How France’s billionaires rallied around Arnaud Lagardère

Is it old relationships or the prospect of new deals that attracted LVMH’s Bernard Arnault to the media group?

by Leila AbboudTwenty years ago at the Polo Club in Paris, LVMH founder Bernard Arnault and media baron Jean-Luc Lagardère sat down for dinner after their regular game of tennis.

After they were joined by Mr Lagardère’s son Arnaud, the conversation took on a serious tone when the two titans of French industry discussed the sudden death of an acquaintance.

“If anything happens to me,” Mr Lagardère told his friend, “you must promise to take care of Arnaud.”

Mr Arnault agreed and — 17 years after the elder Mr Lagardère’s death — the luxury boss appears to be honouring his pledge. On Monday, Groupe Arnault announced it would buy 25 per cent of Arnaud Lagardère’s personal holding company through which he controls the publicly traded Lagardère group.

The deal has provided respite to Mr Lagardère after a bruising battle with a London-based hedge fund and saved him from an embarrassing reckoning with his French creditors.

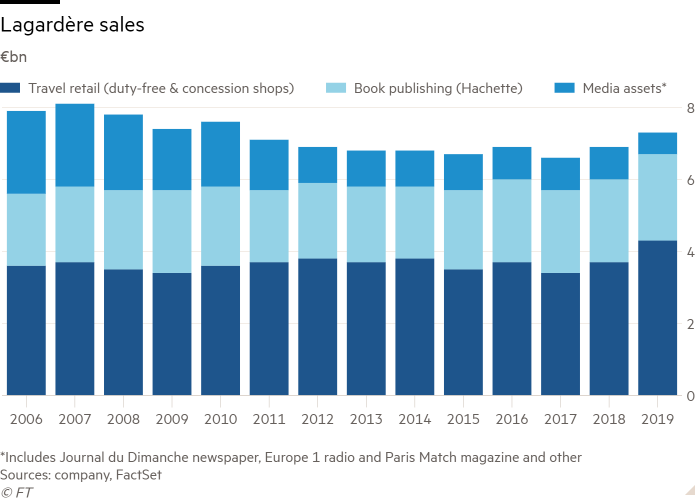

It gives him a new opportunity to restore the fortunes of the Lagardère group, which was once one of France’s industrial powerhouses and today is focused on the Hachette publishing house and Relay newsagents as well as radio, sports and entertainment assets.

“I have spent a lot of time defending myself and the company, now I want to move forward,” Mr Lagardère told the Financial Times in an interview. “If I’m lucky, I have 15 or 20 years left to work to strengthen my family’s company. The goal is to make Lagardère a global leader in its two businesses — book publishing and travel retail.”

The terms of Mr Arnault’s investment were hashed out in just a few hours when the pair met at LVMH’s office this month, soon after the Covid-19 lockdown lifted, according to people familiar with the events. The 59-year-old heir addressed the 71-year-old tycoon with the informal tu pronoun as he made his pitch.

The deal’s price tag, which people familiar with the matter put at around €80m, understates its importance to Mr Lagardère. It will give him a much-needed cash infusion to pay down €164m in debt owed to French bank Crédit Agricole, against which he had pledged his shares in Lagardère.

The debts were undermining his control over the company that he has run since his father’s death. In early April, Lagardère had to suspend its dividend payments after lockdowns crippled its travel retail business, the biggest division accounting for 60 per cent of the group’s €7.2bn of annual sales. Without the dividend, the chief executive was deprived of the income stream he used to service his debt.

