AT&T: The HBO Max Launch Was A Disaster

by Stefan RedlichSummary

- The HBO Max launch was an utter disaster.

- Pricing, content and distribution all did not add up and failed to generate any excitement.

- Without Roku and Amazon Fire TV distribution deals, HBO Max risks significantly lower visibility as well as lasting damage to the HBO brand.

- The article covers three key takeaways for investors.

As a long-term AT&T (T) shareholder I have been through ups and downs with AT&T stock and have been patiently waiting almost 4 years since the announcement of the Time Warner acquisition for the day AT&T finally launches its own streaming service that leverages Time Warner's rich assets.

That day finally arrived on May 27, 2020 but while I have not been expecting a lot, the launch even managed to miss my very conservative expectations.

Source: arstechnica.com, all image courtesy remains

In my view, and I am not happy to say this, the HBO Max launch was a true disaster, not generating any meaningful buzz and showcasing significant management mistakes. Now that does not mean that the overall HBO Max streaming service is bad and cannot become a success but the very important initial buzz Disney+ (DIS) managed to generate is definitely missing for HBO Max.

I have chosen a drastic title but I feel it is necessary to convey a strong message. Here are three key takeaways from that HBO Max launch for investors.

Takeaway#1: HBO Max is available on many services but not on the most important ones

For a successful streaming service there are generally four key ingredients: an attractive and easy to understand offering (price and content) and a sophisticated distribution strategy which allows customers to access the service anywhere and anytime on any device they desire. In my view AT&T's HBO Max Launch actually failed on both dimensions but the more visible one right now relates to flaws in the distribution strategy.

HBO Max was even striking these distribution platform deals after launch with the latest being one with Comcast which allows all of Comcast's Xfinity customers to sign up for HBO Max. While that is good news it pales sharply in comparison to the platforms where HBO Max is not available, most notably on Roku (ROKU) and Amazon Fire TV (AMZN).

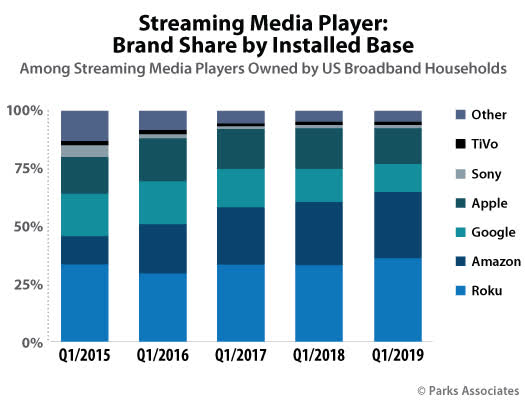

According to the latest figures available this locks out at least 80M potential customers thereof 39.8M on Roku and over 40M users with Amazon's Fire TV platform. To put that into perspective both of these platforms account for almost 70% of the installed base of streaming devices in the US according to latest data as of Q1/2019.

Source: Park Associates

So what's the reason for no deals with Roku and Amazon given the enormous customer potential? Unsurprisingly, it is about money and that AT&T wants to strike a mutually beneficial deal but although we don't know any details I feel AT&T needs to give in here if it wants HBO Max to be meaningful.

Both Roku and Amazon have expressed strong interest collaborating with HBOMax and touting the wealth and value of their respective platforms. Roku said the following:

As the No. 1 streaming platform in the U.S. we believe that HBO Max would benefit greatly from the scale and content marketing capabilities available with distribution on our platform. We are focused on mutually positive distribution agreements with all new OTT services that will deliver a quality user experience to viewers in the more than 40 million households that choose Roku to access their favorite programs and discover new content. Unfortunately we haven't reached agreement yet with HBOMax. While not on our platform today, we look forward to helping HBOMax in the future successfully scale their streaming business.

Source: techcrunch.com

And very similarly Amazon stated:

With a seamless customer experience, nearly 5 million HBO streamers currently access their subscription through Amazon's Prime Video Channels. Unfortunately, with the launch of HBO Max, AT&T is choosing to deny these loyal HBO customers access to the expanded catalog. We believe that if you're paying for HBO, you're entitled to the new programming through the method you're already using. That's just good customer service and that's a priority for us.

Source: deadline.com

The thing is that HBO Max is not only not available on these platforms but it also prevents existing HBO customers who use these services from upgrading to HBO Max and this is what Amazon implicitly describes as bad customer service.

Interestingly, apps for these two platforms have already been developed and are ready for being published but it all comes down to when the deals will be reached. While I understand that AT&T wants to get a good deal they are frankly not in a strong negotiating position here and unless the terms are totally unacceptable they need to give in. Without access to Roku and Fire TV customers are generally not able to watch it on their TV (at least not in an easy to use and customer-friendly manner) and are bound to tablet and mobile which is certainly not the streaming experience I would expect.

