GameStop: Endless Questions

by Carlton Getz, CFASummary

- GameStop has been an enigma for investors for years as the company's shares have been in a persistent downward trajectory.

- The company's business was eroding before falling of a cliff last year which has been widely blamed on the upcoming console refresh cycle.

- GameStop's core businesses, though, have been declining for years - even since before the prior console cycle.

- We find little evidence to support a significant turnaround in trends in the near future with or without new gaming consoles coming to market.

- GameStop's decent cash and liquidity position notwithstanding, the shares can only be viewed as speculative.

GameStop (NYSE:GME) has confounded investors for years. The company has appeared undervalued based on traditional valuation metrics for a long time yet, despite one commentator's recent view that the company's short sellers don't know how to get off the tiger without being eaten, it's instead the company's loyal shareholders who have been thoroughly mauled so far.

GameStop simply isn't particularly appealing from a business standpoint. The high level of free cash flow generation potential is a compelling attribute, but the core business has been struggling for some time, though, in part masked by ancillary business. New video game software and preowned and value gaming, the company's two largest revenue categories, have been under significant pressure over the last decade. In the last seven years - including the last console refresh cycle - new video game software revenues declined more than 40% in a near linear trajectory. In the meantime, the company's preowned and value gaming category declined more than 33%. The decline in new video game sales contributes to the corresponding decline in preowned sales due to the shrinking pool of games available for resale.

Separately, the proposed shift in store format to a social gaming environment, despite its detractors, may prove successful but would still represent a significant capital investment utilizing cash which many investors would rather see directed elsewhere. Ironically, the upcoming console cycle which is often presented as a catalyst for software sales may become more of an anchor as the company's lowest gross margin category by far could also become the company's largest revenue category for the first time. The impact of economic dislocation and recession caused by coronavirus further complicates the company's situation.

Ultimately, the argument on behalf of the company boils down to something along the lines of "it's different this time." We're always rather skeptical of "it's different this time" positions which, in our view, demand a much stronger justification before being incorporated into investment decisions. We therefore consider the potential impact of the upcoming console cycle, ongoing underlying trends in the business, cash flow and short interest positions, etc., to determine whether the company is attractive at this point.

In our case, we don't see the long-term opportunity. The company's short-term results may impress, especially given the positive impact coronavirus closures are having on video game sales, and the company may be able to engineer a variety of cash flow generating transactions which result in leaps in the share price. However, from a long-term perspective, it's difficult to see a sustainable business model for the company without a costly and significant reduction in footprint and scale. The company's shares are thus primarily limited to a speculative trading opportunity which may suit the interests of some but doesn't align with our investment approach.

Inherent Biases

First, it's worth noting that evidence definitely suggests the Seeking Alpha community is quite biased towards an optimistic perspective on the company. Bullish articles receive far more "likes" than articles with a neutral or bearish viewpoint, which is not unusual given investors tend towards optimism regardless of the external and internal realities facing a given company. The concentration of viewpoints, though, suggests an element of self-reinforcing bias - actively seeking out viewpoints which affirm one's already established beliefs - a form of confirmation bias.

Source: 42 Courses

Inherent bias can be detrimental to the rational investment decision making process. It's worth taking a moment to step back and wonder whether the analysis and commentary on the company is quite as broad based as one would like to believe and, perhaps, assess the company from an independent perspective rather than those commenting on the company. We attempt this approach and write here to provide our perspective.

A Stellar Quarter?

The conventional wisdom is that the company is headed towards a decent first quarter. The company has reported that comparable store sales were modestly positive before closures associated with the coronavirus with ongoing strength in some regions. Market reports of an exceptionally strong quarter for video game sales - both hardware and software - may allow the company to beat expectations and possibly by a wide margin, though these expectations being already incorporated into the valuation a stellar result would not necessarily presage a sharp or persistent response in the stock price.

