Megacap Algo Trade Taking Lumps Right After Everyone Piled In

by Lu Wang, Vildana Hajric- Declines in Facebook, Apple counter gains in broad market

- Fund exposure in megacap growth hovers near a decade high

If there was one thing money managers believed heading into Memorial Day, it was that owning America’s algorithmically powered tech superstars was the surest bet for navigating the crisis.

A week later, the strategy is showing signs of wavering.

It’s typical of 2020’s topsy-turvy market that the thing creating concern for these consumer-oriented behemoths is economic optimism. Belief that the coronavirus recovery is taking hold convinced investors several times this week to lighten up on megacap safety stocks and embrace risk among a dicier coalition of energy producers, airlines, financial firms and small caps.

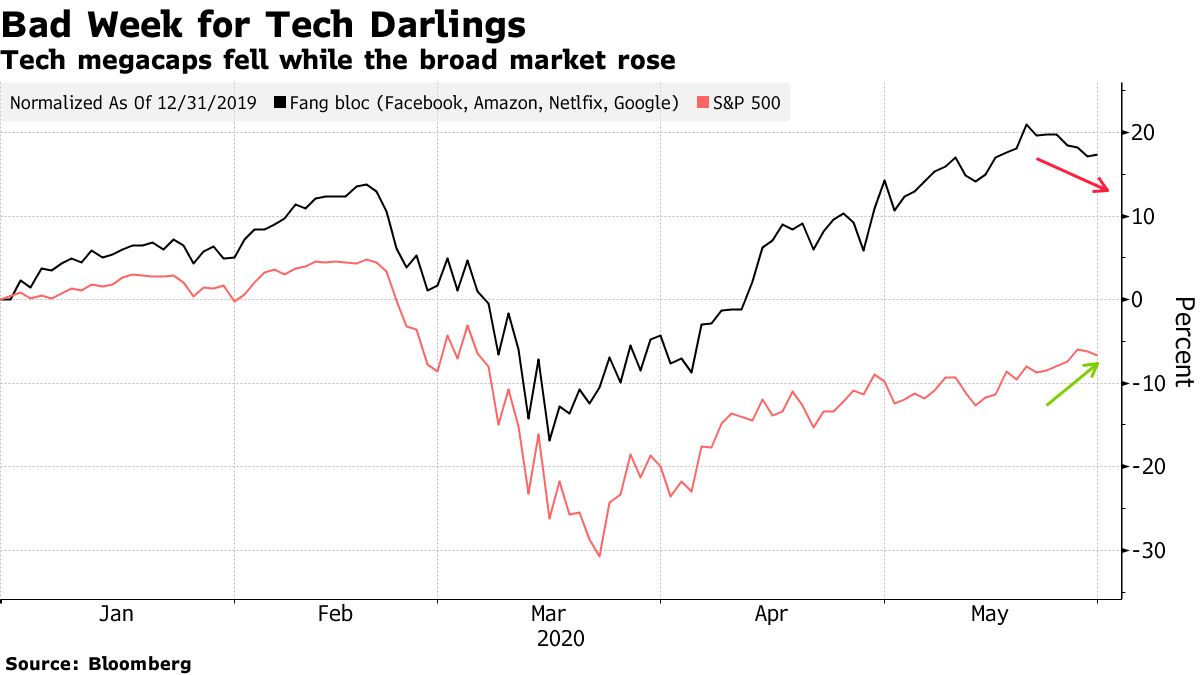

While the FAAMG trade reasserted itself in the final session, the biggest U.S. companies -- Facebook, Apple, Amazon, Microsoft and Alphabet -- have looked unusually vulnerable. They trailed the S&P 500 by 3.6 percentage points over four days, the second-worst performance in three years.

“I don’t think tech will get pounded but I think it’s going to underperform as the economy recovers,” Jim Paulsen, chief investment strategist at the Leuthold Group, said by phone. “Those that have just come into these because they’ve done so well of late this year during the pandemic, they could be hot money that gets disappointed and comes right back out again.”

