Garrett Motion: Significant Upside Potential But Fragile Financial Situation

by Alborada InvestmentsSummary

- Garrett Motion has a solid business with a dominant share of the market. However, the company is in a fragile financial situation with large maturities in 2025 and 2026.

- The company has little room for mistakes to generate enough cash flows to meet its obligations in the years to come.

- The market has heavily punished Garrett stock that has depreciated more than 70% over the past twelve months.

- The current low valuation creates significant upside potential, but investors must aware of the financial risk.

Since its IPO in 2018, the market has heavily punished Garrett Motion (GTX) stock that has depreciated more than 70% over the past twelve months. The company is undervalued under different valuation measures and the negativity of the market creates a major upside potential. However, investors must be aware of the risks involved in this investment.

Garrett Motion has a solid business and a leadership position in the market. This allows the company to maintain high margins, a strong generation of free cash flow and significant liquidity. Yet, its cash flow generation is being affected by a large asbestos-related liability inherited from its former parent company, Honeywell (HON). Moreover, the company will face large debt maturities in 2023, 2025 and 2026, which leaves little room for mistakes. In this article, I will analyze in detail if the future cash flow generation of the company will be enough to meet its future large obligations. Such a positive turn of events will increase Garrett's stock valuation substantially.

Activity and description of the company

Garrett Motion has been an independent publicly-traded company since the spin-off from Honeywell, on October 2018. The company's main activity is the design, manufacture and sale of turbochargers for light vehicle gasoline, light vehicle diesel and commercial vehicle. Other important products for the company are; electric-boosting products, which include electric turbochargers and electric compressors; and connected vehicle technologies. GTX's main customers are original equipment manufacturers (OEMs) - approximately 86% of the revenues in 2019 - such as Ford Motor Company (F), which is its largest customer and accounted for 12% of total sales in 2019. The other 14% of revenue comes from the global aftermarket where GTX sells sell its technologies through more than 190 distributors.

Due to the complexity of its products, the process requires close collaboration with customers in the earliest years of powertrain and new vehicle design. The company has a portfolio of more than 1,400 patents and patents pending. Moreover, GTX estimates that over 100 million vehicles on the road today utilize its products. To get some idea, by the end of 2016 there were approximately 1.3 billion vehicles in the world. Moreover, the company has a development program, which works to develop new suppliers that can meet its specific quality, productivity and cost requirements. This strategy enhances GTX's bargaining power with its suppliers and gives flexibility to its supply chain. The company has 13 factories mainly located in low-cost countries, such as China, India and Mexico.

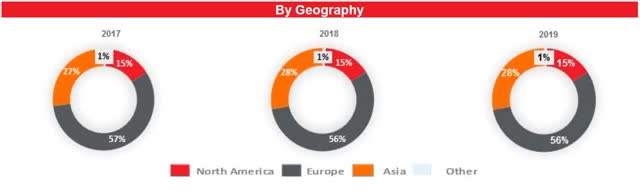

In 2019, light vehicle products accounted for approximately 67% of the company's revenue, while commercial vehicle products accounted for 19%. Analyzing sales by geography, approximately 56% of the revenues come from sales shipped from Europe, while 28% and 15% come from sales shipped from Asia and North America respectively.

(Source: Garrett Motion annual report 2019)

The turbocharger industry

The global turbocharger market consisted on approximately 50 million-unit sales with an estimated total value of approximately $11 billion in 2019. During the same period, GTX generated revenues of approximately $3.2 billion. Although several players are competing in this industry, most of the market share is divided between BorgWarner (BWA) and Garrett Motion, which have almost a duopoly on this sector.

The industry has been affected by key trends in the last decade. Regulatory authorities in the most important vehicle markets such as the United States, the European Union, China, Japan, and Korea have instituted regulations that require sustained and significant improvements in CO2, NOx and particularly matter vehicle emissions. Among other consequences, this generated an increase in the demand for turbochargers and electric-boosting technologies, since these products allow OEMs to reduce engine size without sacrificing vehicle performance, thereby increasing fuel efficiency and decreasing harmful emissions. Although analysts expect this industry to continue growing over the next five years, the automotive industry has been slowing faster than expected in recent years and has negatively affected Garrett's business. In 2019, the light vehicle production decreased 6% and the on-highway commercial Vehicle 2% - Garrett Motion revenue decreased 3.8% during the same period. The negative trend has emphasized by the current COVID-19 crisis and has added more uncertainty about future demand, which has been reflected in many turbocharger companies' valuation.