Unfortunately, GameStop may find itself in an impossible position in terms of expectations for the quarter. The company in essence has little to gain and everything to lose based on first quarter results. A positive result (barring anything that absolutely blows away estimates) will be accepted and dismissed as an aberration based on benefits from the coronavirus "lockdowns" which drove gaming sales to records. On the other hand, if GameStop reports anything other than stellar results, the first question to be asked will be - if the company can't knock it out of the park in this environment, how is it ever going to do so again? The bar may already be implicitly set incredibly high.

Regardless, even a squeeze caused by positive results could well prove fleeting for the very same reason the company hasn't faced a serious short squeeze despite having an extraordinarily high short interest. The short sellers are convinced in their long-term view that the company is in terminal decline and have the capital to withstand short-term shocks in the interim. It's a bit difficult to see a viable scenario, as we discuss below, that would cause short sellers to want to get out of their positions.

Console Cycle

A key contention surrounding the company has been that the upcoming console cycle will provide a tailwind for the company should it make it through to the beginning of the cycle. The concept of the console cycle has already been addressed in other articles and doesn't warrant extensive repeating here, so we'll leave the details to prior contributors.

However, we are interested in focusing on a few aspects of the console cycle debate.

First, the bull case has in part been based, prior to the advent of the coronavirus pandemic, on the belief that the console refresh cycle would be coming about in the midst of a strong economy. Unfortunately, although a quick recovery may be possible, it's unlikely that the global economy will be "on fire" at the end of the year. This specific leg of the stool has clearly been kicked out by the coronavirus warranting a tempering in expectations either on price or sales volume of the new consoles. Indeed, the strong sales of hardware in the first quarter may also presage a comparatively weak (or extended) console refresh cycle with consumers deferring purchases or simply bringing accessory sales forward to the detriment of subsequent periods. The forecast in this regard has grown decided murkier.

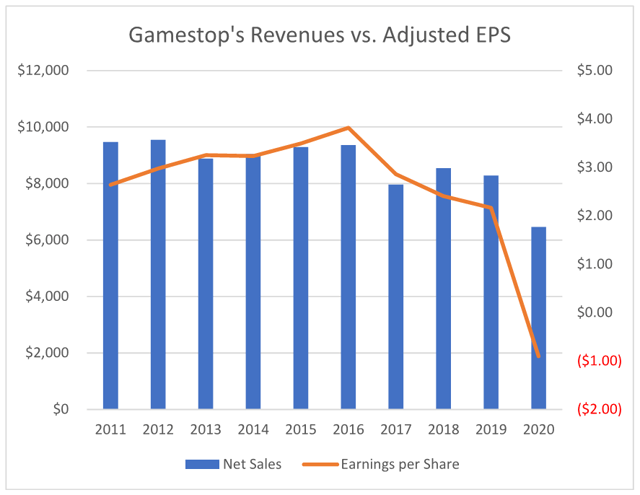

Second, it's worth asking the basic question whether historical experience suggests that the console cycle will help revive the business and drive material incremental sales and margins. The last console refresh cycle occurred around 2012-2014 with new consoles being released in November of 2012 and 2013. In looking at the company's historical revenues and earnings per share, noting that the year reflects the year in which the fiscal year ended (i.e., 2013 is for the period from February 2012 through January 2013), can you see the last console refresh cycle?

Source: Winter Harbor Capital/GameStop Financial Filings

It's not a trick question - neither can we in this data. The first console in the eighth generation, the Wii U, was released in November of 2012. The following consoles, the PlayStation 4 and Xbox One, were released in November of 2013.

We grant that this is a very generalized question, and there has been extensive debate in this forum on the merits of assessing performance during the prior cycle and whether the prior cycle will be representative of the upcoming cycle. However, contextually, it's difficult to see an initial rationale for believing the upcoming cycle will materially change the company's financial direction when the prior cycle was neither presaged by a steep decline in revenues nor resulted in a significant increase in revenues or profits.

Now, is it possible that the slight boost in gross margins the company experienced during calendar years 2015 and 2016 - the second and third years after the consoles were introduced - was associated with the expected shift from lower margin hardware sales to higher margin software sales? Yes, absolutely, though the benefit was largely offset by ongoing growth in selling, general, and administrative expenses and proved rather temporary.