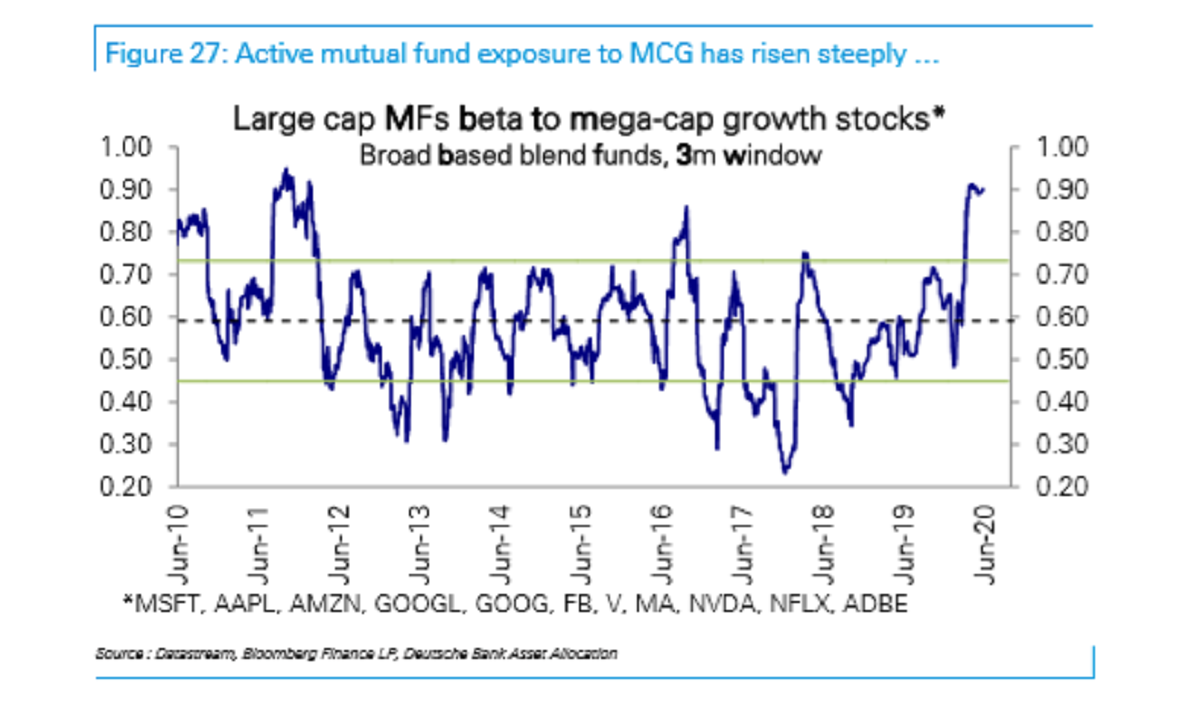

While barely a dent on their returns, it’s a gut-check for everyone who piled in, betting that surging demand for digital equipment and services makes these stocks immune to the lockdown. So strong is confidence in the stay-at-home trade that the gap between investor ownership in tech megacaps and the rest of the market has swelled to the widest in at least a decade.

Software makers and internet companies were among the worst performers in the S&P 500 over the week, supplanted by beaten-down companies loosely categorized as value plays, stocks once seen as too risky to own during the pandemic. The tech-heavy Nasdaq 100 index added 1.5% during the stretch, trailing the S&P 500 and Dow Jones Industrial Average, with each rising 3%.

The rotation is a vote of confidence in the economy and helps broaden participation in a market where gains had been dangerously concentrated in a handful of stocks. To tech devotees, obviously, the shift is less happy news.

The Big Five, along with other megacap growth stocks such as Netflix and Nvidia, have seen their exposure in mutual funds rising to the top end of a 10-year range, data compiled by Deutsche Bank show. Hedge funds showed a similar preference, boosting stakes in Amazon and Microsoft at a clip matched in no other stocks, Goldman Sachs found.

That affection is being put to the test on multiple fronts. President Donald Trump on Thursday signed an executive order that seeks to limit liability protections for social-media companies. Meanwhile, U.S.-China tensions resurfaced, putting tech again in the cross-chair of an ongoing trade spat. All of it is likely to take some shine out of the trade, according to Sean Darby, global equity strategist at Jefferies.

“The escalating U.S.-China technology war may introduce quite a sea-change in idiosyncratic risk,” Darby wrote in a note, dialing down his bullish view on tech stocks. “As the U.S. economy bottoms out, many of the outlying, underperforming sectors will see meaningful bounces in data hence increasing the probability of them having better relative earnings growth than the S&P 500 IT sector.”