Takeaway #2: AT&T failed to generate any meaningful buzz surrounding the launch of HBO Max

It is only anecdotal evidence but when Disney+ was launched already days and weeks before launch day I got ads everywhere on Instagram and on Facebook and the buzz was tremendous especially given that at that time it was not even launched in the country I am residing in, which is Germany.

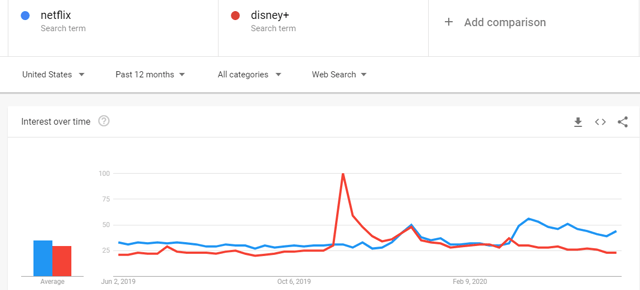

We can also see that by looking at Google Trends for Disney+ and Netflix (NFLX) and then compare it to HBO Max.

Source: Google Trends

It becomes blatantly obvious just how big the buzz surrounding Disney+ was back in November 2019. Interest over time skyrocketed and easily outpaced that for Netflix and remained above or in-line with Netflix for the next 6 months before the coronavirus outbreak saw Netflix take the lead again.

On launch day alone Disney+ zoomed out of the gates by surpassing 10M subscribers and recording over 3.2M app downloads. Those are staggering numbers even if we consider that Disney was only priced at $5.99 and came for free for 12 months with a Verizon (VZ) wireless plan.

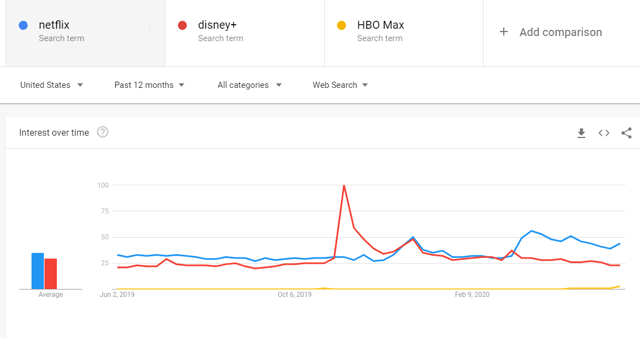

So let's see how HBO Max fits into the picture with interest generated over time.

Source: Google Trends

It is quite shocking to see just how non-existent any sort of interest in HBO Max really is. Disney+ already generated significant interest months before its launch whereas for HBO Max the line is flat in comparison to these two streaming giants. Only on launch day itself we can actually see something different than a flat yellow line for HBO Max but it is totally meaningless compared to the other two.

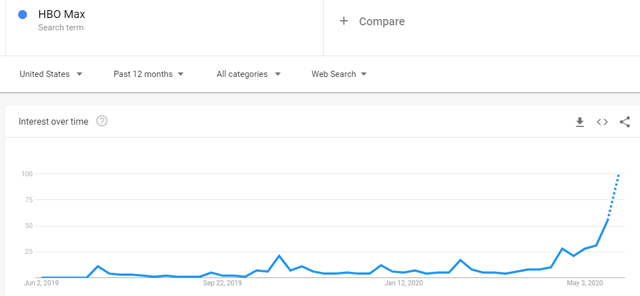

Even if we only focus on HBO Max interest over time exclusively, as shown below, there is no meaningful excitement or interest to be seen in the data before May 2020.

Source: Google Trends

This observation is also backed by news, or in that case non-news, relating to subscriber numbers on launch day. All we have heard so far is that there have been 90,000 mobile downloads on launch day which is even significantly below the 300,000 mobile downloads for short-firm video service Quibi and not even comparable to the 3.2M app downloads for Disney+.

Takeaway #3: Provide a better offering to the customer

While AT&T cannot fix its launch day disaster anymore, that is the past, it needs to focus on the present and the future if it wants to get anywhere close to the 50M domestic HBO Max subscribers it is targeting by 2025.

To do that I feel they need to do four things:

1) Strike a deal with Roku and Amazon as fast as possible

2) Offer some sort of appeasement to existing HBO customers who could no longer access that service on Roku and Amazon: It can be described as the one of the worst product roll-outs ever given that the HBO Max pre-order deal which theoretically allowed existing HBO customers to simply roll over to HBO Max was misleading given that those customers using HBO with Roku and Amazon Fire TV simply could not do that. It is much more difficult to win a new customer than keep an existing customer but if you can't even keep existing customers this is a very dangerous situation. As such I feel AT&T needs to offer some sort of discount or appeasement to these HBO customers, like 3-6 months of free service, also in order to prevent any further long-lasting damage to the highly respected HBO brand

3) Bundle HBO Max with some wireless plans or find other big-buzz cooperation partners like Disney with Verizon: Disney's deal with Verizon in combination with the overall low price for Disney+ has shown how to generate enormous buzz for the platform and turn this excitement into subscriptions. While right now most of these are not adding any revenue for Disney it gives them an enormous potential customer base they can tap into once the free months are over. HBO Max is owned by AT&T and as such it is not a far-fetched idea to propose some sort of bundle with AT&T's own wireless plans especially after the day 1 buzz simply did not happen.

