Accenture: An Attractive Long-Term Investment Opportunity

by Ash AndersonSummary

- Accenture is nearing 52-week highs, but there's still a little room to run until fair value.

- IT Spending is forecast to be on the rise in 2021, and COVID-19 will only accelerate that as digital transformations speed up.

- It's boring, but it's consistent. That's why I'm buying Accenture for my personal portfolio.

While big-name technology companies are already pushing to new 52-week highs, one name still has some space ahead of it. Accenture (ACN), the world's top consultancy firm, stands to benefit from an increase in technology spending, the corporate migration to the cloud, and the soaring remote work landscape.

Image: Accenture Logo

I want to dig into this 'A+' rated Hideaway stock to see if new 52-week highs are in its future.

An Accenture Overview

Accenture is a technology consulting firm with five distinct sectors, each serving companies that operate in those segments: Communications, Media & Technology, Financial Services, Health & Public Service, Products, and Resources.

Across all segments, Accenture consults firms on moves to the cloud, outsourcing, and working with other large-scale providers, like Salesforce (CRM). In an ever-changing technological world, Accenture's services are generally always required; else, a firm would have to hire specialized staff.

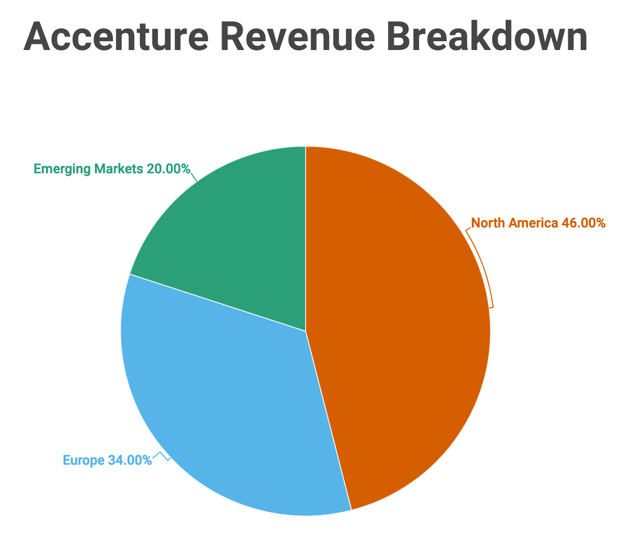

Image: Accenture 2019 revenue breakdown by geography

More than three-quarters of the Fortune 500 can be called Accenture clients. Having this many clients across almost every quantifiable industry allows Accenture to see where the tech marketplace is going, thus allowing Accenture to help all customers get there.

Today, 56% of Accenture's revenues are from consulting services, while the remaining 44% comes from outsourcing. The company is geographically diverse, with 46% of last year's revenues coming from North America, and 34% coming from Europe.

A History Of Growth

Accenture has a history of consistent growth. The company attains this growth by being the largest and most trusted consulting firm in the market. Over time, it has built this position by hiring talented consultants and acquiring firms with specializations in the direction the market is heading.

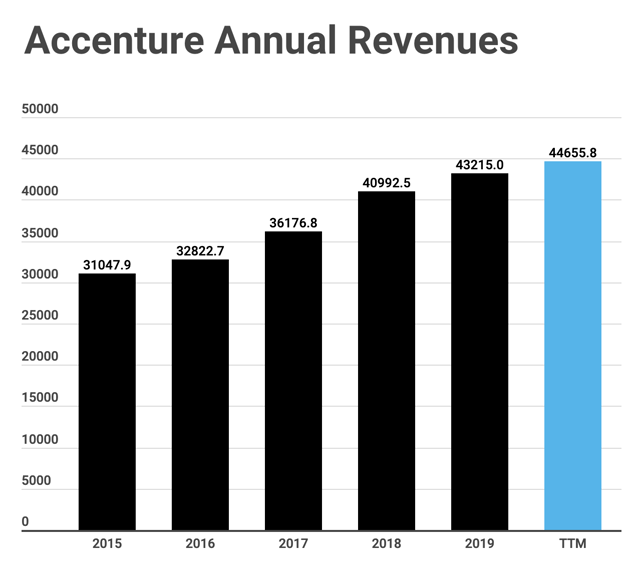

Image: Accenture's Annual Revenues

Over the last five years, Accenture's revenues grew 39.2% to $43.215B in 2019. This is a CAGR of 6.84% over that period. It's not phenomenal, but it's admirable from a $100B+ services firm that relies heavily on employees (i.e., not a SaaS).

