3 Sports Apparel Stocks to Trade for Players and Spectators Alike

From heart-pounding highs to sweat-inducing lows, these three apparel stocks are well-suited for trading

A forced timeout stopped neither bulls nor bears from participating in sports apparel stocks. But for today’s investors, is now a better time to buy or sell? Let’s look at the current champs on Wall Street, and where each stands off and on the price chart before breaking out the pompoms.

The novel coronavirus has devastated individuals, businesses and economies around the world. It’s also hit our love of sports from every imaginable angle.

For some, that’s meant a closed gym. For others, Covid-19 has prevented going for a trail run or hike on public lands shuttered by the pandemic. And of course, individual and team sports from recreational endeavors and all the way to the big leagues have been disrupted for participants and spectators alike

Yet, despite the near universal stoppage time and reduced load of sweaty clothes to wash and wear, many sports apparel stocks have been on an inexplicable tear. Others, more logically so, haven’t:

In the end champion stocks cheered on by today’s investors, and those booed like the NY Jets, aren’t future guarantees for bulls and bears that find themselves on the right side of action. The trend is your friend until it’s not. And sometimes you’ll find a hidden gem buried in the bargain bin.

Sports Apparel Stocks to Trade: Nike (NKE)

Source: Charts by TradingView

The first of our sports apparel stocks to trade are shares of Nike. Right now the world’s largest retail sports brand looks ready to grow even bigger based on the price chart, setting the stock as a clear “buy,”

Technically, the sporting goods giant’s shares have formed a ‘V-like’ bottom on the monthly chart. It’s a type of base often seen as less durable than a bottom developed over the longer-term. But Nike’s panic low was also a very well-supported (and successful) test of both its long-term uptrend and a pair of key Fibonacci levels. And there’s more too.

With a bullish stochastics crossover now signaling inside neutral territory and an earnings catalyst next Thursday, the consensus is that this apparel stock is well-positioned to breakout.

For investors looking to play this apparel stock for upside, one favored options strategy to limit and reduce risk, as well as offer realistic but big-time profit potential is the July $105 / $110 bull call spread.

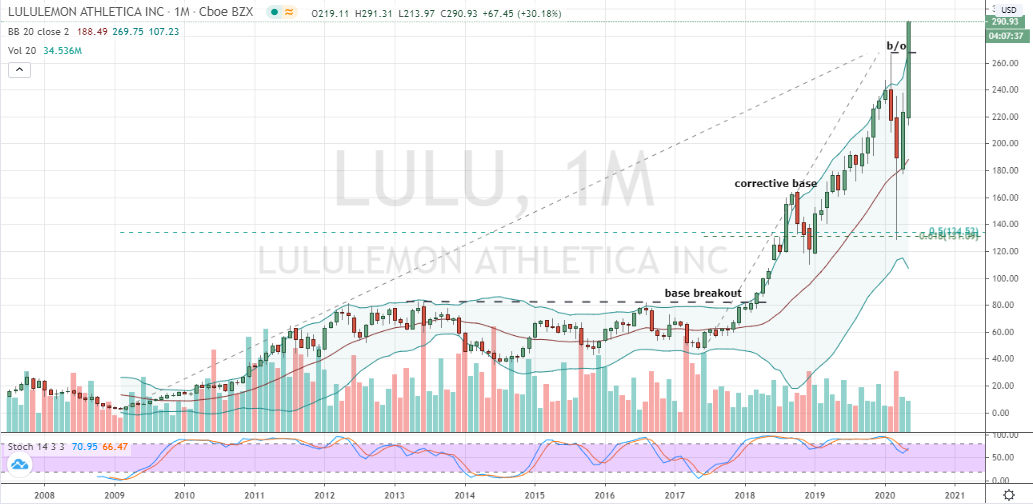

Lululemon (LULU)

Source: Charts by TradingView

The next of our sports apparel stocks to trade is athleisure and yoga-centric powerhouse Lululemon. Similar to Nike shares, Lululemon is another name that’s been championed by investors since the darkest hours of the coronavirus on Wall Street. Here though, bulls could be getting ahead of themselves.

