Crushing It: Splunk's Strong Fundamentals Drive Stock Higher

by Steve AugerSummary

- Splunk is a leader in Big Data/SIEM and is transitioning to a recurring revenue business model.

- The recent pandemic-driven acceleration from a perpetual license to ARR skews revenue growth, making it appear to be flat.

- Fundamentals are strong and will carry the company through this time of uncertainty.

- My opinion is that the stock price is undervalued relative to its peers, making it a good buying opportunity.

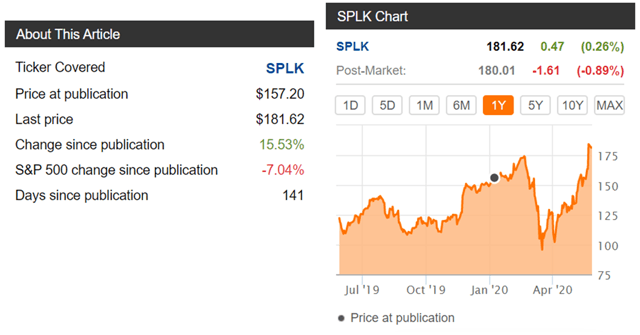

In my last article on Splunk Inc. (NASDAQ:SPLK), titled "Splunk: A Slam Dunk Buy," I issued a very bullish rating on this Big Data/SIEM company. One pandemic and bear market later, this stock is up 16% while the S&P 500 is down 7%.

(Source: Seeking Alpha)

Similar to when I last wrote about Splunk, the stock is again in breakout mode. The stock has come a long way after bottoming at a price below $100 in March, and it recently touched a new all-time high and is now sitting at ~$182 for a gain of more than 80% in a couple of months.

(Source: Yahoo Finance/MS Paint)

The question now arises: what now? The market for digital transformation stocks has been shaky this week with indications that "return to work" will happen soon. But Splunk stock has held up, maintaining its breakout posture. This is a good sign and suggestive of future gains to come.

Splunk is one of the more difficult stocks to analyze, as the pandemic has accelerated this company's transformation to a recurring revenue business model which is distorting revenue growth. The YoY revenue growth for Q2 is expected to be flat.

... due primarily to cloud acceleration and variability in duration, our revenue and operating margin targets are lower for Q2 than our original plan. Specifically, we expect total revenues of approximately $520 million in Q2, roughly flat year-over-year. Slower revenue growth is directly related to higher cloud mix, which is now expected to be in the high 40% range, the highest ever. This will also put pressure on our margin, so we expect non-GAAP operating margin of negative 10% to negative 15% in Q2.

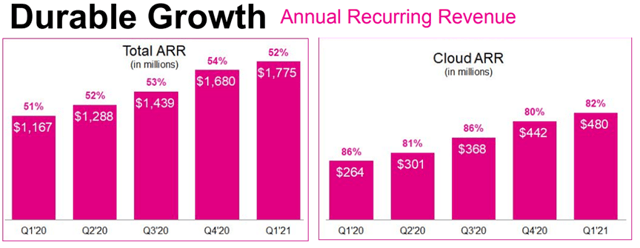

It should that guidance for the remainder of the year has been withdrawn. Despite the withdrawn guidance, Splunk has several positive factors going for it, including expected ARR growth of mid-40% for this year, consistent operating cash flow, and a strong balance sheet of $1.76 billion in cash and equivalents, it should survive the pandemic and recession quite nicely.

(Source: Splunk)

Given the stock breakout, undervaluation, and strong company fundamentals, I am giving Splunk a very bullish rating. This company will be around and in good shape once the pandemic scare subsides and global growth restarts. This company is one of my favorites.

The Rule Of 40

One industry metric that is often used for software companies is the Rule of 40. The rule provides a single metric for evaluating both high-growth companies that aren't profitable and mature companies that have lower growth but are profitable. Revenue growth and profitability (expressed as a margin) must add up to at least 40% in order to fulfill the rule. Analysts use various figures for profitability. I use the free cash flow margin.

The rationale for the Rule of 40 is as follows. If a company grows by more than 40% annually, then you can tolerate some level of negative free cash flow. But if a company grows by less than 40%, then it should have a positive free cash flow to make up for the less-than-ideal growth. This rule accommodates both young, high-growth companies as well as mature, moderate-growth companies. The 40% threshold is somewhat arbitrary but typically divides the digital transformation stock universe in half, separating the best stocks from the so-so ones.

For a further description of the rule and calculation, please refer to a previous article I have written.

