Ecolab: High Multiple, 'Leaky Equity Bucket', Time To Cash Out

by Robert HoneywillSummary

- Ecolab has provided solid returns for shareholders over the last five years or more.

- Ecolab shares are trading at possibly unsustainably high multiples.

- A detailed analysis reveals shareholders should be concerned with a "leaky equity bucket".

- It is time to cash out of Ecolab shares.

Investment Thesis

Ecolab (ECL) attracts a high earnings multiple. This has provided opportunities for Ecolab to use M&A activity to acquire businesses at low EBITDA multiples to increase EPS. This new investment produces additional earnings which in turn attract high EPS multiples, pushing the share price even higher. It is a virtuous cycle. However, I identify two major issues for Ecolab shareholders. Firstly, the merger (SALE) of Ecolab's upstream energy business has the reverse effect to the past M&A activity. Ecolab is giving up EPS which was previously reflected in Ecolab's share price at high multiples, and shareholders will receive shares in Apergy (APY) with that EPS likely reflected in Apergy share price at much lower multiples. Secondly, my analysis identifies Ecolab suffers from what I refer to as "leaky equity bucket" syndrome, a malady which is explained in more detail below. Ecolab is a sell.

The Dividend Growth Income+ Club Approach

The logo of the DGI+ Club explained:

Total Return, Dividends, Share Price

The only way an investor can achieve a positive return on an investment in shares, is through receipt of dividends and/or an increase in the share price above the buy price - the only way.

Assets, Liabilities

The engines and the lubrication, along with human talent, driving the business. Shareholders have no legal rights to or ownership of the assets. Shareholders in a limited liability company have no legal obligations in respect of the liabilities.

"Equity Bucket"

Shareholders have an equitable entitlement to their equity in the company. Equity is increased by capital raised from shareholders, and by earnings of the company. While shareholders have an equitable entitlement to their equity in the company, they have little to no say in how the equity is distributed. In some companies, management actions in respect of the shareholders' equity does not always benefit shareholders, and can be highly detrimental to shareholders. At the DGI+ Club, in addition to reviewing profitability, balance sheet strength, liquidity and other metrics, we take the extra step of checking the "Equity Bucket" for "leaks", i.e., effective distributions out of equity that do not benefit shareholders.

Below I address for Ecolab,

- Historical And Potential Future Shareholder Returns;

- Checking the Ecolab "Equity Bucket";

Ecolab: Assessing Historical And Potential Future Shareholder Returns

In this article and in most of my articles, I seek to show how targeting a desired return on an investment in shares can be facilitated by actually estimating what future returns will be based primarily on analysts' EPS estimates and other publicly-available data. After all, gaining a return is the primary aim of most investing.

First, I provide details of actual rates of return for Ecolab shareholders investing in the company over the last four to five years.

