Yandex: Not So Immune To Corona As You Might Think

by Danil KolyakoSummary

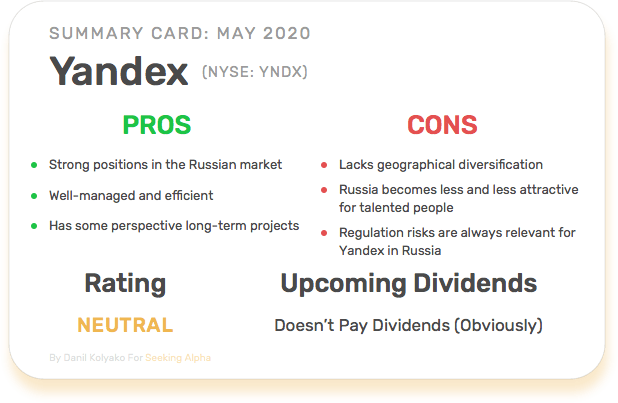

- The coronavirus outbreak is going to reveal the biggest downside of Yandex's case: the company is tied tightly with the ever-shrinking Russian economy.

- Yandex.Taxi's prospects are unclear.

- I keep my neutral view and expect the stock to remain volatile.

Photo source: Yandex; edited by Author

What's the most important factor to look at when we talk about growth stocks? That's right, growth. In the case of Yandex (NASDAQ:YNDX), I see a clear contradiction here: the stock has almost reached pre-corona levels amid a significant slowdown in operational results and the postponed Yandex.Taxi IPO. Investors should not forget that the company is far from being a monopolist in many areas of the Russian market, and now it will face a harsh battle in a highly competitive environment. I continue to consider the stock suitable only for short- to mid-term trades as it is likely to follow its established price movement pattern.

Impact Of The Virus

Yandex Search. Market share in Russia - 57%

The management of Yandex recently informed investors about the growth of advertising revenue and an increase in the number of Yandex.Taxi rides in May compared to April. However, the bottom of the crisis in the advertising market may not have passed yet.

Forbes Russia, referring to a Goldman Sachs report about Yandex, notes that the fall in the company's advertising revenue in May has slowed down. This April, advertising revenue of the company fell by 17-19% compared to April last year, and in May (up until May 22) it has fallen only by 7-9% year-on-year. Ad segments such as travel, cars, and real estate remain under pressure, while other segments show either growth or stagnation. The management seems to be confident about the operational metrics in the near-term and views April as a bottom, after which the profits will gradually recover.

Conversely, some experts interviewed by Forbes are sure that it's too early to talk about any improvements, and the reduction in advertising costs is yet to come. The manager of one of the companies cooperating with Yandex stated that Yandex itself could have improved its performance, but the situation in the advertising market is still very tough: the largest advertisers face a reduction in revenues by 10% or more. He concluded that the advertising segment is still not at the bottom yet, and everything indicates that advertisers are going to have more financial problems in the near future.

Yandex.Drive. Market share in Russia - 36%

Among other Yandex segments affected by the virus, I also would like to highlight Yandex.Drive. Moscow Mayor's Office said that on the first day of carsharing services reopening, citizens rented only 5% of available cars. Experts note that the proper work of services is hindered by restrictions - mandatory passes and leases of five days or more.

The prospects for Yandex.Drive look bleak for this year as there's a high probability that the company's biggest car fleet will mostly stay idle. The mayor of Moscow (where carsharing services are concentrated) said that the quarantine restrictions may be kept at least partially until a coronavirus vaccine becomes available. According to vc.ru sources, a downtime of cars within a month will cost each carsharing company about 500-700 million rubles ($7-10 mn) based on daily traffic of 50-70 thousand trips per day, a cost of 7 rubles per minute and average trip duration of 35 minutes.

