After all, we had China’s experience with the virus as a guide as to what would take place here.

Then why all the doomsday headlines? In many cases, I think doomsday headlines are created grab your attention to get clicks. Fear sells. After all, the biggest days for newspaper sales are when there are dramatic headlines.

I also think that many of the articles were based on the author’s opinion, bias, or what he or she wanted to happen to the market. I also think that politics entered into what many of the authors wanted to see happen. Somehow, you have to cut through all of the noise and search for the facts.

Rule Number Two

You will get a lot better feel for the market by looking at 100 one-year charts than you will from reading 100 headlines.

Back on March 18th, it appeared to me that the major damage had been done to the market. The virus in China was running its course and there was absolutely no reason why it would not do the same here in the U.S. In other words, this was not another 2008-2009. This would be a temporary recession and market sell-off that would rectify itself much faster than it did during the financial crises.

To me, this looked more like a quick 30%-35% bear market as opposed to the long, drawn out 54.5% hit that the market underwent in 2007-2009.

I was beaten up good by the comments on the March 18th article that I wrote titled “We are not out of the Woods yet but get Ready.” But, that’s okay, I had a very strong conviction in what I had written and it has obviously turned out to be good advice at the time. Just, look at where the market is today.

But more importantly, besides my strong belief that the virus would be a difficult but temporary situation, I looked at 1,000 one-year stock charts that night. I was starting to be tainted by the doomsday headlines myself, I needed to see if things really looked as grim as the headlines were painting them to be.

I keep my chart analysis very simple. At any given point in time, a chart is in one of four predominant patterns: sideways trend, uptrend, topping out trend, or downtrend. I used the get the printed chart books delivered to my home many years ago before digital charts came along.

I would take a sharpie pen and mark a number one, two, three, or four on every chart in the book. This would show me what the predominant trend of stocks in the market was at the time. It would also show me what the strong vs. weak stocks in the market were at the time.

Back on March 18th, most stocks were still in a downtrend (4), but I saw a lot of them start to bottom out and go sideways (1). This was a very encouraging sign. The market had very quickly built in a very swift but somewhat temporary hit in the U.S. economy.

The one stock that really caught my eye that night was Boeing (BA). It was putting in a bottom and that lead me to state that a bottom in Boeing would lead to a bottom in the DJIA. I missed it by four days. The DJIA hit an intra-day low of 1,820 on March 23rd.

The charts that I looked at that evening dispelled all of the doomsday headlines that I was seeing. The downtrend in the vast majority of stocks was coming to an end, and many were in the early stages of new sideways trends.

Rule Number Three

The market is forward-looking.

While most individual investors seem to be concerned with yesterday, today, and tomorrow, the market is way ahead of them and looks three months, six months, one-year, and even two years down the road. Learning this rule will greatly improve your investing and help you understand why the market is raging higher while the economy is still shut down.

The market prices in a recession way before the actual recession happens. The market also prices in a recovery way before the actual recovery takes place. We learned on Thursday that we are now in a recession, yet the market was done pricing this in two months ago!

I got hammered by the comments on my March 27, article that was titled “A new bull market is being born.” This was just four days after the market had bottomed. But this was not as audacious as it may have sounded at the time. I was just applying rule number three.

Now that the market had bottomed, it was writing off 2020 earnings as a big drop vs. the previous year. This is the first time that this has happened since 2009. The 12-year long bull market ended in early March as S&P 500 earnings estimates were dipping below last year’s record $163. The 12-year streak of earnings growth for the S&P had come to an end.

This fact leads to the next and most important rule.

Rule Number Four

Stocks and the market follow earnings and earnings expectations.

This rule will help keep you on course with the overall market more than anything that I know of. It will also help you get rid of emotion, bias, opinion, and doomsday headlines. This simple rule kept me almost fully invested for twelve straight years.

In early March of 2009, earnings for 2010 started looking quite a bit higher than 2009 and this was the beginning of a new bull market. S&P 500 earnings went up every year after that until this year. This year ended the longest bull market in history. As of now earnings estimates for this year are about $125 per share. This compares with $163 last year.

Keep in mind however that when we began this year, the expectations were for record earnings again in 2020. The market bounded higher all through January and February in anticipation of this.

As the COVID-19 virus outbreak started to heat up here in the U.S about mid-February, analysts like me began to sharpen our pencils and put numbers to what was taking place as the virus began to spread here in America.

Luckily, I was several weeks ahead of the consensus estimates that were on the street. The consensus estimate always lags when things are happening very quickly. I started selling stocks as they crossed below my line in the sand and I started putting in inverse ETFs beginning on March 6th as estimates began to plunge.

