Earnings: What Canadian Banks Are Telling Us And Which One Is My Favorite

by The Dividend GuySummary

- All Canadian Banks reported their earnings during the week of May 25 th.

- They all revealed massive earnings decreases due to higher provisions for credit losses.

- One of the Big 6 Canadian Banks is likely to outperform the others.

The week of May 25 th has been marked on my calendar for a while. During that week, all the Canadian banks went in line to do their quarterly oral presentations. Since they reported later than the U.S. banks, we were able to get a clear picture of the impact of the covid-19 pandemic on the economy and on the banks specifically.

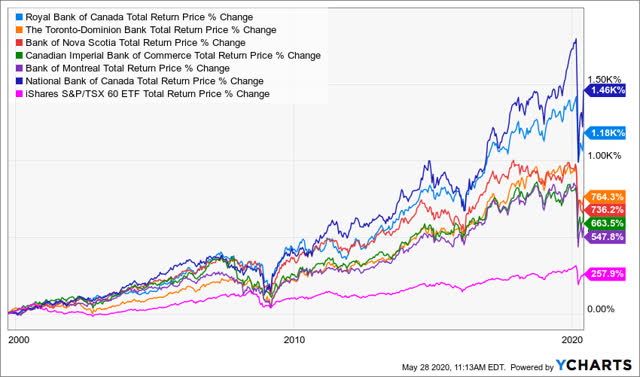

Canadian banks are not only at the center of the Canadian economy, but they figure to be among the most reliable dividend payers in the world of banking. In fact, they have been outperforming the TSX 60 handily over the past 30 years.

Source: Ycharts

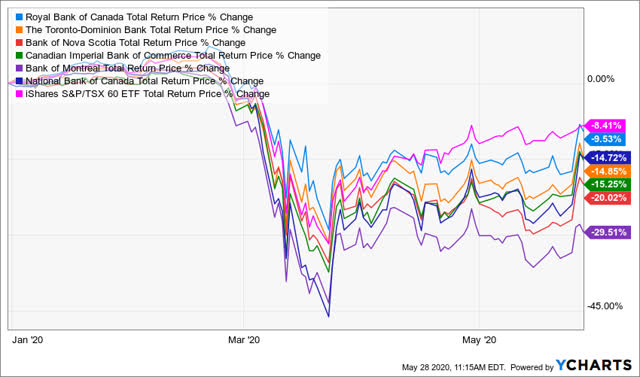

However, the story has changed since the beginning of this year. This has created a great opportunity for those of you looking for a solid company combined with a steady and growing dividend.

Source: Ycharts

All dollar amounts reported in this article are CAD.

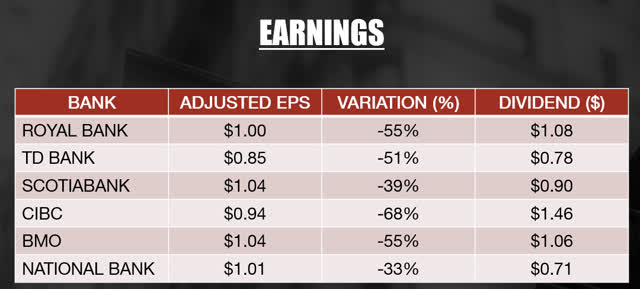

Banks earnings are a disaster

To put it simply, the Canadian Banks’ earnings were a disaster this quarter. By looking at their adjusted EPS, I noticed the average earnings drop was 50%!

Source: author’s table, Canadian banks quarterly statements

Out of the big 6, half of them beat both EPS and revenue growth expectations (Scotia (BNS), CIBC (CM) and National Bank (OTCPK:NTIOF)). One might easily assume these results set the table for a “gloom and doom” story for the Canadian banking industry.

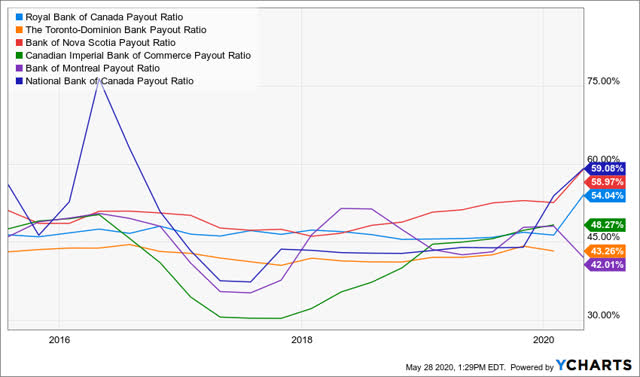

EPS dropped so far that Royal Bank (RY), CIBC and BMO (BMO) even showed a payout ratio over 100% for this quarter. Do you think their dividends are at risk? Not at all. The reason why earnings were so bad is because all the banks posted higher provisions for credit losses.

