Closed-End Funds: Eaton Vance's Option Funds

by Nick AckermanSummary

- Eaton Vance offers many respectable funds.

- Today, I wanted to give a broad overview of the option based funds we don't discuss very often.

- I also wanted to touch on how how they may fit in one's portfolio.

Written by Nick Ackerman, co-produced by Stanford Chemist

Eaton Vance offers many different types of closed-end funds. I believe they offer investors an attractive way to get familiar with CEFs. They usually offer all-around diversified exposure to equities in most of their funds, as well as offering a variety of fixed income focused funds. They operate leveraged funds and option-based funds.

We have discussed at length the Eaton Vance Tax-Managed Buy-Write Income Fund (ETB), Eaton Vance Tax-Managed Buy-Write Opportunities Fund (ETV) and Eaton Vance Tax-Managed Buy-Write Strategy Fund (EXD). That's because, from our point of view, we see EXD as the no brainer as the one of those three to invest in as they all offer quite a bit of the same exposure at wildly different discounts.

Today, we wanted to explore the other option-based funds with a quick overview and how they may fit in an investor's portfolio. Every investor has a different strategy and objective. I hope this overview can give a quick update on where the funds stand today. Before getting started, it is quite obvious that many of these funds hold some of the same positions. Primarily, this is in the tech space as their top ten overlaps the most with these tech names. This isn't necessarily a bad thing as their options strategies can set them a bit apart overall.

Eaton Vance Equity Income Fund (EOI) - Eaton Vance Equity Income Fund II (EOS)

These funds are essentially the same. Though their holdings can change drastically as we will discuss below. The first fund launched in October 2004. The second was offered up shortly after in January of 2005.

The investment policy for both of these funds is "investing in a portfolio of primarily large- and midcap securities that the investment adviser believes have above-average growth and financial strength and write call options on individual securities to generate current earnings from the option premium."

This is a key fact to note - several of Eaton Vance's funds write call options on indexes and not the individual security. What this can do is potentially cap the upside of the funds if the underlying positions get called away. However, they target an overwritten percentage of the portfolio at 50%. They can ultimately buy back the written contract or roll it out to hang onto the underlying positions as well.

EOI last reported its sector exposure all the way back in its Annual Report from September 30, 2019. They have updated their holdings since then, but they don't provide a sector breakdown besides in their reports. At that time, the fund held 21% in tech, 14% in healthcare and 13.4% in financials.

EOS, which reported December 31st, 2019, had in their Annual Report a whopping 36.9% in tech, 16% in healthcare and 15.4% in consumer discretionary.

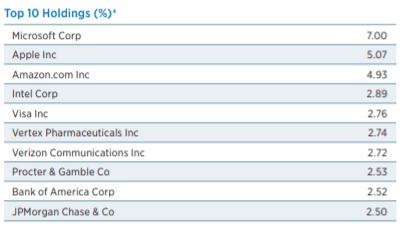

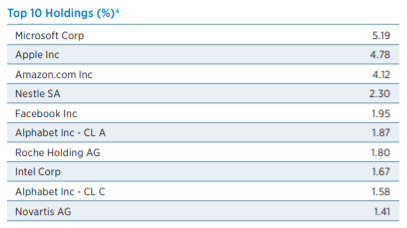

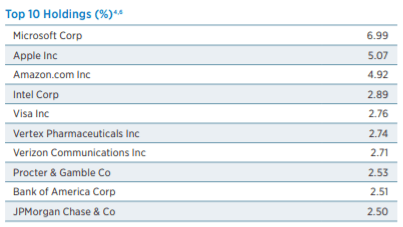

(Source - Funds' Fact Sheets)

These holdings were as of the end of March 2020. When putting the funds' top ten holdings side by side, we see they do share some of the same top tech holdings. However, for EOS, we see a significantly greater percentage in their top holdings. This can help explain the fund's greater exposure to tech.

