Etsy: A Niche E-Commerce Poised For Growth

by Value KickerSummary

- Etsy has been firing on all cylinders since 2017 increasing both growth and profitability.

- Etsy is facing competitive threats from its larger rivals. However, the company has a strong brand and vibrant community that keep it strong within its niche.

- Etsy would need to be careful it doesn’t alienate its sellers with all the changes that it is making.

- Etsy may seem expensive, but it has a lot of room for growth. The management team seems to be on point.

Etsy (NASDAQ:ETSY) has had a spectacular Q1 2020. Like a lot of e-commerce companies, Etsy's stock price has been doing really well. Shares are up nearly 50% from the beginning of the year. I wanted to analyze this company to see if there is an investment opportunity here, or have we all just missed the boat.

Just a brief background on the company, Etsy is an e-commerce marketplace for unique, artisan, and homemade products. The main thing that differentiates it from other e-commerce sites, particularly Amazon (NASDAQ:AMZN), is its user community of both buyers and sellers. In particular, buyers who appreciate the value of these types of products and artisan makers who are the sellers of these products.

Naturally, these products are going to be a bit more expensive. Therefore, in order for this type of marketplace to succeed, it needs to feel more intimate. It can't have a "big corporation" or "mass market" appeal like Amazon. It needs to feel unique and niche, which is an interesting thing to say about a corporation that's $9.2 billion in market capitalization.

Specialty products are big business. Investment banking firm Nomura expects the specialty goods market to grow between $140 billion and $170 billion by 2023. Currently, Etsy has about a 4-5% market share of this industry with a current total addressable market of $100 billion. Etsy itself claims to have an up to $250 billion total addressable market expanded beyond just the "unique" and "special" niche to include other relevant retail categories.

The "unique" or "special" retail market is fractured with many firms, ranging from hobbyists who manage their own websites to small retail stores. There is room for growth for Etsy either through more buyers becoming aware of the value of these types of products or by stealing market share from smaller competitors.

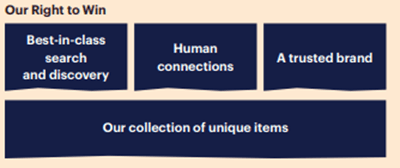

The main question to ask though is, will this be a winner-take-all market similar to how Amazon initially and continues to dominate online e-commerce? In my opinion, I believe not, but Etsy has to play it smart. Other online retailers have attempted to challenge Amazon's dominance in recent years by offering differentiated products that can't be found elsewhere, providing a unique shopping experience and/or aggressively price matching. That's not to say Amazon is not a formidable competitor, but Etsy has a few advantages and can very well capture the entire niche. Etsy needs to continue to offer unique and special products that can't be found elsewhere. In order to accomplish this goal, the company needs to nourish its community and maintain its personal feel.

The great turnaround at Etsy

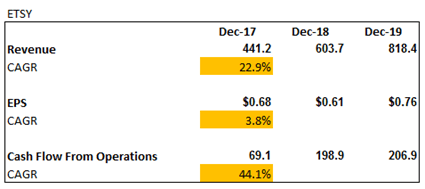

Etsy underwent a massive re-organization in 2017. Since that, time the company has been firing on all cylinders. Net income, which was negative in 2016, has been growing steadily these past few years. Revenue has grown by 23% CAGR in 2017-2019. Etsy's number of sellers has increased greatly from 2012 to 2019. In the latest filing, the number of active sellers was still showing signs of growth reaching 2.8 million.

Author calculations - from company data

Statista number of active Etsy sellers

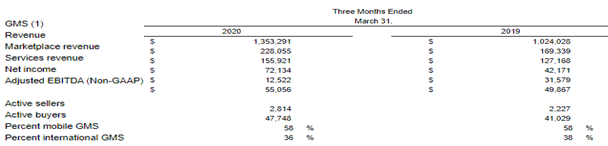

The results of Q1 2020 are continuing this trend despite the coronavirus pandemic. Gross merchandise sales ("GMS"), i.e. products sold on the Etsy platform, increased by 32% to $1.3 billion from $1.0 billion compared to the same quarter last year. From this GMS, Etsy earned revenue of $228 million vs. $169 million compared to the same quarter last year. Net revenue margin held steady at roughly 16%. Gross profit for the company increased by 24.8%, and gross margin remained high at 63%. The company generated $29 million in cash from its operating activities, and it had a healthy cash balance of $898 million at the end of the quarter.

Etsy Q1 2020 results - Edited by Author for brevity

Growing pains and trade-offs

Does this improvement in overall business performance come with a cost, though? The latest moves the company has been making should be concerning for long-term investors. As I've mentioned, the competitive advantage Etsy has over a larger e-commerce site like Amazon is its community. In its push to grow its market share, Etsy may be starting to make moves that might alienate its sellers.

The first of these changes is making sellers pay for advertisements on other platforms like Instagram, Facebook, Pinterest, etc. The way the advertising program works is that, when someone clicks on an Etsy advertisement that pops up in a 3rd party site and ends up making a purchase, the seller will be charged a fee. This fee is 12-15% of the sale on top of Etsy's other fees (platform fees, transaction fees, and shipping fees).

"That is a big chunk of change going to Etsy," says RJ Laskin, who makes handmade jewelry with his wife in Cave Creek, Arizona, and will be required to participate in the ad program. "If they find us a buyer, we probably won't make a profit on that sale. But maybe that buyer will come back. I think our goal will be buyer retention."

Etsy's Push To Compete With Amazon Leaves Sellers Squeezed By Rising Costs

Another recent controversial move has been to push sellers to offer free shipping for orders above $35. While this is standard practice for big e-commerce sites like Amazon, it is another layer of costs to Etsy's sellers. Etsy puts sellers who don't comply in the last priority for search results.

