Essential Properties: E-Commerce-Resistant Real Estate For The Long Term

by Cashflow CapitalistSummary

- Since EPRT focuses on service and experience tenants, it has been hit particularly hard by COVID-19, but it should also fare well in the e-commerce dominated world coming after COVID-19.

- Will the dividend be cut in Q2? I would argue that it doesn't matter to long-term investors. In fact, it might be beneficial in the long run.

- EPRT's balance sheet and liquidity remain very strong, and debt is low. The company went into this pandemic in a strong financial position.

- Shares yield 6.85%, and the dividend should continue to grow over the long term.

Investment Thesis

Essential Properties Realty Trust (EPRT) is a net lease real estate investment trust focused on service- and experience-based retail properties with relatively small footprints. These properties, averaging $2 million per unit, are very liquid (easily sellable) and highly re-leasable. Like net lease peers STORE Capital (STOR) and National Retail Properties (NNN), EPRT tends also to focus on middle-market, non-investment grade tenants, as these properties typically make for higher risk-adjusted returns than those occupied by large corporate tenants.

With only a little over 50% of rent collected for the months of April and May, investors may view EPRT as failing or struggling right now. Management does not view the situation that way. Indeed, in my own view, EPRT's short-term pain signifies their long-term gain. That is because the REIT has assembled a portfolio of highly liquid, re-leasable, e-commerce-resistant properties. As other retail REITs are forced to compete with online retailers in the coming years, EPRT will remain largely insulated from this struggle.

The selloff has rendered EPRT shares attractive for long-term dividend growth investors, even if the dividend is temporarily reduced this year.

The Company

EPRT owns 1,050 properties leased to 212 tenants across 43 states. The weighted average remaining lease term on its portfolio, as of the end of Q1, is 14.6 years — one of the longest WALTs of any net lease REIT. Given the relative newness of EPRT's buildings, it shouldn't be surprising that its portfolio is 99.5% occupied.

Since EPRT focuses on middle-market, non-investment grade tenants, it is imperative to identify and quantify the risk of each asset. One way of doing that is by collecting unit-level financial reporting (i.e. store sales numbers) in order to see how each location is performing. Almost all (98.3%) of EPRT's properties provide regular store sales reports. Rent coverage stood at 2.9x at the end of Q1. What's more, 60.1% of EPRT's portfolio operate under master leases, which puts the landlord at even more of a position of strength over the tenant in negotiations.

The beauty of triple net leases (which apply to 93.8% of EPRT's properties) is that the tenant is responsible for all property-level expenses such as taxes, insurance, and building maintenance. This allows the REIT to convert most of its rental revenue into profits and distributable cash flow. In Q1, EPRT's EBITDA ratio sat at 81.2%, while its AFFO margin came in at 64.1%. In other words, almost 2/3rds of revenue gets translated into distributable cash flow.

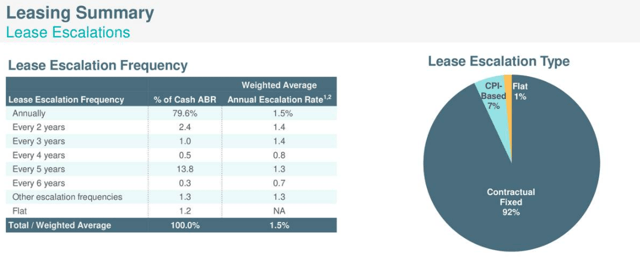

Another positive of triple net leases is that they almost always include contractual rent escalations. For EPRT, 99% of leases include rent escalations at a weighted average of 1.5% per year.

Source: Q1 2020 Presentation

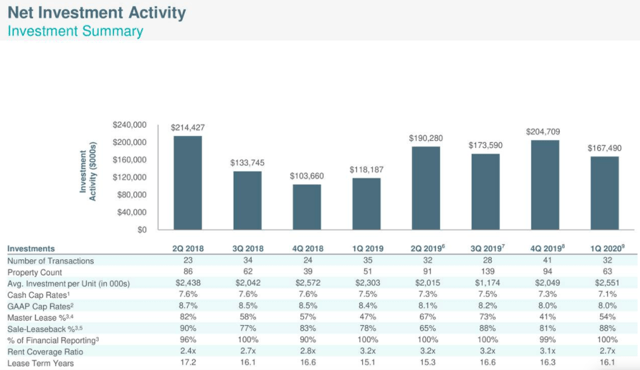

And with EPRT paying out less than 3/4ths of its AFFO in 2019, the company has actively invested in growth via acquisitions since going public in mid-2018:

Source: Q1 2020 Presentation

Notice that acquisitions fall in the range of 7.3% to 7.6%. And yet EPRT's weighted average cost of capital, up until the stock price drop, hovered around the low 4s. Earlier this year, management executed an equity raise above $25 per share, which translates into a cost of equity of 3.65%.

