Catasys: The Numbers Speak For Themselves

by Jack ZhangSummary

- Catasys is ramping to hit 2020 guidance even without the Q3 launch of the new national plan.

- If the launch goes as expected, it could put 2020 revenue in triple-digit (of millions) territory.

- The company is trading at 7.7 times TTM revenue and is still undervalued compared to its peers in the telehealth industry.

- The recent short report, while bringing up some valid claims, also contains poorly constructed accusations with weak supporting evidence.

Editor's note: Seeking Alpha is proud to welcome Jack Zhang as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA PREMIUM. Click here to find out more »

COVID-19 has catalyzed years of growth in the telehealth industry into just a few short months. This is part of the reason why popular telehealth names like Livongo (LVGO) and Teledoc (TDOC) have surged 106% and 65% respectively since the start of March. Investors may deem these two teleheath plays too expensive after their recent run-ups; if so, I want to share with you an undervalued and relatively undiscovered gem in this space: Catasys (CATS).

Catasys is a healthcare company that uses machine learning and AI to identify treatment-avoidant individuals with chronic illnesses that can be improved by behavioral health therapies. By targeting and assigning virtual care coaches to aid them through its flagship "OnTrak" program, Catasys is able to improve the overall health of its members while delivering an average yearly savings of $16.2k per member to the health insurance companies.

I won't be doing a deep dive into the business model, as fellow SA contributor Katie Mikles has already done so expertly in this article. Instead, I will be analyzing the company's revenue growth and valuation while expressing rebuttals against the recently published short report.

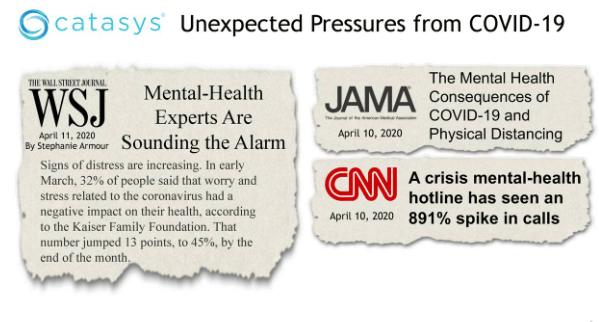

The TAM is Expanding

As a millennial, I can visibly observe the surge in mental/behavioral health issues as society, especially my generation and the generation after ours, operates in an environment where social comparison runs rampant and dopamine rushes can be obtained by simply double-tapping our smartphones. What doesn't help is having the most polarizing president in the history of the United States along with a deterioration in foreign relations and a recession of undefined magnitude on the horizon. And then, there's COVID-19, the biggest pandemic since the Spanish Flu of 1920. As these series of events continue to unfold, there is increasing opportunity for Catasys to bloom into a telehealth giant of the future.

Source: Catasys Q1-2020 Earnings Deck

Revenue Projections

Back in November of 2019, CEO Terren Peizer gave 2020 guidance of $90M after analysts weren't sure Catasys would even hit its 2019 guidance of $35M. But come Q4 earnings, Catasys reported an explosive 4th quarter revenue figure of $11.8M, which catapulted the company into beating 2019 guidance by $0.1M. It was close down the stretch, as it had been for the past 3 years, but this trend may finally buckle by the end of this fiscal year.

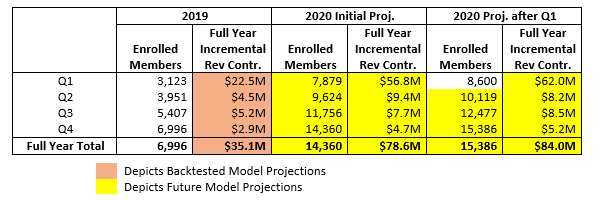

The thing with subscription based companies is that revenues are relatively easy to model. In this case, there are many ways to do so. One method is taking the eligible outreach pool and applying a 20% conversion rate at 80% retention. My case against this is it usually takes an unknown numbers of months to achieve the steady state conversion rate of 20% (somewhere between 12-15). Additionally, there may be many factors that might alter not only the time required to achieve the steady state rate but also what that actual rate is. I feel a better way would be to factor in less potential unknowns and derive a model solely based off of enrolled members. And thus, this is what you see below:

