Clovis Oncology: You Should Embrace Volatility To Enjoy Profitability

by BioSci Capital PartnersSummary

- Amid the Corona Bear market, many fundamentally strong stocks are still trading at a deep bargain to their true worth.

- Amid the market volatility, Clovis Oncology shares are exchanging hands far below their intrinsic value.

- In May, the FDA granted the approval of Rubraca for the deadliest form of prostate cancer, metastatic castration-resistant prostate cancer with the BRCA1/2 mutations.

The only reason to sell them a stock now is to buy other, more attractive stocks. If you can't find more attractive stocks, hold on to what you have. - Sir. John Templeton

In late 2019, Clovis Oncology (CLVS) was trading as low as $3.21. After I issued my buy recommendation, Clovis shares quickly rallied and thereby traded as high as $16.43. As you know, the Corona Bear market took Clovis down to $3.77. At that point, I made my buy recommendation again. Thereafter, the stock embarked on a vigorous rebound to reach $10. Despite that Clovis gained the FDA approval of Rubraca as I forecasted, the stock then gave up some gains due to a public offering. You might think that I'm bragging. Don't shoot the messenger. Listen to the message. My point is that bio-stocks are highly volatile.

A biotech can move drastically in either direction. As such, your objective is to build shares amid a market overreaction when the stock tumbled far below its intrinsic value (i.e. true worth). Don't be afraid of the volatility associated with your stock. Embrace it! It will serve you well! In this research, I'll present a fundamental update on Clovis and share with you my expectation of this volatile growth equity.

Figure 1: Clovis chart (Source: StockCharts)

About The Company

As usual, I'll present a brief corporate overview for new investors. If you are familiar with the firm, you should skip to the subsequent section. Based in Boulder, Colorado, Clovis is engaged in the innovation and commercialization of stellar medicines to serve the unmet needs in various oncology indications. They include ovarian, prostate, breast and bladder cancers.

I believe that Clovis is special because the company already has an approved cancer medicine, rucaparib (i.e., Rubraca). As an oral, small-molecule inhibitor of poly (ADP-ribose) polymerase ("PARP"), Rubraca gained FDA approval as maintenance for recurrent ovarian cancer. Despite being a second-line drug, Rubraca has been delivering increasing sales since approval in April 2018.

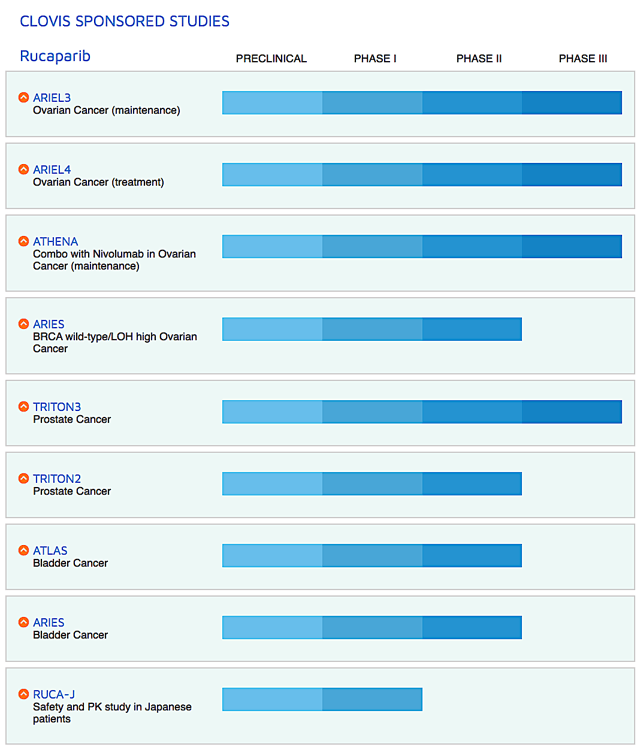

Figure 2: Therapeutic pipeline (Source: Clovis)

Corporate Strategy

When you invest in biotech, be sure to focus on corporate strategy because it tells you whether growth can be sustained. On this front, Clovis is studying Rubraca in combinations with either an immune checkpoint inhibitor (Opdivo) for the first-line ovarian cancer maintenance.

There are also other drugs (i.e., lucitanib and rociletinib) being assessed in the Phase 1 studies for various cancer indications. Interestingly, Clovis recently in-licensed a radiopharmaceutical targeting drug known as FAP-2286. You can expect the company to file a new drug ("IND") application for FAP-2286 by 2H this year.

