Why Growth Will Continue To Outperform 'Traditional Value'

by IntegratorSummary

- Growth investing has handily outperformed traditional value investing over the last ten years, a trend which has been exacerbated since the pandemic.

- Traditional value investors hoping for a reversal of fortune may be disappointed as the pandemic has brought about large demand shifts which will likely remain in a new normal.

- A multitude of factors including higher levels of peak demand, secular shifts in interest rates and capital reinvestment opportunities help set up growth businesses to continue to outperform.

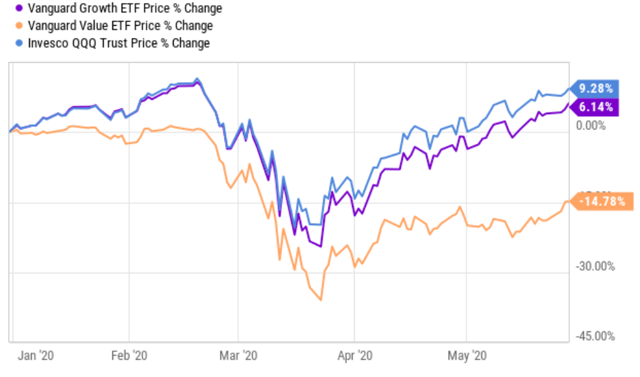

The dispersion in stock returns for growth businesses in the stock market and traditional value stocks has only increased over the last few months. While growth has comprehensively outperformed value for the majority of the last 10 years, this has really accelerated since the coronavirus pandemic took shape. In broad brush terms, the value rich Vanguard Value ETF (VTV), with components in traditional industrials, financials and energy sectors has barely doubled and has returned 10.7% annualized over the last 10 years compared with Vanguard Growth ETF (VUG) or the Nasdaq 100 (QQQ), up 15.3% annualized and 18.73% respectively over this time. This disparity has become particularly pronounced with the onset of the pandemic, with the Nasdaq 100 up 9.3% and the Vanguard Growth ETF up 6.14% year to date, compared with Vanguard Value ETF which is still down almost 14.8%.

Source: YCharts

The long-awaited recovery in the performance of value and value funds has been heralded for quite some time, however I would suggest that faster growing components of the market are likely to continue to outperform traditional value measures, in spite of the fact that returns from growth have already been so impressive for such a long period time.

Share price acceleration for growth businesses have been powered by higher long term demand

While the strong share price returns of many faster growing sectors of the market have confounded experts, the reality has been that the last few months have provided a meaningful acceleration of secular trends that ordinarily may have taken years. This has not only helped power many names within the growth spectrum to strong quarterly results, but it arguably sets them up for an impressive continuation of these results well into the future.

Reports of massive hiring by Amazon (AMZN) of over 100,000 temporary workers in its e-commerce business over the last few months isn't simply a 'feel good story'. It's indicative of the massive surge in demand above previous normal trends that Amazon was clearly under prepared for. Shopify's (SHOP) CTO has reported seeing traffic levels that are equivalent of a black Friday every day!. Businesses like Twilio (TWLO) have more than doubled from market lows as their customers rush to digitize their experiences as consumers in lockdown avoid physical interactions of all types with brands.

Even the growth businesses that have struggled during the current crisis, such as Visa (V) have seen evidence of trends will set them up nicely in the long term. Visa's cross-border transactions business has collapsed as people have less frequently traveled, however it's seen a surge in card not present transactions as many consumers take their first experience with e-commerce and online payments in emerging markets, something that is promising for long term carded volume.

As consumers get used to the convenience of not having to go into a physical store to buy groceries or now find that they can virtually consult with a doctor, then these will become behaviors with some permanence. The longer the lockdowns persist and the more that consumers remain fearful, the more ingrained these long-term these habits will become. The trends represented by the surge in stock prices of growth businesses don't just represent an uptick in the next 1 or 2 quarters of earnings. Rather it's setting the stage for years of uplift in demand that's likely to occur from acceleration in shifts of consumer behavior.

Large pockets of traditional value may not make it, or will be impaired for some time

Many traditional value names may have finally yielded the 'last puff from their cigar butts' as Buffett was want to observe. The retail sector which was home to a number of slow growing, high-yielding plays is looking increasingly like it may finally see large scale implosions. The collapse of retailers such as JCPenney (JCP), J.Crew and Neiman Marcus (NMG) should be instructive for value investors evaluating other impressive high yielders such as Macy's (M)(dividend now suspended) and Bed Bath Beyond (BBBY) both of which yielded above 10% recently. Valuation measures of both businesses, such as Price/Sales, are at the cheapest levels that they've been for years. Other sectors will provide additional puffs of the cigar, however they've unfortunately been impaired through little fault of their own.

The worst unemployment rates for years have made gun shy consumers nervous about outlaying large sums of money for highly discretionary purchases. Traditional value plays like the auto makers, Ford (F) and GM (GM), trade at sales multiples which are also amongst the cheapest they've seen for the last 5+ years.

The financial sector has been weighed down by long-term interest rates which refuse to go upwards. This is materially impacting the ability of the large financial institutions such as Bank of America (BAC.PK) and JP Morgan (JPM) to be able to profitably lend on the razor thin spread between negligible deposit rates and depressed lending rates.