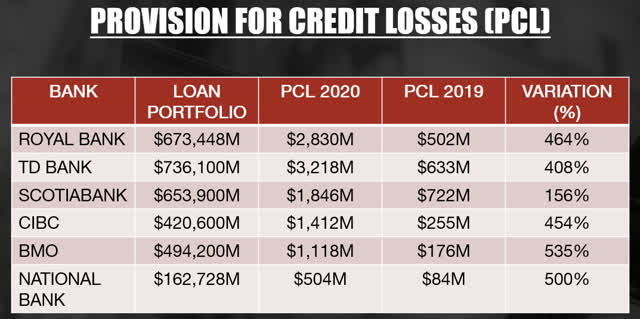

Provisions for credit losses are through the roof!

A quick recap for those who are unfamiliar with banks and their balance sheet. Banks love to lend money to consumers and businesses as they make interest revenues from this activity. Since we don’t want banks to stop operating in our economy (it’s like having your heart stop pumping blood), we ask them to review their loan portfolio quarterly. They then assess the likelihood of getting paid back on all their loans. When a loan is late or they think it will eventually go into default, they move that amount of money into their provision for credit losses (PCL). The PCL has a direct impact on earnings.

Source: author’s table, Canadian banks quarterly statements

As one can easily see, all the banks besides Scotia have increased their PCL by 400% to 500% compared to last year’s same quarter. I’ve also displayed their total loan portfolio to give you an idea of the proportion of bad loans for each bank.

The PCL is a number calculated based on generally accepted accounting principles. It is not real cash that is immediately lost. For years, banks have been increasing or decreasing that number according to their current assumptions. In fact, this is one of the reasons why Steve Eisman (aka The Big Short) was shorting Canadian banks in 2019, as he assumed the Canadian bankers were too generous in their assumptions. I guess he is smiling right now!

What does this tell us? Is that bad?

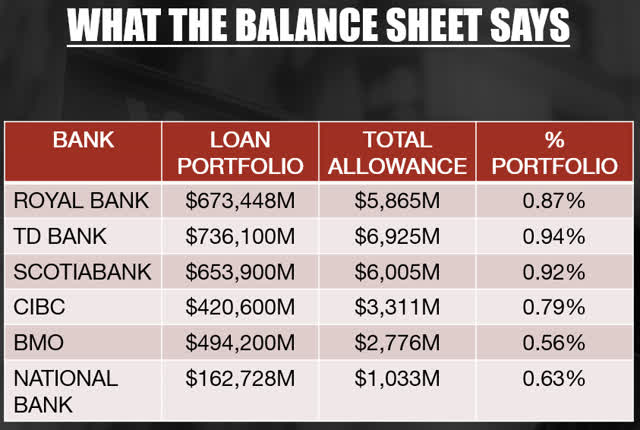

When you look at the PLC variation, you may have held your breath for a second. We are talking of 5x for two banks and 4x for 3 others. Speaking of which, you may wonder why ScotiaBank showed such a low variation. That is because they already had a larger allowance for credit losses on their balance sheet.

Source: author’s table, Canadian banks quarterly statements

The different between both charts is that the PCL for the quarter reduces the bank’s current earnings while the total allowance for credit losses is the total shown on the bank’s balance sheet (only the PCL fluctuation will hurt earnings).

The second chart tells us two things:

#1 BMO and National Bank are confident (overconfident?) regarding the quality of their loan portfolio.

#2 All banks believe that the covid-19 won’t be the end of the world (less than 1% of their loan portfolios are at risk).

Unless we have another wave of economic lockdowns this fall, the Canadian economy will remain resilient.

So, what about the dividends?

Many investors may be worried about their precious dividends. What if the banks decided to cut their dividends? While half of the banks show a quarterly payout ratio over 100% for the current quarter, it is a different story when you look at the total trailing twelve months:

Source: Ycharts

You can sleep well at night, unless the banks add another billion or two in PCL in the coming quarters, the dividends are sound and safe. I don’t expect any dividend increases for the rest of the year as banks are usually quite conservative (therefore, we love them).

My favorite bank right now

When people ask me, which is my favorite bank, I usually answer National Bank. I like their CEO since I worked for the guy (and he quoted Star Trek during his conference call!), I like their diversification across wealth management, capital markets and the international banking segments along with their agility (it helps to be the smallest of the big 6!).