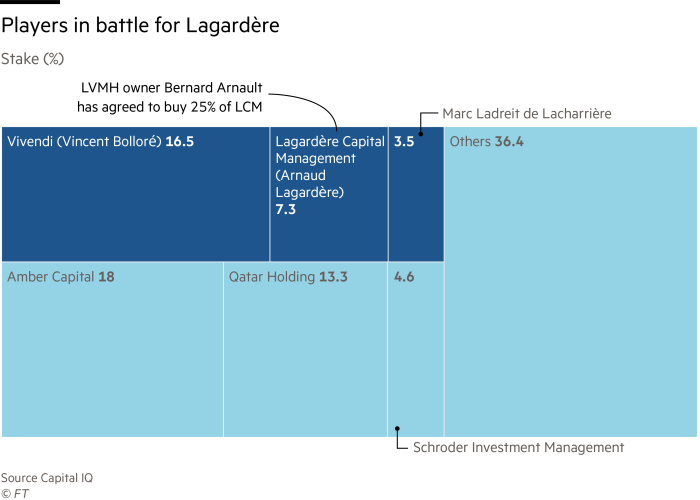

The arrival of Mr Arnault also gives Mr Lagardère a powerful ally in his long-running battle against activist investor Amber Capital. The hedge fund has slammed his record as a manager and wants to overhaul the company's distinctive legal structure, known as a société en commandité par actions, a hybrid between a partnership and a limited liability company. It guarantees Mr Lagardère’s control even though his holding company — now shared with Mr Arnault — owns just 7.3 per cent of the group’s equity.

Amber has applied pressure in court to force Mr Lagardère to disclose the full financials of his personal holding company, arguing that shareholders need to know the extent of his debt problems. The 2018 accounts showed that there was an additional €202m in debt at another related vehicle controlled by Mr Lagardère, according to documents reviewed by the FT, more than the value of Mr Arnault’s shares in the group.

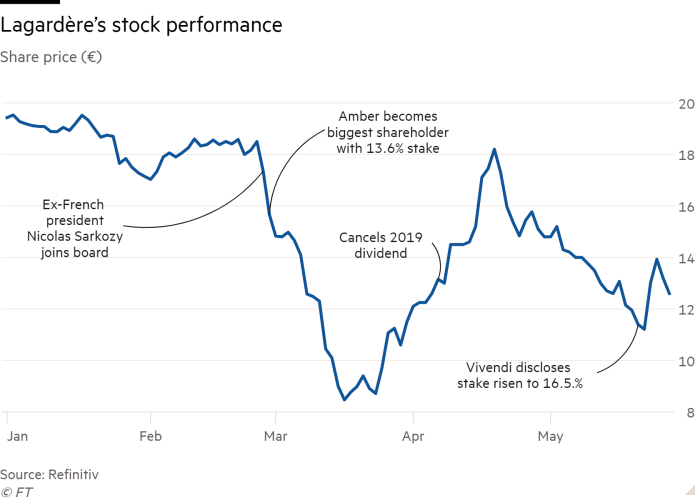

For all its agitating, Amber failed in an effort to replace the board at the May 5 shareholder meeting. In the run-up to that vote, however, Mr Lagardère had to scramble for support and ended up with one of France’s fiercest corporate raiders on the shareholder registry — Vincent Bolloré.

Advisers from Rothschild had spent months making the rounds of France’s wealthy families and institutions to seek new friendly investors for Mr Lagardère. But it was former French president Nicolas Sarkozy, who in February was nominated to join the Lagardère board, who approached Mr Bolloré, according to people familiar with the matter.

The politician, who is so close to Arnaud Lagardère that he once referred to him as a brother, is also friends with Mr Bolloré, whose family-run empire spans logistics and shipping in Africa to Universal Music Group.

Mr Bolloré agreed to invest, and one person close to the situation said that he assured Mr Sarkozy that he would act amicably and not seek creeping control as he has done elsewhere at companies including Bouygues and Ubisoft.

The Breton billionaire was also on good terms with Arnaud Lagardère, a neighbour in the exclusive Paris enclave of Villa Montmorency.

Recommended

FT CollectionsPrize assets

Arnaud Lagardère’s battle to retain grip on French empire

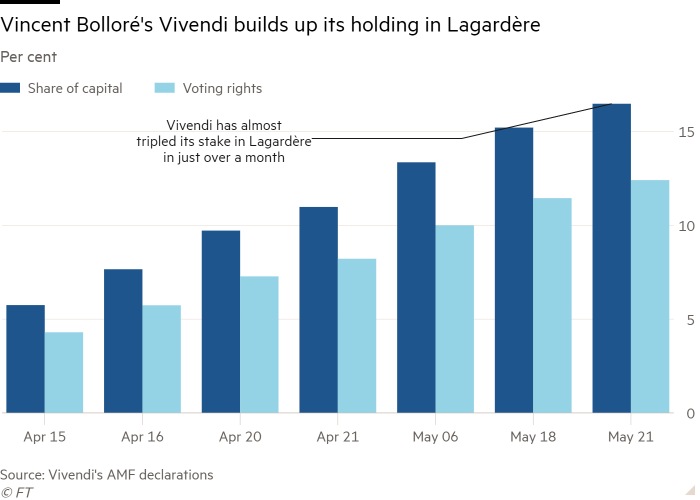

Using the French media group Vivendi which he controls, Mr Bolloré built an 11 per cent stake in the Lagardère group in three weeks before the vote and has since raised it further to 16.5 per cent.

