Bio-Rad: A Very Interesting Short-Term Investment Thanks To Gains On Sartorius Holding

by Edmund InghamSummary

- Bio-Rad's 2 Core business divisions: Life Sciences and Clinical Diagnostics posted so-so results in Q120 delivering net profits of $74m.

- Although both divisions are progressing nicely for the company and offer future value, the real story here is BioRad's ~35% stake in Sartorius.

- Bio-Rad made unrealised gains >$2.0bn on the 92% share price gains made by Sartorius in 2019, and another ~$900m in Q120.

- Since Q1 Sartorius is up 37% meaning Bio-Rad looks set for another blockbusting quarter. EPS was >$58 in FY19 and >$23 in Q120 - it could be the highest yet in Q220.

- As such Bio-Rad looks an attractive buy, but only in the short term, in my view, given that Sartorius' share price cannot climb higher ad infinitum - when it stops climbing Bio-Rad's huge net profits will be decimated.

Investment Thesis

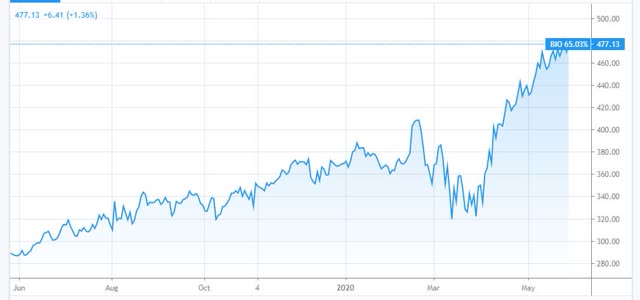

Bio-Rad (BIO) 1-year share price performance. Source: TradingView.

In my last note on Bio-Rad (BIO) published back in December I suggested that, despite sluggish growth in 2019, the company could continue to grow its share price since it generated steady income streams through sales of its >9,000 specialty products via its 2 business segments, Life Sciences and Clinical Diagnostics, to laboratories, research centres, biotechnology and pharmaceutical companies, food producers and transfusion labs.

Bio-Rad stock had enjoyed a strong year in 2019, growing by 72% to reach a price of $383 - despite the company's sluggish annual top-line revenue growth of 1%. Operating expenses did decline in 2019, however, by 23%, from $1.33bn to $1.03bn, meaning Bio-Rad's operating income increased to $230m, from -$103m in 2018.

Perhaps far more significantly for the company and its share price in particular, were the huge gains that Bio-Rad made through its 37% ownership of Sartorius AG, a Germany based technology supplier to the biotechnology, pharmaceutical, chemical and food and beverage industries, over which, despite its significant interest, Bio-Rad exerts no control.

Sartorius grew its share price in 2019 by 92%, from $109 to $197, which earned Bio-Rad just over $2bn, the company reported in its 2019 10K submission. This resulted in its earning EPS of $59.32 per share which is an extremely high figure not just for Bio-Rad, but for most companies.

It's certainly an unusual situation but one that we can assume has played a prominent role in Bio-Rad's share price rising 25% so far in 2020, to $477 at the time of writing. In Q120 the contribution from Sartorius was $899m - down by 21% from $1.6bn in Q119, but hugely significant nonetheless, since Bio-Rad earned $572m of revenues from its core business divisions, and made an operating profit of $74.3m (margin of 13%).

Given that Sartorius has continued to grow its share price since the end of the last reporting period, by another 37% to $322 at the time of writing, the prospects for Q220 look even better than in Q1, and, quite possibly, FY19.

Strangely, there was little discussion of the Sartorius holding or the company's performance during the Q120 earnings call and Bio-Rad management fielded no questions relating to its holding and the gains it may or may not make in 2020.

In the rest of this article I will briefly discuss the performance and prospects for BioRad's 2 core divisions, plus the effect that COVID-19 has had on the company's performance to date and how it will affect 2020 results, and then explain in more detail the impact of Sartorius on the Bio-Rad's results, and why I believe now may be a great time to buy Bio-Rad stock.

Clinical Diagnostics

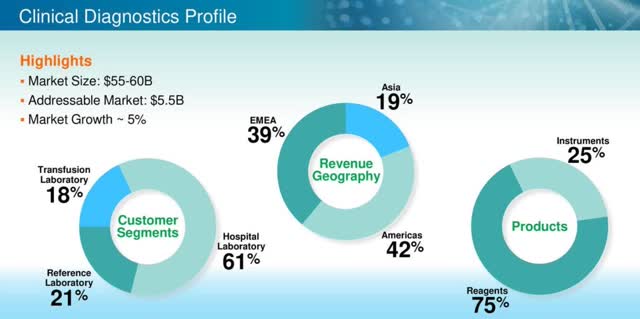

Bio-Rad Clinical Diagnostics Profile. Source: company presentation at JP Morgan Healthcare Conference 2020.