Industry growth outlook

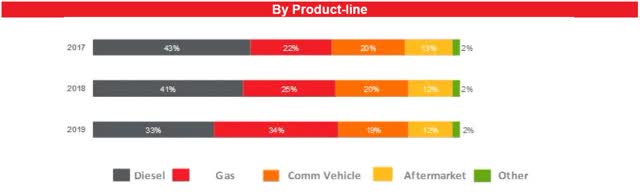

Looking forward, the situation is more encouraging. Market penetration of vehicles with a turbocharger is expected to increase from approximately 49% in 2019 to approximately 55% by 2023, and its production to grow at CAGR of approximately 4% during the same period. Garrett Motion management is confident in growing its business at a faster rate than overall automobile production. Particularly, the growth rate for gasoline turbochargers is expected to be higher and increase from approximately 40% in 2019 to 52% in 2023 - an 8% annual CAGR. On the other hand, diesel turbocharger production will experience a modest decline due to a decrease in diesel powertrains. These trends have shifted Garrett's focus from diesel products to gas products, which accounted for 34% of its sales in 2019.

(Source: Garrett Motion annual report 2019)

The growth outlook in the overall vehicle production is less rosy. The future vehicle production growth rate ultimately will depend on how badly and how long-lasting the current crisis may become, which is something nobody knows with certainty. Yet, the total automobile sales volume is estimated to recover in the coming years with a modest CAGR of about 1% to 2%. The company plans to focus more on emerging markets, - particularly China - where vehicle ownership remains well below ownership levels in developed markets and the growth rate is expected to be 4% approximately.

Obligations payable to Honeywell

Before the spinoff, Garrett Motion inherited a large indemnification agreement from Honeywell - primarily related to its legacy Bendix business - and is required to make payments to its former parent company in amounts equal to 90% of Honeywell's asbestos-related liability payments. Such amounts are up to a cap equivalent of $175 million annually. According to Garret Motion annual report: "the agreement will terminate upon the earlier of (x) December 31, 2048, or (y) December 31st of the third consecutive year during which certain amounts owed to Honeywell during each such year were less than $25 million as converted into Euros in accordance with the terms of the agreement."

On December 2019, the company filed a lawsuit against Honeywell alleging that "Honeywell and its executives, and not Garrett's current management, devised Garrett's spinoff to offload Honeywell's more than $1 billion legacy Bendix asbestos liability while saddling Garrett with unconscionable and illegal covenants that unnecessarily limit its ability to control its long term future". The outcome of this lawsuit will have a significant impact on GTX stock valuation.

Growth and past performance

| 2015 | 2016 | 2017 | 2018 | 2019 | |

| Operating income | 376 | 252 | 356 | 407 | 422 |

| Growth | -33.0% | 41.3% | 14.3% | 3.7% | |

| Net Income (excl. extraordinary items) | 254 | 199 | 351 | 273 | 313 |

| Growth | -21.7% | 76.4% | -22.2% | 14.7% | |

| EPS (excl. extraordinary items) | 3.43 | 2.69 | 4.74 | 3.69 | 4.20 |

| Growth | -21.6% | 76.2% | -22.2% | 13.8% |

(Source: Created by the author using data from the Financial Times)

The company provides information on the years before its IPO. Garrett's operating income and net income have been volatile over the past 5 years. However, the trend over this period has been positive. The company has a 5-year net income growth rate of 5.4%, much higher than its main competitor, BorgWarner. In terms of revenue, Garrett's 5-year sales growth of 2.8% lagged BorgWarner growth rate of 4.1%. This shows that Garrett has been more effective at growing its margins.

| Revenue (5 yr growth rate) | Net income (5 yr growth rate) | |

| Garrett Motion | 2.8 | 5.4 |

| BorgWarner | 4.1 | 3.2 |

(Source: Created by the author using data from the Financial Times)

Profitability

| 2015 | 2016 | 2017 | 2018 | 2019 | |

| Op EBIT Margin | 12.9% | 8.4% | 11.5% | 12.1% | 13.0% |

| Net Margin | 8.7% | 6.6% | 11.3% | 8.1% | 9.6% |

(Source: Created by the author using data from the Financial Times)

Garrett Motion has a profitable business and has been able to maintain its high margins over the years. This allows the company to generate high free cash flows, which will be GTX's main source to meet its future obligations. The company has a wide 5-year average margin of almost 9% and presents a high return on average assets and return on investment. The inventory turnover is also a good measure to analyze business performance. It tells the number of times a business sells and replaces its stock of goods during a given period. Garrett Motion's high inventory turnover means that the company sells its goods faster than its peers and indicates strong revenue. On the other hand, as you can observe, the company does not display a return on equity. The reason for this is that Garrett Motion has negative equity - discussed below.