Another billionaire, Marc Ladreit de Lacharrière, built a 3.5 per cent stake and informed Mr Lagardère he would back him.

Ahead of the crunch shareholder meeting, the Lagardère camp was also exploring a back-up plan. An adviser from Rothschild sounded out big shareholders, including the Qatar Investment Authority, about the possibility of Mr Lagardère giving up the commandité structure in exchange for a bigger equity stake — up to 20 per cent — in the listed group. Mr Lagardère would sacrifice control in exchange for a greater amount of liquid stock, fortifying his finances. Shareholders would suffer dilution but with more traditional corporate governance, and the possibility of a takeover or break-up, the valuation should improve.

But then came the surprise rescue by Mr Arnault, who agreed to invest in Lagardère Capital & Management (LCM). The proceeds will be used to pay down the Crédit Agricole loans.

The price was is in line with the €34 per share that was already ascribed to the Lagardère stake on LCM’s balance sheet, said one source, which represents a hefty premium to the current share price of €13.

The ties between the Arnault and Lagardère families run deep. In 2005, Mr Arnault bought Jean-Luc Lagardère’s mansion on the Left Bank from his widow, and still lives there. He sat on Lagardère’s board from 2004 to 2012; Arnaud Lagardère sat on the LVMH board between 2003 and 2009.

But nonetheless, the arrival of Mr Arnault and Mr Bolloré has set France’s business elite into a frenzy of speculation over the billionaires’ plans.

One banker said: “I don’t believe for a second that this is about honouring the memory of Jean-Luc.”

Another added: “It may very well be friendly but there is no free lunch with Bernard Arnault.”

Both billionaires may be attracted by Lagardère’s media assets, which include the Journal du Dimanche newspaper, radio station Europe 1, and Paris Match magazine. They bring in less than €300m in annual sales and are unprofitable, but confer political clout in France.

LVMH’s travel retail business called DFS could be combined with Lagardère’s similar business that operates duty-free stores and newsagents in airports and train stations, bankers said.

Mr Bolloré has not spoken publicly about Lagardère but he may have his eyes on its book publishing business Hachette, which brought in more than half of operating profit last year. Vivendi already owns a smaller French publishing business called Editis.

Jean-Claude Daumas, a professor emeritus of the University of Franche-Comté who has written about the history of France’s family companies, argued the two supposed “white knights” may well intend to dismantle the company.

“Of course we cannot exclude that the two businessmen are acting out of friendship, but their past histories make it more likely that something else is going on. Both created their family-run empires through raids and hostile takeovers. If I were in Arnaud Lagardere’s shoes, I would not sleep particularly well.”

It also remains to be seen what Amber will do. It has lost money on its investment so far since it bought its shares at prices varying from €18 to €20.

Amber’s founder Joseph Oughourlian said the fund plans to wait to see how things develop. It does not exclude mounting another proxy battle next year and has called on the French markets regulator to probe the deal with Mr Arnault.

“The commandité, which provides all the power to Mr Lagardère, has gone from being controlled solely by him to being shared by Bernard Arnault,” said Mr Oughourlian. “This is a material change that shareholders deserve to know more about.”

Asked whether he worried that Amber might form an alliance with one of the billionaires, Mr Lagardère dismissed the idea. “The families that anchor the French business world do not have much affinity for the tactics or philosophy of activist investors. I simply do not think that is going to happen.”

He also called attention to the fact that the billionaires were not all on the same footing.

“Bernard Arnault has come in at my request — via his family holding company and with an agreement that we will act in concert long-term — in my personal vehicle [LCM] that controls Lagardere’s operational businesses,” he explained. “Vincent Bolloré and Marc Ladreit de Lacharrière have made a financial investment in the listed group because they believed in its future prospects.”

He does not think that any would turn hostile towards him or the company. “I am not afraid of that at all,” he said. “They are my friends.”

Additional reporting by David Keohane