As we can see above Bio-Rad's Clinical Diagnostics segment revenues are split between 3 geographical markets: Asia, the Americas and EMEA, and its clientele is almost exclusively laboratories. The company performs broadly three different types of testing: Diagnostics, which includes testing and monitoring for infectious and autoimmune diseases as well as diabetes, Blood Typing, which includes virus screening and HIV tests, and Quality Assurance.

In total, within this division BioRad markets more than 3,000 different products performing 300 different types of in vitro diagnostics (IVD) tests, into a market that the company estimates to be worth >$12bn. Usually, BioRad supplies its tests in packages that include reagents, software and instruments allowing customers to generate reproducible test results, creating a stream of recurring revenues based on selling kits for each new sample, building upon a standardised and installed test system.

In Q120 the company reported that overall, Clinical Diagnostics sales had increased year-on-year by 1.9% to $343m (60% of all Q120 company revenues) buoyed by solid growth in blood typing and quality controls, which was offset slightly by struggling diabetes and immunology product lines, owing, management says, to the impact of COVID-19 which reduced non-critical hospital and clinic visits.

BioRad believes it is the second largest supplier to the blood typing market having placed more than 4,000 automated systems at laboratories in total, and outlined plans to expand its portfolio in this sector at the JP Morgan Healthcare conference in January in an attempt to create a market leading portfolio for safe transfusions. In August last year, Bio-Rad paid $60m to acquire Exact Diagnostics in an attempt to boost its market penetration in the areas of quality controls and assay verification panels, according to the company's 2019 10K.

Life Sciences

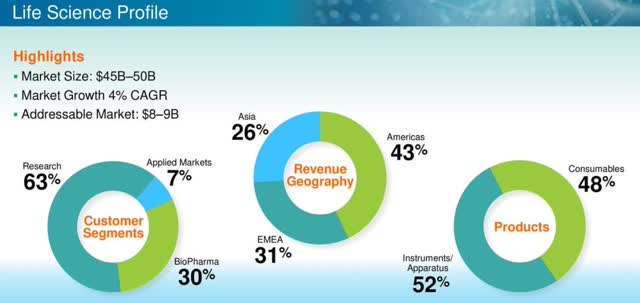

Bio-Rad Life Sciences division overview. Source: company presentation at JP Morgan Healthcare Conference 2020.

Bio-Rad's Life Sciences division accounted for 40% of all revenues in Q120, but the division addresses a larger and more diversified market overall that the company estimates is worth $45-$50bn with a currently addressable market of $8 - $9bn.

The company describes its activities in this market as "creating advanced tools to answer complex biological questions", and offers more than 6,000 reagents, apparatus and laboratory instruments to its global customer base, focused primarily on 3 specific sectors: proteomics, genomics and cell biology.

Bio-Rad markets leading polymerase chain reaction ("PCR") and digital droplet PCR systems which saw an uplift in sales in Q120 owing to increased demand caused by COVID-19 related testing and research requirements, offset by a decrease in academic research demand and a decrease in sales of its process media lines. The company is targeting the growing cell biology market with a number of new products focused on flow cytometry, such as cell imagers, cytometry antibodies and cell sorters and analysers.

Sales increased in Q120 by 5.3% year-on-year to $227m. The launch of its new QX One Droplet Digital PCR system that is easier to use and offers more accurate data as well as regulatory compliance will be expected to boost sales going forward, as is a new RNA kit focused on 2D genomics and sequencing library preparation.

Targeting Covid 19 testing and solutions

Bio-Rad is the first company to secure an Emergency Use Authorisation ("EUA") for a COVID-19 antibody serology test kit (which has also met CE Mark requirements in Europe) which has a diagnostics sensitivity of 98% eight days after the onset of symptoms. Bio-Rad management says it is capable of manufacturing "a few million tests a week if the demand is there".

The company has also secured an EUA for a second COVID-19 test kit that leverages its Droplet Digital PCR technology which is capable of detecting the disease even when a low viral load is present. The test can be completed using its QX200 and QXDx ddPCR systems, of which there are thousands already in operation in hospitals in the US and globally.

The Sartorius question

Based on the above we can conclude that Bio-Rad is a mid-to-large size supplier of products and services to a growing industry which has high barriers to entry owing to the complex nature of the research being conducted by end-clients. We can also see that Bio-Rad is generally a profit making company that tends to earn bottom-line revenues >$50m in each quarter, achieving net profit margins >10%.

Whilst this is impressive in its own way (and may well improve as the company offers enhanced products that are more efficient and easier to use, as well as innovative solutions such as COVID-19 testing kits), there seems to be little doubt that the extra income from its Sartorius holding provides most of the justification for the company's stock price being as high as $477.

In fact, plugging net income minus the Sartorius contribution into a discounted cash flow ("DCF") model gives me a rough and ready fair value price of ~$120 and EPS of ~$6-$8 per annum, by my calculations. Therefore, the performance of Sartorius - both company and share price - is critical to determining in which direction Bio-Rad's share price may travel.