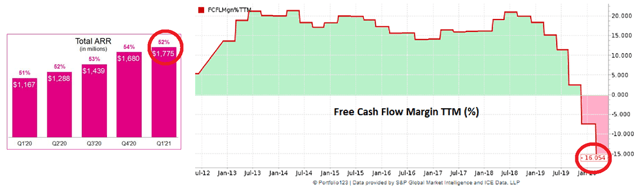

The two factors required for calculating the Rule of 40 are revenue growth and free cash flow margin. In Splunk's case, the revenue growth is distorted due to the transformation to a recurring revenue model. Therefore, I am using the growth in total ARR instead, which is 52% YoY.

The company's TTM free cash flow margin dropped dramatically in the most recent quarter to -16%. I believe this is due to the margin compression associated to the big acceleration in conversions to ARR.

(Source: Splunk/Portfolio123/MS Paint)

The Rule of 40 calculation for Splunk is as follows:

Revenue Growth + FCF margin = 52% - 16% = 36%

The score is slightly lower than the necessary 40% needed to fulfill the rule of thumb. But this doesn't bother me too much given the temporary drop in free cash flow that should recover to positive territory once the accelerated shift to recurring revenue subsides.

Stock Valuation

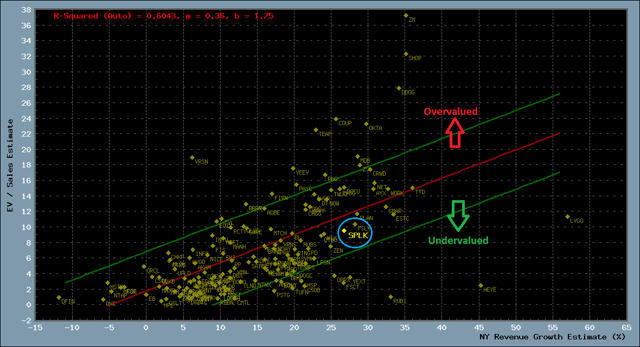

There are numerous techniques for valuing stocks. Some analysts use fundamental ratios such as P/E, P/S, EV/P, or EV/S. I believe that one should not employ a simple ratio, and the reason is simple. Higher-growth stocks are valued more than lower-growth stocks, and rightly so. Growth is a significant parameter in discounted cash flow valuation.

Therefore, I employ a technique that uses a scatter plot to determine relative valuation for the stock of interest versus the remaining 150+ stocks in my digital transformation stock universe. The Y-axis represents the enterprise value/forward sales, while the X-axis is the estimated forward Y-o-Y sales growth.

The plot below illustrates how Splunk stacks up against the other stocks on a relative basis based on forward sales multiple.

(Source: Portfolio123/private software)

A best-fit line is drawn in red and represents an average valuation based on next year's sales growth. The higher the anticipated revenue growth, the higher the valuation. In this instance, Splunk is positioned below the best-fit line, suggesting that the company is undervalued on a relative basis relative to its peers.

Investment Risks

There are several risks that investors should consider before investing in Splunk. First of all, I view the current stock market action to be reminiscent of the Dot.com era, immediately prior to the crash starting in 2000. Back then, I quadrupled my investments in a few months. Technology stocks were hopping. But it wasn't long before the market turned into a disaster zone with the Nasdaq index dropping by ~70%.

While Splunk is undervalued in my opinion, the same cannot be said for some of its software peers. Companies such as Zoom (ZM), Shopify (SHOP), Atlassian (TEAM), and Coupa (COUP) are extremely overvalued. A market crash led by these software stocks could cause Splunk to get swept along with the crowd.

The biggest risk to Splunk's business is if customers are unable to continue making payments according to subscription schedules. Some of Splunk's customers are asking for shorter contract durations due to market uncertainty. Ultimately there could be some subscription defaults due to the pandemic and global recession.

Summary and Conclusions

Splunk is a leading-edge company involved in the area of Big Data and SIEM. Splunk is in the midst of transitioning its business model to recurring revenue, which has been accelerated by the pandemic. This transition is clouding the company's financials, making it appear as if revenue growth is flat, and compressing margins. The transformation also causes Splunk to fail on the Rule of 40, although not by much, and I expect it to bounce back in future quarters.

Given that the company's fundamentals are strong, and in my opinion, the stock price is undervalued, I expect that Splunk will emerge from the pandemic in terrific shape and continue to perform well thereafter. The stock price is pushing to new all-time highs, suggesting more bullishness to come. For these reasons, I am giving Splunk a very bullish rating.

Join My Exclusive Service While the Price is Low ...

Digital Transformation is a once-in-a-lifetime investment opportunity fueled by the need for businesses to convert to the new digital era or risk being left behind. You can take advantage of this opportunity by subscribing to the Digital Transformation marketplace service. Tap into three high-growth portfolios, industry/subindustry tracking spreadsheets, and three unique proprietary rating systems. Don't miss out on the digital revolution. We are still in the early innings and there are plenty of high-growth investment opportunities out there waiting for you!

Start your 2-week free trial today!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.