The core debate in this forum surrounding the console refresh cycle, though, revolves around unit sales of consoles and the belief, to summarize, that a rise in the number of consoles sold will in turn drive both accessory and preowned game revenues. The latter in particular due to the reported backward compatibility of the upcoming consoles. In one case, the argument has been made that in this console refresh cycle GameStop will sell more units than in the past, driving incremental sales, while others have argued that this will not be the case.

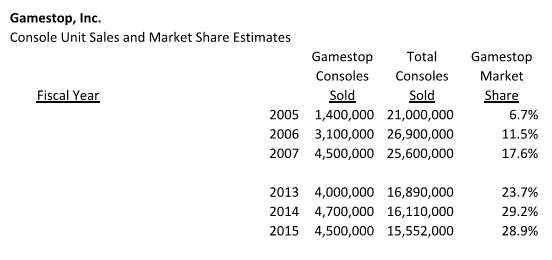

Contributor John Miller's perspective that the company increased console unit sales (not just dollar sales) in the last console refresh cycle is supported by the company's annual reports and management statements on earnings conference calls. The company's 2013 annual report (for the period ended January 31, 2014) makes numerous references to the company capturing "the No. 1 retail position in selling the next generation video game consoles." The quoted conference call speaking about hardware unit sales in Mr. Miller's article is slightly more ambiguous but still relevant, especially since it addresses the fourth quarter of fiscal year 2014 (ending January 31, 2015), the year after the console refresh cycle began as the major consoles were first released in November 2013.

The discrepancy in positions intrigued us since clearly both can't be the case. Perspective requires taking a step back and considering the potential for the 2020 console cycle in the context of what we'll call the 2013 and 2005/2006 console cycles based on the primary console launch dates. Justin Dopierala is correct in his assessment that total console unit sales in the United States generally declined from 2008 through the present, but what does this mean with respect to GameStop's market share in consoles? Why did the company's management state unit sales were up significantly over the last console cycle if this was not in fact the case?

GameStop doesn't report unit sales of new video gaming consoles. However, we can develop and estimate approximately what unit sales would have been by making a few assumptions. First, we'll assume that new video game hardware sales (which the company broke out until the fourth quarter of last year) were entirely attributable to retail sales of new game consoles to the exclusion of all other hardware. Second, we'll define an average new console sales price based on the console retail prices established at their introduction. Third, we'll assume that any per unit discounts applicable to the average new console sales price which reduced reported revenues were offset by sales of other console hardware unassociated with the new consoles. The result is certainly a very rough approximation of unit sales and should be taken as such, but not entirely unreasonable as a basis for a high level perspective.

In this model, GameStop would have sold roughly 1.4 million console units in fiscal 2005 (ending January 28, 2006, after the November 2005 introduction of the Xbox 360), 3.1 million console units in fiscal 2006 (ending February 3, 2007, after the November 2006 introduction of the rather poorly received PlayStation3), and 4.5 million console units in fiscal year 2007 (ending February 2, 2008). The estimates are sensitive to about +/- 10% depending on the exact average selling price assumed and complicated somewhat by a 53rd week in fiscal year 2006 and interim acquisitions, but we'll set those considerations aside for a moment.

A similar calculation performed for the 2013 console cycle, when cross referenced with U.S. sales of new gaming consoles, results in the following table:

Source: Winter Harbor Advisors/Statistica

The conclusion is that there is truth in both statements - while total console unit sales declined between the 2005/2006 and 2013 console cycles, GameStop's unit sales rose as the company captured a greater share of the market for new video gaming consoles. The management comment about sales exceeding the prior cycle appears to be accurate, which punches a hole into the theory that greater console unit sales in the upcoming cycle will materially drive improvement in accessory or software revenues.

A check is simple enough - new video gaming hardware revenues rose proportionately more for the 2013 cycle versus the 2005/2006 cycle than the corresponding increase in average console price, so the company had to have sold at least as many - if not more - consoles in the later cycle than in the prior cycle, not fewer consoles.

Granted, this is a quite generalized approach to considering the potential impact of the console cycle on the business, but we simply don't see a historical justification for significant faith in the upcoming console cycle making a significant difference for the company.