Yandex.Taxi. Market share in Russia - ~27-30%

In late March, Yandex.Taxi withdrew the application for the acquisition of the Vezet taxi service. RBC sources note that Yandex decided to focus on supporting its current partners - drivers and taxi companies - in the face of declining market demand. For reference, Yandex.Taxi has agreed to buy call-centers and software of Vezet in July 2019. Under the terms of the deal, the current shareholders of Vezet were to receive up to 3.6% of Yandex.Taxi shares and up to $71.5 million when key indicators were achieved.

The deal with Vezet, however, could come in handy amidst an upcoming threat from China - DiDi (DIDI), the biggest taxi service in China, comes to Russia. In May, DiDi started to recruit its first drivers in Russia. The company promises to charge drivers a commission of 5.5% per ride, which is significantly lower than the rates of competitors. The Yandex.Taxi commission in Russia depends on the distance and the cost of the ride. There are also fixed commissions: at the "Economy" tariff in the Moscow region, the commission amounts to 12%, and at "Comfort," it amounts to 20.47%.

In the meantime, Yandex.Taxi hopes to remain profitable in the second half of the year despite a sharp drop in demand due to restrictions amid the pandemic. The company forecasts that if demand falls by 60% in the second quarter, it will cause negative EBITDA, but a decline of 40% will allow the company to reach break-even. Let's see how the presence of DiDi will affect Yandex.Taxi earnings this year.

The covid crisis also confounded the management's plans to hold a Yandex.Taxi IPO this year. Yandex Deputy CEO Tigran Khudaverdyan noted that the IPO of Yandex.Taxi is not on the company's top priority list at the moment. After the second quarter, probably, it would be possible to assess Yandex's chances of a successful IPO of its Taxi segment.

Adapting To A New Normal

Yandex is about to meet the key fundamental constraint every company faces in the Russian market: weak economic growth. Surely, the company can easily scale its internal startups like Yandex.Lavka in Moscow and Saint Petersburg, but outside these two cities, the company will inevitably face limited demand from the population with ever-declining income.

The Russian economy, decimated by halved oil prices and inconsistent anti-virus actions of the government, will have a long way to full recovery. Here on SA, I often see comments that my view on the Russian economy is too gloomy. Let me clarify: in Russia, export-oriented and domestic-oriented companies live in two different worlds. The most concerning problem I see for the Russian economy is that its domestic-oriented part has been degrading for the last decade.

Each consequent economic crisis in Russia after 1998 implied an adaptation to a new reality for the population: each time incomes diminished, the USD/RUB rate became higher, and the population had to consume less and less. This time is no exception: the currency rate crashed to 70-75 rubles per dollar, the GDP decline is estimated at 4-6%. For the year as a whole, the drop in real income of the Russian population may amount to 8 to 12%, according to calculations of the Higher School of Economics. I don't know by what miracle Russian companies like Yandex should thrive amid constantly declining purchasing power of Russians, but this fact seems to be hugely underestimated by analysts and investors.

On The Stock

Source: TradingView, edited by Author

It seems it's time to formulate a Yandex version of Murphy's law: "once the stock price surpasses its IPO price level, something bad will eventually occur reverting the price back." This rule works surprisingly well throughout the whole history of Yandex as a public company.

The stock has already got an appreciation for its recent successful growth and even looks a bit expensive for a Russian growth stock with a forward P/E over 44, considering that almost every Russian company has a specific "geopolitical" discount. Yandex, in turn, doesn't seem to have such a discount priced in, and this makes the stock even more expensive.

Final Thoughts

While FAANGM companies continue to monopolize the whole clusters of the global economy even at the risk of being de-monopolized, Yandex will have to settle for the remains of the Russian economy already dominated by state-owned companies like Sberbank, Rostelecom, Mail.ru (which is de-facto state-controlled too), and others.

The company's effectiveness is beyond doubt. Nonetheless, the impact of the pandemic on business, advertising costs, taxi rides is going to be long-lasting and decisive of the company's investment attractiveness in the future.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.