Earnings are due in roughly two weeks, but investors aren’t waiting around for the quarterly release. Shares have already broken out to fresh all-time-highs. This apparel stock’s ‘V’ bottom was also a technically well-supported one to cheer on initially. But Lululemon now looks too pricey to justify a purchase.

Bottom-line, with the stock roughly 10% past the prior and pattern high and trading through the upper Bollinger Band, Wall Street’s pom-poms could easily be replaced with profit-taking in front of or certainly following earnings. As much, Lululemon is a champion apparel stock that’s best watched from the sidelines.

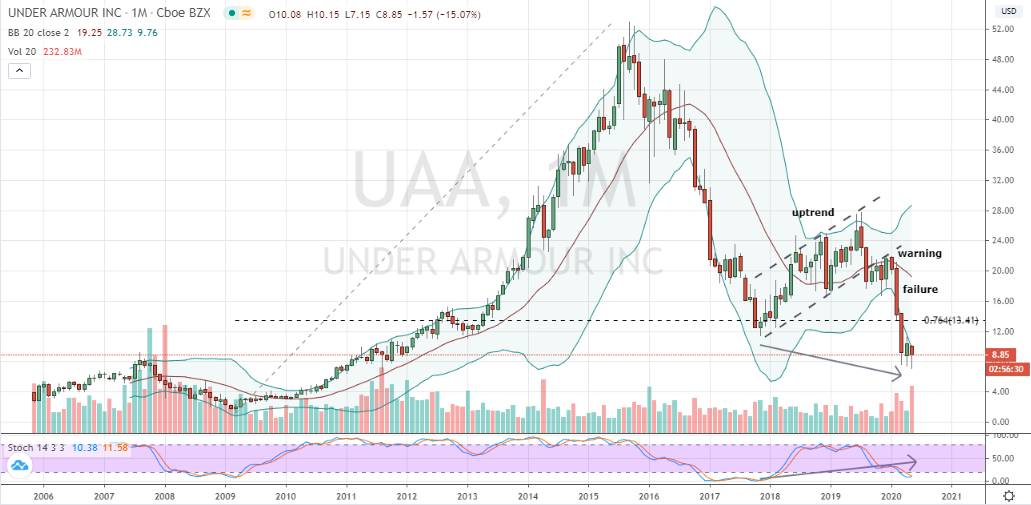

Under Armour (UAA)

Source: Charts by TradingView

Under Armour is the last of today’s sports apparel stocks on our radar. This underdog most recently crashed on the back of a massive quarterly loss, slumping revenues and forecast that has lacked any indication the company can rebound to the black anytime soon. In a nutshell, what had been a turnaround play prior to the coronavirus now finds that path looking even more difficult to navigate.

That all sounds bad, but things also look really bad for Under Armour, on the price-chart. Technically, the stock began showing signs of failure within its comeback story ahead of Covid-19.

The monthly chart showed an early warning as shares fell beneath channel support late last year. That price action was then compounded by the pandemic as the stock tumbled cleanly below its lifetime 76% retracement level. But I’m not bearish.

With the Under Armour story looking so unfixable off and on the price chart, I can’t help but be a fan of this apparel stock. Some of that optimism is helped by the lower-low divergence in shares relative to stochastics. A third month of price action outside the lower Bollinger Band also has our attention. Lastly and as we finish up May with a promising hammer bottom in hand and an imminent oversold and bullish crossover in tow, it could be time to suit up shortly as a bull.

Disclosure: Investment accounts under Christopher Tyler’s management does not own any securities mentioned in this article. The information offered is based upon Christopher Tyler’s observations and strictly intended for educational purposes only; the use of which is the responsibility of the individual. For additional market insights and related musings, follow Chris on Twitter @Options_CAT and StockTwits.