So, what could this mean for the upcoming console cycle? In order to assess, let's assume GameStop retains an approximate unit market share of just under 30%. We'll assume that the "revolutionary" nature of the upcoming consoles drives console unit sales growth of at least 20% to a minimum of 20 million units per year (a rather generous assumption in our view), resulting in GameStop sales of about 6 million console units annually. We apply the same general assumptions used to roughly calculate the company's unit volumes in reverse in combination with the projected retail prices for the new consoles to come up with a best case estimate of between $2.7 billion and $3.0 billion in new video game hardware sales. A result of this magnitude would add approximately $1.5 billion to the company's annual revenues albeit at a low gross margin.

In reality, we think such an outcome is unlikely since it would deviate significantly from historical experience in both prior console cycles and is unlikely in the context of weak economic conditions. We instead expect annual sales will remain approximately flat with prior years around 16 million to 17 million units. The company's new video game hardware revenue will increase about $1 billion in 2021 (the year after the current fiscal year) with a potentially decent boost at the end of the current fiscal year due to holiday sales. However, as has happened historically, the boost in low margin revenues will only last two to three years before dropping off.

We thus don't see any specific boost to the company's core new video game software or preowned software sales as a result of the console cycle. GameStop certainly would benefit from a boost in new video game hardware sales anywhere approaching that magnitude despite being a low margin business. However, it's necessary to wonder whether the assumptions underlying that estimate are reasonable, particularly whether the economic conditions and nature of the new gaming consoles will actually yield a significant jump in console unit sales.

Software Revenues

In some regard, the entire console cycle discussion is something of a canard since console sales are not what drives the business in the long term. Instead, accessory and software sales (and in particular sales of previously owned hardware and software) are the company's core businesses for which console sales are, at best, a rough and unreliable proxy.

In this regard, the argument has been put forward that due to backward compatibility features of the upcoming consoles sales of legacy games (which are GameStop's highest margin business) will be boosted significantly. The counterargument has been presented that, while this may be the case, the added incentive to keep existing legacy games will reduce resale supply (even beyond the limitation imposed by declining new video game software ales) just as demand rises.

Historically, there is little evidence for console sales driving sales of either new or preowned software for the company despite the statements made by the company about weakness related to the upcoming console cycle:

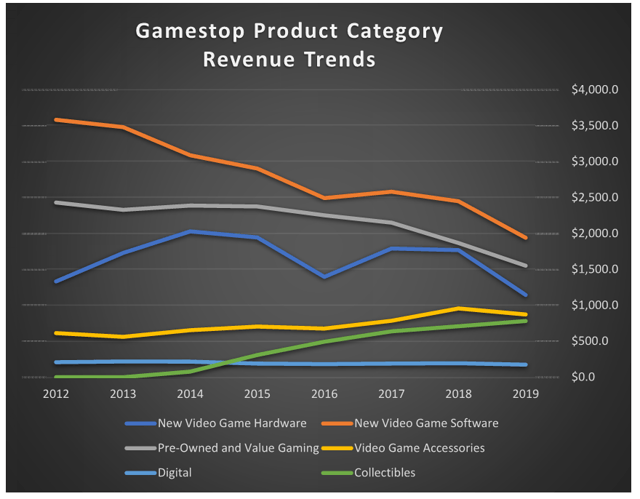

Source: Winter Harbor Capital/GameStop Financial Reports

In 2019, the company modified its category reporting to reduce the level of detail in category financial statements requiring an estimate of full year category results based on the results through the third quarter of the fiscal year and historical performance of prior years.

The above chart reflects the underlying issue for the company in that all of the company's core operating categories have been in decline for years. The sale of new video game software - the company's largest individual revenue category - has generally been declining since at least 2012. The pre-owned and value gaming category, which includes both hardware and software, has been in decline since the same time with the exception of a slight gain in revenues during the last console cycle in 2013/2014. The console refresh cycle can clearly be seen in the company's revenues figures with a significant revenue increase in 2013 and 2014 before falling off. The downward trend has been masked to some degree by rising sales of video game accessories and collectibles, but these have hardly offset the most recent declines in the largest categories.

