Spirit Aerosystems Holdings: Strong Enough To Challenge This Crisis

by Patrik MackovychSummary

- Spirit AeroSystems Holdings, Inc. has built up a strong cash position to challenge the current crisis.

- Spirit and its customers - Boeing and Airbus have exclusive agreements about its products but may pose a risk to SPR's business.

- P/S bands and Industrial production show us a significant deviation from mean and could signal the bottom.

- During the last business cycle, despite a similar crisis, Spirit achieved that has a sustainable growing cyclical business (ROA, ROE, ROIC > WACC).

- In the Q1 2020 summary, management introduced a considerable cost reduction and cash preservation. Boeing also continues the 737 MAX production program.

Editor's note: Seeking Alpha is proud to welcome Patrik Mackovych as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA PREMIUM. Click here to find out more »

Spirit AeroSystems Holdings, Inc. (NYSE:SPR) reflects a perfect discount in the current market situation. It holds too much cash to cover all current liabilities and to challenge problems in the aircraft sector, which consist of temporary massive production cuts from big customers - Boeing (NYSE:BA) and Airbus (OTCPK:EADSY). The company survived similar crises, and these discounts led to significant investment opportunities. As we are talking about cyclic business, the disruptions in industrial productions have always been temporary. Many valuation models show us the stock is cheap right now. Price-to-sales bands are showing us potential supports and deviation from the mean.

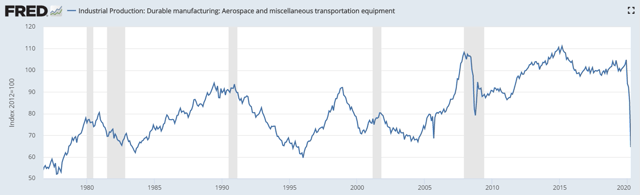

Source: Board of Governors of the Federal Reserve System (US)

About the Company

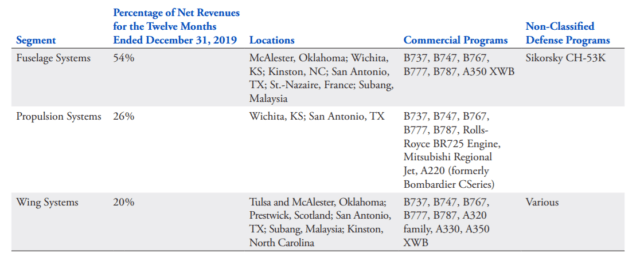

The company operates in three main segments: Fuselage Systems, Propulsion Systems, and Wing Systems. The major part of the revenue is coming from two big worldwide clients - Boeing and Airbus. Spirit also provides its services to other companies, but that represents a minority of revenue. The company also provides these components for military aircraft. There are estimates that Spirit has a 20% share of the global non-OEM aerostructures market. Don't forget that this sector is highly competitive.

Spirit has three main revenue elements:

Source: Spirit AeroSystems Holding, Inc. annual report 2019

Arrangement with Boeing

Spirit and Boeing arranged a supply agreement, in which the company, in the long-term, will be Boeing's exclusive supplier. These agreements include products for Boeing's B737, B747, B767, and B777 commercial aircraft programs, as well as for specific products for Boeing's B787 program. These supply agreements cover the life of these programs, including any commercial derivative models. During the term of the Sustaining Agreement, and absent default by Spirit, Boeing is obligated to purchase from Spirit all of its requirements for products covered by the Sustaining Agreement. What does it mean?

