iShares Cohen & Steers REIT ETF: Portfolio Selection Makes All The Difference In Real Estate

by Michael A. Gayed, CFASummary

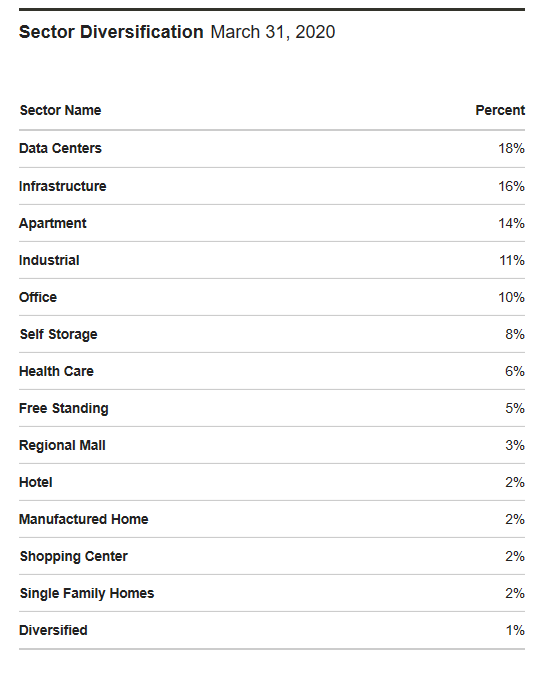

- The iShares Cohen & Steers REIT ETF's largest holdings are in data centers.

- States are starting to reopen their economies which will help REITs.

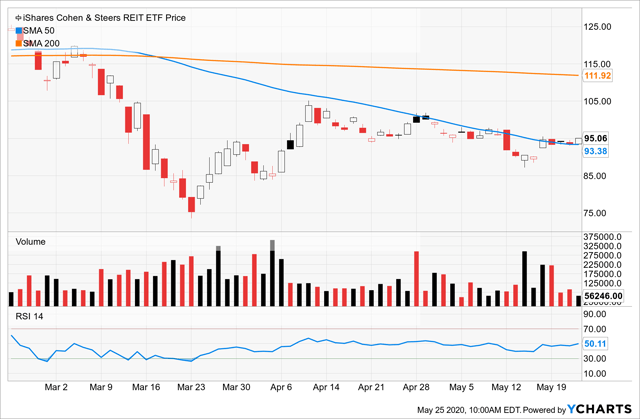

- With a current price of $95.06, it looks like a good entry point.

Look at market fluctuations as your friend rather than your enemy; profit from folly rather than participate in it. - Warren Buffett

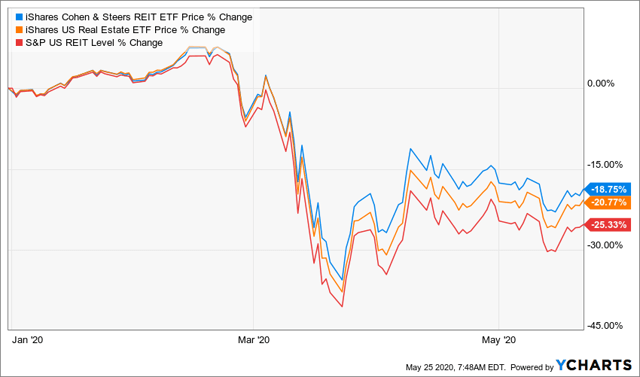

The iShares Cohen & Steers REIT ETF (BATS:ICF) offers a better selection of underlying real estate investments than the broader REIT ETFs. Its portfolio selection has shown through this year as the market touched bottom in late March and has since accelerated. Even though the fund is still in negative territory for 2020, it offers a good entry point for investors looking to add real estate to their portfolio.

Overall economic conditions are starting to improve for real estate investments. The three-month grace period for mortgage payments is coming to an end. "With states starting to reopen, the prospects for rent and mortgage collections are likely to slowly begin improving. Support coming from the Fed and zero interest rates should only help," as described by the Lead-Lag Report.

Compared to the broader iShares U.S. Real Estate ETF's (NYSEARCA:IYR) 113 holdings, ICF has a much more concentrated portfolio of only 30. With the largest component being data centers, which own and manage facilities that customers use to safely store data. Data center REITs offer a range of products and services to help keep servers and data safe, including providing uninterruptible power supplies, air-cooled chillers and physical security. These are names such as Equinix (NASDAQ:EQIX) and Digital Realty Trust (NYSE:DLR) that are up more than 20% over the past 12 months. As companies migrate their data storage from on-site facilities to the cloud, data center REITs are the beneficiary.

The largest drags on the portfolio have come from Health Care, Malls, and Office as would be expected during this economic shutdown. Even though we may never go back to crowded malls and large office parks, they are not going away completely, and they represent a much smaller portion of ICF than IYR at almost 8% for each of those segments. Elective surgeries and therefore rehabilitation centers are restarting throughout the country. This will help the health care REITs within ICF such as Welltower (NYSE:WELL) and Ventas (NYSE:VTR).

ICF has strategically added to the portfolio during this downturn. It added Sun Communities (NYSE:SUI) which owns and develops manufactured housing and RV communities in the southeast and midwestern regions of the US. These are areas of growing population and some of the first to reopen the economies.

The iShares Cohen & Steers REIT ETF looks more expensive with a PE of 46.3 when compared to the iShares U.S. Real Estate ETF with a PE of 32.9. However, the REIT category has an average PE of 43.1 according to Morningstar, and ICF’s portfolio of REITs is growing cash flow at 6.0% compared to IYR’s 3% growth. ICF has shown it tried to protect investors by limiting the downside compared to the broader ETFs. It has a downside capture ratio of 50 for the past 10 years equated with IYR’s 59 for the same time period. Again, the portfolio selection is ICF’s strong point as made visible in its 10-yr alpha calculation of 3.65 compared to the overall REIT category average of 2.22.

Since the March 23rd low in the stock market, ICF has been pushing up against its 50-day moving average and has been above it recently. If this trend continues, it makes for another positive sign for the fund.

*Like this article? Don't forget to hit the Follow button above!

Subscribers warned to go risk-off Jan. 27. Now what?

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.