COVID-19 (Coronavirus) Plays To Benefit As Economies Reopen

by Matt BohlsenSummary

- Countries all over the world are now reopening their economies, a brief review.

- Country by country update on coronavirus statistics.

- Country ETFs, sector ETFs, and stocks to consider investing into as economies reopen.

This article first appeared on Trend Investing on May 15, 2020: therefore all data is as of this date.

Following on from my 'coronavirus beaten down stocks/funds series' this article serves as a summary of 'well-valued beaten down' countries, sectors and stocks that stand to benefit most as countries reopen their economies. The timing appears about right as countries all over the world are now reopening their economies. Opening up of limited overseas travel has also begun.

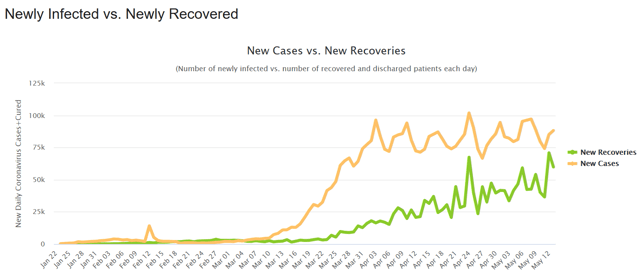

We may soon reach the cross-over point where more people are recovering each day from COVID-19 than new cases per day. The chart below shows we look to be near that crucial cross-over point.

Global new recoveries per day (green) may soon exceed new cases per day (orange)

A brief review of countries who have already reopened or who are reopening their economies now

- China - China was the first to reopen, and has now reopened its economy.

- South Korea

- Iran

- European countries - Germany, Austria, Denmark, Norway, Switzerland, Poland, Albania, the Czech Republic, and others. Note Sweden never went through lockdown and so remained open.

- UK, Canada, Australia and New Zealand

- USA - Some states. Trump has recommended States begin to reopen, releasing guidelines on how that may happen; however the decisions will be taken by each state Governors on a local basis.

- Most of Asia has reopened or plans to open soon.

Country by country update on coronavirus statistics

Before investing into any country funds it would be wise to see how they are doing in terms of coronavirus cases. The link is here, then click on the individual country to see their daily new cases graph.

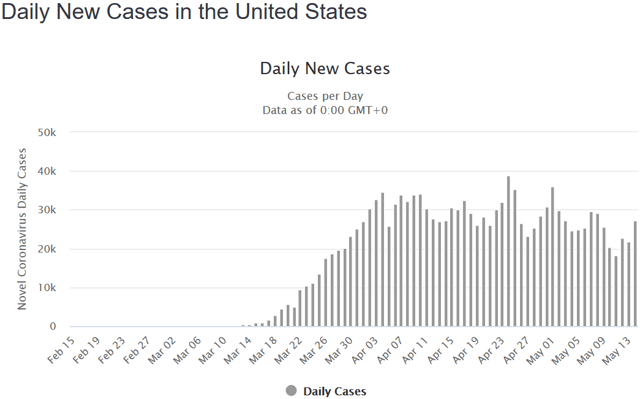

US daily new cases of coronavirus have started to slowly decline

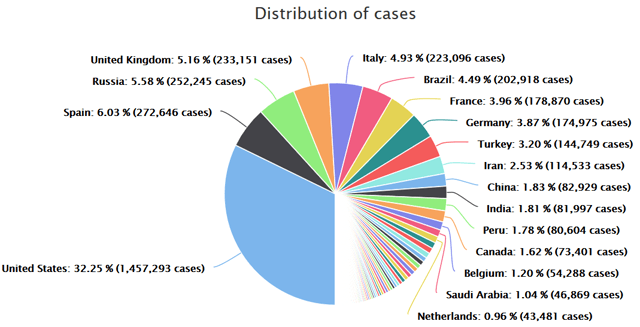

Total 'reported' coronavirus cases by country

Country ETFs to consider investing into as economies reopen

As countries reopen, oil and export oriented countries will do well, helped by increased global activity. In time tourism based countries will also recover.

Five well valued country funds that should recover as their economies (and global economies) reopen.

iShares Canada (EWC) - Price = USD 23.65

Canada is mostly a services economy (70% of GDP), but exports (30% of GDP) are still the country's backbone, notably energy and mining. Canada will benefit from higher oil and metal prices, and in time tourism.

The current PE is 11.76 and the dividend yield is 2.67%.

iShares South Korea (EWY) - Price = USD 50.86

South Korea is a modern tech economy, led by exports of electronics and cars. Exports account for more than 50% of GDP. South Korea is a member of the G20. We saw in April a recovery in China smartphone shipments up 17% YoY, this bodes well for South Korea. Global car sales are still badly down but should recover as economies reopen.

