Westlake Chemical Corporation: Too Early To Go Long Here

by Individual TraderSummary

- First-quarter numbers were encouraging considering lower sales prices witnessed in the quarter.

- We like the fundamentals of caustic soda despite headwinds in Q1.

- Debt has been on the rise which may adversely affect dividend growth levels going forward.

- We await second-quarter numbers.

With the S&P 500 now firmly above 3,000, it looks like we will now retest the recent March lows. Achieving this level so soon after that sub-2,200 print back in March is something the bears would have never expected. Furthermore, with unemployment claims skyrocketing and GDP in the US expected to plummet this year, it seems surreal that the spiders can be trading over 3,000 at this point.

We must remember however that the market is a discounting mechanism which is already pricing in how the economy will recover over the next few quarters. If the economy does not recover as the market expects, the next intermediate decline in the spiders will be steep, but we still do not expect the March 23rd lows to be revisited. The maximum decline we would envisage would be somewhere in the region of 60% to 65% which is the lowest Fibonacci retracement technical level. We will be able to calculate this expected level once this present intermediate cycle forms its intermediate high.

We always like to follow the cycles of the main indices to time certain positions. Westlake Chemical Corporation (NYSE:WLK) is one such company, which is still down well over $20 a share or 30%+ year to date. We have been long this stock on certain occasions, and it has served us well. Although there are a lot of moving parts in Westlake at present, just like the main indices, we believe that if the stock price is rising, it essentially means that the firm's fundamentals are becoming bullish.

In the first quarter this year, for example, Westlake reported $0.65 in earnings per share (excluding the tax benefit of $62 million) along with $1.93 billion in top-line sales. Both of these numbers beat estimates, which was encouraging. The Olefins and Vinyls segments saw elevated volumes buoyed by strong performances from polyethylene in the Olefins segment and PVC resin in the Vinyls segment. In fact, these products essentially made the first quarter, as their higher volumes softened the blow with respect to lower pricing due to the lockdowns in the Chinese market in January along with European markets in March.

For example, although the market witnessed significant declines in the price of caustic soda in the first quarter due to reduced demand, we remain bullish on this compound over the next decade. Plenty of reports have been done on the fundamentals of caustic soda which state that the compound's market is set to grow rapidly over the next decade or so. This is bullish for Westlake as well as its competitors as demand is what fuels the price curve.

For the time being though, Westlake has had to pivot in order to be as efficient as possible in current trading conditions. This has meant drawing down debt from its credit facility, reducing its capex commitments for 2020 plus decreasing its level of operations to suit current demand. Furthermore, due to the extra load that has come onto to the balance sheet, the firm has spaced out the payments of its debt obligations to protect its liquidity position as much as possible.

Where does the above information leave the long-term investor? Although the valuation may look compelling at present (forward book multiple of 0.78 and forward cash/flow multiple of 4.98), the increase of interest-bearing debt has meant that the firm's debt to equity (0.81) ratio has been rising and the interest coverage ratio (5.58) has been falling. If these trends continue, we do not foresee management being able to maintain the aggressive dividend growth rates we have seen in recent years.

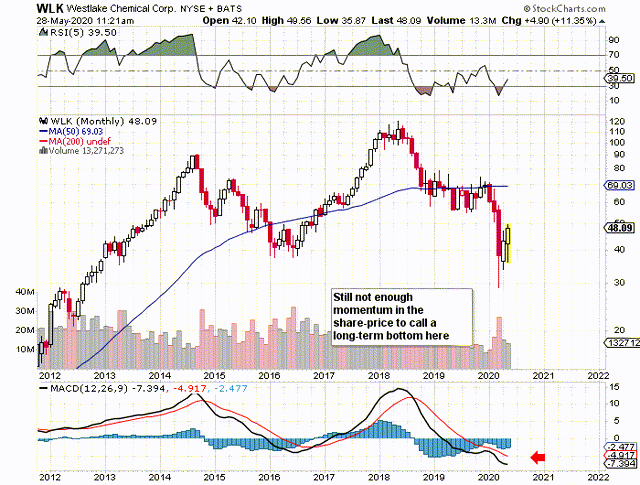

This is why we see conflicting signals on the long-term technicals above. May's trading has been choppy for example, which is why the histogram and MACD indicators have still not given any sort of long-term buying signals.

Therefore, to sum up, Westlake is another stock that we would not jump into too soon. The reason being is that earnings may remain subdued until we see trading conditions change significantly. An upward trend in forward earnings projections should coincide with a crossover of that MACD indicator. Let's see what the second quarter brings.

----------------------

Elevation Code's blueprint is simple. To relentlessly be on the hunt for attractive setups through value plays, swing plays or volatility plays. Trading a wide range of strategies gives us massive diversification, which is key. We started with $100k. The portfolio will not stop until it reaches $1 million.

-----------------------

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.