How To Retire: Master Your Fear

by Colorado Wealth Management FundSummary

- We hope you’re using this time to check up on or get started on your retirement accounts.

- We implore you to use this time wisely.

- Things are bad, and they might get worse, but from a long-term perspective the latest portion of 2020 will go down as little more than a blip on the radar.

- Avoid making rash decisions that stem from fear, anxiety, uncertainty, and government intervention. You don't want to be assigning ratings like a big bank.

Yes, Coronavirus is scary. But now's not the time to panic. Image Source

We have to assume a few things are happening as a result of the stay at home orders in effect across a majority of the United States:

- An increasing number of Americans are concerned about their finances, from basic personal finance to retirement accounts and portfolios.

- An increasing number of Americans are reassessing their portfolios, out of everything from panic to necessity.

- Individuals who have done very little or nothing to prepare for retirement are starting to seriously consider and/or activate plans for retirement.

- We can only hope some young people have seen the light and are actively looking to enhance their present and future financial positions.

- We can assume that some of the people who fall into these categories have discovered or are rediscovering Seeking Alpha.

If we’re onto something here, high five the air and welcome or welcome back.

Act Or Be Acted Upon

While some people crawl into a hole when things go wrong, there are large numbers of others who do the opposite. They see a problem impacting the world and immediately spring into action to help others and/or themselves. Because, if for no other reason, taking action in one area helps stunt the overall anxiety and uncertainty we’re all experiencing. We hope you fall firmly into this camp of acting rather than being acted upon. That said, if you choose to take action, proceed with caution.

Risk Tolerance

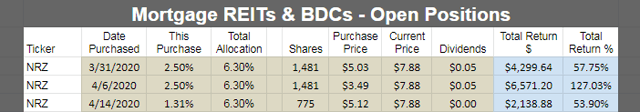

One question each investor needs to consider is their own risk tolerance. We were actively buying shares in late March and early April. The image below shows how we're doing with New Residential (NRZ):

Source: The REIT Forum

This is one of the mortgage REITs that plunged to trade at an absolutely massive discount. As you can tell from our first date and purchase price, 3/31/2020 at $5.03, we were a little early.

On 4/6/2020, we doubled our position at $3.49.

On 4/14/2020, we added a bit more to our position at $5.12.

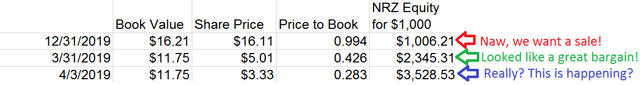

Before doubling down on 4/6/2020, we posted the following image:

Source: The REIT Forum

With projections for book value around $11.75, we saw the amount of equity we could buy for each $1,000 ramping up dramatically. That was a great deal. Book value came in a bit lower for the end of the quarter, but the fundamental premise was still precisely on point. We were getting an enormous discount on a quality REIT.

Does Everyone Buy During a Panic?

Contrary to what people like to say, many freeze up when prices are plunging. That makes sense. The prices wouldn't be plunging if investors were overwhelmingly trying to buy.

