Charter Communications' EBITDA Margin Should Continue To Expand In 2020

by Ploutos InvestingSummary

- Charter Communications is the second largest cable operator in the United States.

- The company should be able to continue to grow its cable Internet business thanks to a spike in demand caused by the outbreak of COVID-19.

- Its EBITDA margin should also expand thanks to growth in its Internet business, declining churn rate, and higher adoption of self-installations for new subscribers.

- However, Charter's shares are expensive when compared to its peers.

Investment Thesis

Charter Communications (CHTR) delivered a solid quarter with strong Internet subscribers growth thanks to the outbreak of COVID-19. This trend should continue in Q2 2020 as many people realize the importance of having high-speed Internet at home. Charter's EBITDA margin should expand thanks to the growth in its higher margin Internet business, the decline in its churn rate, and the adoption of self-installations by new subscribers. However, its shares are not cheap when compared to its peers. Therefore, we think investors may want to wait on the sidelines or seek opportunities elsewhere.

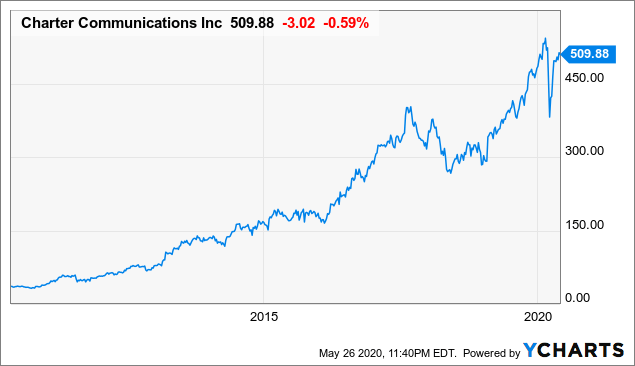

Data by YCharts

Recent Developments: Q1 2020 Highlights

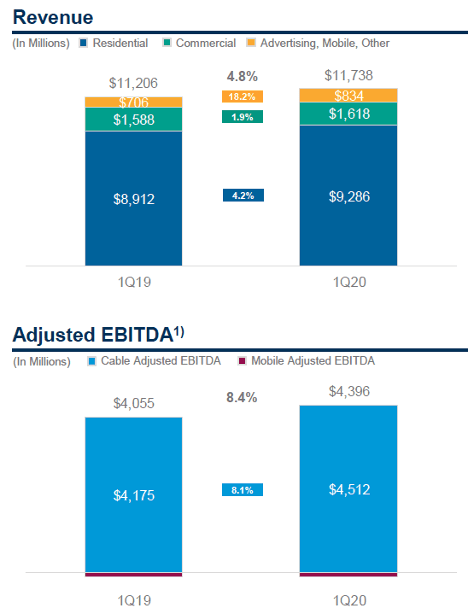

Charter delivered a solid Q1 2020. As can be seen from the chart below, its revenue increased by 4.8% year over year to $11.7 billion. The company saw growth across its 3 main segments: residential, commercial and mobile segments. Charter's adjusted EBITDA growth was even more impressive with a year over year growth rate of 8.4%.

Source: Q1 2020 Investor Presentation

Growth and Earnings Analysis

COVID-19 providing a boost to its Internet business

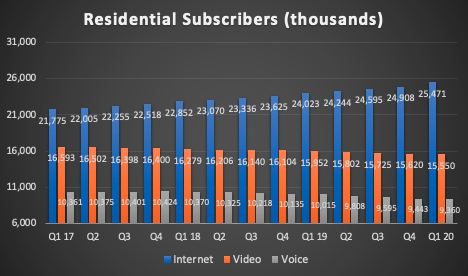

Charter saw its Internet customers increase by 563 thousand in Q1 2020. This was much better than Q1 2019's 398 thousand subscriber adds. The strong growth was boosted by the lockdown caused by COVID-19 towards the end of the quarter. The company still lost about 70 thousand video customers in Q1 2020 but the result was also better than Q1 2019's 152 thousand customer loss.

Source: Created by author

Looking forward, Q2 2020 should be another solid quarter. Management indicated that Charter is growing its customers at about 10,000 per day since early March. Therefore, new customer adds in April will be about 300 thousand. We expect the total number of Internet subscribers to continue to grow in May and June albeit at a slower pace as social distancing restrictions are gradually relaxed. We do not expect Charter's total Internet subscribers to decline anytime soon in a post COVID-19 world as many people will still spend more time using Internet at home.

EBITDA margin should expand thanks to reduction in costs

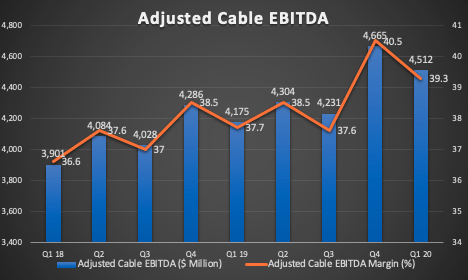

Charter continues to grow its adjusted cable EBITDA margin in Q1 2020. As can be seen from the chart, its EBITDA margin of 39.3% was 160 basis points better than Q1 2019's 37.7%. Looking forward, we expect its margin to continue to expand year over year for the following reasons. First, as we have mentioned in our previous article, Charter's higher margin Internet business will continue to grow thanks to growing demands for higher speed and bandwidth. Second, the churn rate is going down rapidly as people realize the importance of having Internet services at home in a post COVID-19 world. Third, people's preference of having fewer contacts has resulted in many people choosing for self-installations. The adoption rate has increased from 55% in the beginning of Q1 2019 to 70% at the end of the quarter. In fact, management noted that the self-installation rate is now over 90% at the time of the conference call. This should help reduce its operating expenses in the next few quarters.

Source: Created by author

Valuation Analysis

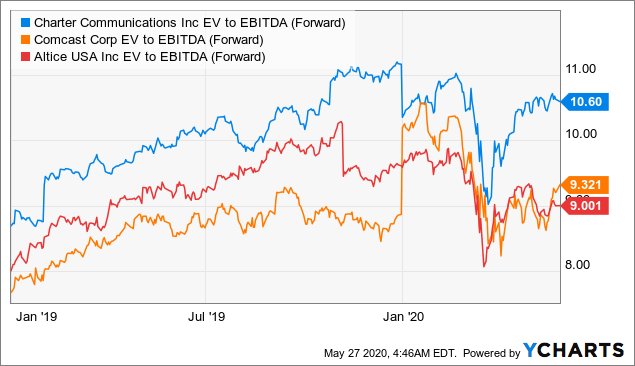

Charter is currently trading at a forward EV to EBITDA of 10.60x. This valuation is higher than Altice USA's (ATUS) 9x and Comcast's (CMCSA) 9.32x. Therefore, Charter's shares are not cheap at this price.

Data by YCharts

Risks and Challenges

Charter faces several risks:

1) Charter also faces other DSL competitors that may gradually upgrade their infrastructure from legacy copper wire to optic fiber network.

2) Subscriber loss in its legacy cable TV business may accelerate as its subscribers shift to video streaming.

Investor Takeaway

We like Charter's growth outlook and its recession-resilient business. However, its shares are not cheap right now. Hence, we think investors may want to seek opportunities elsewhere.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.