Impairment doesn't just refer to the threat of insolvency of liquidation. More fundamentally, the massive shifts in demand between the 'haves and the have nots' have resulted in returns on invested capital for many traditional value businesses progressively declining, and the recent pandemic is only likely to accelerate this. Businesses such as Ford, GM, Bed Bath and Beyond and Macy's have all seen progressively lower rates of return on invested capital.

As Charlie Munger has observed "it's hard for a stock to earn much better returns than the business that underlies it". As returns on invested capital for many traditional value stocks continue to sink, it will become hard for investors in these companies to see stellar performance.

Large Cap Growth is now becoming 'the new value'

There's an argument to be made that large-cap growth businesses are actually "the new value" based on their cash positions, revenue growth and valuations. When a business like Alphabet (GOOG) is looked at on a net cash basis, excluding "other bets" such as Waymo and Verily, an argument could be made that Alphabet's Google search business would be trading at a little over 20 times free cash flow.

Facebook (FB), similarly continues to push 20% revenue growth and maintain very high operating margins margin's near 35%. Adjusted for its net cash balance of close to $50B and on a normalized basis, Facebook also happens to trade in multiple of just over 20 times earnings.

In both of these instances, the business is actually at a premium in terms of quality to the market and yet both are valued not materially over market multiples, in spite of the strong recent share price run.

When compared with the relative uncertainty of businesses in the retail and industrial sectors that are more traditionally associated as being value investments, there's a case to be made that the returns associated with businesses such as Facebook and Google will be better compared to traditional value-based investments.

This illustrates the phenomenon that if strongly profitable, rapidly growing businesses don't appreciate fast enough, then they build up large cash balances and their valuation multiples start to rapidly compress, giving them a profile of businesses that are better quality than the market but valued at or slightly above market multiples.

Lower long-term interest rates are a game changer for growth businesses

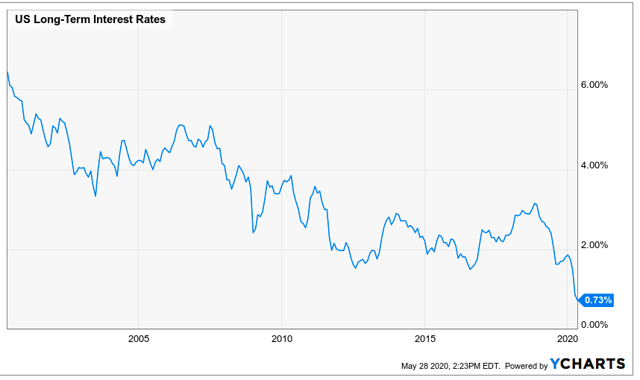

The flattening of long term interest rates over the last few months as a result of both a general worldwide economic slowdown will have the effect of keeping long-term interest rates at historically low levels of near 1 to 2% for an extended period of time. This will favorably impact the discounting of future cash flows for higher growth companies whose valuation tends to be disproportionately more dependent on longer-dated cash flow's compared to more traditional value based businesses. To put this in some context, long-term interest rates are currently less than 1% compared to a long-term average near 4 1/2%, which indicates the magnitude of the valuation uplift favoring gross businesses.

Source: YCharts

Additionally, growth businesses can more effectively use the environment of depressed interest rates to magnify their advantage. Being able to make good use of debt to amplify the effect of earnings reinvestment at very high rates of capital will deliver significant long term value to shareholders in these businesses.

Put another way, borrowing at next to nothing to bring forward projects where a return on capital of 20%+ is earned is going to create significant long term value. It makes sense for a business like Twilio to do so, precisely because of the opportunity set that's in front of them. It makes less sense for a Macy's or a Bed Bath Beyond, because they are just trying to conserve and hang onto the stores they have, rather than looking to expand store footprint.

Concluding Thoughts

There is no doubt that growth businesses have appreciated very significantly over the last decade, and even more so over the last few months, compared to the performance of traditional value investments. However rather than expecting a reversion to the mean, growth businesses will probably maintain their advantage over time, due to a step up in both near and medium term demand.

This will accentuate a disparity in returns on invested capital where growing businesses have the ability to deploy retained earnings in opportunities that will provide significant returns on invested capital, further creating value for shareholders. Larger growth names should pop onto value investor screens as their multiples continue to compress and cash balances accrue, providing relatively inexpensive options to participate in moderate to strong growth, as traditional value names continue long term declines.

To see other ideas of high quality, growing businesses that are positioned to be long term wealth creators, please consider a Free Trial of Sustainable Growth.

- Ideas based on the philosophy of Project $1M, which has outperformed the S&P500 by almost 50% for 2019, and over the last 4 years

- Access to Large Cap, Emerging Leader and High Conviction Model Portfolio which all outperformed the S&P500 in 2019

- Watch list that covers a broad universe of businesses with 'unfair competitive advantages' in fast growing markets

- Exclusive ideas on potential 'Wealth Creators of tomorrow'

Disclosure: I am/we are long GOOG, FB, TWLO, AMZN, V. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.