At the end of 2019, Boeing ordered Spirit to stop all B737 MAX deliveries with effect in January 01/2020. The main reason was that Boeing had announced a temporary suspension of B737 MAX production. Next month, on February, Boeing and Spirit made an agreement, in which Spirit is going to deliver to Boeing 216 shipsets of B737 MAX in 2020. It's important to say that this number reflects less than half of 2019's production (B737 MAX). In the annual report (2019), Spirit noted, currently, it does not expect a production rate of 52 aircraft per month sooner than in 2022. According to this agreement, Boeing should pay to Spirit 225 million USD in 1Q 2020, which means prepayments for costs and shipset deliveries over the next two years. These shipments were in danger because of significant uncertainty. In the Q1 2020 call was announced, about reached an agreement of 737 MAX production in the total quantity of 125 units in 2020. According to the previous deal, it's obvious, when things get better, production could be much higher than is stuck right now. In the short term, Spirit has an agreement with Boeing (125 units - B737 MAX) and didn't want to comment or provide any guidelines. Currently, the uncertainty in this sector remains high.

Complications in business, potential risk, and competitors

We can see that almost all programs cooperate with Boeing and Airbus businesses. We know right now that mentioned giants are in trouble (low demand, lockdowns, and production cuts).

We can easily see significant connections between Spirit and Boeing or Airbus. I have been thinking of Boeing's discount, but what discouraged me about this giant is the wrong balance sheet and lack of cash (cash to total current liabilities). Spirit has a much better balance sheet. There is a significant correlation between the mentioned companies. According to the estimates, Spirit has almost 20% (non-OEM aerostructures) market share. Despite big competition in this sector, it has a considerable change to survive this crisis, which could easily hard-damage its competitors with a worse balance sheet.

Even if Spirit is quite successful in obtaining and retaining new customers, there are expectations that Boeing and Airbus will continue to account for a substantial portion of Spirit's sales for the foreseeable future. We need to keep in mind that the main risk is if customers will reduce the requirements under agreements (as Boeing did in December 2019 when it directed Spirit to stop all B737 MAX deliveries to Boeing effective January 1, 2020). Any deterioration in its business could hardly affect Spirit's financial position. According to the annual report:

Boeing and Airbus also have the contractual right to cancel their supply agreements with us for convenience, which could include the termination of one or more aircraft models or programs for which we supply products.

It is causing problems in the short term (right now). Although Boeing and Airbus would be requested to pay for certain expenses, there is guarantee these payments would adequately cover all costs or lost profits resulting from the termination.

I believe there will be a massive drop in production and cut-orders from these big clients in Q2, which will profoundly impact all suppliers and Spirit as well. There is a significant economic downturn globally, but the aircraft industry is one of those, which will be affected the most. Despite this information, I'm very doubtful that Spirit will default. It is one of the leading suppliers in this sector, owns many patents and technology, and has quite a solid balance sheet. There are also the next risks. The US Government is spending a lot of money on defense, but in these hard times, there is a possibility they will cut the costs and help companies instead. It would also harm Spirit's revenue.

Financial position

The company announced that its Board of Directors reduced its quarterly dividend to a penny per share to preserve liquidity until B737 MAX production reaches higher levels.

In the next table, we can see how the company was doing in the previous decade. We can see that there is sustainable revenue growth every year, also in 2012-2013, during the debt crisis in Europe. EBITDA does not have the same trend, but there is a big difference. In 2013 there was a reported loss of 199.5 million USD, and there is a high probability 2020 will be similar, maybe worse. Reports in the Q1 (discussed below) were adverse (-0.79 EPS), and according to estimates, Q2 should be even worse (-1.21 EPS). But that's what the market priced in, maybe "overpriced." When we look at the balance sheet, we can see a permanent-growth except for mentioned problematic years (and now). An excellent sign is that the company had in Dec. 2019 a perfect "cash and cash equivalents" position in a high of 2350.5 mills. USD and prepared for any problematic situation. Spirit holds in dec. 2019 the highest amount of cash in its history.

