PayPal: Shares Lack Further Upside At The Current Valuation

by Nikolaos SismanisSummary

- PayPal has undergone an explosive rally in its share price.

- Future expectations are set too high. The current valuation does not justify the company's future potential earnings.

- PayPal remains a great company. I will stay away at this point and hope to buy on a potential pullback opportunity.

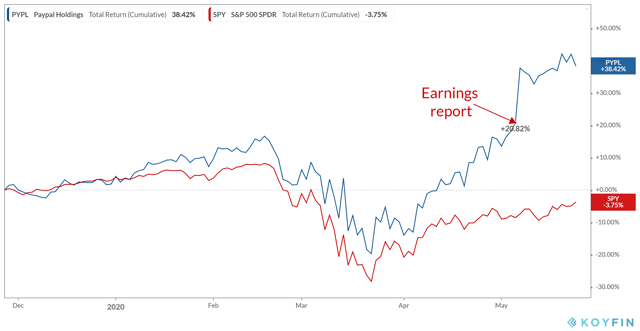

PayPal (NASDAQ:PYPL) shares are currently trading near all-time highs after an enormous rally over the past few months. Since its low point in March at around $82/share, PayPal has gained a little over 70%, currently changing hands at $141/share. The stock had already starting rebounding away from the S&P 500 in hope for an increased online transaction volume through Covid-19. Gains really took off, however, with the release of the company's earnings report.

In my view, the recent rally is unjustified. The current valuation amid PayPal's multiple expansion is not supported by the future expected growth, leaving no additional upside for the present stockholders.

In this article, I will:

- Discuss what has caused the explosive share price appreciation

- Explain why PayPal's current valuation is unreasonable

- Conclude why there is not any upside going forward at this price

Image by raphaelsilva

Examining the Take-Off

PayPal's recovery had already started well before the company reported earnings. In fact, shares were near all-time highs the day before the report. After the earnings release, shares took off to new highs, as CEO Dan Schulman characterized April as the company's strongest month ever. That is in terms of new active users and engagement.

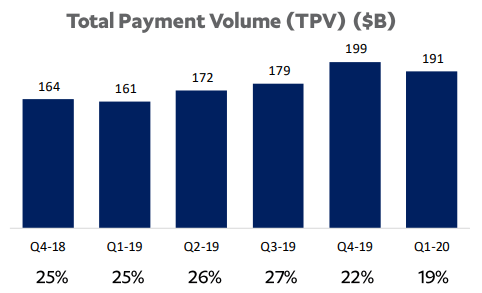

The total payment volume for the quarter was up a solid 19% YoY.

Source: Investor presentation

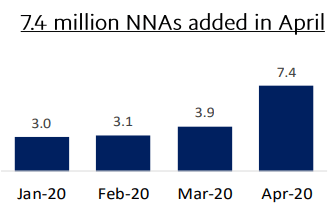

The exciting part, however, is in regards to April. The company revealed that its daily transaction volume grew by 25% within the month. Not YoY, but rather from the beginning of the month to the end of it. At the same time frame, the company added 7.4 million net new active users. This is almost more than double the additions it would normally achieve in previous, regular months.

Source: Investor presentation

The cherry on top was the CEO's statement on the earnings call. Mr. Schulman unveiled that on May 1st, the company had its biggest, highest single-day transaction volume ever. That applied to Venmo as well. Therefore, it was made clear that April's remarkable numbers were not the peak, and that growth is indeed rapidly continuing towards May as well.

A few days later, PayPal also started an offering of $4B of senior notes. Impressively, the company was able to issue 2050 notes at 3.25% or as little as 1.35% for its 2023 notes. With such low rates and the company's historical ability to achieve high ROI on its capital, the market has continued to push the stock higher over the past few days.

While these numbers are impressive and point towards a bright future for the company, I believe that shares have hit the ceiling and offer minimum upside going forward.

