Lyra Therapeutics: A Chance To Pick Up This ENT Play As It Plateaus Post-IPO

by Edmund InghamSummary

- Lyra Therapeutics completed its IPO in late-April selling 3.5m shares at a price of $16 - the higher end of expectations - to raise $56m.

- The company is focused on the development and commercialisation of novel integrated drug and delivery solutions for treatment of ear, nose and throat diseases.

- Lyra's proprietary technology platform, XTreo is designed to precisely deliver medicines directly to the affected tissue for sustained periods with a single administration.

- The company's first 2 product candidates - LYR-210 and LYR 220 - are bioresorbable polymeric matrices designed to deliver continuous drug therapy to the sinonasal passages for treatment of chronic rhinosinusitis.

- LYR-210 is currently in phase 2 trials with results expected in early 2021. Phase 1 results were encouraging. This is a potentially transformative treatment method that addresses a large market. I am neutral-to-bullish.

Investment Thesis

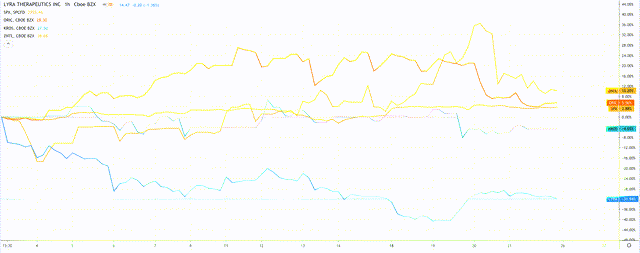

Lyra Therapeutics (LYRA) share price performance since IPO. Source: TradingView.

In the months of March and April only 4 companies successfully completed IPOs - the lowest number in over a decade, according to data from Renaissance Capital. The last time the number was as low was in 2009, following the global financial crisis, so perhaps it isn't surprising that numbers have dropped in the face of another global crisis - in this case the coronavirus pandemic.

All 4 companies that IPO'd were biotech concerns, and of the 4, 3 have successfully increased their share price in the short period since joining the NASDAQ.

Share price performance of companies to have IPO's in April and March 2020.

Oric Pharmaceuticals (ORIC), Keros Therapeutics (KROS), and Zentalis Pharmaceuticals (ZNTL) have all made gains, but the stock that is the focus of this analysis - Lyra Therapeutics - has seen the its share price drop back after an initial post-IPO surge to $18.5, to trade at $15.95 at the time of writing.

As mentioned in the bullet points above, Lyra has developed a proprietary technology platform called XTreo which is used to provide novel integrated drug and delivery systems for localized treatment of ear nose and throat ("ENT") diseases, by precisely and consistently delivering medicines directly to the affected tissue for sustained periods with a single administration. The company is hopeful that the XTreo platform can be leveraged to treat a range of ENT diseases and is actively exploring different therapeutic areas, management says.

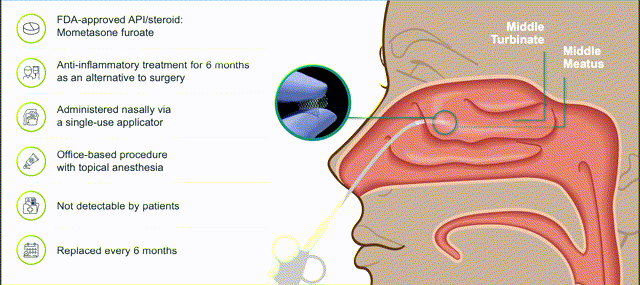

Currently, Lyra is advancing 2 candidates - LYR-210 and LYR-220 - through clinical trials. Both are bioresorbable polymeric matrices - which can be administered to the sinonasal passages in a single non-invasive procedure - to deliver the FDA approved active drug ingredient Mometasone Furoate for a continuous period of up to 6 months, to help treat patients suffering from Chronic Rhinosinusitis ("CRS").

LYR-210 is being evaluated as an alternative treatment to surgery in an ongoing, 110-patient, phase 2 trial named LANTERN, having met its primary endpoint in a phase 1 clinical trial by demonstrating rapid, clinically meaningful and durable improvement on a patient symptom severity scale over a period of 25 weeks with a tolerable safety profile. LYR-220 - designed to treat CRS patients with enlarged nasal cavities owing to surgery, who continue to require CRS treatment - is expected to enter a proof-of-concept clinical trial before the end of 2021.