The current ratio is at a safe level of 2.81. There has also been a degree in current liabilities as the company pays off other current liabilities in high 196 million USD (more than 57% of this section). Total long term liabilities are 4 111 million USD (long term debt + other long term liabilities). There is a significant probability we will notice a decline in operating margin and EBITDA. The interest coverage ratio is getting worse, but it's a cyclical business. Now Spirit could be close to the bottom in this industry (in Q2). The company has enough cash (1833.6 Mill. USD) so that it could refinance all total current liabilities (short term debt and other short term liabilities). There could be a more significant decline in Q2, maybe another price drop, but according to estimates, Q3 and Q4 could perform much better if there won't be the second wave of coronavirus in Europe and the USA. There are many risks, of course, like another price leg down due to Q2, but the company has a considerable chance to survive and maybe strengthen its position on the market.

| Fiscal Period | Dec 2012 | Dec 2013 | Dec 2014 | Dec 2015 | Dec 2016 | Dec 2017 | Dec 2018 | Dec 2019 | Dec 2019 (Q) | Mar 2020 (Q) |

| Revenue | 5397.7 | 5961 | 6799.2 | 6643.9 | 6792.9 | 6983 | 7222 | 7863.1 | 1959.3 | 1077.3 |

| EBITDA | 250.5 | -199.4 | 526.5 | 1041.9 | 926.6 | 790.6 | 1067.2 | 1006.7 | 166.5 | -149.2 |

| Operating Income | -53.9 | -334 | 825.1 | 863 | 737.9 | 551.8 | 833.2 | 760.8 | 95.7 | -124.9 |

| Interest Expense | -82.9 | -70.1 | -88.1 | -52.7 | -57.3 | -41.7 | -80 | -91.9 | -25.8 | -32.2 |

| Operating Margin % | -1 | -5.6 | 12.14 | 12.99 | 10.86 | 7.9 | 11.54 | 9.68 | 4.88 | -11.59 |

| Total Current Assets | 3355.4 | 2944.2 | 3052.1 | 3299.1 | 2910.4 | 2651.1 | 2849.3 | 4643 | 4643 | 4026.1 |

| Total Assets | 5415.3 | 5107.2 | 5162.7 | 5764.5 | 5405.2 | 5267.8 | 5685.9 | 7606 | 7606 | 7001.1 |

| Total Current Liabilities | 1067 | 1335.6 | 1258.8 | 1458.3 | 1544.2 | 1621 | 1582.1 | 1760.7 | 1760.7 | 1434.1 |

| Total Liabilities | 3418.4 | 3626.2 | 3540.7 | 3644.5 | 3476.4 | 3466.3 | 4447.8 | 5844.1 | 5844.1 | 5544.7 |

| Net Issuance of Debt | -23.4 | -10.4 | -16.8 | -36.4 | -36.6 | -27.8 | 737 | 1020 | 783.7 | -13 |

| Capital Expenditure | -249 | -272.6 | -220.2 | -360.1 | -254 | -273.1 | -271.2 | -232.2 | -113.4 | -31 |

| Interest Coverage | 0 | 0 | 9.37 | 16.38 | 12.88 | 13.23 | 10.42 | 8.28 | 3.71 | 0 |

Source: Own processing. Data by Gurufocus.

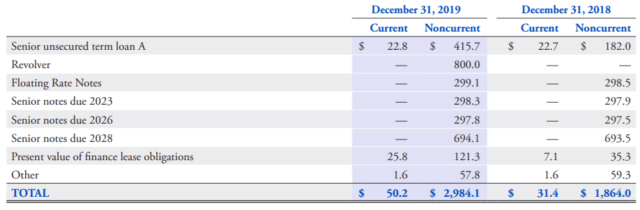

Debt

From the table below, we know that the company has almost no current debt in the balance sheet. Most of the debt is due to 2023, 2026, 2028. On July 12, 2018, the company entered into a $1,256.0 senior unsecured "debt ", which consisted of an $800.0 revolving credit facility, a $206.0 term loan A facility and a $250.0 delayed draw term loan facility. All these mentioned ways of financing have maturity on July 12, 2023. The newest information after the Q1 statement says that total long-term debt and capital lease obligations are high at 3020 mills. USD and Spirit paid down the revolver. Total current liabilities are 1434.1 mills. USD.