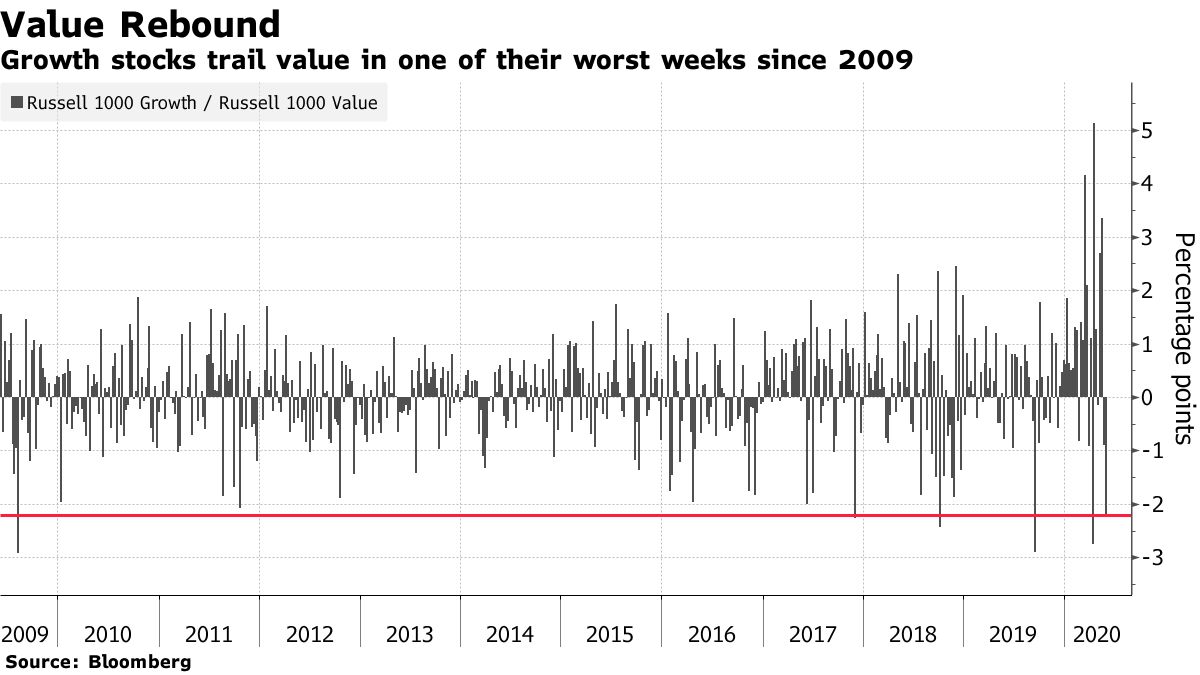

The sudden shift from tech stocks in favor of banks is rekindling a debate on the growth-versus-value trade. Thanks to tech’s dominance over the past decade, chasing faster growers has proved a persistent winning strategy over bargain hunting. This week, however, buying cheap stocks worked better. The Russell 1000 Value Index beat its growth counterpart by more than 2 percentage points, the fifth-best week since 2009.

The value rebound remains delicate, considering growth is “crushing value on fundamentals,” according to Jonathan Golub, Credit Suisse’s chief U.S. equity strategist. Companies in the Russell 1000 Value Index are expected to see their profits plunge 42% this year, more than three times the contraction forecast for its growth counterpart. The disparity is even more pronounced for cyclical stocks that are more so affected by fluctuations in the economy, Credit Suisse data show. In the three months ending in June, cyclical value stocks are projected to see their earnings completely wiped out.

While the bounce in banks and small-caps is likely to last given their tendency to outperform in the initial phase of recoveries out of past recessions, it’d be a mistake to give up on tech given the industry’s superior earnings power, Dan Skelly, who leads Morgan Stanley Wealth Management’s strategy and research team, said in a Bloomberg Television interview with Jonathan Ferro.

“There will be structural changes to the way we operate, both from a living and working perspective post-pandemic,” Skelly said. “The earning stream will likely continue to be fairly aggressive, and may improve in some cases. It’s not a question of abandoning them completely.”

Binky Chadha, chief global strategist at Deutsche Bank, is less sanguine. He downgraded tech shares earlier this week, citing “stretched” positioning, particularly in the megacaps. Based the firm’s data on price-earnings ratios, the 10 biggest tech-related stocks were trading at a roughly 120% premium relative to the rest of the market. The spread stayed below 50% until 2017.

The group “benefits from the Covid-19 shock, but this looks fully priced in,” Chadha wrote in a note. “With the second derivative of macro growth beginning to turn up as the staggered re-opening of economies gets underway, we look to increase our exposure to cyclical growth.”

— With assistance by Sarah Ponczek, and Claire Ballentine