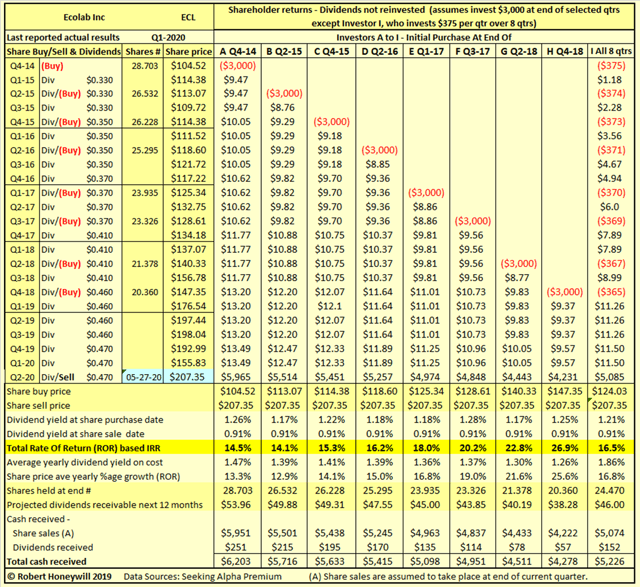

Table 1 - Ecolab: Historical Shareholder Returns

For many stocks where I create a table similar to Table 1 above, I find a wide range of returns indicating a degree of volatility and risk. Table 1 above shows the results for Ecolab were strongly positive for all of nine different investors, each investing $3,000 over the last five years and holding to the present. These rates of return, ranging from 14.1% to 26.9%, are not just hypothetical results. They are very real results for anyone who purchased shares on the various dates and held through to May 27, 2020. In the above examples, the assumed share sale price is the same for all investors, illustrating the impact on returns of the price at which an investor buys shares. Duration of investment is also a factor to consider. Investor H has a rate of return of 26.9% compared to Investor A's rate of return of 14.5%, but Investor A's $3,000 investment has grown to $6,203 compared to $4,278 for Investor H. This is due to the duration the respective investments have been held. If the Ecolab share price grows at less than 26.9% in the future, Investor H's rate of return will reduce over time.

Projecting Future Shareholder Returns

If rate of return is the basis on which we judge the performance of our investments, then surely we should be seeking to estimate future likely rates of return when we are making investments. But how do we do that? I use proprietary models to generate net income, balance sheet/funds flows, and projected rates of return going out three to five years. Much of this is automated, but still involves a great deal of research and business and data analysis to back up the projections. Let us first look at the traditional approach to assessing value of a stock for investment purposes.

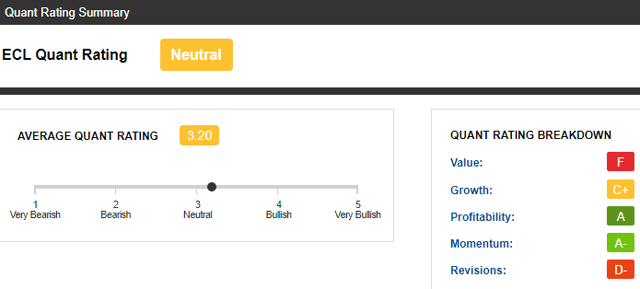

Assessment Based On Quant Ratings For Share Investment Decisions

Share buy price, dividends, share sale price, and duration the shares are held are the only factors affecting the return on an investment in shares. That makes potential share sale price the single most important and uncontrollable unknown when making a share buy decision. My expertise is in fundamental analysis, but I do recognize, any methodology, Quant or Elliott Waves or other techniques providing assistance in assessing possible future share price direction, can be of benefit to share investors. I find SA Quant ratings useful for both screening for stocks of interest and as a form of due diligence.

Figure 1

Quant ratings for Ecolab show the company is strong on "Profitability" and "Momentum". But for the "F" on value and the D- for "Revisions", I would expect Ecolab would be rated "Bullish" based on those two rating elements. The "F" and D- ratings automatically downgrade Ecolab to "Neutral".

- For "Value" Ecolab has Ds and Fs across the board, based on comparison to sector medians. I believe this is driven by Ecolab's high P/E ratio which I discuss in more detail further below.

- If I click on "Growth," I'm taken to a list of 19 fundamental measures each individually graded. For fifteen of these 19 measures Ecolab earns one "A" and fourteen "Bs", for growth compared to sector medians. Cs are earned for Revenue, Cash Flow and CAPEX TTM and FWD, based on comparison to sector medians.

- The "A+" for "Profitability" reflects above sector performance for Return on Capital, Gross Profit and EBITDA and EBIT Margins, and Cash Flow metrics. The only area of weakness is CAPEX/Sales (TTM).

- For "Momentum" Ecolab earns As and Bs for share price momentum for 3 months to 1 year, once again compared to sector performance.

- For "Revisions" Ecolab earns a D- due to 18 downward EPS revisions and nil upward revisions over the last 90 days. The sector median also has nil upgrades over the last 90 days, reflecting the impact of COVID-19.