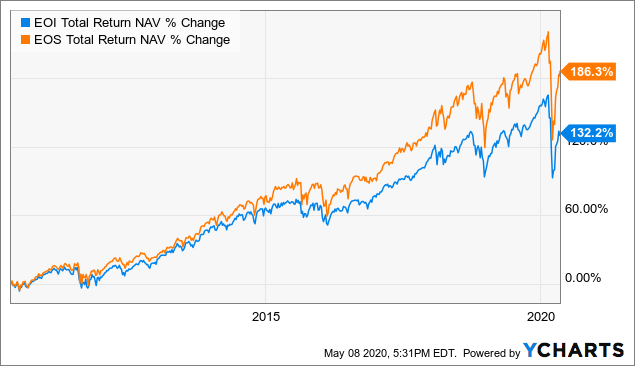

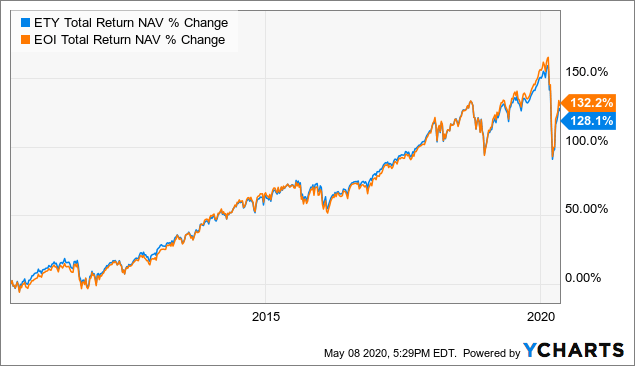

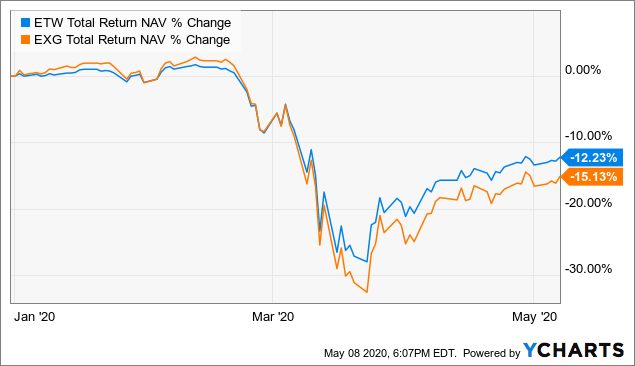

Data by YCharts

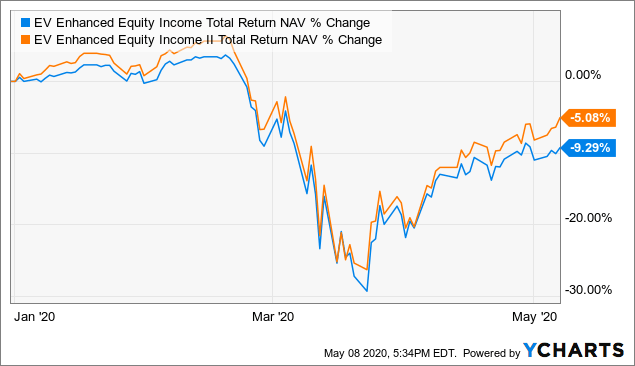

When comparing the funds' performances over the last 10 years, it isn't close. EOS has handily outperformed EOI. However, this is at greater risk with more cyclical holdings. Further, the latest selloff has disproportionately affected the financial sector versus the tech sector. This is very evident from the chart below.

Data by YCharts

I do personally hold EOS. Putting money into EOI would be putting money to work in a fund that is trading at a discount of 6.44%. EOS is currently trading for a slight premium of 0.49%. That isn't necessarily terrible, though. If an investor wanted the much greater exposure to tech - without being in an all in tech fund - then EOS could be a great addition as well. The case could also be made that financials have been lagging significantly relatively speaking, that they could be more likely to rebound over the next couple of years and outperform. I could also see a case for adding both funds since their holdings do differ.

Eaton Vance Tax-Managed Diversified Equity Income Fund (ETY)

ETY has an investment policy to "invest in a diversified portfolio of domestic and foreign common stocks with an emphasis on dividend-paying stocks and writes S&P 500 Index call options with respect to a portion of the value of its common stock portfolio to generate current cash flow from the options premium received."

This fund also writes options with a target of about 50% of the portfolio being overwritten. As previously mentioned though, this fund doesn't write them on individual positions but the S&P 500 Index itself. These are 'cash settled' at expiration since an investor can't buy an index itself. This means the fund doesn't have to worry about giving up an underlying position that is running upward with strong momentum. However, in theory, the losses on the contracts are unlimited as the S&P 500 can go to infinite. That's obviously very unlikely to happen. The portfolio is also 'hedged' from these losses as it is very likely that, if this was occurring, the fund's underlying positions would also be running higher.