Rubraca Approval

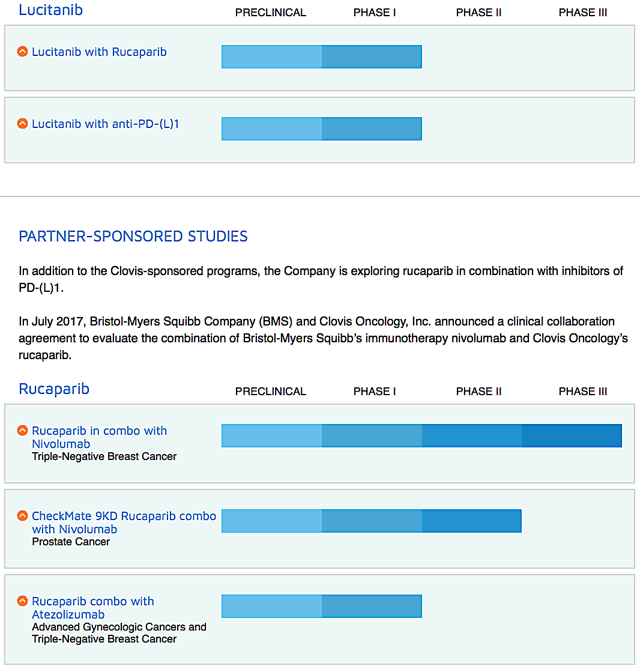

Shifting gears, you should assess the recent regulatory victory. On May 15th, Clovis announced the Rubraca approval for the deadliest form of prostate cancer, metastatic castration-resistant prostate cancer with the BRCA1/2 mutation (i.e., mCRPC BRCA1/2). The decision was based on the ongoing Phase 2 TRITON trial with approval contingent on the successful confirmatory Phase 3 TRITON study.

As you know, the days leading to approval were filled with uncertainty, excitement and fear. Instead of letting the market doubts cloud your judgment, I congratulate you for being bold with your approval forecasting with me. I know you were disappointed that the approval didn't translate into a huge rally. Nonetheless, the fundamentals of Clovis are now substantially strengthened. In light of the said milestone, Dr. Wassim Abida, the Principal Investigator of the TRITON2 trial remarked,

Standard treatment options for men with mCRPC have been limited to androgen receptor-targeting therapies, taxane chemotherapy, Radium-223 and sipuleucel-T. Rubraca is the first in a class of drugs to become newly available to patients with mCRPC who harbor a deleterious BRCA mutation. Given the level and duration of responses observed with Rubraca in men with mCRPC and these mutations, it represents an important and timely new treatment option for this patient population.

Figure 3: Rubraca indications (Source: Clovis)

As you can see, Rubraca gained the FDA approval based on one single-arm Phase 2 TRITON trial. That's no small feat! After all, FDA approval is usually based on a multi-arm Phase 3 clinical investigation. As I shared in my commentary, I know you don't like Clovis management. Sure, what they did in the past might not make you feel happy. However, I always give people second chances because people can change. In late 2019, the management reduced the operating cash burn as they promised. Now, they gained a difficult FDA approval.

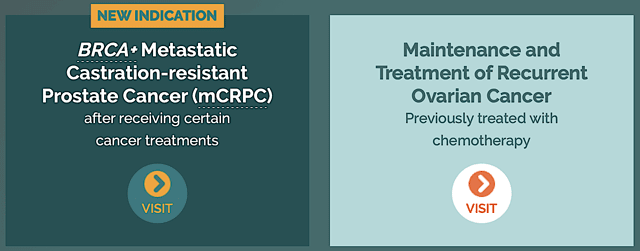

Aside from the management stepping up, Rubraca is an excellent drug. That certainly helped to secure the approval. In the figure below, you can see that Rubraca generated the 44% confirmed objective response rate (i.e., ORR) and the 6-months duration of response (i.e., DOR).

Both metrics are stellar for this deadly prostate cancer. Based on my estimate, Rubraca will generate a peak revenue of roughly $1B. As such, I believe that this approval carved a pathway for Rubraca to reach the land of blockbuster. To temper overoptimism, just don't expect it overnight. Though it takes time to galvanize sales, you can expect improvement to come in the next quarter.