Lyra estimates that CRS affects 14m people in the US - with 8m treated annually, whilst 4m people fail medical management. Sinusitis impacts 12% of the adult population of the US - some 30m people, making it more prevalent than diabetes or heart disease in people over the age of 65. Lyra says that $60bn is spent annually on direct treatments for patients with sinusitis, with $5bn spent on surgery.

Currently, first-line therapy for CRS usually involves steroid sprays and oral steroids, whilst second-line therapy is typically nasal surgery, which is an expensive procedure costing ~$14k, with ~400k procedures performed annually.

As such, Lyra's implantable solutions appear to address an area of unmet need with a solution that is convenient, less expensive than surgery, and potentially very effective in treating a troublesome disease with a range of uncomfortable and distressing symptoms. The company completed a $30m Series C fundraising shortly before its IPO, led by Perceptive Advisors, which gave them a roughly 32% share of the Lyra prior to the IPO. Lyra has a number of other institutional backers including North Bridge Venture Partners, Polaris Venture Partners, and RA Capital Healthcare Fund.

IPO pricing can be fickle and companies can gain or lose substantially in their aftermath as they face public scrutiny for the first time, but I believe Lyra can succeed based on the strength of its platform, current treatments in development and sure financial footing.

There are currently no FDA approved treatments available to treat the majority of CRS sufferers and I believe that Lyra's technology - originally developed by a pair of Ivy League scientists researching treatments for peripheral artery disease could represent a breakthrough that provides CRS treating physicians with a superior and more cost-effective treatment compared with current standards of care.

Caveats include the length of time the company will require to gain approval for its treatment, the risk of trial failure (which would impact the company's attempts to develop more wide-ranging ENT treatments) and the uncertain nature of future cash flows, given the company does not provide any details on pricing or sales volumes.

Company Overview

According to Xconomy Lyra's technology has been in development for a decade, originally as part of another Watertown, Massachusetts-based company, Arsenal Medical, founded by MIT scientist and drug delivery specialist Bob Langer and Harvard Chemist and Genzyme (GENZ) co-founder George Whitesides. Arsenal spun-out some of its research - including the scaffold technology designed to treat peripheral vascular disease that would eventually be used in Lyra's CRS treatments - into a new company named 480 Biomedical, which became Lyra Therapeutics in 2018.

Both Langer (who is also a board member of Moderna - the mRNA specialist making waves developing a coronavirus vaccine) and Whitesides sit on Lyra's Board of Directors, alongside representatives from VC backers Northbridge and Perceptive advisors. The company's President and CEO is Maria Palasis PhD, who spent 7 years at Arsenal Medical between 2008 and 2015. The company's Chief Financial Officer, Don Elsey, was formerly CEO at Senseonics, the developers of continuous glucose monitoring devices who have struggled to date to make an impact on a highly lucrative market.

XTreo technology

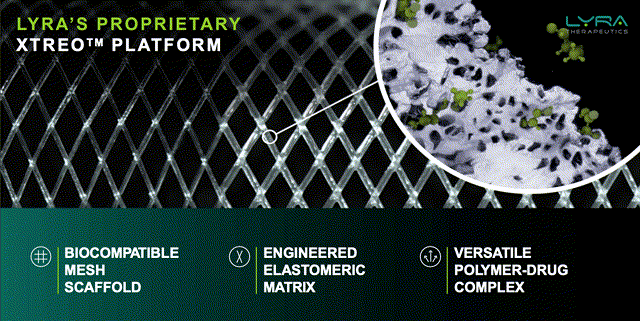

XTreo image and features. Source: Lyra Bank of America Healthcare Conference presentation.

The Xtreo platform looks to be a deft piece of engineering, with a mesh scaffold structure that optimizes the surface area for more consistent and long-lasting drug delivery, without interfering with the underlying tissue function, and a pliant structure that resists deformation, whilst exerting a strong enough elastic force to remain in position as the tissue remodels itself.