I took my offense off the field and started playing defense until the dust settled. Estimates for the S&P have dropped every week since early March. They have now settled in at somewhere around $125 per share.

The market wrote this year off back in mid-March and started looking ahead to 2021 and 2022. When it became apparent that COVID-19 would be a fairly temporary occurrence and that the U.S. would go into a very sharp but relatively short recession, the market started to trade on next year's anticipated earnings. I put my offense back on the field.

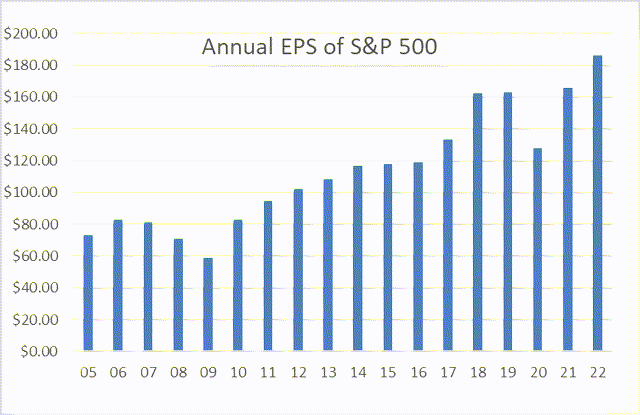

The graph below represents what I consider to be the very best guide for the market. It represents the actual S&P 500 earnings from 2005-2018. It also shows the current expectations for 2020, 2021, and 2022. You can see the big dip this year after twelve straight years of growth. But, you can also see the expected return to record earnings in 2021 and 2022.

Figure 1

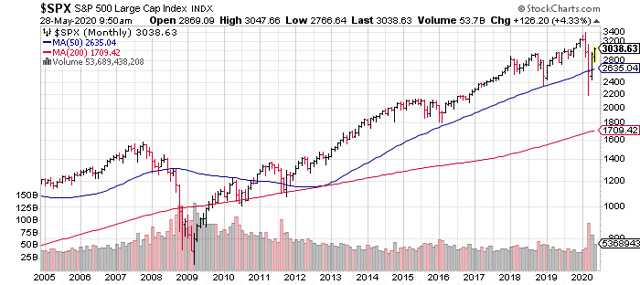

You can also see the correlation below between earnings and the S&P 500 over the last fifteen years. The same is true for individual stocks. That is why I prefer stocks that are growing their earnings at a very rapid pace and look to continue that pattern in the future. If I am right that stocks follow earnings, it only makes sense that don’t want to own single digit earnings growers.

Figure 2

Now For My Current Forecast

By looking at the earnings charts above in Figure 2, you can see where the analysts' forecasts are at the current time. Right now, the analyst community is expecting record earnings in 2021 and 2022. This is why you have just witnessed a V-shaped recovery in the market. The market is looking down the road.

The market is looking for a V-shaped recovery in earnings in 2021 and 2022. It is as simple as that. I maintain my bullish stance on the market with my next target for the S& P 500 to be 3,200 and 3,700 12-18 months from now.

Keep in mind that I update my earnings forecasts for the S&P 500 almost daily. There is always constant downside risk to them. There is also upside potential.

What are the risks to these current earnings expectatons? COVID-19 could come storming back in Fall. Another black swan event could happen to the economy. Our relations with China could continue to deteriorate, or any number of unknown events could occur. But the market is currently trading on forecasts that are out there now. When unexpected events come along, those expectations will change and the market will react immediately.

I am sure that my latest article will get slammed with negative comments once again. My view does not seem to be the popular one at the moment. That is okay however, I would rather be right than popular. I am not after page clicks here. Instead, I hope that I can help make you a better investor and take a big chunk of mystery out of the market for you.

For What It Is Worth

Go back and read just the titles of the last eight articles that I wrote about the macro outlook for the market. All I did was apply the rules that I have learned over the years of how the game is played.

It is up to you, you can use your opinion, your bias, doomsday headlines, or even the phase of the moon to guide you in the market, or you can follow earnings. That is what the market follows.

Best Stocks Now Premium gives you access to 4 unconstrained model portfolios, daily live trades (if any), and a weekly in-depth market-timing newsletter. This newsletter put out a BUY SIGNAL on 3/27/2009. That BUY SIGNAL has been in place for almost 11 years, but, what are we saying now? We seek out the Best Stocks Now for each portfolio. At times we deploy inverse funds for protection. All this comes from a professional money manager and analyst with over 22 years of experience in the business. Try it for free for two weeks.

Join us today and get instant access to everything mentioned above.

Disclosure: I am/we are long SHOP, DXCM, TDOC, DKNG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.