PayPal's Valuation - Beyond Reasonable

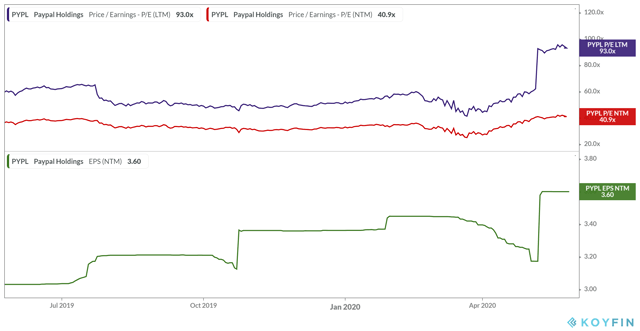

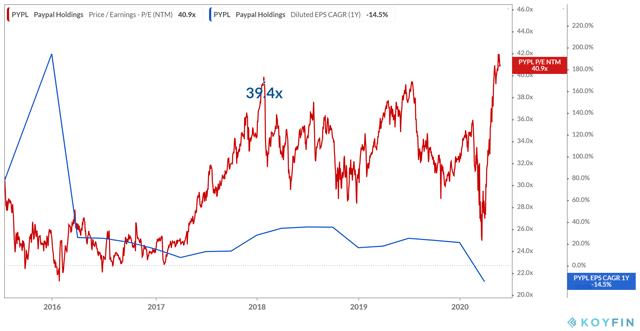

PayPal's valuation has massively deviated from its historical P/E ratios amid higher analyst expectations. With a surge in new active users, analysts estimate a new higher EPS of $3.60 for the next 12 months. Still, even if PayPal delivers on these expectations, the stock is currently trading at a forward P/E ratio of ~41, as the graph below illustrates.

The forward P/E of ~41 is the highest PayPal has ever seen. It implies that the current outlook in terms of PayPal's earnings growth is the most optimistic it has been since its IPO. The closest this figure has been to today was around 40 in early 2018. Over the next three quarters throughout 2018, PayPal grew its EPS 34.2%, 35.4%, and 35.2%, respectively. Therefore, it only makes sense that now the market expects an equally impressive, if not higher, EPS growth to justify this multiple again. In my view, there is not a case to justify these expectations. Suppose that PayPal actually meets the analyst expectations of EPS of $3.60 next year. Over the past 12 months, PayPal's EPS amounts to $1.60. Being generous, I will assume PayPal's 2019 EPS of $2.09 to exclude its previous less profitable quarter. Even from that figure, an EPS growth to $3.60 implies growth of ~72%. Again I have not included PayPal's recent less profitable quarter, as well. I can't see such EPS growth materializing. Even considering April's impressive transaction volume and net user additions, these expectations are just unreasonable.

An EPS CAGR of 30%-40% could be supported one way or the other. TPV for Q1 was $191B. Assume that March's TPV was a little over 1/3 of that at $65B. The company said that within April, daily transactions rose by 25%. Therefore April's TPV should be around $81.5B. This amount multiplied by three months comes out to $243B. However, let's assume some in-between growth as well, reaching $250B. That implies a 45% growth from Q2 of 2019. In any scenario, I can't see how an expected EPS growth of 72% could materialize.

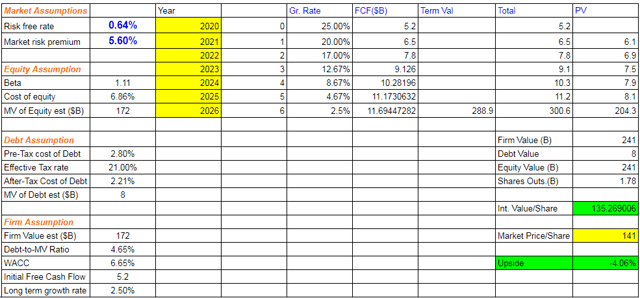

To confirm my concerns, I performed a discounted cash flow valuation model. In terms of the company's free-cash-flow growth, I assume an initial 25%, which gradually declines over time. I believe that this is prudent and that the 25% initial growth reflects the company's optimistic statements. Intrinsic value per share comes out $135, implying that PayPal is overvalued by around 4.4%.

Source: Author

Even if I were to use more optimistic estimates, however, the intrinsic value would not come out far from PayPal's current price. Therefore I don't see significant, if any, upside for investors to buy at ~$141/share.

Conclusion

PayPal is an amazing company, no doubt about it. It offers a resilient family of products that has definitely seen significant growth amid the "stay-at-home" economy. Until recently, the company offered investors attractive returns even though it was historically trading at a slight premium. However, the recently increased expectations have raised the bar way too high. Even if PayPal delivers, its share price is hard to justify. At best, PayPal has no further upside at this point.

I will stay away at this valuation and hope to add if a better opportunity presents itself, after a possible pullback.

If you liked this article, please consider following me here on Seeking Alpha. Your support is much appreciated.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.