Source: Created by author Jack Zhang using enrollment data from Catasys

A couple of key things to highlight from these numbers. First off, this model is assuming member growth trends from 2018 to 2019 and applying an 88.7% retention rate to generate the full year incremental revenue contribution numbers. Additionally, the model is only taking into account current customer contracts; any new national rollouts (aka the one scheduled for Q3 launch) or products (COPD, congestive heart failure, etc.) are not factored. And finally, with the Catasys revenue model being subscription based, the enrolled members at the end of Q1 is by far the largest contributor to full year revenue figures due to their 12 month contribution vs the 9, 6, and 3 month contributions from the members in the subsequent quarters. In other words, roughly $62M should already be booked for FY 2020; this may be what Peizer is referring to when he regularly states that "it's about what we know, not what we expect."

So, when all of this is factored in, we can see that there is an initial implied revenue contribution of $11.4M from the national plan that is schedule to launch in Q3 in order for the company to hit full year guidance of $90M. Because Q1-2020 enrolled member count came in higher than projected, this implied revenue contribution is now $6M. Keep in mind that during the Q1 conference call, management reported 10,176 enrolled members as of May 7th,which is largely propelled by a 1,339 net enrolled member increase in April. Similar to how they beat Q1 enrolled member estimates (despite a huge cyclical Q1 disenrollment number of 1,245), Catasys is also beating Q2 enrolled member estimates less than halfway through the quarter. With management stating that May's pace is shaping up similarly to April's pace, Catasys may be a whole quarter ahead in terms of membership. As these high enrollment rates continue to take place, it is evident that there is less of a need for the unreleased national plan to make any contribution for Catasys to hit its 2020 revenue goal of $90M. So when management states during its RBC Investor Capital investor presentation that they are 2 weeks away from the CEO of the unnamed plan signing the deal, investors need to take notice. If this thing rolls out in the beginning of July as planned, I am conservatively modeling a $10M contribution to 2020 numbers. When that happens, a 2020 triple-digit (of millions) revenue number is within reach.

Valuation

So, how do we value this thing? Currently, Catasys is trading at 7.7 times TTM revenue (price to sales), which is slightly higher than the sector median of 6.7 but nowhere near as much as its peers in the telehealth space. Livongo (18.1x trailing rev.) and Teledoc (19.5x trailing rev.) are both trading at significantly higher multiples. Of course, these companies are further along than Catasys, but that only speaks to the potential of Catasys' stock price once things get rolling. After all, Peizer is claiming that Catasys is a year or two behind Livongo from a revenue standpoint. I tend to agree.

Future potential aside, let's start our valuation conservatively. Let's say that instead of 7.7 times TTM revenue, Catasys ends the year at the sector median of 6.7. If we then assume that Catasys just barely scrapes together $90M in revenue and ends the year with 18M in shares (a dilution pace that is quicker than its current pace), Catasys should be trading at $33.5 by year end, representing a 74% upside from Thursday's close of $19.24. The fact that there is this much upside in the stock price when we assume that nothing goes in the way of shareholders over the next half year speaks volumes. If instead, the national plan rolls out as expected, and it contributes $10M to full year revenue numbers as projected, $37.22 is within reach (93% upside), with room for a lot more.

And then, there's the recent acquisition of AbleTo by Optum at a valuation of $470M. AbleTo reported FY 2019 revenue of $40M, which puts the valuation at 11.75x 2019 revenue. If we were to apply that same valuation to Catasys' 2019 revenues, we would be looking at a $24.19 share price, roughly a 26% premium from Thursday's close. This is closer to what Catasys should be trading at today.

Risks

The first thing that may come to investors' minds from a risk perspective is the recent short report that was published. I won't dignify the whole piece, as there were some claims made with very shaky supporting evidence. At the same time, there were some things that I feel should be addressed.