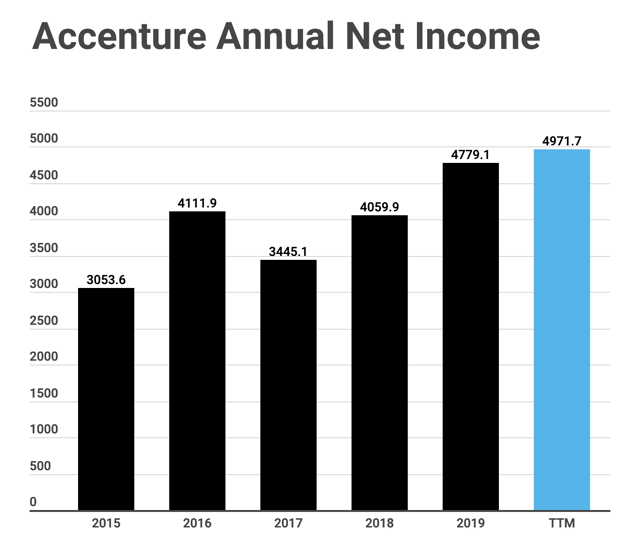

Image: Accenture's Annual Net Income

Net margins have been quite stable over the same period allowing Accenture to grow net income from $3.05B in 2015 to $4.78B in 2019. That's 57% growth, or 9.45% CAGR. Over the trailing twelve months, net income is up further, and closing in on the $5B mark.

Despite the pandemic and ensuing macro conditions, analysts do still have a positive outlook on the company for this year. Top-line growth is seen to grow conservatively, at 5%, while the bottom line will grow by roughly the same amount.

Growing IT Spending

Going forward into 2021 and beyond, I think the outlook becomes even more bullish than the 6.8% top-line growth we have seen over the last five years thanks, in part, to an increase in IT spending.

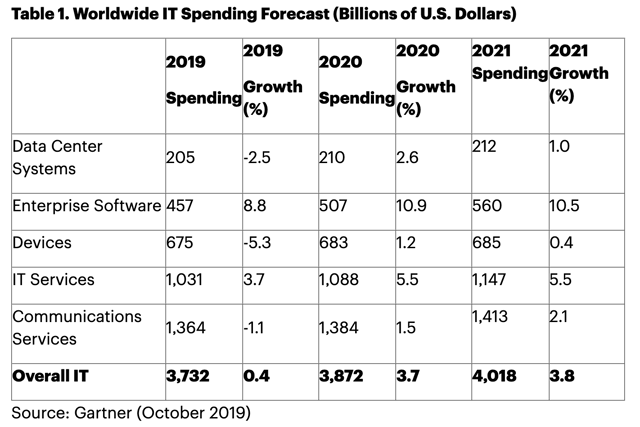

Image: Gartner's expected IT Spending for 20/21 (Pre-COVID-19)

Let's assume, just for a minute, that COVID-19 did not reveal its ugly head. When we were still in that pre-COVID-19 world, Gartner's research indicated that 2020 IT spending would grow 3.7% to $3.87T. The firm also expected that 2021 growth would accelerate a little further (by 3.8%) to $4.02T.

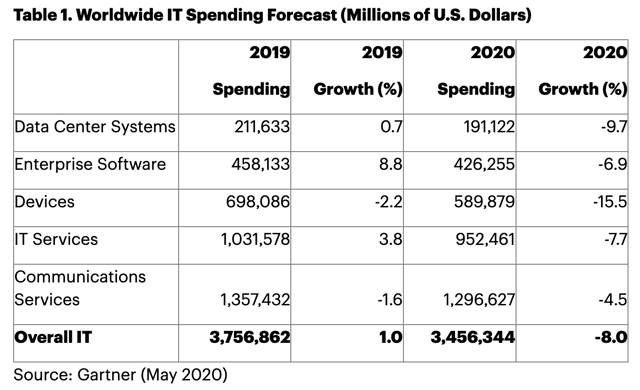

Image: Gartner's expected IT Spending for '20

Of course, we don't live in that world, which is why Gartner recently wrote about a potential 8% slowdown in spending for this calendar year. Even if that is the case, I don't think this is a negative for Accenture. It's quite the opposite.

Accenture helps the brightest and best companies with their IT needs. If those companies are still spending, Accenture and its employees are still the ones helping. If we do see a slowdown this year, you can bet we will grow back faster next year. Tech isn't going away, the cloud is here to stay, and Accenture has the expertise to lead the way.

Another potential tailwind is outsourcing. Accenture leads the way in IT outsourcing, and what the pandemic has shown many is that companies should not keep all their eggs in one basket (or in this case city). Again, Gartner's research shows that outsourcing will continue to grow, and those outsourcing budgets will get larger.

Recent Acquisitions Accretive

One of the reasons that Accenture has been able to sit atop the tech consulting landscape is its acquisition strategy. In 2019 alone, Accenture acquired 33 businesses. The goal with the acquisitions, primarily, is to gain expertise in a segment that the overall company sees as necessary to future growth.