Figure 4: TRITON2 data results (Source: Clovis)

Lynparza Approval

As I scan the market daily to gauge its sentiment, I realized that market fear is pervasive in Clovis since the recent Lynparza approval. As such, it can be easy to be fearful when you see a competing molecule getting approved. You may ask, Dr. Tran, why is that the case? My friend, you are affected by the market sentiment of fear, the most powerful human emotion. That's why fear has been driving down the share price of your Clovis stock.

If you take a step back, you'd realize that fear is False Expectations Appearing Real. Specifically, you'll see that multiple good medicines can exist in the same market. A prime example in the diabetes niche, there are several blockbusters like Novolog, Humalog, etc. The same is true for cancer indications and orphan conditions.

To explore Lynparza further, I dug up the literature for you. Though you might think Lynparza is a better drug, closer inspection revealed concerning findings. As you can see, AstraZeneca (AZN) gained the Lynparza approval based on the Phase 3 PROfound trial outcomes. Nonetheless, experts stated that there are critical flaws in the trial design.

For instance, Jacob Pleith of Vantage Evaluate presented the argument against the Profound trial's control arm. In other words, Mr. Pleith said that patients in PROfound are already non-responsive to hormonal therapy, which is imprudent. Another expert, Dr. Vinay Prasad, stated that he is "deeply, almost delinquently, inappropriate; just bad medicine. You might as well have given a sugar pill, and neglected to care for them further."

That aside, PROfound excludes patients on taxane while giving them a PARP inhibitor (Lynparza). That made me question whether the 50% ORR of Lynparza compared to 44% ORR for Rubraca is legitimate. If Rubraca can generate a 44% ORR in patients who already failed taxane, would Rubraca post a better ORR if TRITON2 excluded patients who already failed taxane? You can bet that the ORR for Rubraca would be much higher than 50%. The confirmatory PSA reduction of over 50% is your proof in the pudding.

That being said, the fact that Rubraca does a phenomenal job for patients who already failed other drugs like taxane tells you that it's a great medicine. And TRITON2 didn't put Rubraca against the control enzalumatide (i.e. a hormonal therapy) in patients no longer responding to hormonal therapy.

Regardless of the therapeutic merits of Lynparza, I believe that the more treatment options for patients, the better. Though I'm surprised at the Lynparza approval, I believe that the FDA wants patients to have more medicines. In my view, there is no such thing as a perfect drug. Some subjects will respond better to Rubraca, while others will enjoy more benefits from Lynparza. Therefore, the ORR is not 100% as an IBI expert member, Dr. Drendo, elucidated.

Public Offering

Here is the straw that broke the camel's back. Three days following approval, on May 19th, Clovis issued $85M in a public offering which upset investors. It seems to me that in the Coronavirus environment, the market is extremely sensitive to a public offering regardless of whether an offering is prudent. Since shareholders didn't like the capital raise, the stock tumbled over 14% in the coming days. Nevertheless, when you look at it from a fundamental viewpoint, you'll see that it must be done to improve the balance sheet.

Clovis mentioned that it will use the money to pay back the refinancing and to fund research and development. Simply put, it's important for the company to continue investing in growth. I rather Clovis raised cash when the shares were trading high than when it's tumbling. Moreover, it's good that Clovis execute an offering rather than incurring heavy bank debts that can be recalled at the first sign of trouble.

Notwithstanding, I can see your argument that if Clovis waited a few more days, the investor's optimism wouldn't be fizzled out. Regardless if Clovis should have waited, it's a necessary move from the corporate view. Now, the offering was already closed on May 21st. Yet the underwriter still has the 30-days option to purchase another $12.7M of stocks by June 21. After June 21, I believe that the market sentiment will significantly improve.