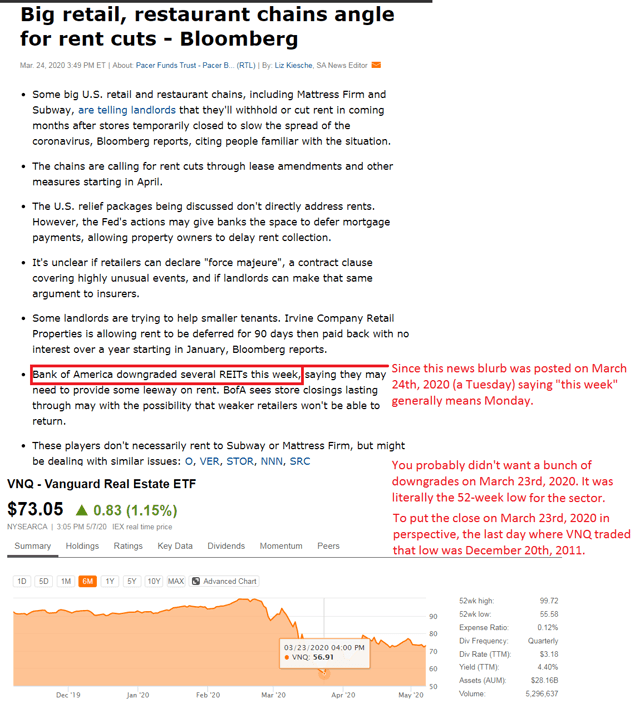

It is important for investors to keep a calm eye on the market. If they got into a panic, they might make a mistake like Bank of America (BAC.PK):

Source: Seeking Alpha

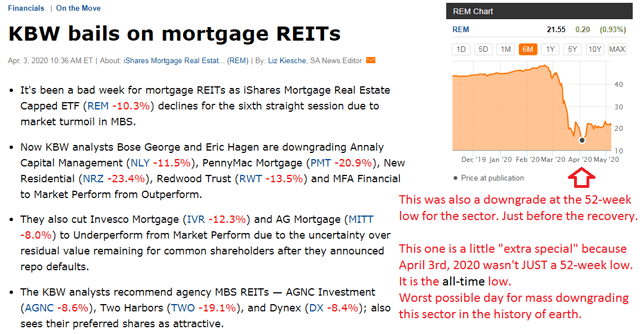

That's a rough start to the decade. We don't know which REITs were included in the "several REITs", but we know it was a REALLY bad day to issue downgrades.

If you're thinking that perhaps the major banks are providing indicators for precisely what investors shouldn't do, you could be onto something. Much like massive downgrades on equity REITs on March 23rd, 2020, there was the opportunity for massive downgrades on mortgage REITs on April 3rd, 2020:

Source: Seeking Alpha

If you read that image closely, you'll notice NRZ was one getting a downgrade. Shares closed at $3.33 that day, the single lowest close in company history. Today's closing price of $7.54 is up 126% since then. If we give the benefit of the doubt and apply the prior day's closing value, it was $4.26. In that case, NRZ is only up 77% since then.

I'm excluding the dividend in those calculations, but what's an extra 1% to 1.5% when the call already missed 77% upside?

You Knew Our View

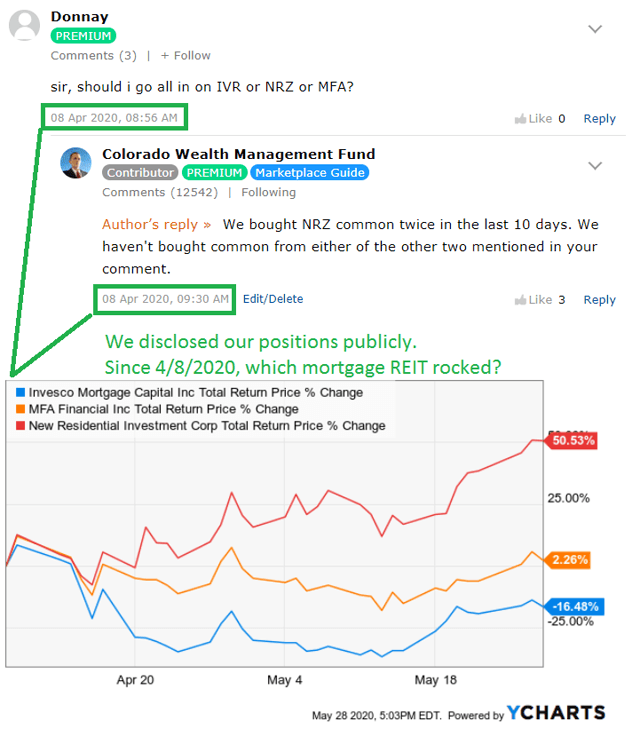

We were quite vocal in our bullish tone on NRZ:

