Surge in U.S. Incomes Masks Fragile Situation for Many Americans

by Reade Pickert- One-time stimulus payments cause outsize gain in report

- Jobless benefits only replacing some income for the unemployed

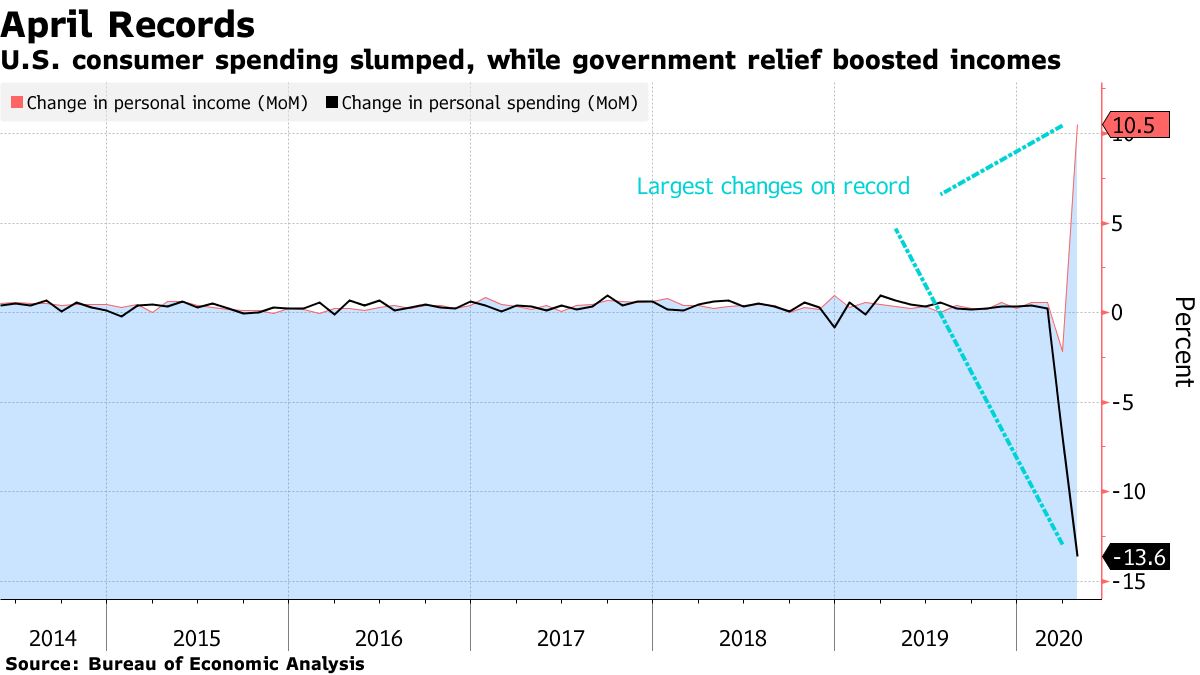

April’s record plunge in U.S. consumer spending came with an unexpected twist: a record surge in Americans’ incomes, which had been forecast to decline amid massive job losses.

It doesn’t mean, though, that Americans will continue to have that level of cash on hand in the coming months, or that consumer spending is going to spring back to pre-Covid-19 levels any time soon.

The 10.5% increase in personal income from the prior month resulted from government benefit payments authorized by the CARES Act that padded Americans’ wallets during the coronavirus pandemic. That figure was driven in large part by household relief checks, or the $1,200 refundable tax credits distributed largely in April to citizens.

While the report suggests money did get into the hands of many Americans who desperately needed the funds to pay their bills and buy food, the boost will be temporary unless Congress authorizes another round of payments. And the income gain, while eye-popping, looks even larger because of the way the Commerce Department reports the monthly data.

Unemployment insurance payments, which surged an annualized $360.5 billion from the prior month, actually offset less than half of the loss in compensation, said Michelle Meyer, head of U.S. economics at Bank of America Corp. Wages and salaries declined 8% in April from the prior month.

“The reason the numbers look so extreme this month was because of the one-time checks that were sent out -- which won’t be continuing,” Meyer said. “It temporarily masks the fact that people are in a fragile economic position.”

Financial markets focused on the negative parts Friday, with the S&P 500 index and Treasury yields lower.

Spending during the month was limited in large part due to the shutdowns that kept Americans at home, with outlays set to rebound somewhat in the coming months as businesses begin to reopen across the nation. At the same time, incomes may struggle, even with the boost from jobless benefits.

What Bloomberg’s Economists Say

“While easing lockdowns will help increase consumer spending, the elevated savings rate -- amid low consumer confidence -- will limit the extent of a rebound in consumer spending and GDP growth overall.”

-- Yelena Shulyatyeva, Andrew Husby and Eliza Winger

Read more for the full note.

While unemployment insurance payments will likely continue to boost income, several of the programs are set to expire at varying points this year, JPMorgan Chase & Co.’s Daniel Silver said in a note.

That includes the additional $600 weekly payment, or Federal Pandemic Unemployment Compensation, which is set to expire at the end of July. Democrats and Republicans haven’t yet agreed on whether to extend the program.

The latest numbers also seem particularly enormous due to the way they’re reported -- at an annualized rate, wrote Stephen Stanley, chief economist at Amherst Pierpont Securities. This “means that when there is a one-off payment, as we saw with household relief checks, the BEA methodology means that the magnitude gets multiplied by 12.”

Incomes saw an annualized increase of $3 trillion in government social benefits in the month, almost all driven by a category labeled “Other” -- as distinct from standard programs such as Social Security and Medicare, as well as unemployment insurance.

The data indicate that about $200 billion in relief checks resulted in a $2.6 trillion annualized rise in “other” government transfer payments, according to Stanley.

Another caveat: The income from the stimulus checks, tax saving and unemployment insurance support were counted for accounting purposes in April, even though much of that wasn’t received until later, Diane Swonk, chief economist at Grant Thornton LLP, wrote on Twitter following the report.