Financial Assessment

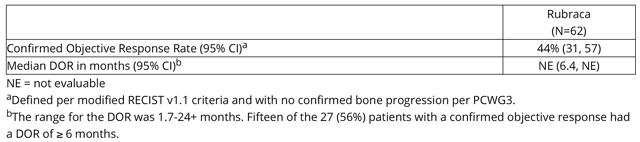

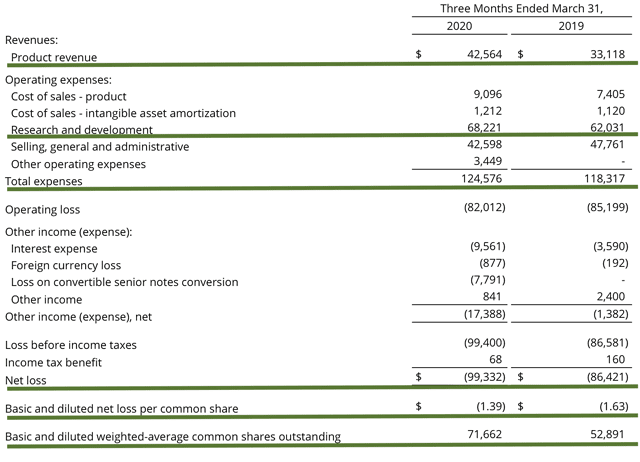

Just as you would get an annual physical for your well-being, it's important to check the financial health of your stock. For instance, your health is affected by "blood flow" as your stock's viability is dependent on the "cash flow." With that in mind, I'll analyze the 1Q2020 earnings report for the period that ended on March 31, 2020.

As follows, Clovis garnered $42.6M in quarterly revenues compared to $33.1M for 1Q2019. This represents a 29% year-over-year and an 8% sequential increases from last quarter. Considering the ongoing Coronavirus pandemic quarantine, you can see that this is a magnificent feat. The President and CEO (Patrick Mahaffy) stated,

We are pleased with our sales growth in 1Q and believe that Rubraca is well-positioned as an oncology treatment option in the COVID-19 era. While we may see some impact on near-term revenues as oncology practices and patients adjust to the impact of this virus in the U.S. and Europe, it is obvious that cancer patients will continue to be diagnosed and treated given the evident risks in not actively managing their disease. We believe that Rubraca has significant advantages as a maintenance option in an environment in which physicians are trying to reduce patient visits to their clinics. Rubraca is an oral agent and is both delivered directly to and taken at home. Unlike observation, which on average requires a return to immunosuppressive chemotherapy after approximately five months, Rubraca has proven to extend progression-free survival by independent assessment on average nearly fourteen months. And finally, Rubraca only requires monthly routine monitoring. In addition to seeking to establish Rubraca as the maintenance treatment option of choice in recurrent ovarian cancer, we also look forward to the potential launch in the U.S. of Rubraca in BRCA1/2-mutant recurrent, metastatic castrate-resistant prostate cancer.

As you can see, there are several advantages that enabled Rubraca to generate robust sales amid this challenging environment. First, the 14-months progression-free survival for patients taking Rubraca is a big plus. After all, a cancer drug needs to improve survival. Second, Rubraca only required monthly monitoring. This is a huge advantage because people don't want to go to the hospital or clinic during the Coronavirus pandemic. Third, Rubraca can be taken orally either at home or the clinic. Hence, Rubraca fits in line with the social distancing for COVID-19.

That aside, the research and development (R&D) for the corresponding periods registered at $68.2M and $62.0M. I view the 10% R&D increase positively because the money invested today can turn into blockbuster profits in the future. You have to plant a tree to enjoy its fruit. Additionally, there was $99.3M ($1.39 per share) in net losses compared to $86.4M ($1.63 per share) decline for the same comparison. On a per-share basis, the bottomline improved by 14.7%. As such, Clovis is tightening up the bottomline, which is another step toward success.

Figure 5: Key financial metrics (Source: Clovis)

About the balance sheet, there was $228.4M in cash, equivalents, and short-term investments. Against the $124.5M quarterly OpEx, Clovis believed there is enough cash runway into 2H2021. If you recall, the firm recently improved its balance sheet by the convertible debt transaction occurred back in April. That is to say, Clovis extended its 2.50% senior convertible notes of $32.77M due 2021 to 2024 for a higher interest rate, i.e., 4.50%. Therefore, the firm only has to pay a bi-annual interest. As a result, this cuts down the annual OpEx by $32.7M, a significant reduction.

Upcoming Catalysts

When you analyze a biotech, it's essential that you pay attention to the upcoming catalysts. It'll cue you in on the share price movement. Looking ahead, there are several incoming events that you should keep in mind.

The first one is the Rubraca data presentation at the 2020 Annual American Society of Clinical Oncology ("ASCO") meeting to be held from May 29 to 31st. Due to COVID-19 concerns, the meeting will occur virtually, i.e., online.

The second catalyst is the data reporting for Lucitanib's Phase 1 study for various cancer indications. The presentation will occur at the September 2020 Annual European Society of Medical Oncology (i.e., ESMO) meeting. I believe that the data will be robust. Specifically, I ascribed a 65% (i.e., more than favorable) chance of positive data. Therefore, you can expect that there is a good chance that Clovis will rally during that time.