Assessment Based On Analysts' EPS Estimates

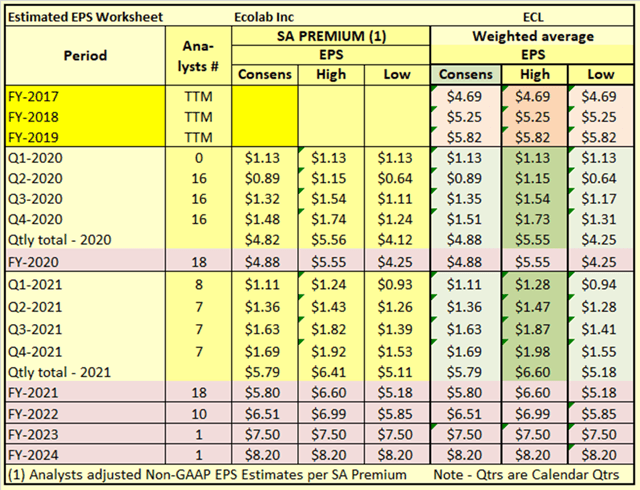

Figure 2 - Summary Of Analysts' Adjusted Non-GAAP EPS Estimates

Some observations on contents of Fig. 2

- The analysts' quarterly EPS estimates for consensus, high and low, do not add to the yearly EPS estimates for consensus, high and low. This is generally the case because the analyst with the high estimate for the year is not necessarily the analyst with the highest estimate each and every quarter, ditto low and consensus figures. To overcome this, I adjust the quarterly EPS figures in the proportion of yearly totals to quarterly totals.

- The further out estimates are made the less certain they become. The 2023 and 2024 estimates, due to being covered by only 1 analyst, will be even more uncertain. Although I will include these in my projections for completeness, I do not intend to comment on or draw conclusions in respect of these out years.

I incorporate the above analysts' EPS estimates from SA Premium into my rate of return projections utilizing my proprietary 1View∞Scenarios Dashboards further below. As for Quant ratings, EPS and EPS growth estimates do not quantify the rate of return that can be expected for the stock in question.

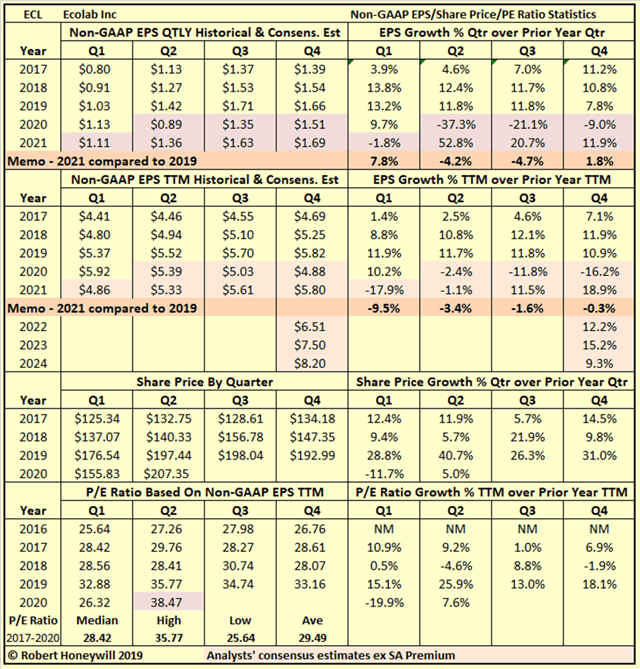

Figure 3 - Non-GAAP P/E Ratios, Historical And Future Estimates

Figure 3 is primarily designed to determine an appropriate range of non-GAAP P/E ratios for determining estimated future share price levels for Ecolab. This is necessary for quantifying estimated future rates of return. Figure 3 also informs us of past non-GAAP EPS growth rates compared to forward estimates of EPS growth based on analysts' consensus estimates. The forward EPS consensus estimates indicate expectations of growth rate of negative 16.2% for 2020 over 2019. Analysts' consensus estimate of EPS for 2021 is estimated to be 18.9% up on 2020 but still down 0.3% on 2019. It should be understood, in quantifying the estimated rates of return below, I'm relying on the soundness of analysts' consensus estimates of EPS. The other important factor is determining appropriate future P/E ratios, which is fraught with difficulty. P/E ratios are impacted by issues both at the macro and micro level. I don't believe I will have any arguments against the notion current P/E ratios are influenced by expectations of future EPS growth rates. Below, I quantify potential rates of return under various scenarios utilizing my proprietary 1View∞Scenarios Dashboards.

