Exxon Mobil: Higher Oil Prices To Recover Share Price

by David KrejcaSummary

- Exxon Mobil is one of the world’s largest oil and gas companies.

- The company’s business has been hit hard by coronavirus outbreak but oil prices may quickly recover.

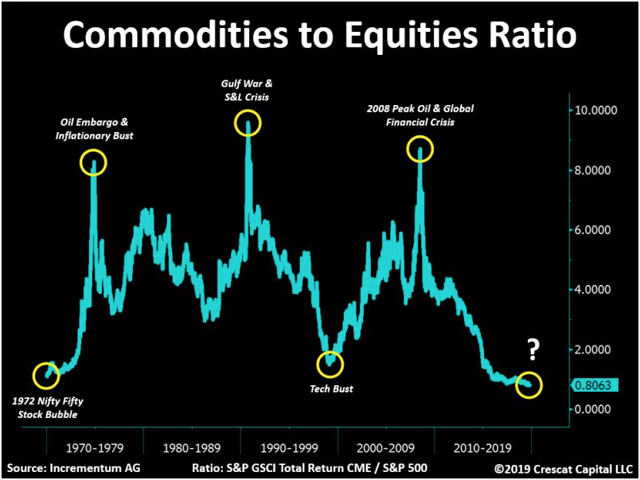

- DCF valuation and low commodities to equities ratio suggest the company’s shares are significantly undervalued.

Investment Thesis

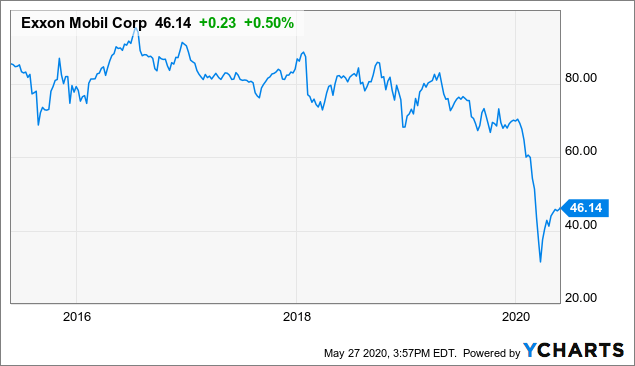

Shares of Exxon Mobil (XOM) have experienced an unprecedented plunge as coronavirus outbreak and tensions in the oil market suppressed prices to record low levels. With signs of economic recovery, I believe prices of oil can quickly recover which will positively impact the share price of one of the world's energy providing and manufacturing companies.

Source: tradersinsight.news

Corporate profile

Exxon Mobil Corporation is one of the world's largest energy companies involved in exploration for, and production of, crude oil and natural gas and manufacture, trade, transport and sale of crude oil, natural gas, petroleum products and other petrochemical products, operating in 45 countries with several brands such as Esso, Exxon, Mobil and Exxon Mobil Chemical. As of December 2019, the company had over 74000 employees.

Key insights from the latest quarterly earnings call

Reading through the latest quarterly earnings call statement, the company's management reported on results and developments since fourth quarter 2019. While both upstream and downstream business segments have considerably deteriorated, chemical segment has performed particularly well due improved margins from lower liquids feedstock prices.

In Chemical, we anticipate continued margin support from lower liquids feedstock pricing while noting that overall realizations remain near bottom cycle for many of our products. - Stephen Littleton, Vice President, Investor Relations and Secretary

Financial analysis

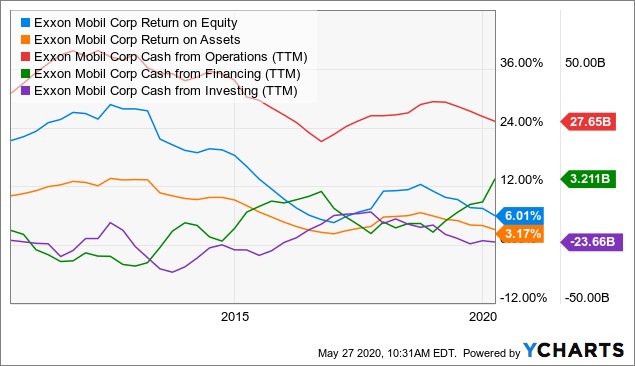

Looking at the company's financial statements, the company has relatively little debt on its balance sheet, positive cash flow from operations and positive single-digit profitability measures (trailing twelve-months return on assets of 3 percent and return on equity exceeding 6 percent). Even though the company's cash from operations and profitability has slightly descended over the past few years, (apart from liquidity), the company's financials are in good shape.

Valuation

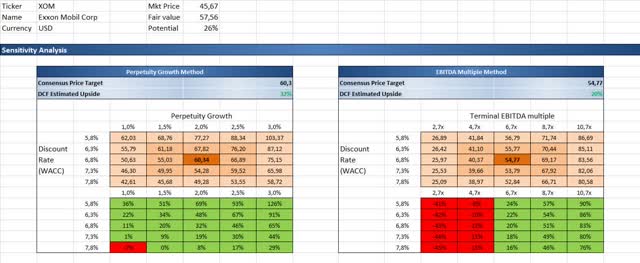

Plugging in Exxon Mobil Corp's financial statement figures into my DCF template, the company's shares show to have an upside. Under the perpetuity growth method with a terminal growth rate of 2 percent, 2 percent annual revenue growth over the next five years and stable operating income margin of 6.6 percent assumption, the model's estimate of intrinsic value of the stock comes at $60. Under the EBITDA multiple approach of a discounted cash flow model, the intrinsic value per-share value of the company stands roughly at $54.77 if we assume that the appropriate exit EV/EBITDA multiple in five years' time is at 6.7x.

Source: Author's own DCF

The bottom line

To sum up, Exxon Mobil is an outstanding company, currently trading with a record-low valuation in the environment of significantly low commodities to equities prices. A high dividend yield coupled with brisk oil price recovery in recent weeks may indicate a higher share price in the upcoming months.

Global Wealth Ideation, A new marketplace service focused on discovering ideas with wealth-building potential

Interested in finding out more investment decision making information? If you like access to in-depth articles, including discounted cash flow analysis, insights from equity analysis tools and prospectively much more, consider joining Global Wealth Ideation!

Join us today and get instant access to all articles and community of engaged investors aiming to benefit from growth opportunities all around the world.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: Please note that this article has an informative purpose, expresses its author's opinion, and does not constitute investment recommendation or advice. The author does not know individual investor's circumstances, portfolio constraints, etc. Readers are expected to do their own analysis prior to making any investment decisions.