ETY states they are diversified. They are, albeit, not very much different from EOI, though. Tech in this fund is coming in at 22.1% exposure, 14.1% belongs to healthcare and financials at 13.3%. This is almost identical to EOI. Setting this fund apart from EOI is the different type of options written. Seriously, check out this fund's holdings at the end of March and go back up to EOI's holdings. The only difference is the percentage allocation!

(Source - Fund's Fact Sheet)

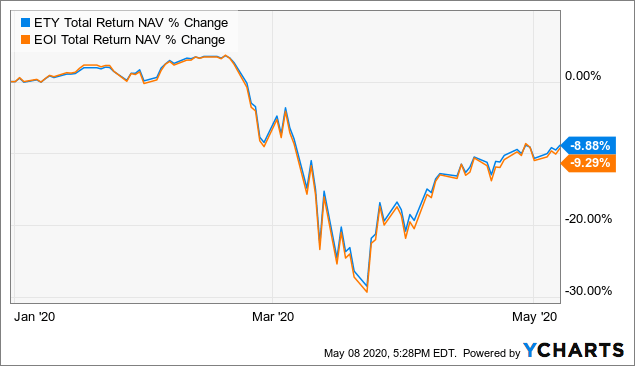

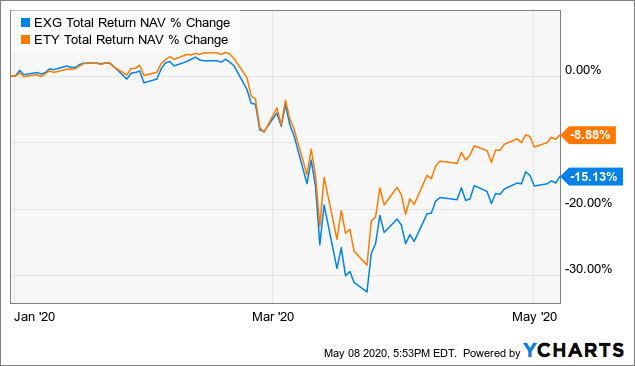

Data by YCharts

On a YTD basis, the funds haven't performed all that different either.

Data by YCharts

To go even further back, looking at the 10-year return, we see they are almost identical as well. Overall, it would appear that holding ETY or EOI is basically the same. Even more so than EOI and EOS, when those two are essentially the same investment strategy with a wildly different portfolio composition. ETY is a great holding, though, with an options strategy that is slightly defensive due to being able to collect premiums no matter what way the market is moving. The diversified portfolio is also a nice addition to any portfolio that needs some equity exposure.

ETY is held in our Taxable Income Portfolio at the CEF/ETF Income Laboratory. The fund's latest discount is 5.13%.

Eaton Vance Tax-Managed Global Diversified Equity Income Fund (EXG)

EXG is one of the two options based funds that have a global tilt to its portfolio. The fund is quite similar to ETY above except is its foreign holding counterpart.

The fund's investment policy is "investing in a diversified portfolio of domestic and foreign common stocks with an emphasis on dividend-paying stocks and writes call options on one or more U.S. and foreign indices with respect to a portion of the value of its common stocks portfolio to generate current cash flow from the options premium received."

Similar to ETY, the fund targets an option overwritten percentage of 50% on its portfolio. It is no surprise that the fund has significantly lagged its U.S. based peer, even while holding a few of the same tech names in its top holdings.