Assessment Based On Quantification Of Potential Rates Of Return

My forward-looking analyses bring another dimension - the quantification of potential returns utilizing various pieces of financial information already available.

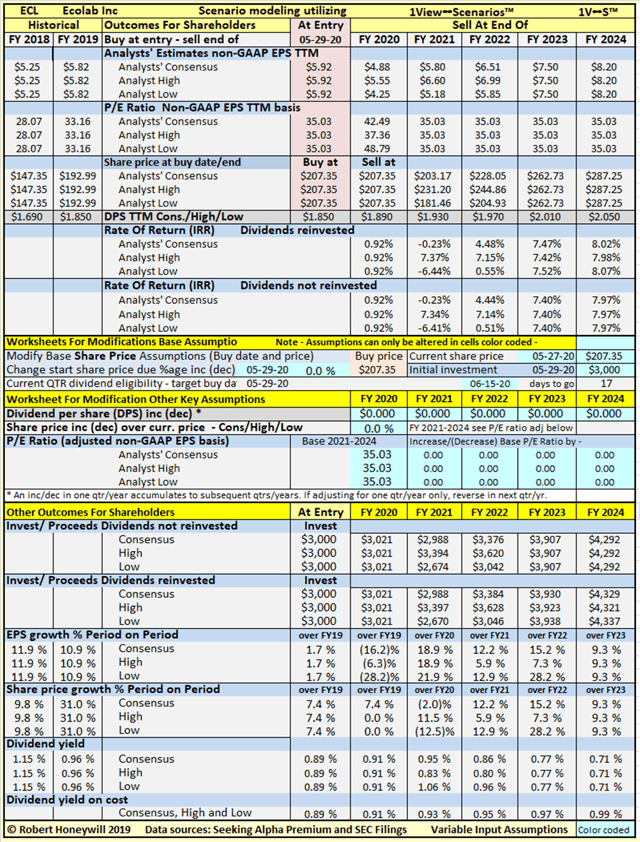

Table 2.1 - 1View∞Scenarios Dashboard

Table 2.1 shows buying at the current share price would provide indicative rates of return through end of 2022 of 4% to 5% for the consensus case, ~7% for the high case, and less than 1% for the low case. These rates of return assume EPS results in accordance with analysts' consensus, high and low estimates and a constant adjusted non-GAAP P/E ratio of 35.03 (current P/E ratio Q1-2020 TTM). The P/E ratio of 35.03 is well above the historical median of 28.42 and average of 29.49, and close to the historical high of 35.77 per Fig. 3 above. It should be noted these historical multiples were set in periods including some very high EPS growth rates. With analysts' consensus estimates showing no growth in EPS for the 2 years from end of 2019 through end of 2021, it is perplexing why the current P/E multiple should be over 20% above an already high historical median. Ecolab's P/E ratio is also well above its peers as per this peer comparison from SA Premium.