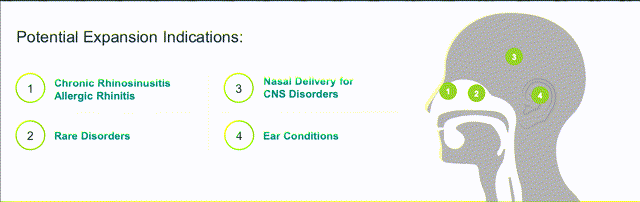

The structure is comprised of bioresorbable polymers designed for extended slow release of drug formulations. As such, Lyra management believes the technology is versatile enough to treat rare ENT disorders, CNS disorders and ear conditions as illustrated below.

Source: Lyra Bank of America Healthcare Conference presentation.

LYR-210 and LYR-220

LYR-210 - insertion and product features. Source: Lyra Bank of America Healthcare Conference presentation.

LYR-210 is expected to be allocated the lions' share of Lyra's financial resources, with a planned $47 - $50m of the IPO funds going towards its clinical development ($4 - $6m has been allocated to LYR-220).

LYR-210 has been designed to treat surgically naive CRS patients who have failed first-line treatment via sustained delivery of Mometasone Furoate. The implantable drug matrix is administered via a brief, non-invasive, in-office procedure by an ENT physician, under endoscopic visualization via a single-use applicator.

There is nothing new about the products' use of Mometasone Furoate which is a common steroidal treatment used to treat asthma, hay-fever and skin conditions. The drug has some side-effects which include headaches, sore throat, and respiratory infections, but Lyra believes these side-effects are reduced when administered using XTreo, as compared to the use of oral steroids.

LYR-210 impressed in a phase 1 clinical trial that treated 20 patients in New Zealand and Australia, achieving its primary endpoint of safety by week 4, with significant reduction of symptoms (recorded using the aptly named SNOT-22 score) at week 1, persisting to week 25. The average change from baseline ("CFBL") at week 1 was -13 points, with the minimal clinically significant difference required being -8.9 points. Symptom relief across the entire course of the trial averaged -20.5 at week 24, and -20 points one week after the removal of the device from patients' nasal passages. No significant adverse events were reported.

The phase 2 LANTERN trial - being conducted at sites in Poland, the Czech Republic, New Zealand, Australia and Austria will enroll67 patients, with the primary endpoint being Change from Baseline (CFBL) in Chronic Sinusitis symptom scores at week 4, and the secondary being evaluation of the effect of LYR-210 in improving CS disease-specific quality of life over a period of 24 weeks, using the SNOT-22 scale. The trial will also include a 6-month follow-up safety data, and results - if successful - are expected to form the basis of a phase 3 protocol submission to the FDA, with an Investigational New Drug application ("IND") having been accepted by the FDA in December 2019.

LYR-220, which the company believes will provide a preferred alternative to revision surgery and post-surgical medical management, is currently in product feasibility studies, with plans to advance the candidate into a proof-of-concept ("POC") clinical trial by the end of 2021. If successful, the company will look to seek approval via the supplemental-NDA ("s-NDA") pathway which ought to speed up the approval process significantly.

Drawbacks

Given the recent backlash against excessive opioid use in the United States, and the development of non-steroidal treatments (e.g. Pacira Biosciences use of non-steroidal local anesthetic to treat pain), I would be interested to know if Lyra had any plans to explore a non-steroidal alternative to Mometasone Furoate.

Additionally, it is worth pointing out that Lyra do not appear to be positioning LYR-210 as a first-line treatment, meaning patients will only be offered the device if e.g. nasal steroid sprays or oral steroidal treatments have failed to tackle a patients' condition. That restricts Lyra's market to the ~4m patients who fail medical management and the ~400k who receive surgery. Lyra estimates that 90% of this population receive suboptimal treatment options, 60% of whom would benefit from treatment with Lyra-210, and 40% of whom (the post-surgery population) would benefit from LYR-220.

Commercialization & market

LYR-210 and LYR-220 are expected to be paid for in 2 parts - the professional fee for the in-office insertion procedure (which ought to happen every 6 months until the condition is successfully cured), and the fee for the product itself. Lyra believes that both can be covered by reimbursement, leveraging CPT codes for the procedure, and a J-Code (available for drugs that cannot be self-administered) for the product fee, with pharmacies potentially receiving a mark-up of 5% - 10% per unit.

Lyra does not currently have a commercial sales team in place and has sketched out a sales model that looks typical of an early stage medical device company, planning to implement product awareness campaigns, limit the product acquisition "hassle-factor", and attempt to secure wide-spread payer coverage and secure reimbursement deals.