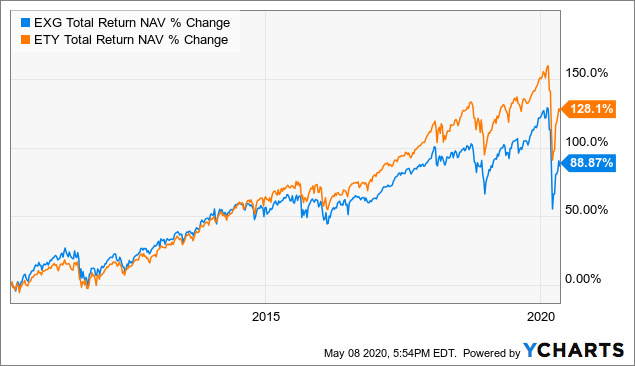

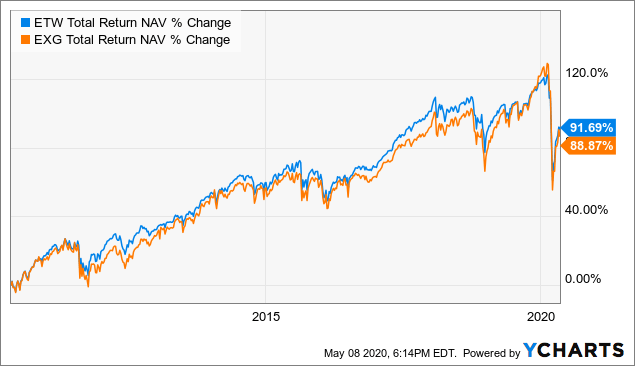

Data by YCharts

This is on a YTD basis and a longer-term basis as well. The last 10-year performance can be seen below.

Data by YCharts

The fund was last reported to hold 52.84% in North America, 33.53% in Europe and 13.64% in Asia/Pacific.

(Source)

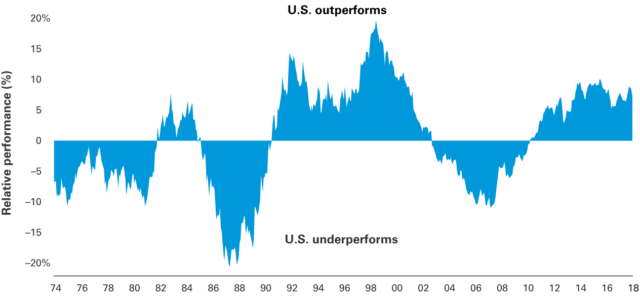

This fund would be for an investor that believes international equities can finally overtake the U.S. equities. It might be surprising but no, U.S. does not always outperform international securities. In fact, one could make the argument that the trend is due for a reversal. I certainly felt this way going through 2019 and added some to my international positions. However, the latest COVID-19 induced panic has meant that international securities are likely to continue to underperform for the short term. The U.S. is seen as being more stable and therefore safer. This will draw in greater investor demand. For that reason, I would only add to this position if one is a longer-term focused investor and if one is lacking international exposure overall.

EXG is held in our Taxable Income Portfolio at the CEF/ETF Income Laboratory. The latest discount for the fund is 8.16%.

Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund (ETW)

ETW is another option based EV fund with a focus on global positions. However, in this case, the option exposure is targeted to 80 to 100% of the portfolio being overwritten. The last reported percentage was 92%.

The fund's investment policy is "investing in a diversified portfolio of common stocks and writes call options on one or more U.S. and foreign indices on a substantial portion of the value of its common stock portfolio to seek to generate current earnings from the option premium." They continue with another offsetting feature from EXG above; "the fund's portfolio managers use the adviser's and sub-advisers internal research and proprietary modeling techniques in making investment decisions."

The sub-adviser, in this case, is Parametric Portfolio Associates, which the parent company is actually Eaton Vance itself. The fund's top holdings are all quite similar to the rest, with quite a few tech names in the top ten. The portfolio was also 20.7% tech, 13% consumer discretionary, and 12.6% healthcare. Healthcare is another common theme in these funds as well.

(Source - Fund's Fact Sheet)

The portfolio is invested 55.89% in North America, 32.16% in Europe and 11.95% in Asia. That does make the portfolio international exposure quite similar to EXG's above.

Data by YCharts

On a YTD basis, we see the fund has outperformed its EXG counterpart. This isn't surprising as the fund has a higher overwriting to options.

Data by YCharts

What did surprise me, though, is the fact that looking over the past 10 years, the funds have performed quite similar. I would have initially thought that EXG's performance would have been better considering the lesser drag from the fund's options writing strategy. Similarly, the funds have pretty comparable discounts too, with ETW at an 8.43% discount. That can be compared with EXG's at 8.16%.

Overall, it is hard to choose between ETW and EXG. The funds have performed quite similarly, and the discounts are around the same level. Even the distribution rates are very similar too; EXG at 10.76% and ETW is at 10.70%. For this reason, I could see picking either one or the other or even both. I would have thought that ETW would have underperformed because of the higher portion of option writing, but that doesn't seem to have been the case. Based on its current stats too, there really isn't an edge over one or the other either.