Third, Clovis is advancing Rubraca in combinations with Bristol-Myers Squibb (BMY)'s Opdivo into the first-line indication for Ovarian cancer. I like combination therapy for cancer because it is the cornerstone of prudent management. If you think about it, Rubraca alone delivers robust results for Ovarian cancer. Thereby, you can bet that its combo with an immune checkpoint inhibitor, Opdivo, will galvanize strong clinical outcomes. Hence, this can entice BMY to acquire Clovis for Rubraca. The other incentive is that Rubraca recently gained FDA approval for the deadliest prostate cancer.

Fourth, Clovis intends to submit the investigational new drug (i.e., IND) application for FDA-2286, a radiopharmaceutical therapy targeting FAP later this year. Nevertheless, I believe this is a minor development, which won't significantly move your stock.

Fifth, you can anticipate Rubraca sales to ramp up as soon as the next quarter. The longer Rubraca is in the market, the faster the sales growth. When the Coronavirus pandemic quarantine is removed, sales should be boosted much higher, in the high double digits. Despite upcoming growth, I believe that Rubraca won't become a blockbuster until the next couple of years.

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are "growth-cycle dependent." At this point in its life cycle, the main concern for Clovis is if Rubraca sales will continue to ramp up. Make no doubt that Rubraca is a stellar drug. The question is if Clovis has the resources to rally sales quickly.

Additionally, Clovis has a high cash burn rate, which is its Achilles heel. If the company does not conservatively manage its cash, the firm can run into a potential cash flow constraint. Nonetheless, the risks are reduced because Clovis has enough capital to last until 2H2021. Furthermore, there is the chance that other franchises, i.e., Lucitanib might post subpar data. In that case, the stock can tumble over 50% and vice versa.

Conclusion

In all, I maintain my buy recommendation on Clovis Oncology with the five out of five stars rating. Clovis Oncology has overcome the odds in gaining the FDA approval to expand Rubraca's label for both ovarian cancer and the deadliest form of prostate cancer. Though the stock did not appreciate further, it banked over one fold for members who bought in at the recent low. While volatility can spook many traders/investors, if you are patient and opportunistic to build shares at the pullback, you can potentially make a lot of money. Looking ahead, I expect Rubraca sales to increase robustly in the coming quarters. Other catalysts like the upcoming ASCO and ESMO presentation can give the shares more momentum. In the long view, there is the data for the combo of Rubraca/Opdivo that'll advance this drug into a first-line for ovarian cancer. FAP-2286 is another franchise to improve Clovis prospects. That being said, you should keep tabs to see if Clovis will file its IND in the second half of this year.

As usual, I'd like to remind investors that the choice to buy, sell, or hold Clovis is ultimately yours to make. In my view, if you're interested in this stock now is a good time to build a position. Make sure you build your shares in a "stepwise fashion" to get the best average cost. Last but not least, I'd like to close out this article with the wisdom of my mentor, once you become fearless, life becomes limitless.

Thanks for reading! Please hit the orange "Follow" button on top for more. Don't miss out on the most profitable content (i.e. higher level intelligence) inside IBI. Here's what members said:

Dr. Tran's analyses are the best in the biotech sphere, well worth the price of subscription.

Very professional, extremely knowledgeable, and very honest … I would highly recommend this service, and his stock picks have been very profitable.

Not satisfied? See countless testimonies here.

I'm so confident in the value of my service that I'm giving you a 2-week FREE trial, money-back guarantee.

Disclosure: I am/we are long CLVS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: As a medical doctor/market expert, I’m not a registered investment advisor. Despite that I strive to provide the most accurate information, I neither guarantee the accuracy nor timeliness. Past performance does NOT guarantee future results. I reserve the right to make any investment decision for myself and my affiliates pertaining to any security without notification except where it is required by law. I am also NOT responsible for the actions of my affiliates. The thesis that I presented may change anytime due to the changing nature of information itself. Investment in stocks and options can result in a loss of capital. The information presented should NOT be construed as a recommendation to buy or sell any form of security. My articles are best utilized as educational and informational materials to assist investors in your own due diligence process. That said, you are expected to perform your own due diligence and take responsibility for your actions. You should also consult with your own financial advisor for specific guidance, as financial circumstances are individualized.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.