The current PE is 12.43 and the dividend yield is 1.37%.

iShares MSCI Australia (EWA) - Price = USD 16.52

Note: For Australian investors the iShares S&P/ASX 200 ETF [ASX:IOZ] (Price = AUD 22.04) is in AUD, so may be more suitable.

Australia's most important sector by far is mining and it is bringing in record revenues in financial year 2020. Tourism and overseas student education has been severely impacted. Australia should recover as its economy reopens, provided relations with China and key trading partners remain strong. There is some current tension with China.

The current PE is 14.58 and the dividend yield is 4.77%.

iShares MSCI Germany (EWG) - Price = USD 22.53

Germany is the power house of Europe, the world's 4th largest economy, & the world's 3rd larger exporter and importer of goods. Motor vehicles, trailers & machinery are key exports.

The current PE is 11.54 and the dividend yield is 2.38%.

iShares MSCI Russia (ERUS) - Price = USD 31.38

Russia is an export driven economy led by oil and gas, metals and timber. As oil price recovers the ERUS ETF should also recover.

Note: Russia is still struggling with coronavirus as you can see the chart here.

The current PE is 5.98 and the dividend yield is 6.62%.

Russia

Sector ETFs to consider investing into as economies reopen

MicroSectors US Big Oil Index 3X Leveraged ETN (NRGU) - Price = USD 3.47 (WTI oil price = USD 27.47)

The oil sector should start to recover as the global COVID-19 lockdowns start to be eased and oil demand picks up. Traders may want to consider a long US oil 3x leveraged play. The MicroSectors U.S. Big Oil Index 3X Leveraged ETN has been set-up for investors who want to go long (are bullish) on the collective of ten equally weighted US oil miners in the Index basket, with a 3x leverage. NRGU offers an exciting high risk/high reward product. The upside may be a multi-bagger, and the downside may be 100% capital loss. Suitable for sophisticated investors only, noting the fund uses leverage and derivatives.

US Global Jets ETF (JETS) - Price = USD 12.15

The airline industry has been smashed due to COVID-19. Most airlines are just surviving with limited flights. Government support is helping. The US Global Jets ETF is mostly a recovery play on the US airlines sector, also with some global exposure.

The current PE is quoted by USGlobalETFs as 6.98 and the dividend yield is 3.22%.

Note: The sector will likely report negative earnings in 2020, sending the PE to negative. ETF.com already shows JETS PE as -1.85.

iShares Global REIT (REET) - Price = USD 18.46

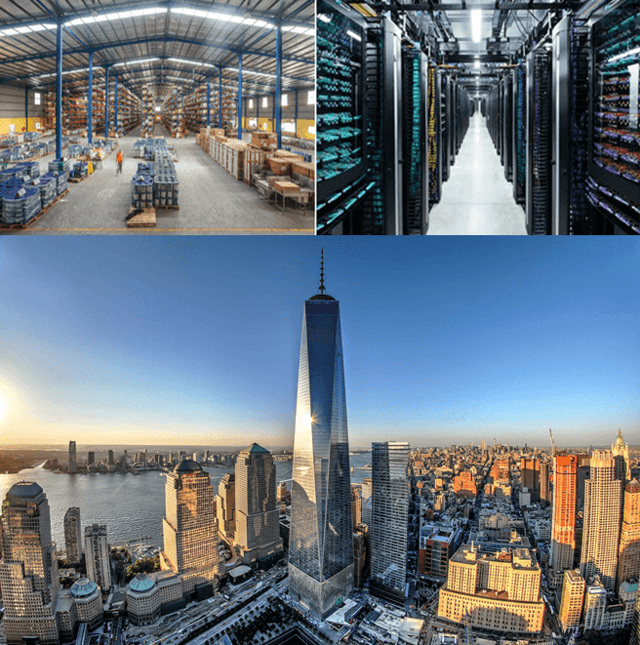

The global property industry has been impacted by COVID-19 with vacancies and downward pressure on rents. The iShares Global REIT ETF is partly a recovery play as shops and offices reopen, notably in the USA. The REET fund is very well diversified across the property sectors (including residential, industrial, retail, offices, specialized (logistics, data centers), and health care; however there is a strong US country weighting at ~65%.

The current P/CF is 12.18 and the dividend yield is 7.09%.

Note: For comparison purposes, the current US PE is 19.52, and global PE is 19.52. I think the similarity is due to the fact that the iShares global index is now dominated by US stocks representing a 70.45% weighting.