ETW is held in our Taxable Income Portfolio at the CEF/ETF Income Laboratory.

Eaton Vance Risk-Managed Diversified Equity Income Fund (ETJ)

This is one of the more interesting EV funds. This is one of the most defensive equity CEFs that I know of. The fund's investment policy is "invests in a diversified portfolio of common stocks and purchases out-of-the-money, short-dated S&P 500 index put options and sells-out-of-the-money S&P 500 Index call options of the same term as the put options with roll dates that are staggered across the options portfolio." The portfolio can be overwritten up to 100%, as well as 100% of its portfolio being covered by put options.

For those that are more familiar with options, this is called a collar strategy. They are collecting a premium like the other option based funds above, then they are also taking it a step further and buying puts on the underlying positions. Thus, should the security drop in value, the put option will rise in value. This is buying insurance on the underlying portfolio.

That insurance is also where I have a problem with the fund. It is really expensive insurance when 100% of the portfolio can be protected. Then, limiting the upside by having to roll the written option contracts or buy it back to not have the position called.

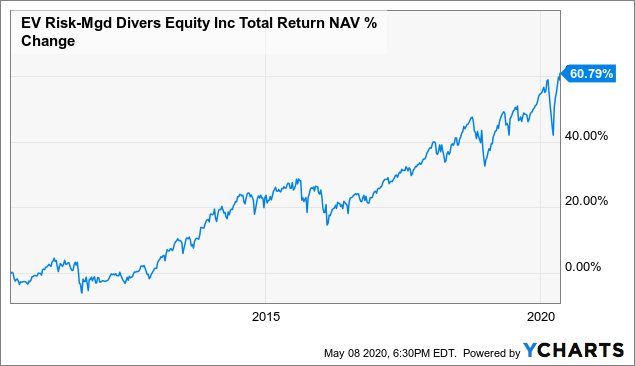

Data by YCharts

This is quite evident in the fund's 10-year performance of 60.79% reflected above. These protections that the fund buys are very expensive and generally don't pay off as there is an upward bias to the market.

Tech made up 22.8% of the fund, followed by 13.7% in healthcare and 13.5% in financials. Check out the fund's top ten holdings:

(Source - Fund's Fact Sheet)

Does this look familiar? Go back up to EOI's portfolio list. That's correct, it is identical +/- a few percentage basis points. The big difference is that EOI had returned over double for the same time period.

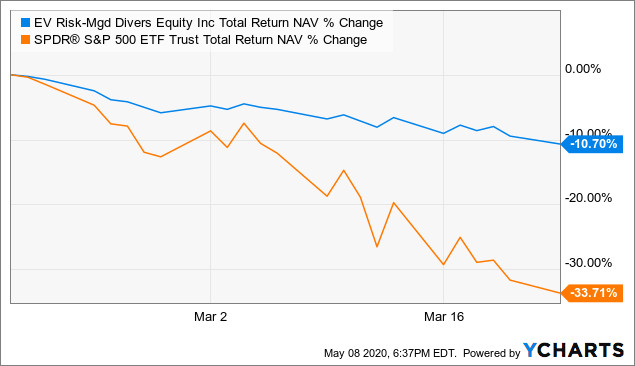

So, where does ETJ shine? In large market selloffs. The one that we just witnessed is a great example of the fund holding up very well relatively speaking to the broader market.

Data by YCharts

A look at the fund's NAV total return in relation to S&P 500 ETF (SPY) from the February 19th high to the March 23rd low. The fund's NAV held up very well. The major issue with having a very defensive portfolio in CEF form is the fact that an investor can't really take advantage of it due to the premium/discounts that appear.