One huge advantage of unit-level financial reporting is the ability to detect those sites that are seeing eroding fundamentals. Notice that rent coverage for EPRT's acquisitions have been above 2.7x since Q3 2018. Compare that to rent coverage for dispositions, which has dropped from 1.8x in Q3 2018 down to 0.7x for the 10 properties sold (at a 3.2% gain) in Q1 2020. The ability to keep an eye on store sales gives EPRT the ability to sell underperforming locations. Keeping the best performing sites should lead to higher re-leasing and occupancy rates.

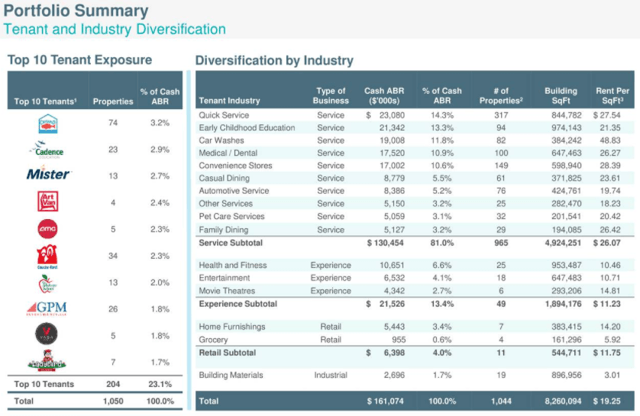

Perusing the REIT's top ten tenants, one may not have heard of most of the names. The largest tenant is seafood QSR Captain D's, which boasts hundreds of locations across the South and Midwest. Among the other top ten names are three early childhood education (pre-K) providers (Cadence, the Malvern School, and Ladybird Academy), two convenience store operators (Couche-Tard and GPM Investments), Mister carwash, Art Van furniture, AMC movie theaters, and Vasa Fitness (gyms).

Source: Q1 2020 Presentation

Interestingly, the degree to which EPRT's tenant base is weak in the face of COVID-19 (or, at least, the pandemic-related stay-at-home orders) is almost the same degree to which it is resilient against the ever-rising e-commerce trend. Take EPRT's top tenant industry — quick service (i.e. fast food). Even after years of operations, food delivery services have not yet found a way to become profitable. Thus, it's difficult to envision the core dine-in and drive-thru services of QSRs being disrupted anytime soon.

The same goes for private pre-K schools. It simply isn't economical for most families to hire private tutors. Likewise, no smartphone apps have yet been invented that will clean the exterior of your car and vacuum the interior. You see where I'm going with this. EPRT has intentionally built a portfolio that is designed to withstand the e-commerce megatrend.

Movie theaters, however, are one property type that I can envision slowly declining in the long-term. Some may remain for the long-term, but many other locations may not have enough business to justify remaining open. Movie studios may begin to release movies straight-to-streaming, and the existing plethora of streaming entertainment may continue to keep people watching at home rather than the theater. Management made a comment on the Q1 conference call indicating that their outlook for movie theaters has dimmed as well.

But aside from the possible exception of movie theaters, EPRT's short-term pain during this uniquely difficult period is also their long-term gain once the economy normalizes.

Q1 Update & The Burning Question On Everyone's Minds

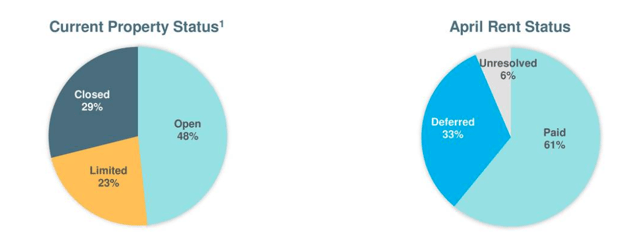

As of the Q1 conference call on May 10th, 71% of EPRT's portfolio by ABR was partially or fully open for business, compared to 66% on April 15th. Rent collected by that date in May came in at a disappointingly low 51%, compared to 53% on April 15th. Approximately 33% of April rent has been deferred, and that percentage will likely be slightly more for May and slightly less for June. According to COO Gregg Siebert, "The average deferral period is 3.1 months with an average payback period of 12.7 months."