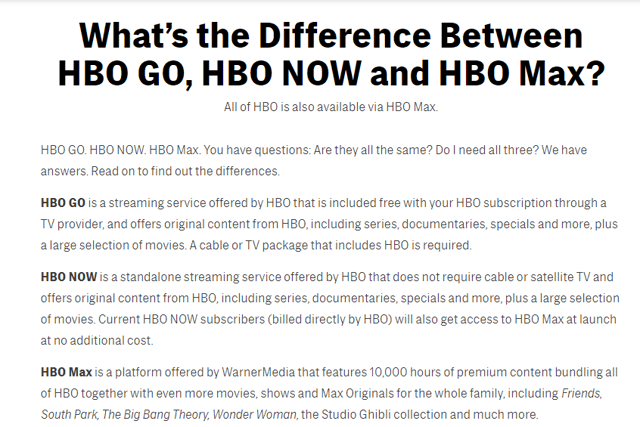

4) Fix the convoluted messaging with HBO GO, HBO NOW and HBO Max as well as the confusing upgrade pricing: Netflix is Netflix and Disney+ is Disney+ but with HBO there are three different services with rather meaningless names. Thus, it is no surprise that AT&T itself hosts a website which shows the difference between GO, NOW and MAX and while there may be good reasons that all three exists it is very confusing as a potential customer to be confronted with three very similar names.

Source: hbo.com

On top of that the pricing is also confusing. For new customers HBO Max comes at $14.99 a month making it the most expensive streaming service. That is an easy and straightforward message. However, for existing HBO customers it is totally different and not that easy to understand if you are eligible for a free upgrade and if not what you have to pay for it. For instance in order to get the free upgrade the company which is currently billing you for HBO, like Charter, needs to strike a deal with HBO. If not there were some pre-order deals available which get you discounted pricing of $11.99/month for the first 12 months but then you didn't qualify for the seven-day free trial anymore, which in my view should be 1 month anyway. If you are currently subscribed to HBO NOW at $15/month you need to know that HBO MAX will offer the same and more at the same cost but you might have to cancel that HBO NOW subscription if you are not eligible for the upgrade offer or currently use Roku or Amazon Fire TV.

This setup needs to be fixed and simplified and I really wonder what AT&T was doing all these years and why it came up with such confusing naming and pricing.

Investor Takeaway

Investors have waited almost 4 yours to finally see how AT&T will leverage its $85B Time Warner acquisition and based on launch day and the insights we can derive from the current offering it is in my view one of the worst product roll-outs ever, certainly the worst of the big streaming platforms.

Launch day was a disaster given that pricing, content and distribution simply weren't in balance and failed to generate any meaningful buzz and excitement. That does not mean HBO Max itself will remain a failure but management will have to react swiftly to limit further damage to the brand and prevent its loyal HBO customers from leaving the service altogether. Thus, it must urgently strike a deal with Roku and Amazon even if the terms of that agreement are not what AT&T would like but as long as it is not totally outrageous I feel they need to accept it. AT&T needs to go where the customer is and that is on Roku and Amazon whether they like it or not. However, when CEO John Stankey said that...

We must be doing something right if somebody believes we are now starting to be more in conflict with their business, so I don't necessarily take that as a bad sign

... I can only shake my head since Roku and Amazon are far less dependent on HBO Max than the other way round given that they have Netflix and Disney+ which together have over 200M potential subscribers already on their service.

As an investor the HBO Max launch was hugely disappointing and I seriously wonder who made these decisions and why. It will be crucial to see how subscriber numbers will develop, potential (temporary) pricing adjustments as well as distribution strategy. AT&T needs to go where the customer is and that is on Roku and Amazon whether they like it or not.

I am keeping AT&T for the dividend which remains safely covered but ultimately even if AT&T is able to pay back all its Time Warner debt and more in-line with its schedule we need to see some kind of positive momentum with HBO Max as otherwise the stock is bound to stay where it currently is for a (very) long time.

If you enjoyed this article, the only favor I ask for is to click the "Follow" button next to my name at the top of this article. This allows me to develop my readership so that I can offer my opinion and experiences to interested readers who may not have received them otherwise. Happy investing.

Disclosure: I am/we are long T, DIS, VZ, ROKU, AMZN. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not offering financial advice but only my personal opinion. Investors may take further aspects and their own due diligence into consideration before making a decision.