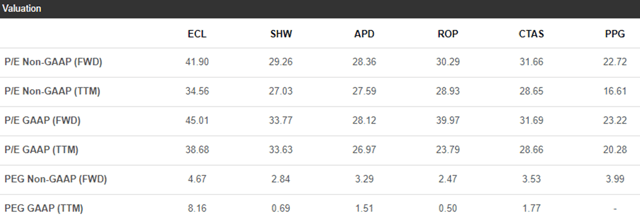

Figure 4

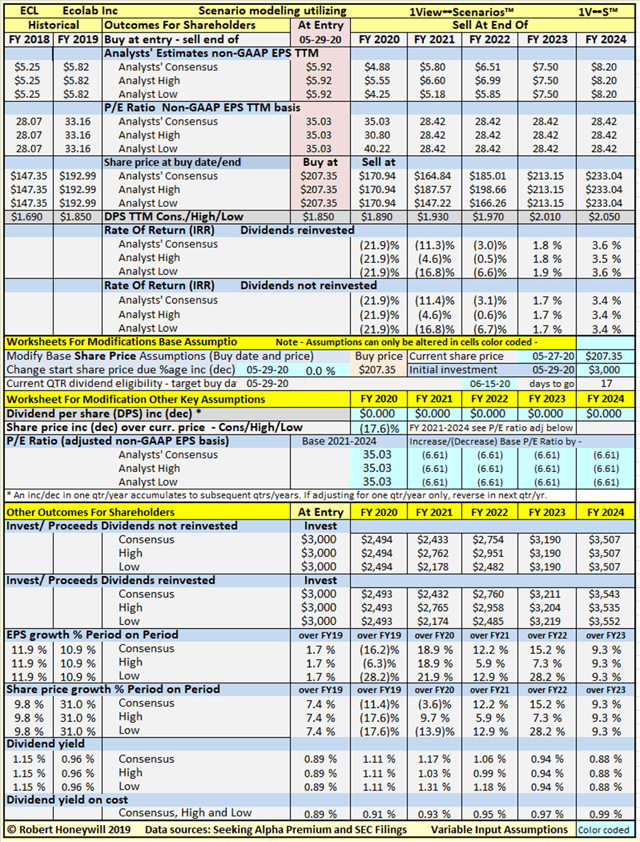

Table 2.2 - 1View∞Scenarios Dashboard

Table 2.2 uses the same assumptions as in Table 2.1 above, except for a reduction in the P/E ratio from the present 35.03 to the Ecolab's historical median of 28.42. Ending share price for 2020 is assumed to be 17.6% below the current share price (at $170.94, still well above the low of $125.22 on March 23, 2020). At the assumed lower historical level P/E ratio, indicative returns through end of 2022 are negative for all of the consensus, high and low cases. This should be very concerning for any holder of the shares as there is a very real risk of multiple contraction, as discussed below.

Checking the Ecolab "Equity Bucket"

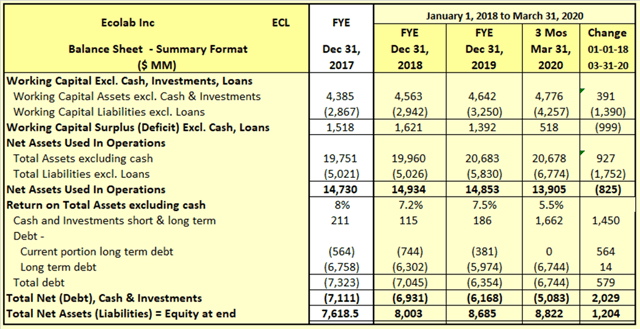

Table 3.1 Ecolab Balance Sheet - Summary Format

Table 3.1 shows an increase in Shareholders' Equity of $1.2 billion over the 2.25 years, January 1, 2018 through end of March 31, 2020. There was also an increase in total liabilities excluding loans of $1.7 billion, increasing funds available for application to $2.9 billion. This $2.9 billion was applied to increasing operating assets by $0.9 billion and reducing net debt by $2.0 billion.