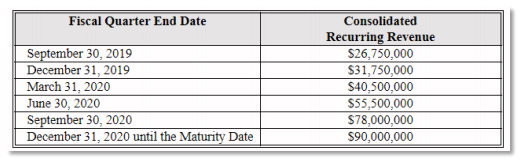

First off, there is the covenant situation with Goldman Sachs:

Source: Culper Research

The numbers above represent the total R12 revenue numbers that Catasys needs to achieve leading up to the end of FY 2020. The claim made in the report is that Catasys needs to hit $22.6M in revenue in Q2-2020 in order to meet the covenant requirements. Otherwise, the company would be in a "highly distressed situation."

While I agree with the $22.6M revenue requirement, I disagree with the severity of the consequence. The whole point of the agreement is to ensure that Catasys hits $90M in revenue by the end of 2020. All of the revenue "requirement" numbers along the way are just checkpoints to see if they're on track, which according to my numbers, they are. As long as Goldman Sachs believes this as well, nothing major should come of it. Think about it: when factoring in seasonality, we know that Q4 is traditionally the largest contributor to total year revenue. Yet, for these revenue checkpoints, the inferred Q4 revenue contribution of $22M came in at less than Q3's of $22.5M. These "checkpoints" don't seem very fine-tuned. Unless Goldman Sachs is out for blood, the most they would do is nickel and dime Catasys for not completely playing by their rules.

Other than the covenant situation, 90% of what is addressable in the remaining report can be attributed to the fact that Catasys is still operating like a hyper-growth startup:

Claim No. 1: Multiple customer logos have disappeared over time from investor decks, inferring souring of relationships with healthcare providers.

It's not like Catasys falsified relationships. There were master service agreements signed with all of these plans, but they just haven't moved past the pilot stage … yet.

Claim No. 2: Financial claims turned out to be misleading.

What I'm more worried about is whether they have hit guidance. Projections change all the time as a result of changes in business. This is especially so in startup environments where the data is less than desirable and situations are much more fluid. This is part of the reason why Catasys brought on Curt Medeiros, former President of Analytics at Optum, and it seems like he has done wonders thus far in correcting that.

Claim No. 3: "Care coaches" are "cherry-picking" cost savings and claiming high disenrollment rates.

If you take the worst sales professionals (aka the ones most likely to complain) in any high-performing B2C company and look at their disenrollment or cancellation rates, you would likely notice high rates too. A couple of bad apples don't spoil the whole bunch.

Claim No. 4: Enrollment rates that are stated in interviews/calls do not match up with what the company reports.

Given the fact that the eligible outreach pool, or EOP, is ever expanding, EOP from a certain timeframe may eventually trend up to a 20% enrollment rate, but this will forever be diluted by future additions to the EOP where the enrollment is still ramping. Thus, the aggregated enrollment rate will never truly be 20%.

Claim No. 5: There is nothing cutting edge at Catasys; the entire operation is a low-tech cost center.

I won't go too much into this one; just look at the amount of data scientists and AI engineers there are working for the company on Linkedin.

Claim No. 6: Peizer is a stock fraud due to having been involved in multiple companies that eventually became worthless.

Entrepreneurs start companies that eventually fail all the time, doesn't mean they are maliciously trying to steal money from investors.

Did I miss anything? Leave me a comment if so.

Other than the contents from the short report, there are some additional risks that I see. Firstly, as mentioned during the Q1 conference call, medical utilization is down across the board as a result of COVID-19. Management has indicated that this will likely decrease the growth of the EOP and are looking to negotiate lower utilization requirements with the healthcare providers moving forward. Additionally, layoffs could potentially have a negative effect on enrolled members due to the loss of insurance for potential customers. While both of these serve as headwinds that could hinder the growth of the company, these headwinds should be offset by the increase in behavioral health-caused issues due to COVID-19 as well as the increased accessibility of potential members as a result of the stay-at-home orders.

Summary

While there are certainly risks involved with Catasys, the simultaneous upside is hard to ignore. There is enough cash here to last, at the very least, another year during which management projects to go cash flow positive. Whether that will happen on time is still up in the air, but the revenue numbers would certainly hit a triple-digit run rate by then. With the telehealth space being hot in the "coronaconomy," there is ample runway for Catasys' undervalued share price to build momentum as we approach the second half of 2020.

Disclosure: I am/we are long CATS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.