Omega Healthcare: This Outperformer Is Undervalued With An 8.7% Yield

by Gen AlphaSummary

- Omega Healthcare has a strong track record with market beating returns.

- The current share price offers an attractive entry point with a strong going-in yield.

- Management appears to be responding well to COVID-19 and has been operationally proactive.

- An aging population and the new PDPM model provide strong tailwinds.

Investment Thesis

Omega Healthcare Investors (OHI) has been somewhat of a battleground stock, with bears arguing that operators have tight coverage ratios and bulls saying that a tsunami of aging baby boomers will create surge in demand for their properties. The pandemic has added to these concerns with reports of COVID-19 breakouts in nursing homes, which contributed to the stock declining dramatically to a multi-year low of $13.33 before recovering to the present level of $30.71 as of writing.

While the bear concerns are not unfounded, I believe the fears are overblown and the stock presents an attractive risk vs. reward proposition at the current low valuation combined with a growing high dividend yield. This combination has given OHI investors market beating returns in the past and should continue into the years ahead.

Brief Overview

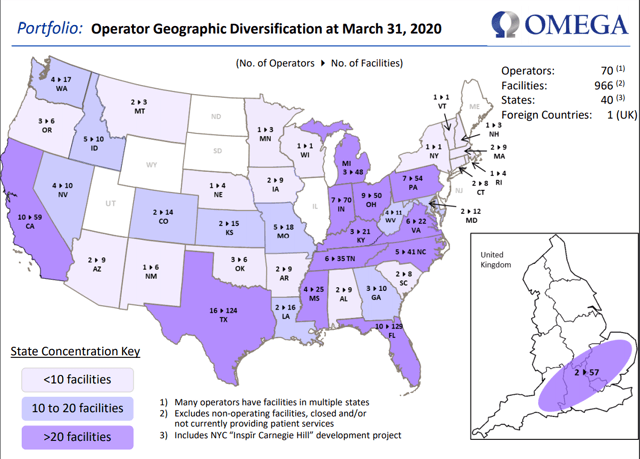

Omega is the largest skilled nursing landlord with 966 facilities spread across 40 states and 70 Operators, and 57 of their facilities are with 2 Operators in the United Kingdom. As seen below, the company is geographically diversified with higher concentrations in Florida (13% of portfolio count) and Texas (13%).

Source: Q1'20 Investor Presentation

Track Record of Outperformance

Omega has an excellent track record of increasing dividends every year for 17 years, including during the Great Recession. One of the advantages that Omega possesses is its economy of scale and diversification, which enables it to acquire triple-net lease properties from the private market at attractive cap rates. In addition, its employment of master leases with cross collateral provisions and quality operator relationships helps it to mitigate the risk of any one property from defaulting.

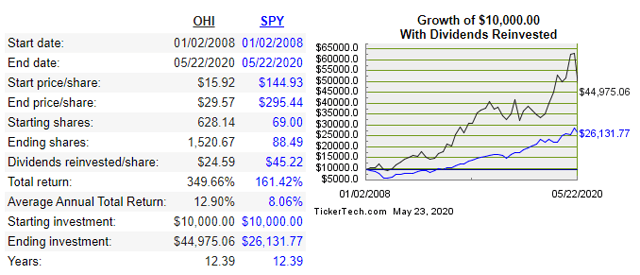

I believe Omega's track record of risk management combined with low valuations due to negative investor sentiment are the primary reasons for why it has produced outsized returns compared to the S&P 500. As seen below, $10K invested in OHI on 1/1/2008 with dividends reinvested would now be worth $45K, equating a 350% return or 12.9% annualized and far outstripping the S&P 500 return over the same period.

Source: DividendChannel

To be fair, had I picked the year 1995 as a starting point, the annual return would not be as spectacular, although still a respectable 8% CAGR with dividend reinvestment. This is because of reimbursement changes that CMS made to the skilled nursing sector in the late 1990's. Arguably, those changes were painful but necessary for the sector as Medicare would have otherwise been put at greater risk.

Hindsight is 2020 of course, but focusing back on the return since 2008 reminds me of shareholder returns in the tobacco industry, where a consistently low share price due to negative shareholder sentiment combined with a high and growing dividend yield results in out-sized compounding returns. While OHI is not necessarily considered a sleep-well-at-night stock in many investors' minds, it's because many don't consider it to be a SWAN stock that has enabled dividend reinvestment at a depressed share price, resulting in it outperforming the market by such a wide margin.