It's this trend that belies to some degree the company's perspective that it's the upcoming console cycle that is impacting recent results. The statement likely has a kernel of truth - there is an impact even if it doesn't account for the full magnitude of the drop in revenues in the last year - while it's nonetheless worth noting that the accelerating decline in the critical pre-owned and value gaming category long predated the present console cycle.

It's not difficult to see in this chart what the short sellers find appealing about the company. It's possible revenues will bounce back in the coming years based on console sales, but from a historical perspective, it's unlikely the company will materially top the console unit sales experienced seen in 2013/2014. The persistent decline in new video game software and pre-owned and value gaming will also likely continue after the console cycle. The last two categories alone represented a more than $2.5 billion decline in revenues over the last seven years from revenue in fiscal year 2012 of about $6 billion to revenue in fiscal year 2019 of about $3.5 billion. The $975 million increase in collectibles and video game accessory sales offset part of this loss but can't hope to replace it all.

We suspect there is a long-term floor in these figures, especially in the most profitable resale category, but it's not clear where that floor will be found. In the years ahead, it's quite conceivable that new video game software and preowned revenues will continue to decline despite the possibility of a temporary bump associated with new consoles but it's rather more difficult to see a way for accessories and collectibles to grow anywhere near fast enough to offset even a significant portion of those declines.

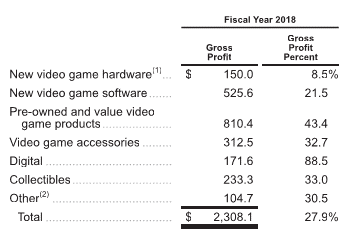

In any case, the coming console cycle may well be the first time that the company's new video game hardware sales - which carry a gross margin less than half that of new video game software sales and less than a third that of the company's other key categories - become the company's largest revenue source.

Source: GameStop Form 10-K (2018)

This is precisely why the console refresh cycle alone can't salvage the company, and the positive case is so heavily dependent on console sales driving a reversal in the longstanding downward trend in the company's other core categories.

Expenses

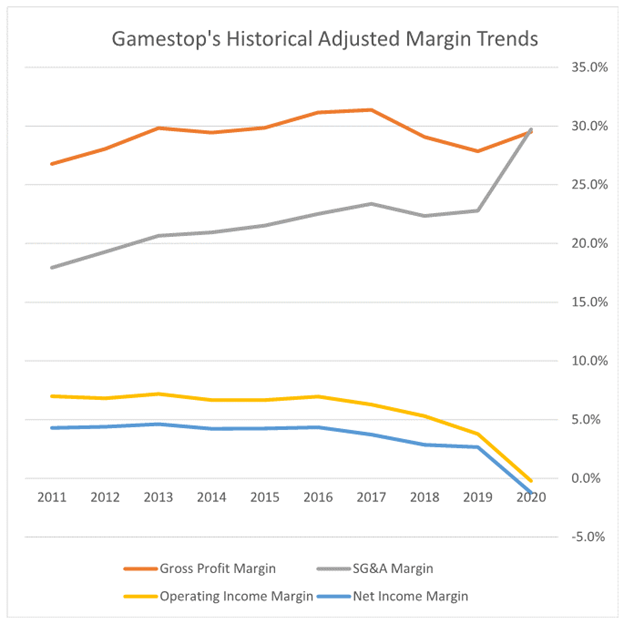

However, Mr. Dopierala is unequivocally correct in at least one view - that the company's other core issue is operating expense management. The collapse in net income in the last fiscal year was driven by management's inability to reduce operating expenses at anywhere approaching the rate of decline in revenues especially as gross margins actually rose during the same period:

Source: Winter Harbor Capital

The coronavirus likely won't help the company on the expense side as curbside pickup and online orders can't replace the full value of fully functioning stores. In addition, it's difficult to see the company cutting expenses deeply enough quickly enough to make a material difference unless the downward trend in software sales slows or reverses, neither of which strikes us as especially likely in the foreseeable future.