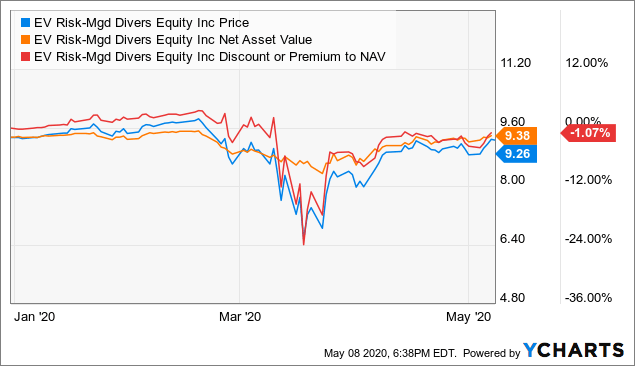

Data by YCharts

On the YTD chart, we can clearly see what happened. NAV didn't really budge relative to the market, which we highlighted above. Though, the fund's share price collapsed and its discount dropped through the floor. The current discount of 1.07% is relatively slim too. Perhaps, if the selloff was much longer than this latest quick (but very sharp) dip, then we could see something different. For example, during the GFC for 2008, the fund's NAV total return was -4.57%. The fund's total market return, though, for that year was 6.32%. People were definitely able to take advantage of the fund in that case.

I still find it hard to invest in a fund that will underperform 99% of the rest of the time. That's what ultimately drives me away from the fund. It isn't for me with a longer-term mindset when I want to invest for the next 5 to 10 years or possibly never sell my positions. Picking up anyone of these other EV option funds would have been a better option. That is even considering the significant underperformance in the international names too.

For an investor that is looking for shorter-term protection, then this fund could work. I think the timing is rather difficult though, and it's very hard to consistently know when to buy and hold the fund. As of right now, it might seem like a good time to buy into the fund as the markets have rebounded so sharply from the lows - might be indicating that we get a pullback again and head lower. The flip side of this is we continue to head higher, and this fund continues to underperform. Additionally, it isn't bulletproof with this defensive strategy as we saw the fund's NAV will hold up very well (as it should!) But its share price still craters in an unwarranted manner. If CEFs were more rational and didn't have the feature of discounts and premiums then it would be a better defensive play. Ultimately, I don't want that to be the case as we take much more benefit in utilizing our rotation strategy between under and overvalued funds. So I'm very much a fan of discounts and premiums in the end.

Conclusion

I hope this quick update was useful for readers in deciding whether or not an Eaton Vance option-based fund was right for them - and which one might be right for them. Ultimately, I believe the majority of EV's funds have a place in an investor's portfolio. Aside from ETJ, which has a much more narrow purpose. Even if I don't find ETJ that appealing, it doesn't mean it isn't right for some other investors.

ETW and EXG are good positions for investors that need to add international exposure. These funds lean heavier into tech exposure (similarly to all these funds,) but they are still quite diversified overall. It has definitely been a long time that U.S. securities have outperformed their international peers. On a shorter-term basis, this does seem set to continue with the latest coronavirus selloff.

That heavier exposure to tech positions isn't necessarily surprising either. Considering even the S&P 500 is 26.53% of tech now too. The EV funds that are focused in the U.S. are essentially just mirroring the S&P 500 for the most part. They are then utilizing the various option strategies to offset themselves. EOS does generally hold significantly more tech though, which is exactly why its portfolio has outperformed.

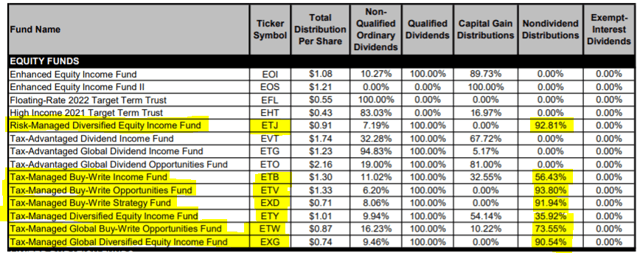

Another important note on the option-based funds is the return of capital that is generated by the funds. We have discussed in the past that ROC isn't always bad either.

(Source - 2019 Tax Information)

The majority of the funds we covered today are great sources of ROC. Besides EOI and EOS, all the others discussed have significant payments that are attributed to ROC. These portions of the distribution reduce an investor's cost basis. Meaning that that portion isn't taxable if held in a taxable account until the position is sold. Essentially, if held for forever, one may not have a tax obligation. This can then be passed onto an heir with a stepped-up basis. If in the future that is still how the tax law works.

If a position is reduced to a bellow $0 cost basis, the position is then taxed at capital gains rates for any income collected after that. So, if it is held long enough and enough is paid out, an investor could ultimately have a tax obligation before selling the position.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

Disclosure: I am/we are long EOS, EXD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article was originally published on May 8th, 2020 to members of the CEF/ETF Income Laboratory.