Image: Symantec logo

Accenture's most recent deal (of significant scale) was for Broadcom's (AVGO) Symantec Cyber Security Services business. This deal enhances Accenture's security offerings at a time when we're rapidly changing the workplace (office to remote).

Many recent deals Accenture has completed have chosen to focus on security, a market that is expected to see significant growth going forward. According to Allied Market Research, the cybersecurity market will grow at 11.9% CAGR to reach $258.99B by 2025.

I'm a little bit more bullish on that number. I think that as we continue to transition from large offices to home offices, more work will need to be done to ensure businesses are secure. Potential investors should see Accenture's deeper moves into cybersecurity as a big positive.

However, it should be noted that acquiring a large number of companies over a short period can also pose significant risks. Frequent acquisitions are a distraction, and if improperly integrated, those distractions could grow.

Risks: Remote Work and Low Barriers To Entry

Consulting is labor-intensive, and consultants command high salaries. With tech firms (like Twitter (TWTR) and Shopify (SHOP)) recently announcing new remote policies, Accenture may find it has to pay more for top talent that could now work from home.

To be able to retain top talent, Accenture may have to pay consultants more or modify a consultant's day-to-day work-life. Both of those options would, no doubt, be a hit to margins.

Consulting also carries a low barrier to entry. A one-person shop could, if positioned correctly, come in and do the work of Accenture consultants for a fraction of the price. Unlikely, yes, especially when it comes to Fortune 500 firms. It's not quite as unlikely for other big consulting names to swoop up contracts, however. Names like Hitachi Consulting, Pariveda Solutions, or even Deloitte could compete with Accenture on a purely consulting level.

Accenture keeps that competition at bay through the acquisitions mentioned above. In tech consulting, firms have to move forward and fast. Accenture has been moving forward at a faster pace than the rest of the industry. This faster pace has rewarded investors with many years of compounding growth.

The risks above would present a significant challenge to Accenture. However, I think this company has demonstrated its adaptability and agility in moving forward with technology. I believe the firm will continue to buck the trend while leading enterprise tech forward.

Valuation

At the time of writing, Accenture is trading for roughly 8% off its all-time high. The company has gained some 40% since its March lows. As investors, our job is not to dwell on what could have been (getting in at the March lows) but assessing if there's still an opportunity to invest today. With Accenture, I believe there is, but I think that gap is getting quite narrow at current prices.

Accenture is an incredibly stable firm that pays a growing dividend (9 years of growth). This is a buy-and-forget type of purchase thanks to that stability and the expected continuing growth of the tech industry. For those reasons, my DCF assumes a discount rate of 8.5%, and I have assumed that Accenture can also grow its earnings at that rate (8.5%) over the next five years.

An 8.5% growth in earnings over the next five years will be a bit of a dropdown from the last five years, where the firm grew at 9.45% CAGR. After five years, my assumption is 4% growth in perpetuity. This gives us a fair value of $206.90, a price that I am willing to continue adding to my Accenture position below.

Hideaway Scores

Accenture has an 'A+' rating when it comes to Quality. It was one of the factors that first got me looking at this firm.

'A+' rated Quality firms have led the market's recoveries from market lows. Over the last two weeks, while the S&P 500 has returned 7.6%, 'A+' rated companies have returned 12.1%.

Here's the complete score rundown:

| Price Grade | Quality Grade | ST Momentum Grade | LT Momentum Grade | Composite Grade |

| D | A+ | B | B | A+ |

Accenture also performs well on other quantitative measures that are available with a High-Quality Hideaway membership:

| Piotroski Score | Ohlson O-Score | Altman Z-Score |

| 7 | 0.060427 | 6.662422 |

High-Quality Hideaway is my new Seeking Alpha marketplace launching June 1st. As a subscriber, you will receive unfettered access to the Hideaway Scores for more than 4,000 actively traded companies. Highly rated Hideaway firms beat the market as a whole and help you rest easy at night, knowing your investments are well-positioned.

Also, you'll get a more in-depth analysis of quality firms and access to more quantitative measures than you can shake a stick at (Piotroski, Altman, Ohlson, Beneish, and more as I add them).

If you'd like to learn more about the Hideaway Score, see this blog post.

Conclusion

Accenture is an often-forgotten name in the tech space. Sure, it doesn't have explosive growth, and it doesn't have those hefty software margins, but it is a great business.

I will continue to be a buyer of this company under $206.90 a share. I expect we will continue to see the dividend growing and earnings compounding into the future on the back of significant growth in the wider technology space.

Disclosure: I am/we are long ACN. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.