Neither Lyra's management team nor its Board of Directors have extensive experience when it comes to commercialization (Arsenal Medical has not had any products approved by the FDA to date) hence this is a potential area of concern. Lyra is not the only company targeting rhinosinusitis, with, for example, the monoclonal antibody Omalizumab - brand name Xolair, jointly owned by Novartis and Roche, and making global sales of $1.83bn in 2017, currently being evaluated as a potential treatment, alongside other biologics.

Meanwhile, Sanofi and Regeneron's Dupixent recently met all of its primary and secondary endpoints in two Phase III trials in patients with adults with inadequately controlled chronic rhinosinusitis with nasal polyps (CRSwNP). It seems possible, however, that Dupixent could be used in combination with a treatment like Lyra's for maximum patient benefit. According to GlobeNewsWire, the global market for treatment of sinusitis is expected to reach $50.4bn by 2024, growing at a CAGR of 12.4%

Financials

At the end of March Lyra reported $35.3m of cash and cash equivalents which, when added to the funds from the IPO, ought to sustain the company until the final quarter of 2023, management says, which is excellent news. During this period Lyra hopes to complete a full phase 3 trial of LYR-210 and a phase 2 trial of LYR-220, and complete the transfer of its manufacturing process to a contract manufacturer.

Lyra made a loss from operations of $16.3m in 2019 and $7.2m in 2018, with R&D expenses accounting for roughly three quarters of all costs in 2019. Losses will no doubt increase over the next couple of years as trial costs increase exponentially. The company's accumulated deficit currently stands at $127.8m.

Conclusion

I find it hard to assess the pricing of the company's shares given the early stage nature of Lyra's products and probable length of time to commercialization. The company has not issued any sales guidance therefore it is left up to the investor to speculate.

Even when restricted to a treatment market of ~4.4m patients, there are positive signs however. Based on data from MD Save I estimate the average cost of endoscopic sinus surgery to be ~$12,000 (slightly less than Lyra's $14k estimate), which, when multiplied by 400,000 patients gives us a market value of $4.4bn. Insurers and physicians may prefer to push a treatment such as Lyra's if it provides a cheaper alternative to costly surgery and a period of hospitalization. Then there is the 4m population actively searching for a better treatment.

It is a shame that Lyra does not provide any information regarding the possible pricing of its products, although we can assume they are likely to be significantly cheaper than surgery - but how will they compete against biologic treatments or current standard-of-care steroidal treatments?

On balance, I believe that Lyra will - provided larger scale trials support the early stage data and no safety concerns are uncovered (and I believe this will prove to be the case since this kind of technology has been proven to work in other fields e.g. birth control implants, slow release anesthetics etc.) - be marketable to a niche market at the very least.

Using some very basic assumptions - that LYR gains approval in 2021, making $1m of sales in that year which grows to $20m by 2025 and OPEX = 70% of sales, then, based on current number of shares =12.4m we arrive at an EPS figure of $0.48 and a PE ratio (based on current share price = $14.4) of 30x.

That makes a rough and ready, rather cautious investment case for Lyra, but if we then factor in the approval of LYR-220, other potential treatment paradigms, combination therapies, reimbursement wins, the growing popularity of medical devices (evidenced by the success of e.g. continuous glucose monitoring, slow release anesthetics etc.), the relative convenience of non-invasive surgery, and manufacturing economies of scale, the investment case begins to grow.

Given that investors are unlikely to face further dilution until late 2023 at the earliest, and the good chance LYR-210 has of securing commercialization, plus the convenience factor of the treatment, I can see Lyra shares gaining in popularity over the medium-to-long term.

If we conclude that COVID-19 has played a part in depressing the post-IPO share price performance then there is a strong case for making an investment in Lyra now.

On the other hand, a more sensible strategy may be to sit on the sidelines a while longer - with few upcoming price catalysts, the stock is unlikely to spike either up or down in 2020, in my view, but other market developments may provide more data with which to evaluate Lyra's share price. Hence, I am neutral for now, but make Lyra a stock to watch, with a very broad target price range of $17.5 - $35.

Gain access to all of the market research and financial analytics used in the preparation of this article plus exclusive content and pharma, healthcare and biotech investment recommendations and research / analytics by subscribing to my channel, Haggerston BioHealth.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.