Stifel Financial Corp.: A New 6.125% Preferred Stock IPO Trading At A 4.50% Premium

by Arbitrage TraderSummary

- Stifel Financial Corp.'s new preferred stock, SF-C, is trading above its PAR, having a YTW of 5.12%.

- Company's leverage and liabilities' payments look solid.

- SF-C gives a 1% more than the average YTW of the sector.

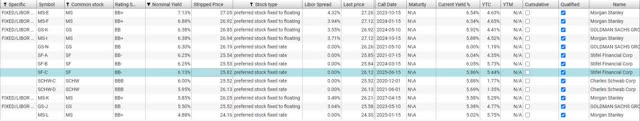

- I compare the new IPO with all other below-investment-grade preferred stocks with a fixed dividend rate.

Introduction

After 2 months of drought in respect of newly issued fixed-income securities, the financial companies are the first to return to raising capital through preferred stock offerings. OceanFirst Financial Corp. (NASDAQ:OCFC), Wintrust Financial Corp. (NASDAQ:WTFC), First Midwest Bancorp (NASDAQ:FMBI) have already offered their IPOs. For OCFC and FMBI, these were also their first-ever issued preferred securities. Now, we see Stifel Financial Corp. (SF) offering their Series C preferred stock, a little over a year after their last fixed income IPO, the Series B preferred stock. In this article, we want to acquaint market participants with the newest preferred stock that shows up on the exchange, to see how it holds up against its peer group, and to determine whether it will find its place in our portfolio or if there is a better alternative.

The New Issue

Before we submerge into our brief analysis, here is a link to the 424B2 Filing by Stifel Financial Corp - the prospectus.

Source: SEC.gov

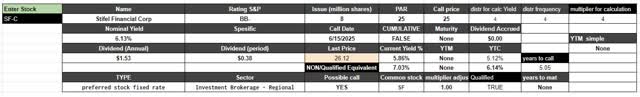

For a total of 8M shares issued, the total gross proceeds to the company are $200M. You can find some relevant information about the new preferred stock in the table below:

Source: Author's spreadsheet

Stifel Financial Corp. 6.125% Non-Cumulative Preferred Stock Series C (SF-C) pays a qualified fixed dividend at a rate of 6.125%. The new preferred stock is expected to be rated a "BB-" by Standard & Poor's and is callable as of 06/25/2025. SF-C is currently trading at a premium of 4.48% of its par value, at a price of $26.12. This translates into a 5.86% Current Yield and a YTC of 5.12%

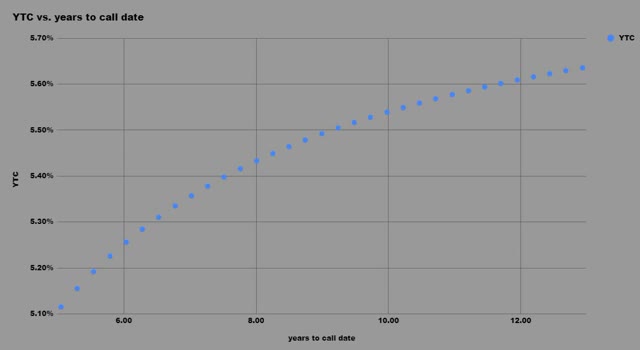

Here's how the stock's YTC curve looks right now:

Source: Author's spreadsheet

The Company

Stifel Financial Corp. is a financial holding company. Its principal subsidiary is Stifel, Nicolaus & Company, Incorporated, a retail and institutional wealth management and investment banking firm. It operates through three segments: Global Wealth Management, Institutional Group and Other. The Global Wealth Management segment consists of the Private Client Group and Stifel Bank businesses. The Institutional Group segment includes research, equity and fixed income institutional sales and trading, investment banking, public finance and syndicate. The Other segment includes interest income from stock borrow activities and interest income. Its principal activities are private client services, including securities transaction and financial planning services; institutional equity and fixed income sales, trading, research and municipal finance; investment banking services, and retail and commercial banking, including personal and commercial lending programs.

Source: Reuters.com | Stifel Financial Corp.