Sale/Leaseback Transaction

GameStop is actively pursuing a sale/leaseback transaction for the company's distribution and office space in Grapevine, Texas. The properties consist of three separate buildings comprising just over 600,000 square feet of Class A industrial distribution/warehouse facilities located in an attractive location next to Dallas Fort Worth (DFW) International Airport.

A potential valuation of any ultimate transaction is complicated by the fact that the marketed terms for the sale/leaseback transaction will almost certainly be modified for a deal to close while there is not a great deal of comparable distribution/industrial space presently on the market proximate to the properties. In addition, GameStop is not exactly the ideal tenant for a purchaser, given the company's credit rating and recent operating results, where a failure of the company (which we're not suggesting is imminent) could place the buyer in a position of holding 600,000 square feet of distribution/industrial space with cancelled or modified leases and, perhaps, even vacancies in a downsizing of the surviving company.

It's still possible to estimate a potential valuation based on the sparse information readily available about the buildings and surrounding properties. The assessed value of the company's largest building is approximately $23 million for tax purposes, or roughly $52.00 per square foot, though these valuations tend to be on the low side. A distribution/industrial building adjacent to the company's properties was offered for lease in the not too distant past for about $7.25 per square foot while offered prices in the area, though for somewhat different properties, range in the upper double digits. In combination with other data points, and again noting this is a rather rough initial estimate, we believe the company's distribution/industrial real estate subject to the sale/leaseback transaction is probably worth somewhere in the neighborhood of $45 million to $60 million, perhaps a little towards the low end were a potential purchaser/lessor to impose a credit related discount.

It's not an especially large amount but would still represent 15% to 20% of the company's current market capitalization. In addition, the influx of cash would materially strengthen the company's financial position albeit at added operating cost.

Business After Coronavirus

The greatest question, of course, is what the company's business will look like after stores reopen and present restrictions ease. Ironically, given the performance of video game sales while movement was limited, a reopening may not be especially kind to the company.

We've developed a number of models with various assumptions to assess the company's potential performance during and after the coronavirus pandemic abates. Admittedly, our financial models are somewhat more pessimistic than those of the analyst community as a whole; for example, our models project a median annual loss for the company for the current year of ($0.44) with a corresponding profit the following year of a mere $0.11 per share. The results are medians within ranges of potential outcomes based on variations in assumptions and testing for sensitivity. However, the wide potential set of variables results in unusually large ranges indicating a high degree of uncertainty.

The broader analyst community estimates only serve to reaffirm the view that no one has a firm grasp on the impact coronavirus and store closures will have on GameStop in particular, and retailers in general, either this year or into the future. The median expectation for a loss of ($0.24) per share in the current year encompasses an estimated range from a loss of ($4.15) per share and a profit of $1.91 per share with a very heavy dependence on the company's fourth quarter results. The current view is that the company's fourth quarter results for 2020 will exceed those of last year; we're somewhat more sanguine about the possibility. In the following year, the median expectation of a profit of $0.36 encompasses a range from a loss of ($1.12) to a profit of $1.10, versus our estimate of approximately $0.11.

Interestingly, our first quarter median model almost exactly matches the street estimate although our range - ($0.19) to ($1.31) is somewhat smaller than the range of market estimates.

Regardless, we come away without a high degree of certainty in most of the projections. The earnings figures are highly sensitive to small changes in assumptions, especially given the vastly reduced number of shares outstanding through share repurchases, and the variability surrounding coronavirus only adds to the challenge. We present our model estimates for reference but don't place any great weight in point values, given the broad ranges.

Cash Flow and Liquidity

The bright spot for the company and its shareholders is the cash and liquidity position. GameStop ended the prior year with $499.4 million in cash and $270.3 million available on the company's revolving credit facility for a total of $769.7 million despite accelerating the typical annual paydown of payables into the fourth quarter from the more traditional first quarter. In comparison, the company had senior notes outstanding of $421.4 million (due in March 2021) and no balance outstanding on the revolving credit facility. The cash balance is slightly deceiving since $207.9 million was held in foreign operations which may incur costs on repatriation, limiting the availability of the full balance. Regardless, the net balance of $348.3 million was not insubstantial.