Source: Seeking Alpha comments and Yahoo Finance

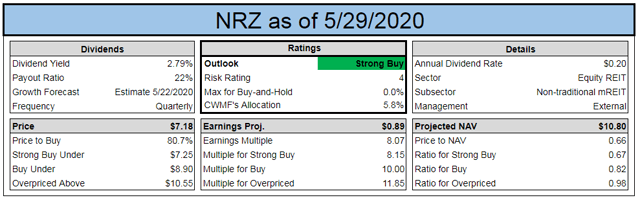

Current outlook? Still bullish on NRZ:

Source: The REIT Forum

Does that mean the stock is right for everyone? Clearly not. We viewed it as a high-risk high-reward opportunity from the start. Each investor needs to evaluate what works for them.

Getting Back Into It

Investors, particularly new ones and those using this time to get back into the game, can make dumb decisions during times like these. Even seasoned investors follow detrimental paths when under distress over an uncertain future. We know it’s difficult to own the following line of thinking, but the future for retirement investors -- new and old -- isn’t any different today than it was when the stock market did nothing but go up. From a retirement investment standpoint, these days will go down as little more than a radar blip in market history. So if you’re feeling lost, muster the strength to avoid purely inane choices.

Sell, Sell, Sell Or Maybe Not?

Certainly, circumstances exist where you have no choice but to sell holdings. This can happen as the result of a global pandemic or personal situations that have little or nothing to do with what’s going on in the world. We enjoy articles from fellow Seeking Alpha contributor Regarded Solutions. We always appreciate his perspective and wish him the best as he struggles with health issues that forced him to liquidate his portfolio. Regarded presents a relatively extreme example of having to sell that nobody wants to think about, let alone experience. The bottom line is Regarded had to sell; he stared his situation in the face and concluded he had no other choice.

You should only be selling holdings if your situation is dire.

If you’re in the unfortunate position of being weeks or months or maybe even a year or two (depending on how this plays out in the next couple months) away from retirement, you have decisions to make. Do you exit some positions and wait out the others? Do you rebalance? Do you suck it up, if at all possible, and work longer than you had planned while you continue to save and/or invest and your portfolio plays catchup?

If you’re not in one of these or some other truly sad and scary position don’t sell because of the Coronavirus and its sweeping consequences. If you’re going to sell anything it’s because the company you originally invested in no longer meets your criteria for investment.

So you’re not selling directly because of Coronavirus panic, you’re selling because, as one example, the company you never thought would cut or suspend its dividend just cut or suspended its dividend. Looking at it this way (even if we’re playing somewhat semantic games with ourselves) takes the emotion out of the situation, out of the transaction. Removing emotion from the equation might be more important now than it has ever been.

If you're familiar with our research, you're probably not getting surprised by dividend cuts frequently. We put intense research into evaluating the safety of each REIT and share that research with our readers. We help investors recognize the differences between investments that are better suited for trading and those that work well for a long-term buy-and-hold strategy.

Rent or Mortgage Deferments

You stocked up on an absurd amount of toilet paper. Why? Because everyone else was.

But there’s a purely psychological component to this behavior.

During times of uncertainty, we experience anxiety. Anxiety stems from a loss of control over what’s going on around you. The natural human reaction to anxiety is to find something you can assume control over. By exerting control over something, anything, you help quell your feelings of anxiety. So if you can fill an entire armoire with toilet paper, you have exerted control over something, anything in an effort to bring much-needed comfort.

We fear something similar might happen as landlords, banks, and the government dangles attractive carrots in front of the American people. Let’s be clear -- we need government intervention that protects people who are hurting. Nobody should have to choose between eating and paying rent. We supported some level of rent, mortgage, car payment, student loan, and credit card deferments. Millions of people need and absolutely deserve these things right now, however…

Don’t use this as an opportunity to stock up on cash for the same reasons you (not you! the person standing six feet away from you in the grocery store line) stocked up on toilet paper. We think it might be tempting to large numbers of otherwise sane and financially capable people. Tempting to not pay the rent, mortgage, or debt payments for a month or two or three to stockpile a war chest of cash. A war chest of cash to -- pick your ending -- ride out the storm, invest more on the dip, make yourself feel better and more secure. If you’re not in dire financial straits (and you’re not about to be), doing this is the most extreme version of robbing Peter to pay Paul.