The REET fund has exposure to companies that own logistics and data centers, as well as office buildings, shopping centers, residential etc

Stocks to consider investing into as economies reopen

Carnival Corporation (CCL) - Price = USD 12.27

Carnival Corporation is the world's leading cruise line company with a majority market share; however the industry has been crippled in 2020 by the coronavirus and is currently effectively shutdown. Risks are high but so are the rewards if Carnival can get back cruising by H2 2020 or H1 2021.

2020 PE is estimated at -3.67, and 2021 PE at 19.4. Analyst's consensus is a 'hold' with a price target of USD 21.23, representing 73% upside.

Commonwealth Bank Of Australia [ASX:CBA] (OTCPK:CMWAY) - Price = AUD 58.90

CBA is Australia's leading retail bank. The bank will be mildly impacted in the short-term by the coronavirus and lower Australian interest rates, putting near term pressure on margins. Government and banks support should keep defaults under control. The economy is now reopening which should help businesses and in time the bank, especially down the track when they can recoup some lost net interest margin.

2020 PE is estimated at 12.5, and 2021 PE at 14.1. The current dividend yield is 5.29%, but this will drop if the bank cuts back its dividend. Analyst's consensus is a 'hold' with a price target of AUD 62.38, representing 6% upside.

Wells Fargo & Company (WFC) - Price = USD 24.92

WFC is a leading US retail bank. The bank has been impacted in the short-term by the coronavirus and lower US interest rates, putting near term pressure on margins. As the economy reopens and businesses and consumers recover, interest rates will rise, and the bank will likely recoup some lost margins.

2020 PE is estimated at 21.2, and 2021 PE at 9.0. The current dividend yield is 8.4%, but this will drop if the bank cuts back its dividend. Analyst's consensus is a 'hold' with a price target of USD 31.31, representing 30% upside.

Note: Another good option would be the iShares U.S. Financials ETF (IYF) (Price = USD 99.66). All the US banks are currently very cheap due to lower margins and the risk of higher bad loans. A swift recovery would see the whole banking index recover well.

Risks

- COVID-19 may get worse or we may get a severe second wave that forces countries back into lockdown.

- Distributions/dividends are likely to be reduced or cut in those sectors/stocks impacted heavily by COVID-19.

- Bankruptcy and liquidity risk - Airlines and cruise companies are burning cash with minimal revenues until we get a recovery of travel.

- Negative interest rates could hurt the financial sector if it occurs.

- Timing risk. When will economies recover?

- Management and currency risk.

- Stock market risks - Liquidity, premium or discount to net asset value [NAV], sentiment.

Further reading

- High Frequency Data Show A Strong Rebound

- Asia Is Slowly Beginning to Reopen Travel. Here’s What the World Could Learn

- COVID-19: this is how Asia-Pacific is emerging from lockdown

- EU could reopen borders to tourists in Covid-19 recovery plan

- US coronavirus death toll passes 80,000 as states move to phased reopening

- The iShares Global Healthcare ETF Buys Some Insurance In Case The Global Coronavirus Gets Much Worse

- The Iron Ore Miners BHP Group & Vale Look To Be Good Buys After Recent Falls

- The EV Metals Miners Are The Cheapest They Have Been Since 2015/16

- Coronavirus Beaten Down Stocks To Add To Your Watchlist

A Carnival Corporation cruise ship at night

Conclusion

The purpose of this article is to give a brief summary of countries, sectors, and stocks that have potential to recover strongly once economies open up. There are many other potential recovery plays right now, so feel free to suggest some in the comments section below.

The flip side is if we go back into lockdowns then these stocks will do poorly. If you are inclined to think COVID-19 will still get a lot worse then my past article 'Some Possible Winners From The Coronavirus Crisis' will give you some more ideas.

Risk is a lot higher with some of the stocks and sectors I covered in this article due to the severe negative impact on certain sectors such as oil, tourism & travel (especially cruises & airlines), property (especially shopping centers, hotels), and banking. There is also the risk of COVID-19 related setbacks such as going back into lockdown. Investors should invest accordingly showing some caution.

It looks like much of the world is now reopening and those sectors hit the hardest have potential to recover the strongest. The current bad news is already priced in making valuations very attractive.

As usual all comments are welcome.

Trend Investing

Thanks for reading the article. If you want to sign up for Trend Investing for my best investing ideas, latest trends, exclusive CEO interviews, chat room access to me, and to other sophisticated investors. You can benefit from the work I've done, especially in the electric vehicle and EV metals sector. You can learn more by reading "The Trend Investing Difference", "Subscriber Feedback On Trend Investing", or sign up here.

Latest Trend Investing articles:

Disclosure: I am/we are long ISHARES MSCI AUSTRALIA [ASX:IOZ], JETS, REET, NRGU, [ASX:CBA], WFC, CCL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information in this article is general in nature and should not be relied upon as personal financial advice.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.