GameStop announced more recently that as of April 4, 2020, the cash and liquidity position had changed to $706 million in cash and $66 million available on the revolving credit facility due to drawdowns as a defense against the impact of coronavirus related store closures. The total position, however, remained notably stable at $772 million despite a sharp decline in revenues. The company likely generated decent free cash flows through the first part of the quarter, and inventory drawdowns likely benefited the company through the remainder. However, the cash balance has also likely also benefited from increased accruals for rents, taxes, and other expenses boosting the headline number while concealing for the moment the exact sources. GameStop has already noted that it has reduced or suspended rent payments to landlords, for example, while the company discusses potential abatement, reductions, etc., so at least part of the preserved cash and liquidity balance has been achieved by borrowing from creditors, creating accruals on the balance sheet which will eventually have to be repaid.

In the meantime, GameStop (as noted earlier) is actively pursuing a sale/leaseback of its facilities in Grapevine, Texas, which would add tens of millions more to the cash balance and likely repurchasing senior notes in the open market at a meaningful discount to face value. The eventual redemption of the senior notes, assuming they are not replaced with new debt, which would likely be far more expensive at this point, would add some $20 million to the company's bottom line, the equivalent of approximately $0.35 in earnings per share. Alternately, a relatively expensive refinancing of a portion of the debt could leave the company in a position to repurchase additional shares, thus vastly reducing the outstanding share count.

However, those may be best case outcomes. A pursuit of the gaming destination strategy would consume cash in capital expenditures rather than debt reduction and share repurchases, potentially squandering millions on a strategy that remains uncertain. GameStop is in a relatively decent financial shape from a balance sheet perspective; the challenging part will be deploying the company's available resources in a way that benefits shareholders rather than into investments, much like the legacy mobile segment, in ineffective attempts to diversify the core business.

The company's cash and liquidity position does, though, make it potentially appealing in the event an activist or retail focused private equity firm thought they could turn around the business. It's questionable, though, whether any of those investors believe they can turn around the business (and get an acquisition done at a workable price) especially given repeated past failures to reach acquisition agreements. The risk of a private equity investor coming in doesn't exactly keep short sellers up at night since any acquisition agreement would effectively limit the upside potential (and short side losses) in comparison with a real reversal in the trajectory of the business.

Ownership

It's necessary to note the company's highly unusual share ownership with three institutions - BlackRock, Fidelity, and Vanguard - holding slightly more than half of the outstanding shares. In combination with five other investors, including hedge funds and an individual, these shareholders together hold an astonishing 90% of the company's outstanding shares.

It's not unusual to see BlackRock and Vanguard as top shareholders in many publicly traded companies given their scale. However, it is still rather unusual to see these institutions, in combination with one other, hold a controlling interest in a company.

The highly concentrated institutional ownership is even more remarkable in light of the large short interest position which approaches, and in some cases reportedly exceeds, the public float. GameStop is by far the most heavily shorted company in the public markets. In theory, a short squeeze could be induced simply by any of the leading shareholders withdrawing their shares from the market, assuming they have lent the shares in the first place. However, in some cases, the institutions may be making more lending their shares than they are on the actual investment, limiting the appeal. The coming and passing of the record date for the contested board election with only a rather mild rise in the share price (relative to the price before the shares cratered in the week after fourth quarter earnings results) doesn't suggest much incentive to recall shares en masse or for an extended period of time.

The Short Interest is Very High…

Still, the short interest in the company can only be described as absolutely ludicrous with nearly every available share sold short. In fact, the very situation reflects the extreme dichotomy in views of the business - this is not a simple situation where one perspective is right and the other wrong. Instead, it's a situation that implies one perspective will be absolutely right and the other absolutely wrong. A company's short interest does not approach its public float without the belief on one side of inevitable absolute disaster. In our experience, outcomes are almost never so definitive, at least not in the short term.