In addition, new construction of skilled nursing facilities is governed by certificates of need in 36 states, which in turn benefits existing operators. CON laws were instituted to limit the number of nursing homes in response to the escalating cost of long-term care. This in turn benefits existing nursing home operators with some degree of stability that they would otherwise not have.

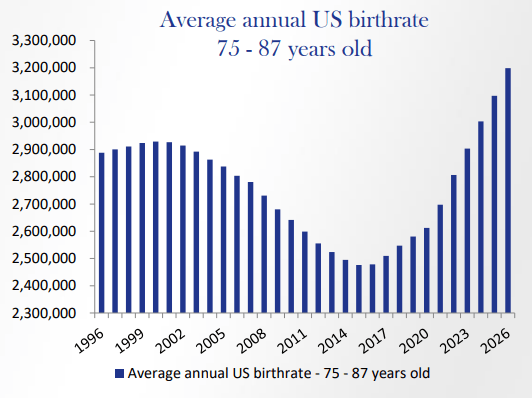

What's also encouraging is that Omega was able to generate FFO growth from 0.37 per share in 2009 to 0.85 per share in 2017, all while the 75 to 87 year old demographic dropped. As seen below, an upward reversion of this demographic is just getting started, and should provide continued tailwinds for the industry for the next decade.

Source: 2018 Investor Day Presentation

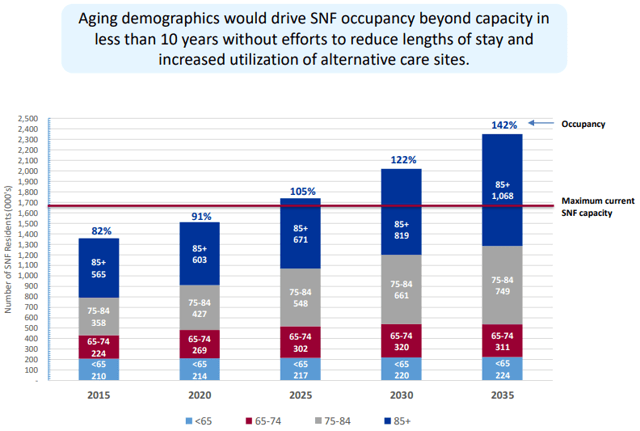

And here are the projected supply shortages based on sharp increases in occupancy in the coming decade:

Source: Q1'20 Investor Presentation

Q1'20 Results

Omega posted solid results with FFO of $0.77 per share as compared to $0.67 in the year ago quarter. Perhaps equally as important is that Omega collected 98% of April rents, signaling that they are not experiencing the same rent deferral issues that their retail counterpart landlords are experiencing. While management did pull full year 2020 guidance, I believe Omega is in a much stronger position to collect rents than other commercial real estate sectors due to the nature of their critical need assets.

Occupancy on the skilled nursing side did fall by 3% to 6% due to elective surgeries being cut off and cases of re-hospitalization due to COVID-19 infections. The company, however, has taken preventative measures to slow and stop the spread of infection in their facilities as Megan Krull remarked on the conference call:

All new admissions are treated as presumptive positive and quarantined for 14 days. Vendors in most areas are not permitted entry into buildings and lastly, food and other deliveries outside for employees to bring in. Our operators are having to find ways to reconfigure their buildings so that they have dedicated wings for positive or suspected positive residents. They are also looking at their portfolios to determine whether there are buildings that can be fully dedicated to COVID-19 patients. We have several instances of that in our portfolio. And while the number of these dedicated buildings is likely to grow, we do not believe that it will grow substantially.

While the company acknowledged that there were around 4000 confirmed cases at the beginning of May, or around 5% of their total residents, the CEO remarked that they are seeing a downward trend in the growth rate of infections in their facilities, which is a positive.