Source: Spirit AeroSystems Holdings, Inc.

As per the Q1 2020 summary:

On April 17, 2020, Spirit raised $1.2 billion aggregate principal amount of 7.5% senior secured second lien notes due 2025 in a private offering. Spirit used the proceeds to pay its full revolver of $800 million on April 30, 2020, and will use the remaining $400 million for general corporate purposes.

Boeing's problems will hardly impact Spirit's business

Total shipsets to Boeing in the 1Q 2020 was 75 compared to 216 in the 1Q 2019. Total shipsets to Airbus in the 1Q 2020 was 237 compared to 224 in the 1Q 2019.

The Boeing Company's order book rapidly decreased in April. Huge companies have cancelled orders on Boeing 737 MAX (in total, 108). This news has a significant impact on Spirit's profit and financial position. The current crisis would be a big challenge for all companies in the whole sector, and companies with low cash level are going to fight for survival. Be prepared for another possible price leg down after the Q2 earnings report, but it will be a better opportunity even more for the potential risk/reward ratio. This ratio is also very good at the current discount.

Spirit has not set any closer guidance for 2020 because of significant uncertainty except mentioned agreements of 125 units of 737 MAX.

Analysis and valuation

Now let's look if this price drop is a real discount if the company can create value and keep growing over the next months and years. From the balance sheet is evident that the company still generates higher and higher revenue. The operating margin is quite stable in area 9-12%, but there is a strong possibility of being lower during this time. I think it's quite a small margin vs its competitors, but Spirit is planning to develop connections with Airbus. On these products, the operating margin is near 20%. EBITDA is not so good and stable, but it is reasonable and mostly depends on the business cycle. The next important point is that assets are growing fast, and the current ratio is in the safe zone. Interest coverage could be higher but is acceptable in the current situation. On the other hand, this is the value that I don't prefer, and total leverage is not satisfying. Anyway, the company has enough current assets (cash and cash equivalents, etc.) to challenge various problems.

| Fiscal Period | 12.14 | 12.15 | 12.16 | 12.17 | 12.18 | 12.19 | 3.2020 (Q) |

| Month End Stock Price | 43.04 | 50.07 | 58.35 | 87.25 | 72.09 | 72.88 | 23.93 |

| ROE % | 23.03 | 42.13 | 23.19 | 19.02 | 40.58 | 35.33 | -40.53 |

| ROA % | 6.99 | 14.44 | 8.41 | 6.65 | 11.27 | 7.98 | -8.93 |

| ROIC % | 28.81 | 20.85 | 12.87 | 9.1 | 17.33 | 15.36 | -7.88 |

| WACC % | 11.88 | 9.3 | 7.63 | 7.51 | 9.66 | 8.01 | 8.49 |

| Net Income | 358.8 | 788.7 | 469.7 | 354.9 | 617 | 530.1 | -163 |

| PB Ratio | 3.74 | 3.2 | 3.68 | 5.54 | 6.14 | 4.33 | 1.7 |

| Book Value per Share | 11.493 | 15.628 | 15.852 | 15.736 | 11.735 | 16.823 | 14.04 |

| Price-to-Tangible-Book | 3.76 | 3.21 | 3.69 | 5.56 | 6.16 | 4.34 | 1.84 |

| Tangible Book per Share | 11.45 | 15.588 | 15.815 | 15.699 | 11.699 | 16.789 | 12.987 |