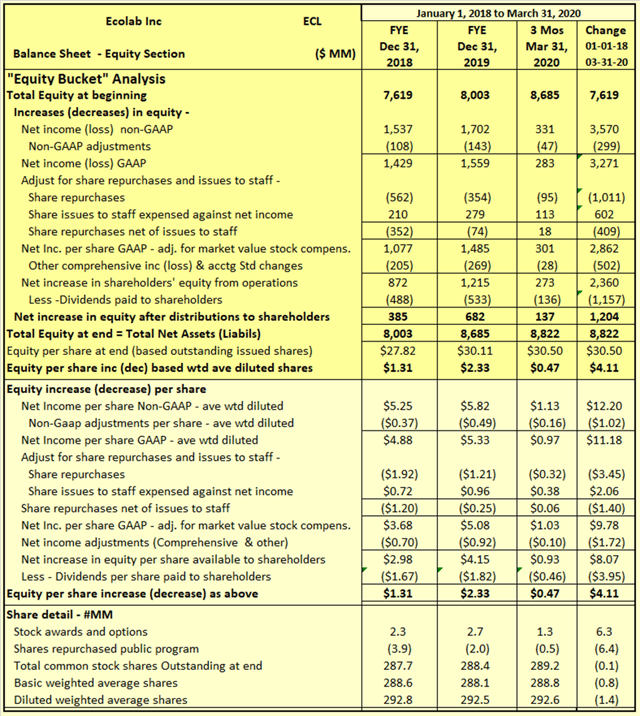

Table 3.2 Ecolab Balance Sheet - Equity Section

I often find with companies, while they produce earnings that increase shareholders' equity, significant amounts of distributions out of equity do not benefit shareholders. Hence the term "leaky equity bucket." It is far from the worst case I have seen but this is happening to a degree with Ecolab as explained below.

Explanatory comments on Table 3.2 for the period January 1, 2018 to March 31, 2020 -

- Reported net income (non-GAAP) over the 2.25 year period totals to $3.57 billion, equivalent to diluted net income per share of $12.20.

- The non-GAAP net income excludes $299 million of costs regarded as unusual or of a non-recurring nature, in order to better show the underlying profitability of Ecolab. Nevertheless these are real costs and reduce shareholders' equity. When taken into account they reduce EPS over the 2.25 year period by $1.02 per share.

- The net income figure is arrived at after a charge of $602 million for 6.3 million shares issued to employees. The issue of these shares was offset by a roughly similar number of shares, 6.4 million shares repurchased for $1.011 billion. The difference of $409 million between the amount of $602 million charged against net income, and the $1.011 billion paid to offset the shares issued has come out of shareholders' equity without being recognized as a charge against net income. Taking this additional cost into account further reduces EPS by $1.40 over the 2.25 year period.

- Other comprehensive income includes such things as foreign exchange translation adjustments in respect of buildings, plant and other facilities located overseas, and changes in valuation of assets in the pension fund - these are not passed through net income as they fluctuate without affecting operations and can easily reverse in a following period. Nevertheless, they do impact on the value of shareholders' equity at any point in time.

- By the time these various items are taken into account, we find the reported EPS of $12.20 has reduced to $9.78 for the 2.25 year period. That becomes a rather serious difference when share price is a multiple of 35 times EPS.

- A further matter to consider is reported non-GAAP net income was $3.6 billion and $1.2 billion was distributed to shareholders by way of dividend, which implies a balance of $2.4 billion for reinvestment. But only $1.2 billion was left for reinvestment, and despite share repurchases share count remained virtually unchanged.

Ecolab: Summary and Conclusions

Ecolab has provided solid total returns to investors over the last four to five years. Continued strong share price growth is reliant on strong EPS growth and continued high P/E multiple. I believe both are at risk and this is in fact quite a concerning stock to hold under these circumstances.

Dividend Growth Income+ Club - Register today for your Free Trial.

Click Triple Treat Offer (1) Your Free 2 Week Trial; (2) 20% Discount New Members; (3) Bespoke reviews for tickers of interest to subscribers.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. I do not recommend that anyone act upon any investment information without first consulting an investment advisor and/or a tax advisor as to the suitability of such investments for their specific situation. Neither information nor any opinion expressed in this article constitutes a solicitation, an offer, or a recommendation to buy, sell, or dispose of any investment, or to provide any investment advice or service. An opinion in this article can change at any time without notice.