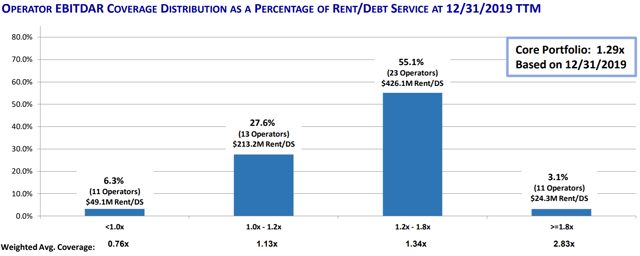

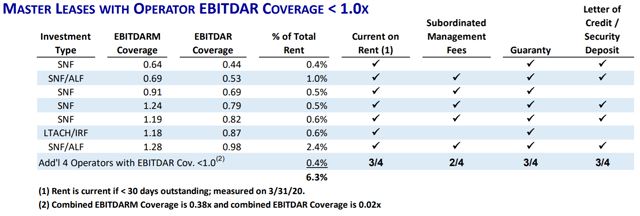

The majority of Omega's operator tenants seem to be healthy as only 6.3% had EBITDAR to Rent coverage below 1.0x. While the 1.0x rent coverage may seem like a low bar to some, it is not uncommon for the SNF industry to operate on thin margins due to the government pay nature of the business, and with rent being the highest expenditure for them.

Source: Q1'20 Investor Presentation

What gives me comfort is that of the Operators that have less than 1.0x rent coverage, they all have bank guaranties and/or a letter of credit / security deposit.

Source: Q1'20 Investor Presentation

Balance Sheet

Turning to the balance sheet, Omega is in a strong liquidity position with over $1.1 billion, of which $618 million is from borrowings against a $1.25 billion revolver and $490 million of existing cash on hand. This leaves an additional $632 million in borrowing capacity on the revolver should they need it. In addition per the conference call, the CARES Act provides between $150K to $175K per facility for additional support.

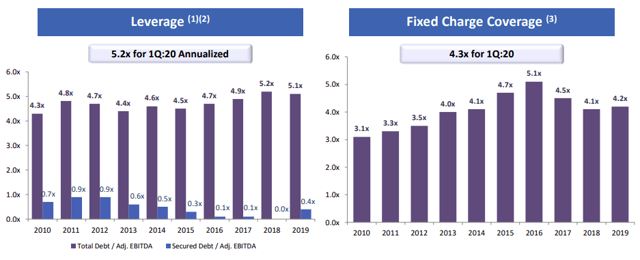

Omega's leverage stands at a reasonable 5.2x Debt to Ebitda, and a 4.3x FCCR with no near term bond maturities. It also sits with a comfortable buffer on its key bond covenants.

Source: Q1'20 Investor Presentation

Patient Driven Payment Model

Lastly, I believe the new Patient Driven Payment Model (PDPM), which replaces the Resource Utilization Group (RUG) model, will help drive Operator profitability. As opposed to the RUG model which incents Operators based on number of therapy minutes provided, PDPM categorizes patients into five categories and incentivizes the appropriate treatment based on the patient category.

While the impact is yet to be seen as Q1 performance is masked by COVID-19, I believe PDPM will strengthen Operator profitability as it reduces unnecessary higher cost activities while also reducing the risk of government audits due to operator over-billing. The intent is to align cost management with improved patient wellness and healing times, which I believe in turn improves the operating model and overall profitability for skilled nursing businesses. This is certainly something to watch for as COVID-19 eases.

Key Risks

A sustained or growth in the level of COVID-19 infection rate is a key hurdle for Omega and its operators. This could cause patients to further defer elective surgeries, which is a source of residents for their properties, and a growth in infection rates at the facility level could further stress their tenants' already stretched resources. I do believe Omega is well-equipped to deal with the latter from financial liquidity standpoint, and from an Operator standpoint as risk mitigation measures such as new patient quarantine and dedicated wings for COVID-19 infections are put in place.

Longer term, Operator rent coverage and the government pay model will always be a concern. However, this is the nature of the business and Omega's management team has put in place risk mitigation cross provisions such as master leases and security deposits to manage this risk. I'm impressed by how quickly the management team was able to replace troubled Operators last year, and get the company back on firm footing. In addition, I believe the new Patient Driven Payment Model will help drive operator profitability through a reduction in non-patient value added activities.

Summary

Omega has been a solid performing stock with a strong track record of increasing dividends. Its properties provide mission critical services that I don't anticipate will go away now or in the future. If anything, their properties will be in much higher demand in the coming decade as evidenced by the expected increase in the 75-87 year old demographic. In addition, I believe the company has the financial resources to weather the COVID-19 crisis and the tenant rent coverage metrics are encouraging.

I believe the stock is currently undervalued at $30.71 as of writing with a 10.3 forward P/FFO, and I assign a price target of $36 based on a forward P/FFO of 12, which is more in line with historical norms for the company and takes into consideration the inherent risks in the business model.

Disclosure: I am/we are long OHI. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.