| PS Ratio | 0.9 | 1.05 | 1.09 | 1.52 | 1.07 | 0.97 | 0.36 |

| Median PS Value | 0 | 0 | 40.7 | 43.63 | 53.83 | 67.83 | 60.33 |

| Shiller PE Ratio | 0 | 38.15 | 34.43 | 49.06 | 33.41 | 28.33 | 10.21 |

| Price-to-Intrinsic-Value | 7.91 | 2.03 | 1.64 | 1.93 | 1.47 | 1.08 | 0.43 |

| Projected-FCF | |||||||

| Intrinsic Value: Projected FCF | 5.44 | 24.7 | 35.61 | 45.29 | 49.15 | 67.67 | 55.88 |

| Price-to-Earnings-Power-Value | 7.75 | 4.87 | 4.09 | 2.05 | 1.8 | 0.89 | |

| Earnings Power Value | -3.01 | 6.46 | 11.98 | 21.32 | 35.11 | 40.51 | 26.77 |

Source: Own processing. Data by Gurufocus.

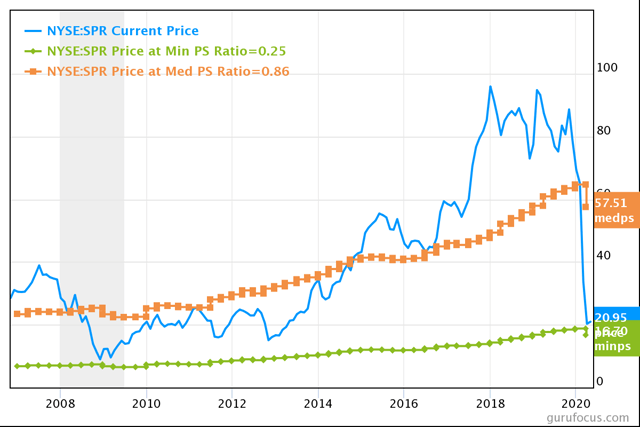

Price-to-sales valuation

In this time, it's better to favor the P/S ratio instead of a simple P/E and P/B or future cash flow methods. The main reason is that P/S is a much better "ratio" for cyclical businesses because, in hard times, cyclical companies have a terrible operating margin, which is deviating from mean in regular times. I have mentioned other valuation methods in the table above, but how I said, it's hard to measure DCF methods when the company has no guidance for future growth. The result would be inaccurate in the current situation and could fake the value quickly. For these reasons, it's better to use P/S ratio and med P/S so that we could count the "margin of safety" from mean. Its public sales are going to decline, so and P/S will probably get worse (rise). On the next chart, we can see P/S bands, which consist of min. P/S, med. P/S. Min P/S could reflect an excellent entry point. Deviation from med. P/S could represent the margin of safety in regular times or stock under/overvaluation.

If we consider that this situation is temporary, then this discount could reflect the opportunity. We have to admit that maybe things won't be like in the past anymore or it will take years. According to these methods, "ratio" floating support should be near 16-18 USD, and the med P/S price is near 60-64 USD. There is a significant probability of med P/S is going to decline because of lower sales next quarters. Still, the current min P/S area could represent reliable support for the future. Spirit is trading near 24 USD per share right now.

Source: Gurufocus

The crucial will be a successful drug or vaccine on COVID-19. Aircraft and travel sectors were damaged the most, and if there will be any sign of improvement, companies from these sectors will rise again. There can be another leg down or next decline, because of lousy Q2, but Spirit has an outstanding risk/reward ratio (1:2 - 1:3) near 20-24 USD / share. As our table shows, the stock is cheap right now. P/S is the lowest in the researched period (2008-2020). Spirit is a cyclical stock, so there are deviations from normal (ROA, ROE, ROIC). These ratios were attractive during the last decade. ROIC is higher than WACC (except the Q1 2020), and this is important. Net Income section is sustainable. Shiller P/E Ratio is excellent, and models like Earning Power Value and Intrinsic Value (Projected FCF) are showing us that stock is cheap with a high margin of safety. But as I said, don't rely on those models (in the current situation). There are risks mainly with Boeing 737 MAX and in Boeing and Airbus orders in general. How things will go on, nobody knows. But this business seems to be cheap right now.