Source: Q1 2020 Presentation

Management made clear on the Q1 conference call that they do not view higher rent collection percentages a sign of better asset management or shrewder leadership. They made it clear that they could have raised their rent collection by taking a harder stance with tenants that requested relief, but they chose not to. Rather, President and CEO Pete Mavoides stated:

We felt it was a more prudent business decision given the extreme nature of the circumstances to work constructively with our tenants with a longer-term view rather than a focus on short-term rent collections. Specifically, we believe our more accommodative stance has resulted in, one, tenants with a healthier liquidity position that are better able to maintain their workforce and invest in restarting their businesses when stay at home orders are lifted. Two, stronger long-term and differentiated relationships with our tenants, which should result in a more constructive relationship going forward. And three, a better position in the event that a tenant needs to file for bankruptcy as these rents now survive with the lease as a post petition obligation.

Despite this accommodative stance, Mavoides does not believe that EPRT's tenants, on the whole, are being opportunistic with their rent deferral requests. The few tenants with whom EPRT had not yet reached an agreement, as of the Q1 conference call, made up only a few percent of ABR.

What about the recently bankrupt furniture store, Art Van, which made up 2.5% of EPRT's rent at the end of 2019? Well, luckily, the bankruptcy wasn't a complete loss for EPRT. The week prior to the earnings release, EPRT signed a deal with a new operator for its four Art Van stores at 70% of its prior rent rate. This puts a mere 0.75% dent in EPRT's future total rent collection, but it will also lower the property sites' value significantly.

Net debt to annualized adjusted EBITDAre (EBITDA from real estate) stood at 4.6x on March 31st. At quarter end, total liquidity was $549 million ($214 million cash plus $335 million of available credit facility), compared to total assets of $2.4 billion. That implies liquidity amounting to 26% of gross investments or 3.4 times annual base rent. It's also four times the company's annual fixed cash costs, including dividends.

What's more, the balance sheet requires very little of that liquidity for debt rollover requirements, as EPRT has no debt maturing until 2024. This gives the REIT flexibility in dealing with temporarily depressed rental income.

But what about the question on every EPRT investor's mind? Will the dividend be cut? For Q1, the dividend payout remained flat but no announcement has been made for Q2's dividend yet.

In this special circumstance, I would argue that, for long-term investors who do not need the income today, it does not matter whether EPRT temporarily minimizes the dividend for a quarter or two. In fact, shareholders would be better off in the long run if management decides to reduce the dividend for a few quarters to preserve the strength of the balance sheet.

The last thing we as shareholders should want is for the company to hobble its ability to grow at a rapid rate in the future by taking on additional debt in order to pay shareholders today. Yes, it's possible that the company could pay the dividend out of available liquidity, but I would rather that cash be available to invest in acquisitions than be sent to shareholders, many of whom will just reinvest it right back into EPRT stock.

In 2019, EPRT paid out 72.1% of AFFO as dividends. The ideal solution, in my opinion, would be to pay out that percentage (or perhaps bump it up to 75% or 80%) of AFFO in Q2, knowing that AFFO will be significantly depressed, and try to make up for the payout dip in the following four quarters.

Dividend Growth

Over the last year and a half, EPRT has raised its dividend twice, each time by a penny per quarter. That amounts to over a 9% annual dividend increase, combining both hikes.

To be conservative, let's estimate no dividend hikes for two years followed by average annual dividend growth of 6% over the next eight years. Buying in at today's 6.85% starting yield would render a massive yield-on-cost of 10.95% after ten years.

But let's be even more conservative and assume that the dividend is cut by 25%. That brings the starting yield down to 5.14%. Thereafter, we'll assume that EPRT gets back on track and raises the dividend by 5% per year on average off of the reduced base. That would produce a 10-year YoC of 8.37% — still a phenomenal YoC!

While extrapolating a 10-year YoC definitely involves some guesswork at this point, the bottom line is that I expect EPRT's investment strategy to pay off once the economy stabilizes. Borrowing costs will remain low, and cap rates should remain above 7% for some time until investors develop an appetite for risk again. This is a good setup for EPRT going forward.

*** If you find this sort of content valuable, please follow me by clicking the orange "Follow" button at the top of the page!

Disclosure: I am/we are long EPRT, NNN. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.