BIZD: I Got The Memo And It Said Burn Before Reading

by James CherrySummary

- My best-case scenario target price is $13.69, and I am bullish on BIZD.

- The average dividend growth rate for the BDCs in BIZD's top ten holdings during the 2008 and 2009 financial crisis was -5.9%.

- Those who invested in BIZD when I published my first or second article could sell, as of 05/27/2020, and have an alpha of 14.18% or 12.1%, respectively.

Even a broken clock is right twice a day. In the stock market, making a right call could be the result of research or dumb luck or a mix of both. Whatever the case was for me, those who invested in BIZD when I published my first or second article could sell, as of 05/27/2020, and have an alpha of 14.18% or 12.1%, respectively.

On April 27th, I wrote an article about BIZD titled "I Guess I Didn't Get The Memo On VanEck Vectors BDC Income ETF." May 12th, I wrote a followup article, "I Still Have Not Received That BDC Memo" The idea behind these two articles was to understand what the market was trying to tell us about BIZD and if what it was saying was logical or not. I concluded that the market had three concerns about the BDC industry.

- Non-accrual loans: A BDC has the option to renegotiate the terms with its portfolio companies to prevent the loan from becoming a nonperforming loan. According to B of A's analyst Derek Hewit, a BDC that can provide flexible solutions, which includes workouts, will be more successful during these turbulent times.

- Pressure on leverage: During a downturn of the business cycle, the market value of the loans decreases due to higher chances of defaults, which increases risks. The BDC must individually discount each loan based upon a market indicator or an exit multiple. After each loan is discounted, the company could be leveraged beyond its limits as established by the Investment Company Act. The SEC recently issued this order allowing temporary exemptions to the leverage requirements. So if a BDC is overleveraged, it could issue senior securities to decrease its leverage. This could result in a BDC issuing more shares at a price below their current NAVPS, which would dilute existing shareholders. The bottom line is we still need to pay attention to how leveraged the BDC is. I will address this in more detail below.

- A decrease in dividends: As loans default or get renegotiated, the BDC has to reduce its dividends as its Net Investment Income declines. Since a majority of BDC investors invest in them for the income, a decline in dividends dramatically reduces the market value of the stock. I will also address this in more detail below.

BIZD Holdings Analysis

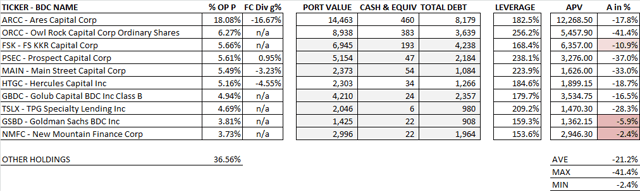

About the below table: FC Div g% is the dividend growth rate during the financial crisis, which is available for only a few of BIZD's top ten holdings. APV is my estimate of what portfolio value will push the BDC beyond the SEC-regulated 150% leverage. A in % is the percentage the portfolio must drop in value to be beyond its required leverage. All the cells in gray were updated the day I wrote this article.

Source: Seeking Alpha and own estimates

Three companies are very close to being overleveraged, and I marked them in red. These companies are FS KKR Capital Corp, Goldman Sachs BDC Inc, and New Mountain Finance Corp. If the leverage of these companies continues to increase, they will probably dilute the shareholder. I believe that NMFC and GSBD are most likely to issue senior securities in the short-term.

The average dividend growth rate for the BDCs in BIZD's top ten holdings during the 2008 and 2009 financial crisis was -5.9%. In my first article, I calculated BIZD's target price using this percentage and the Gordon Growth Model, which is the reason I use the words dividend growth when it is a decrease in dividends.

| BEST CASE | BLENDED CASE | WORST CASE | |

| Target $ | 13.69 | 12.01 | 10.33 |

| imp g% | -3.79% | -5.13% | -6.84% |

Source: own estimates

I calculated three possible scenarios using extreme circumstances for the worst-case and negative situations for the best-case.

Worst-case scenario: NMFC, GSBD, and two other BDCs in the remaining 36.5% of BIZD's holdings (average weight of 2.15%) bankrupt. Then the remaining BDCs will be discounted by 45% (CCC Bond Yield during the financial crisis). The implied dividend growth is -6.84% (decrease in dividends). Very extreme, right?

Best-Case scenario: NMFC, GSBD, and two other BDCs in the remaining 36.5% of BIZD's holdings heavily dilute its shareholders. The portfolios are all discounted by 16.9% (current CCC Bond Yield). The implied dividend growth is -3.79% for this scenario.

Conclusion

Even my best-case scenario could be considered very pessimistic, but I want investors to feel confident in their decision to invest in BIZD. My best-case scenario target price is $13.69, and I am bullish on BIZD. I reduced my rating from very bullish to bullish because my estimated alpha for BIZD is now in the low single digits.

If you like what you read, please follow me via Seeking Alpha. I typically only cover the Brazilian markets and the Food Industry.

Disclosure: I am/we are long BIZD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.