Sartorius - which operates both a Lab Products and Services, and a Bioprocess Solutions division, earned revenues of €509m euros in Q120 - a gain of 16.5% on a constant currency basis, and promisingly, the company's consolidated order intake increased to €629m euros - a 30.4% gain. Sartorius also made a profit margin of 27% on EBITDA of €137.9m euros, although EPS was just €0.83.

In terms of its 2020 guidance, Sartorius management has revised its estimates upwards as a result of its planned acquisition of a portfolio of life sciences assets from Danaher Group, and taking into account coronavirus headwinds, anticipates that group sales will increase by 15% - 19% on an annual basis. The 2020 EBITDA margin is expected to be 27.5%, with net debt to EBITDA forecast to be 2.75x.

Financials and fair value price

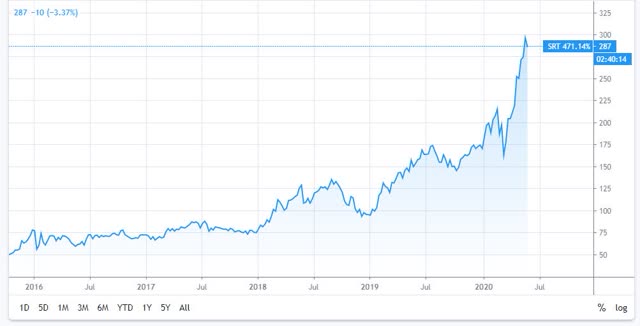

Sartorius AG 5-year share price performance. Source: TradingView

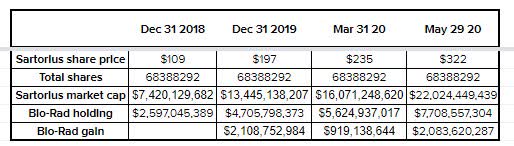

Bio-Rad projected Q2 gain on Sartorius holding. Source: my table using data from Bio-Rad, Sartorius financials.

As we can see above Sartorius' share price has rocketed since the end of March and of course this is great news for Bio-Rad. In the table above I set out how I think it could affect Bio-Rad's Q2 profits.

Sartorius grew its market cap from $7.4bn to $13.5bn between Dec 31 2018 and Dec 31 2019 which I am going to assume is the reporting period for calculating annual gains on its holding. If we do so, we can see that the value of Bio-Rad's stake in Sartorius (the company says it owns 37% of Sartorius' outstanding share capital but I am using 35%, deducting 2% for treasury stock), increases from $2.6bn to $4.7bn, which is very close to the unrealised investment gains figure that Bio-Rad posted in its 2019 full-year earnings submission of $2.03bn, attributing it to its holding in Sartorius.

In the first 3 months of 2020 Sartorius's share price rose to $235, and I estimate Bio-Rad's stake increased in value to ~$5.6bn, which translates to a gain of $900m. Bio-Rad posted gains on unrealised investments of $828m, which again is close to my figure, and it is worth bearing in mind the company has some other small investments as well as the Sartorius holding which may have gone down in this period, bringing the company's overall investment gains down.

Since the end of March Sartorius' share price has rocketed to a price of $322 at the time of writing, which increases the company's market cap to $22bn, Bio-Rad's share to $7.7bn, and its unrealised gain on its holding so far in Q220 to more than $2bn - no wonder Bio-Rad's stock price is currently buoyant!

So long as Sartorius's share price keeps climbing, or at least does not decline, Bio-Rad ought to post absolutely stellar gains in its next set of results, delivering EPS that will likely be double the already extremely impressive $23 the company posted in Q120, and perhaps higher than the $53.89 it posted for FY2019. If Sartorius fails to post share price gains however, there is a very serious lack of justification for Bio-Rad's current high price and we may witness a severe correction.

Conclusion

Such a situation strikes me as highly unusual - mid-sized Life Sciences firms rarely post profits of >$2bn, >$890m, and >$2bn in consecutive reporting periods. However, the situation may not last for long.

Should Sartorius' share price stop growing, Bio-Rad's unrealised gains on its investments will disappear, and the company will fall back on the profits generated by its core operations, which as I have described, are consistent and reliable, but clearly not in the same ballpark as the Sartorius gains.

I would therefore advise investors to think about taking a position in Bio-Rad with short term gains in mind, as the company's Q220 results may well be explosive. Although the outlook for Sartorius' share price looks strong in the rest of 2020 - with the company forecasting sales growth of 15% - 19%, I would be cautious about holding onto Bio-Rad stock for too long, since as soon as Sartorius' share price stabilises and plateaus, the fun will be over.

Gain exclusive access to all of my articles, recommendations and tips plus exclusive content and tips and a model BioHealth portfolio by joining my SA Marketplace - Haggerston BioHealth. I hope to greet you there!

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in BIO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.