…and Why Short Sellers May Not Panic

Yet we're not fully convinced that those short are all that intent on getting out of their positions, which is a necessary precursor to a short squeeze. The short interest has in fact been climbing slightly in spite of its already extraordinary scale and high borrowing cost at least on a temporary basis. The relative infrequency with which large short positions results in dramatic short squeezes aside, we believe there is relatively little reason for short sellers to panic anytime in the near future. The short selling community is playing the long game when it comes to GameStop, not concerning themselves so much with quarterly results but maintaining a committed view that, whatever volatility occurs from quarter to quarter, the long-term persistent decline in the company's preowned and software business will continue and that the core business is inherent and irreversibly impaired. GameStop may not end up in bankruptcy any time soon, but the company will suffer financially for years.

The basis of this viewpoint rests on the conviction that, although the upcoming hardware cycle may boost the company's fortunes despite being focused on lower margin hardware, the subsequent software tailwind will quickly dissipate and the company's same store sales results will continue their downward trajectory as digital gaming erodes market position. In addition, the company will not be able to adjust selling, general, and administrative expenses quickly enough to offset the resulting decline in gross margins, leading to a further compression of operating margins and, potentially, ongoing losses despite positive cash flows in the intermediate term.

Indeed, the short selling community certainly hasn't panicked yet or, for that matter, come terribly close to doing so over the last few years. The occasional jump in share price on decent news has been overwhelmed every time over the last five years by the overall trajectory of the business. In addition, the cumulative gains that many (though certainly not all) short sellers presently have in the shares don't provide a basis for closing positions to protect assets.

In any case, GameStop has been presented as a short squeeze candidate for years. The high short interest and occasionally high borrowing costs make the company appear ripe for the kind of wild outcomes often coincident with earnings surprises. However, even when the shares have bounced, they retain a record of taking a quick round trip with gains quickly dissipating.

At some point, it may be necessary to take a different perspective and consider whether it's just not that great of a business.

Conclusion

The situation surrounding GameStop is both rational and nonsensical. The valuation isn't entirely unreasonable if one's view is that the company is a classical "cigar butt" opportunity able to generate cash flows and reward shareholders while winding down the business to a fraction of its current size serving the core resale market that will persist in some form regardless of digital gaming delivery.

However, it's virtually impossible to find a middle ground - the market's assessment of the outcome is virtually binary between either impending disaster (reflected by the extraordinary short position) or a perception of risk so far from reality that the current share price and short position is simply nonsensical.

GameStop has attractive features not the least of which is a strong cash and liquidity position, limited debt, and an ability to potentially generate free cash flows in a weak economic climate. However, clear negatives exist, especially the persistent decline dating from well before the current console cycle in the highly profitable new video game software and preowned and value gaming categories. The company is also struggling with expense management and rapid deleveraging of its operating costs while facing a console cycle which could prove less than inspiriting in a very challenging economic climate even if revenues are temporarily boosted at the margin. The potential for management to squander the company's cash on a gaming destination concept that proves ineffective is not the least of shareholder's concerns.

Our financial models reflect something similar with a wide and highly sensitive range of earnings per share projections on surprisingly little change in the underlying performance metrics. The analyst community is similarly uncertain over the company's prospects, especially in the short term, with an extraordinarily wide range of earnings estimates for the current quarter. The high estimate of earnings of $0.27 contrasts sharply with a low estimate of ($1.97), a range that implies extraordinary uncertainty and unpredictability. In essence, no one knows what will happen and those who come out the other side being right on earnings day - if anyone ultimately is - will probably have been more lucky than right. In some cases, though, that's all it takes to look great.

In this sense, we would argue that holding shares of GameStop based on the extraordinary short interest position is not investing but pure speculation. GameStop falls definitively in that category of companies where there is a potential for value but where the magnitude of the uncertainties is too large to estimate in any definitive fashion - thus, the endless questions. We've periodically considered a position in the company beyond a handful of options but have never been comfortable that there was a discernible future for the business. The lack of clarity in our own models doesn't change our view that it is a speculative position unsuited to our investment style.

We're interested to see what happens in the next month, but regardless of the specific outcomes, expect a wild ride… or, maybe not.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: We have limited long call option and short put option positions in the company's shares.