Advertising and free shipping are key requirements nowadays of running an online business but, apart from the rising costs, sellers could feel alienated from the decisions being made. Remember, in general, these are creative people, not cut-throat businessmen. Etsy initially kept its seller's loyalty by being relatively easy to deal with. Its platform fees were a low percentage of sales, combined with a flat monthly fee allowing small businesses to grow. The fact that Etsy made these changes mandatory seem to be moves that are more in line with a company like Amazon, and not a company with their brand image.

Now, I am not saying that sellers will be immediately leaving the platform. Requiring free shipping was implemented sometime in mid-2019. The active number of sellers from Q3 2019 increased from 2.5 million to 2.7 million by the end of Q4 2019. As mentioned, the active number of sellers at the end of Q1 2020 is 2.8 million.

The advertising changes were announced sometime in February 2020 and are set to be implemented in May 2020. So, it's still too early to see if it will result in any meaningful decrease in the active number of sellers. From Etsy's perspective, its sellers are being too conservative with their advertising spend as sellers tend to be uncomfortable spending money on advertising that may not yield results. Only time will tell if these programs will cause the desired effect and actually boost gross merchandise sales. Etsy should make sure it listens carefully to its sellers lest it ends up like Grubhub (GRUB).

Etsy's reputation among sellers taking an irreparable hit is a key risk to my otherwise bullish outlook. The number of sellers is indirectly related to gross merchandise sales. It takes two sides to make a marketplace (buyers and sellers). Having a lot of sellers means more products available, which is a key competitive advantage of Etsy, and would continue to drive gross merchandise sales higher.

Valuation

In terms of valuation, at first glance, Etsy may appear to be expensive as it is trading at a forward P/E of 61x. An argument could be made against extrapolating too much Q1 2020 results due to the unusual situation. For a while, when face masks supplies were running low, Etsy's sellers adapted to the situation, and buyers went to the platform for these items. This may partly explain the Q1 2020 surge. However, a long-term benefit for Etsy was that, for many of these buyers, this might be the first time they were introduced to the platform. I believe a few of them will be repeat customers. Using 2019 earnings, the company has a P/E ratio of 82x.

Comparing Etsy to other smaller online e-commerce companies like Wayfair (W), Chewy (CHWY), and Overstock.com (OSTK) are not even making any money. Etsy is profitable and generating a ton of cash flow from operations, roughly $200 million in 2018 and 2019. This highlights the strength of Etsy's management that they were able to grow the firm and turn a profit at the same time, a forgotten concept sometimes in the internet age.

Compared to much larger and more established firms, the company may seem expensive. Facebook (NASDAQ:FB), for example, trades at a forward P/E of 31. Alibaba (NYSE:BABA) trades at a forward P/E of 24. eBay (NASDAQ:EBAY) trades at a forward P/E of 14. However, in terms of valuation, Etsy has one benefit over these bigger names, and that is, it is starting at a much smaller base. In 2019, gross merchandise sales totaled $4.9 billion. Compare this amount with Amazon's gross merchandise sales of $335 billion and you can see that the company still has a decent runway.

(Note: I realize that Facebook is primarily an ad business with some retail operations they are obviously a very different business. Alibaba and Amazon are in a different league in terms of size and scope)

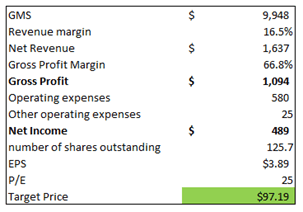

In terms of valuation, I am assuming that Etsy is able to double its GMS to $9.9 billion within the next five years. This is not too far-fetched as, discussed earlier, Nomura estimated Etsy's addressable market will be $140-170 billion by 2023. The company itself claims to possibly have a much larger TAM of $250 billion. The company already has a 4-5% market share. If Etsy can grab a 5-6% market share of a TAM of $170, that will translate to $8.5-10.2 billion.

In 2019, the company had a revenue margin of 16.5%. This translates to revenue for Etsy of $1.6 billion. Etsy has a gross profit margin of 66.8%. Applying these numbers to the GMS, we can arrive at gross profit of $1.0 billion. I took 2019 operating expenses of $454.7 million and grew it by 5% for the next 5 years to arrive at an operating expense of $580. Other expenses throughout 2015 -2019 ranged from about $10 million to $20 million, so I used $25 million as a rough assumption. Putting all of this together gives us a net income of $489 and EPS of $3.89. Using a P/E of 25, which I believe is reasonable multiple, I have arrived at a target price of $97.19, which is a 27% upside from the current share price of $76.24.

Author Calculations - based on company financials

Etsy right now is facing competitive threats from its larger rivals, Amazon and Facebook, however, the company has a strong brand and vibrant community that keeps it strong within its ever-expanding niche. While the company is experiencing some growing pains, Etsy's management has seemed capable of being able to properly steer the company as evidenced by the turnaround in 2017.

Etsy would need to be careful, though it doesn't alienate its sellers with all the changes that it is making. There will always be people complaining about changes and new policies in the platform that they are using. Etsy has had some sellers complaining all the way back from 2015. The important part is for management to be responsive and prepare to tweak or reverse course if these policies are not achieving the intended goals. Etsy may seem expensive, but it has a lot of room for growth. The management team seems to be on point. Etsy is a buy for me.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in ETSY over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Caveat emptor! (Buyer beware.) Please do your own proper due diligence on any stock directly or indirectly mentioned in this article. You probably should seek advice from a broker or financial adviser before making any investment decisions. I don't know you or your specific circumstances, therefore, your tolerance and suitability to take risks may differ. This article should be considered general information, and not relied on as a formal investment recommendation.