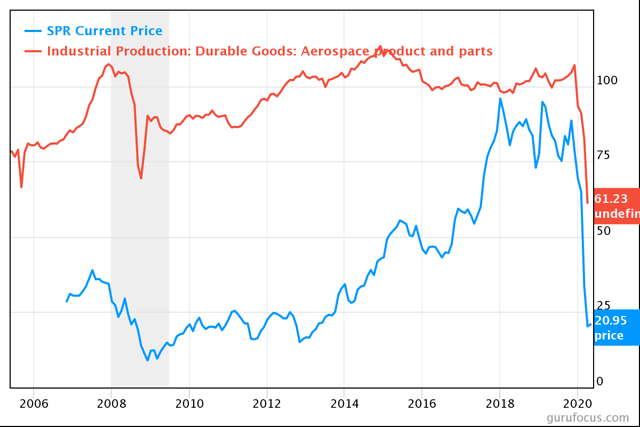

The next thing that I will closely monitor is industrial production in aerospace. Here could be a bottom, but it really depends on the following result, and maybe there will be seen a similar pattern as in the financial crisis. In 2008-2009, the production had begun to rise, but the stock price did not reflect it. Maybe someone is asking why the price is not below 2008 minimum when industrial production is lower. The main reason is that Spirit developed itself and got a more significant market share than in 2008.

Source: Gurufocus

Technical view

Before a few days, it seems that Spirit found a swing bottom at 16.00 USD. We saw a natural decline in the next downturn. The problem is the market is doing a lower and lower high. From mid-term, it will be crucial to breaking the current swing high (green area near 24-26 USD), and if this happens, we could see a more significant rally to the 33-36 USD area. The EMA is crossing, but we need to remember that it is a lagging indicator, but it's telling us the market is bouncing. We need to keep in mind that the market in current time is very volatile to any fundamental news about COVID 19 or industry news. I have marked potentially strong support areas (red), which would represent an attractive opportunity.

Source: Tradingview

Summary from the Q1 Earnings report

Board of directors took many steps to preserve liquidity for the next quarters:

- Reduced cash dividend to a penny per share

- The continued suspension of the share repurchase program

- Received $225 million advances from Boeing; deferred repayment of $123 million in advance from Boeing to 2022 and much more

There was announced a high-cost reduction. Spirit reduced 3200 employees in January and announced an additional reduction of 1450 employees. The company also paid down 800 mills. USD (revolver - debt financing in section debt) and raised $1.2 billion in senior secured second notes on April 17. The next step was to amend credit agreement to allow for bond issuance and to provide additional flexibility in light of market conditions.

The better news is the announcement of the agreement with Boeing on 737 MAX - 125 units production units in 2020. It's just a small part of 2019 737 MAX production, so there still will be high uncertainty. One little surprise is a new temporary agreement, which was announced with Vyaire to produce ventilators.

First Quarter 2020 Results Driven by 737 MAX Production Suspension & COVID-19:

- Delivered 324 shipsets compared to 453 shipsets in the first quarter of 2019

- Revenue of $1.1 billion

- EPS of $(1.57); adjusted EPS of $(0.79)

- Cash from operations of $(331) million; Free cash flow of $(362) million

According to the newest information, Boeing continues in 737 MAX production, which is very positive for Spirit's business.

Conclusion

If we accept some risks, Spirit could represent an excellent investing opportunity. It reflects a cyclical business, so it means problematic seasons for aircraft, travelers, carmakers, etc. There are significant risks about production in general, but so much potential for the future. The company has a good business and enough cash to survive this crisis. Spirit's board of directors is trying to preserve cash and is highly reducing costs. There are also risks for Spirit's prominent clients, which will hardly harm the company. The arguments in this analysis outweigh the bull scenario vs. the bear scenario because the risk should be lower than the potential reward.

Disclosure: I am/we are long SPR. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.