First off, you’re going to have to pay this money back. You might need to pay it back on the other side of this pandemic. Your lender might agree to simply tack these payments onto the backend of your loan or other agreement. None of these options follow sound and basic personal finance. You might as well take out a cash advance on your credit card (please don't).

Second, if you are a renter, not paying your rent takes away what might be your landlord’s only source of income. Not all landlords are huge, rich corporations. And not paying rent isn’t going to do anything positive for your living situation. If a landlord sees reduced income, he or she might also cut corners -- within the law -- on maintenance and such. And there’s a good chance he or she will be doing it not out of spite, but necessity. Plus, if like us, you’re a REIT investor, you want real estate to come out of this as strong as possible.

Third, act to the extreme only out of necessity, not anxiety. That’s the overarching point here. You don’t want this pandemic to create bad habits, particularly if you’re one of the new investors we alluded to at the outset who we think might be reading this article with their newfound time. If you skip the rent or mortgage because of the pandemic, what will you do when faced with a similar decision during less stressful times. Maybe you’ll take the “free” ride you really don’t need because if you got through it and made it work when all hell broke loose, you certainly can make it work now. That’s a slippery slope you never want to try balance on as an investor.

Building a Portfolio

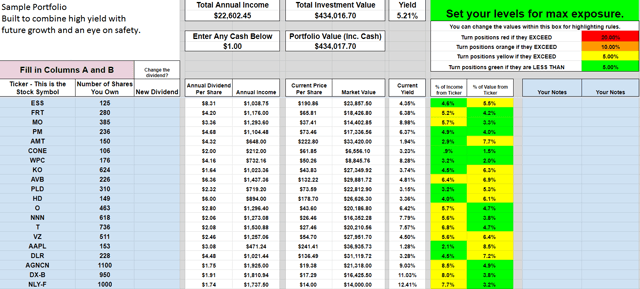

For investors with the courage to invest over the last 3 months, this has been an opportunity to build a portfolio. We've seen exceptional sales throughout the various kinds of REITs. A solid income portfolio might look something like this:

Source: The REIT Forum

The companies used in that sample portfolio are:

| Ticker | Company Name |

| (ESS) | Essex Property Trust |

| (FRT) | Federal Realty Investment Trust |

| (MO) | Altria Group |

| (PM) | Philip Morris International Inc |

| (AMT) | American Tower Corp |

| (CONE) | CyrusOne Inc. |

| (WPC) | W.P. Carey & Co. Llc |

| (KO) | Coca-Cola Company |

| (AVB) | Avalonbay Communities |

| (PLD) | Prologis Inc |

| (HD) | Home Depot |

| (O) | Realty Income Corp |

| (NNN) | National Retail Properties |

| (T) | AT&T Inc |

| (VZ) | Verizon Communications Inc |

| (AAPL) | Apple |

| (DLR.PK) | Digital Realty Trust |

| (AGNCN) | AGNC Preferred Share |

| (DX.PB) | Dynex Capital Inc |

| (NLY.PF) | Annaly Capital Management Inc Pfd |

We have several of these same REITs in our personal portfolio.

Stay Healthy, Stay Sane

We viewed the REIT sector plunge as an opportunity. Things suck. This is one of the saddest and most disturbing times we lived through. Hopefully, it is the worst many investors will experience. That said, even when the sky’s falling, it’s not. Not from the long-term perspective of an investor with sights set on his or her future. Act accordingly. Be kind. And stay healthy and safe.

Ratings Recap: Bullish on NRZ

Want the best research? It’s time to raise your game. Get access to several features you won’t find on the public side.

You can get access to everything we have to offer right now. Try our service and decide for yourself.

Disclosure: I am/we are long AGNCO, DLR, ESS, FRT, NLY.PI, NLY.PF, NNN, NRZ, WPC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.