| Net Income Margin | Net Income Margin (5 yr avg) | Return on Equity | Return on investment | Asset Turnover | Inventory turnover (TTM) | |

| Garrett Motion | 9.3% | 8.9% | -- | 36.8% | 1.43 | 12.32 |

| BorgWarner | 7.7% | 8.0% | 16.5% | 10.2% | 1.01 | 9.49 |

(Source: Created by the author using data from the Financial Times)

Financial Health

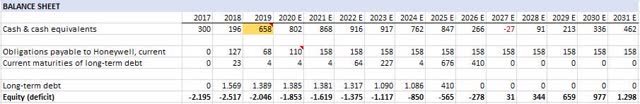

GTX's current balance sheet doesn't look appealing at all, and it is one of the main reasons for its low valuation. Negative equity means the company's liabilities are larger than its assets. The company has total negative equity (or deficit) of $2,046 million, while its total assets and total liabilities are $2,254 million and $4,033 million, respectively. The company holds a total gross debt of $1,484 million and its obligations payable to Honeywell are valued at $1,304 million. On its last earnings call presentation, management mentioned that the company supplemented its cash position of $254 million by fully drawing the remaining cash available under its revolving credit facility. As a result, it started the second quarter with $658 million in cash and cash equivalents.

Due to the impact of the coronavirus crisis, Garrett's current EBITDA has decreased considerably, and the company may not be able to comply with one of the financial covenants in its credit agreement as early as June 30, 2020. This covenant compares outstanding debt to the trailing consolidated EBITDA. Management is in discussions with the lenders on potential modifications to the covenants as well as waivers. A net debt/EBITDA ratio of 3.01 is high but manageable. However, if we add the obligations payable to Honeywell, the net debt/EBITDA ratio jumps to 6.20, which is worrying.

(Source: Garrett Motion Earnings Call Presentation, Q1 2020)

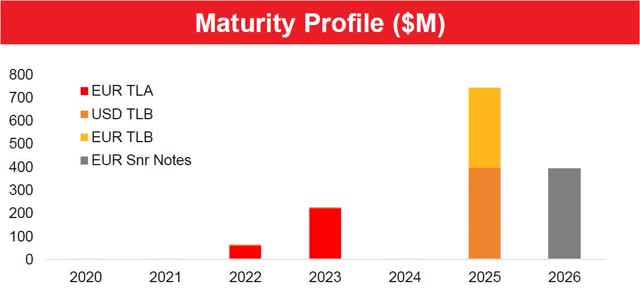

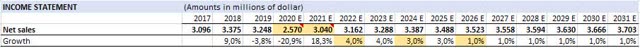

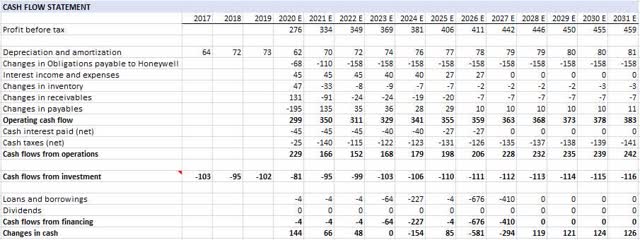

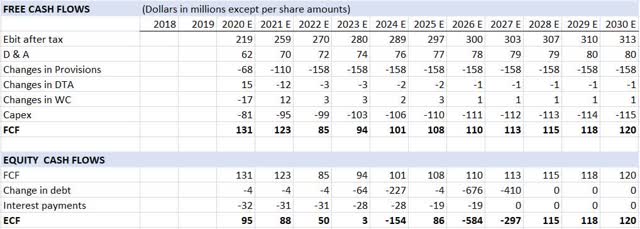

To analyze whether the company will be able to manage its debt and obligation or not, I projected Garrett's future cash flows. I used analysts' sales forecast for the next two years and then supposed that the company will decrease its annual growth rate from 4% to 1% over time to do a cautious estimate. Then I projected GTX's future cash flow statement to estimate the annual "change in cash", which is key to analyze if the current liquidity and cash generation is enough to meet future obligations. Management expects that obligation payable to Honeywell for 2020 will be approximately $108 million. As mentioned before, these payments are capped at $175, and during 2018 and 2019 they were $127 million and $68 million, respectively. Looking forward, I projected that the company will pay on average $158 million annually ($175 * 90% = $158). The maturities of the long-term debt are specified in Garrett's annual report. Please bear in mind that future amounts should be considered approximate.