But considering that National Bank is based in Quebec and the virus has hit that province more than any others, I’d go for my “usual second choice”: Royal Bank. RY is my favorite bank post-covid for the following reasons:

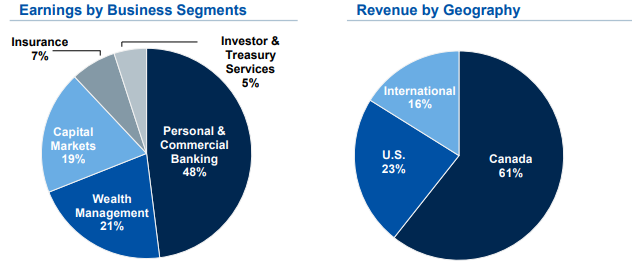

#1 Business diversification

Source: Q2 2020 investors presentation

I like that RY doesn’t only depend on their classic savings and loans activities to grow. Royal Bank is currently the largest bank in terms of market capitalization and by assets under management (very close to TD). It’s exposure to wealth management and capital markets (they recently struck a deal in the ETF world with BlackRock (BLK)) will generate higher earnings going forward.

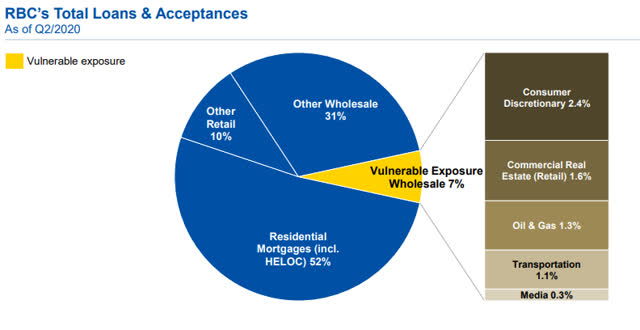

#2 Manageable exposure to the covid-19 economic meltdown

When you dig further into each bank’s earnings presentation, you will find their loans vulnerable exposure to COVID-19 impact. While Royal Bank isn’t the least exposed with 7% of their total loan portfolio shown as vulnerable, their situation is definitely manageable.

Source: Q2 2020 investors presentation

Let’s not imagine that all retail or oil & gas companies will go bankrupt either. The bank currently shows the strongest Common Equity Tier 1 (CET1) ratio of its industry at 11.7% (lowest being BNS at 10.9%).

#3 Strong dividend discount model valuation

I’m not the biggest fan of basing my decision on a valuation model as my calculations are only as good as my assumptions (and you know what they say about assumptions!). But let’s run super conservative numbers just for fun. I’ve used the dividend discount model since many investors will look at the banks to boost their retirement income. Considering RY as a money printing machine seems fair.

| Input Descriptions for 15-Cell Matrix | INPUTS | |||

| Enter Recent Annual Dividend Payment: | $4.32 | |||

| Enter Expected Dividend Growth Rate Years 1-10: | 3.00% | |||

| Enter Expected Terminal Dividend Growth Rate: | 6.00% | |||

| Enter Discount Rate: | 9.00% | |||

| Discount Rate (Horizontal) | ||||

| Margin of Safety | 8.00% | 9.00% | 10.00% | |

| 20% Premium | $211.35 | $142.45 | $107.94 | |

| 10% Premium | $193.73 | $130.58 | $98.94 | |

| Intrinsic Value | $176.12 | $118.71 | $89.95 | |

| 10% Discount | $158.51 | $106.84 | $80.95 | |

| 20% Discount | $140.90 | $94.97 | $71.96 | |

Please read the Dividend Discount Model limitations to fully understand my calculations.

While I consider a small 3% dividend growth rate (annualized dividend growth rate over the past 5 and 10 years are 6.96% and 8.01% respectively), I can find a fair value at $120 (NYSEARCA:CAD). This means that if I buy RY today, I have a margin of safety of 20%.

Final Thought

This was certainly not the quarter all the banks’ CEO’s expected when they started the year back in January. However, we see how strong Canadian banks are and that you should probably consider them for your portfolio. Once again, they have each proven to be a part of one of the strongest banking systems in the world.

Please note that Americans investors can buy the big 5 (RY, TD, BNS, CM and BNS) on the NYSE. Their dividend payment will be subject to currency fluctuation and potential taxes (there is a tax treaty between both countries for retirement accounts so please verify with your broker).

Many investors focus on dividend yield or dividend history. I respectfully think they’re making a mistake. While both metrics are important, aiming at companies that have and show the ability to continue raising their dividend by high single-digit to double-digit numbers will make your portfolio outperform others. When a company pushes its dividend so fast, it’s because it is also growing their revenues and earnings. Isn’t this the fundamental of investing – finding strong companies that will grow? If you are looking for a great combination of dividend and growth, check out Dividend Growth Rocks.

Disclosure: I am/we are long BLK, RY, NTIOF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclosure: I do not hold shares of RY, BLK and NTIOF in my DividendStocksRock portfolios.

Additional disclosure: The opinions and the strategies of the author are not intended to ever be a recommendation to buy or sell a security. The strategy the author uses has worked for him and it is for you to decide if it could benefit your financial future. Please remember to do your own research and know your risk tolerance.