Below, you can see a price chart of Stifel Financial Corp.'s common stock, SF:

Source: Tradingview.com

The company's common stock is currently paying a $0.17 quarterly dividend, which translates into an annualized payout of $0.68. With a market price of $45.07, the current yield of SF is at 1.51%. As an absolute value, this means it pays $46.59M in dividends yearly. For comparison, the yearly dividend expenses for all preferred stocks of the company (including the newly issued Series C Preferred Stock) are $31.58M.

In addition, with a market capitalization of around $3.05B, SF is the second biggest regional investment brokerage company (according to Finviz.com).

Capital Structure

Below, you can see a snapshot of Stifel Financial Corp.'s capital structure as of the time of its last quarterly filing on March 2020. You also can see how the capital structure has evolved historically.

Source: Morningstar.com | Company's Balance Sheet

As of Q1, SF had a total debt of $1.53B, ranking senior to the newly issued preferred stock. The new Series C preferred shares rank is junior to all outstanding debt and equal to the other preferred shares of the company that totals $310M.

The Ratios Of Which We Should Care About

Our purpose today is not to make an investment decision regarding the common stock of SF but to find out if its new preferred stock has the need quality to be part of our portfolio. Here is the moment where I want to remind you of two important aspects of the preferred stocks compared to the common stocks.

- Preferred shareholders have priority over a company's income, meaning they are paid dividends before common shareholders.

- Common stockholders are last in line when it comes to company assets, which means they will be paid out after creditors, bondholders, and preferred shareholders.

Based on our research and experience, these are the most important metrics we use when comparing preferred stocks:

- Market Cap/(Long-term debt + Preferreds). This is our main criteria when determining credit risk. The bigger the ratio, the safer the preferred. Based on the latest annual report and taking into consideration the latest preferred issue, we have a ratio of 3,050/(1,530 + 510) = 1.49, indicating the company is very well leveraged, as its equity is more than enough to cover all its debt and the preferred stocks.

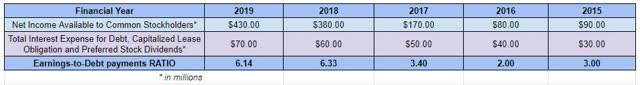

- Earnings/(Debt and Preferred Payments). This is also quite an easy to understand approach. One can use EBITDA instead of earnings, but we prefer to have our buffer in what is left to the common stockholder. The higher this ratio, the better. The ratio with the TTM results is 440/(50 + 31) = 5.43, which is solid, indicating a significant buffer for the preferred stockholders and the bondholders so to be calm about the payments. This is also supported by the following table, where we can also see a steady performance of the company with respect to its debt payments coverage for the last 5 financial years.

Source: Morningstar.com | Company's Income Statement

The Stifel Financial Family

SF has three more outstanding fixed income security: two preferred stocks and a baby bond:

- Stifel Financial Corp. 6.25% Depositary Share Non-Cumulative Preferred Stock Series A (NYSE:SF.PA)

- Stifel Financial Corp. 6.25% Depositary Share Non-Cumulative Preferred Stock Series B (SF.PB)

- Stifel Financial Corp., 5.20% Senior Notes due 10/15/2047 (NYSE:SFB)

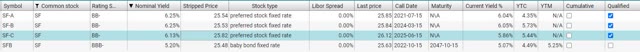

Source: Author's database

If we compare the newly issued preferred stock with the rest of SF's issues, we can see SF-C has the second-highest Yield-to-Worst of 5.12%, equal to its Yield-to-Call. However, we have to add that as preferred stock, it ranks equal to the other two preferred stocks, SF-A and SF-B, and sits junior to the company's baby bond, who also has a higher rating. It is especially important when a company is highly leveraged. Still, in this case, Stifel has quite good coverage of its debt and its three preferred stocks. Besides, SF-C pays a qualified dividend rate, while the company's baby bond pay's interest payments are not qualified.

In addition, in the following chart, you can see a comparison between SF's preferred stocks and baby bond versus the fixed income securities benchmark, the iShares Preferred and Income Securities ETF (PFF). What we can summarize in this case is a constant outperform of the preferred stocks and the baby bond over the benchmark, with a short pause during the COVID-19 panic selling, where all securities have moved extremely correlated.