(Source: Created by the author using data from GTX annual report 2019)

As you can observe, under the current circumstances, the most critical point for the company's finances should be in 2025 and 2026, when Garrett Motion will have to face large debt maturities. Cash and cash equivalent negative balance in 2027 suggests that Garrett's current liquidity and future cash flow generation may not be enough to meet these payments. However, it is a small amount of only $27 million. If the company increases its sales at a higher rate than what I projected and/or the obligations payable to Honeywell turn out to be lower than $158 million, Garrett Motion will be perfectly able to afford its obligation. However, there is also the other side of the coin, if the situation gets more critical and the crisis extends beyond the expected, the company won't be able to generate enough cash to deal with future obligations and may have to refinance payments, or in a worst-case scenario, filing for bankruptcy. Moreover, note that I am considering that current liquidity is $658 million. Given the company drew the remaining cash available under the revolving credit facility after the last quarter report, due to the lack of information I am not including in this analysis the repayment of such loan.

No dividend

Given its financial condition, Garrett Motion does not pay a dividend. According to management, they do not anticipate declaring or paying any cash dividends in the foreseeable future.

Risks

As discussed in detail in the previous section, Garrett Motion's highest weakness is on its balance sheet. The company has a large debt and a high asbestos-related liability. Management has little room for mistakes to generate enough cash flows to meet its obligations in the years to come. This place Garrett Motion in a vulnerable situation, since deterioration in the industry or any unexpected event that negatively affects the company could put its financial condition at greater risk and may restrict further its ability to raise capital.

Another important risk is its dependence on a small number of clients. Garrett Motion top ten customers accounted for approximately 60% of its net sales in 2019, and a substantial portion of them are OEMs in the automotive industry. Given this industry is subject to regulatory changes and cyclical consumer demand patterns, it could affect the continued growth and financial stability of Garrett's customers and consequently hurt its business. Moreover, because Garrett Motion performs in a highly competitive industry that serves a limited number of customers, it has low bargaining power with most of its clients. This affects the ability of the company to successfully negotiate pricing terms, which may adversely affect its results of operations.

Valuation

(Source: Created by the author using data from the Financial Times)

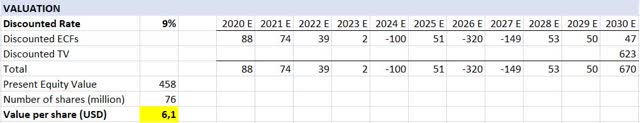

Garrett Motion's stock valuation is the greatest attractiveness for investors. The company has a shocking P/E ratio of 1.22 and is undervalued by any valuation measure compared with its peers. However, these ratios don't tell us the whole story. Given the financial structure of the company, I decided to do a discounted cash flow valuation. I used the same growth rates for revenue used to project the cash flow statement. To discount the cash flows I used a discount rate of 9%. Given the importance of the terminal value in this valuation, I adjusted it. I took Garrett's earnings in 2030 and subtracted the annual obligation payable to Honeywell. Then, I multiplied the number by an exit multiple of 10.

Terminal value = (Estimated net income 2030 - Obligations payable to Honeywell 2030) * 10

Terminal value = ($318m - $158M) * 10 = $1,608m

(Source: Created by the author using data from GTX annual report 2019)

After discounting the cash flows and the terminal value and dividing by the number of shares outstanding, I obtain a value per share of $6.1. The current stock price of $4.6 gives a significant margin of safety. Hence, the company is undervalued by both, a multiples valuation and a discount cash flow valuation. The market is pricing in the fragile financial situation of the company on its stock value. Therefore, If the company succeeds and can meet its obligations with its cash flow generation, the stock price will increase substantially.

Conclusions

The company will face significant challenges in the years to come, given its large debt burden and its asbestos-related liability. Moreover, due to the current coronavirus crisis, there is still a high degree of uncertainty about the business and the industry in the short term. Unexpected situations, such as the actual outbreak of COVID-19 in Wuhan, put the company in a situation with limited room for maneuver. However, Garrett Motion's chances to find its way forward and to take its obligations on using its high free cash flow generation are higher than the market estimates. Furthermore, if the company is favored by a tailwind from the industry and/or a reduction from its asbestos liability, the market will end up rewarding the stock with a much higher valuation. This vulnerable situation can provide a huge return on the investment.

Given the nature of this investment, the best way to approach it would be buying a call option, to hedge the downside potential and harness the upside potential. However, these instruments have a short expiration date, while the highest upside potential is over the long term. My recommendation is a "Buy" for Garrett Motion at the current price of $4.6 and to take a more bullish approach if the price drop to $4.3 or lower. I would also recommend evaluating if this investment matches your risk profile given the high volatility of the stock.

Disclosure: I am/we are long GTX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.