Source: Tradingview.com

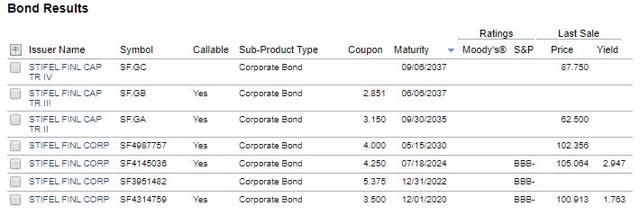

Furthermore, there are seven corporate bonds issued by Stifel:

For comparison, I choose the bond that matures closest to the call date of SF-C, the 2024 Corporate Bond.

Source: FINRA | SF4145036

SF4145036, as it is the FINRA ticker, is rated a "BBB-", it is maturing on 07/18/2024 and has a Yield-to-Maturity of 2.947%. This should be compared to the 5.12% Yield-to-Call of SF-C, but when making that comparison, remember that SF-C's YTC is the maximum you could realize if you hold the preferred stock until 2025. This result is a yield spread of around 2.2% between the two securities. This yield margin can be justified by the higher rank in the capital structure, the higher credit rating, and the shorter term to maturity.

Sector Comparison

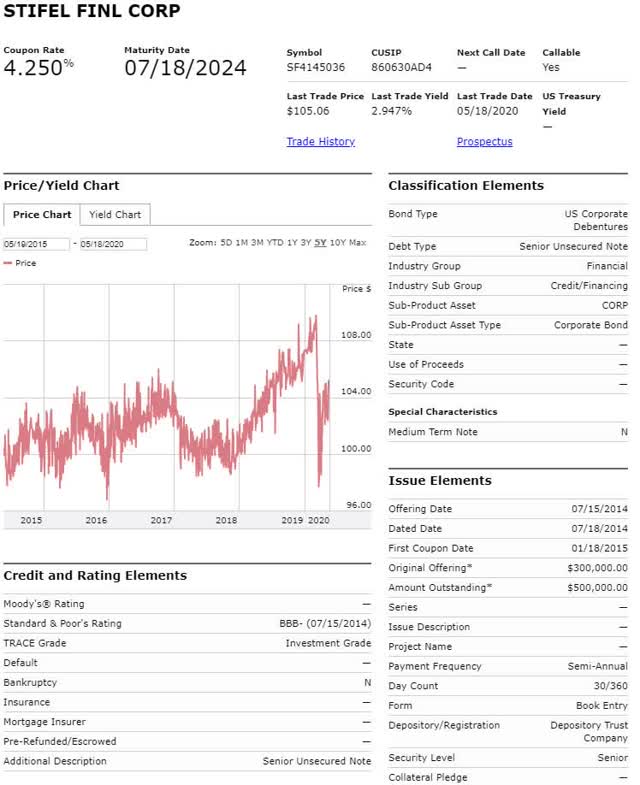

The chart below contains all preferred stocks issued by an in-investment brokerage company that pays a fixed or a fixed-to-floating dividend rate and has a par value of $25. It is important to take note that all of these preferred stocks are eligible for the preferential federal tax rate.

- By Years-to-Call and Yield-to-Call

Source: Author's database

Since, except for MS-L, all issues are trading above their PAR, the YTC is actually their Yield-to-Worst, so the chart is presenting the Yield curve in the sector. For MS-L, the YTW is its Current yield that is 0.73% lower. With its Yield-to-Worst of 5.12%, equal to its Current yield, the newly issued SF-C is lagging from the highest yielding issues in the sector, SF-B, and MS-K. Still, it returns a little more than 1% more than the average YTW of the group. In regard to the fixed-to-floating preferred stocks, after their call date, if not being redeemed, all will start paying a floating dividend, which will be significantly lower than their current nominal yield. Thus, their current yield will drop tangibly drop, making them less attractive.

- The full list:

Source: Author's database

The Below-Investment Grade Preferred Stocks

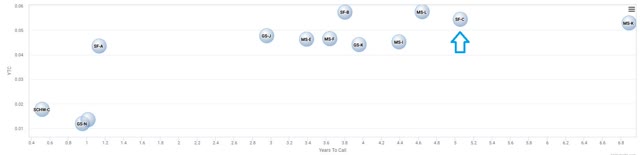

The last charts contain all preferred stocks that pay a fixed dividend rate, have a par value of $25, a positive Yield-to-Call, and a "BB", "BB+", or "BB-" Standard & Poor's rating.

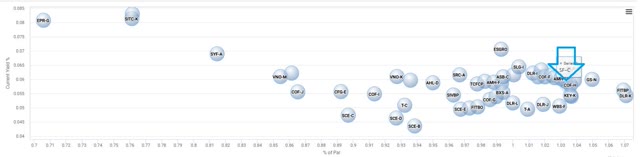

- By % of PAR and Current yield

Source: Author's database

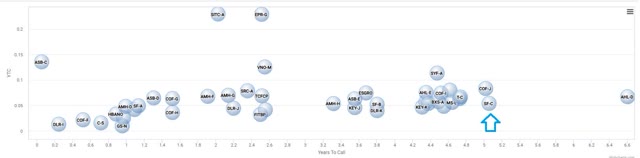

- By Years-to-Call and Yield-to-Call

For this chart, I'll exclude all callable issues to have a much clearer look over the group:

Source: Author's database

Redemption after the Occurrence of a Rating Agency Event or Regulatory Capital Event

It is possible that the Series C Preferred Stock may not satisfy the criteria for additional Tier 1 capital instruments under the applicable capital adequacy rules of the Federal Reserve Board, as a result of official administrative or judicial decisions, actions or pronouncements interpreting those rules and announced after the issuance of the Series C Preferred Stock, or as a result of future changes in law or regulation. As a result, a “Regulatory Capital Event” could occur whereby we would have the right, subject to prior approval of the Federal Reserve Board or other appropriate federal banking agency, to redeem the Series C Preferred Stock in accordance with its terms prior to June 15, 2025 at a redemption price equal to $25,000 per share (equivalent to $25 per depositary share), plus accrued and unpaid dividends for the then-current dividend period to but excluding the redemption date, whether or not declared.

Source: 424B2 Filing by Stifel Financial Corp

Use of Proceeds

We estimate that the net proceeds from this offering will be approximately $193.2 million after deducting the underwriting discount and estimated offering expenses payable by us. We intend to use the net proceeds from this offering for general corporate purposes. Pending such use, the proceeds may be invested temporarily in short-term, interest-bearing, investment-grade securities or similar assets.

Source: 424B2 Filing by Stifel Financial Corp

Addition to the iShares Preferred and Income Securities ETF

With the current market capitalization of the new issue of around $200M, SF-C is a potential addition to the ICE Exchange-Listed Preferred & Hybrid Securities Index during some of the next rebalancings. If so, it will also be included in the holdings of the main benchmark, the iShares Preferred and Income Securities ETF, which is the ETF that seeks to track the investment results of this index, and which is important to us due to its influence on the behavior of all fixed-income securities.

Conclusion

The company is well leveraged, having 1.5x times more equity than debt and preferred stocks and also maintains excellent coverage as regards to its interest and preferred dividends payments. The new IPO is priced at a slightly lower rate than the Stifel's previous two preferred stocks, but in the current market environment, it is the issue with the highest market price. In the sector, when compared to all other fixed-rate and f2f preferred stocks, SF-C has a little more than 1% higher YTW than the average one, but it is not the highest yielding issue, lagging behind SF-B and MS-K. It is already trading at 4.5% premium, while a lot of issues are trading below their par value, and the potential of capital gain seems very limited. Generally, I don't think all bad is over, and I find a second wave of panic reaction very likely. Therefore, I prefer taking a hedged position, where I lock my trade either with a close preferred stock or with the common stock.

Trade With Beta

Coverage of Initial Public Offerings is only one segment of our marketplace. For early access to such research and other more in-depth investment ideas, I invite you to join us at 'Trade With Beta.'

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.