Selling My Uber To Get More Uber

by Trent WelshSummary

- A Grubhub deal seems like a foregone conclusion at this point.

- Uber seems like the most likely winner of a consolidation deal at this time. Other players like Doordash or Amazon.com might make sense if Grubhub is excited to sell.

- Uber's using the coronavirus pandemic as an opportunity to cut costs, and it could be due for a strong bounce back.

I sold my stake in Uber Technologies, Inc. (UBER) after buying it at a nice discount after its memorable IPO difficulties in early 2019. With Grubhub Inc. (GRUB) looking like it is very interested in selling itself for the right price in an industry ripe for consolidation, Uber continues to be the front runner for a potential all-stock deal. However, don't count out a dark horse candidate like Doordash or even Amazon.com, Inc. (AMZN) coming out of nowhere to steal the show for an opportunity like Grubhub. Uber has more than enough cash to survive the coronavirus pandemic, and it looks likely to come out a stronger business through aggressive cost cutting.

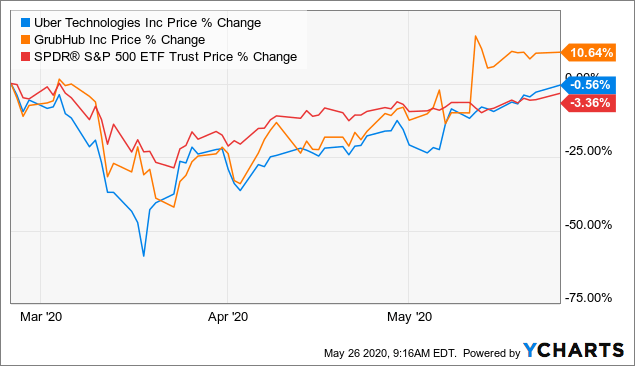

Uber and Grubhub had both been significantly underperforming the market, during the hard-hitting effects of the coronavirus, before some recent outperformance based on news that a possible consolidation deal might be in the works.

The recent outperformance might be signaling how favorably investors are viewing a possible consolidation in the space. A combined Uber Eats (~32% market share) and Grubhub (~24% market share) deal could create an ~ 55% market share for the combined company in the U.S. with Doordash at an ~35% market share as its main competition.

Here's a look at some of Grubhub's main financial numbers over the past year as its revenues continue to climb even as its growth and EPS have recently taken a hit.

| Grubhub | Revenue | % Y/Y | GAAP EPS |

| Q1/2020 | $362.98M | 12.1% | -$0.36 |

| Q4/2019 | $341.3M | 18.6% | -$0.60 |

| Q3/2019 | $322.1M | 30.3% | $0.01 |

| Q2/2019 | $325.06M | 35.6% | $0.01 |

| Q1/2019 | $323.77M | 39.2% | $0.07 |

Table by Trent Welsh

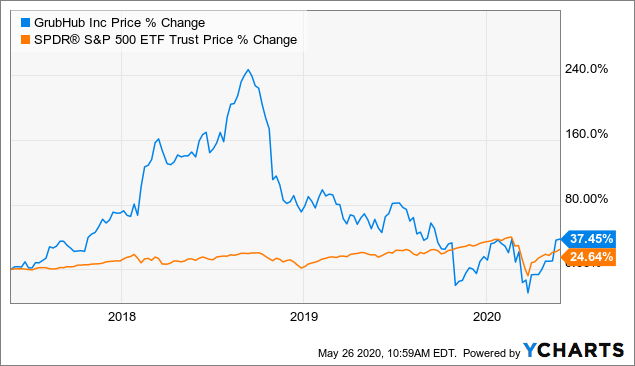

Grubhub has shown in the past that it can operate profitably even with a high growth multiple. This helps explain Grubhub's huge market outperformance over the past few years compared to its recent plummet as coronavirus is changing the rules of the food delivery game.

A significant consolidation in the space between the three major players could open up considerable value and growth for the combined company once costs were driven out and pricing was adjusted accordingly. The combined company could see cost savings of around $300M, according to the WSJ, which is huge considering Grubhub's revenue last quarter came in at ~$363M. This cost cutting strategy would fit in perfectly with Uber's current strategy to rightsize its company during the coronavirus pandemic. Uber's current plan is to cut ~23% of its global work force including recently 600 jobs in India along with another ~3,000 jobs and 45 offices predominately in the United States after ~3700 jobs earlier in May.

In a recent interview, Uber's CEO Khosrowshahi said, "The thing is, no one's really making money in this business,". However, the scale that a Grubhub deal could bring, along with massive cost cutting across both companies, could make the business profitable again in the very near future. The combined company could gain profitability and still operate in a highly competitive market. Doordash would still be a significant competitor along with traditional restaurant delivery from places like Domino's Pizza, Inc. (DPZ) and grocery store deliveries from grocers like The Kroger Co. (KR) for example. I think regulator scrutiny might be overblown at this point as U.S. Senators are already targeting a potential deal even though sources told the New York Post that a deal could bring little resistance from the Department of Justice.

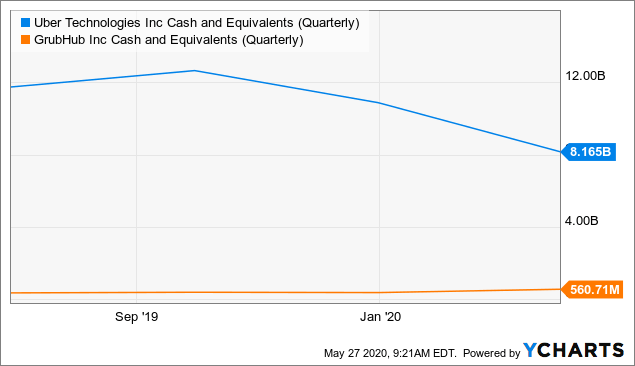

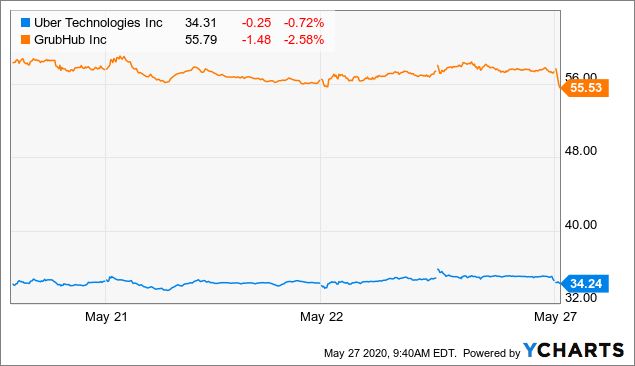

An Uber and Grubhub tie-up also makes sense because both sides are willing to work under a cashless framework. A deal is reportedly very close to happening right now at an exchange ratio of ~1.9-2 shares of Uber for each share of Grubhub that investors own. Maintaining superb liquidity is paramount to any company interested in M&A activity, especially during the coronavirus pandemic.

Consolidation in the space just seems to make too much sense for a deal not to get done, especially when both sides are amenable to a deal. Uber's current price of ~$34.24 means that a Grubhub deal could be valued at ~$65.06-$$68.48 a share. This means that Grubhub is now trading at an ~17%-23% deal discount, which is attractive to me at these valuations.

An Uber deal continues to make the most sense right now. However, there could be additional upside to a currently forecasted deal if Doordash decides to put in its own bid, or a dark horse candidate like Amazon.com decides it now wants to conquer another part of the delivery business for Amazon Prime subscribers. Strong cost cutting across the industry, along with a massive increase in scale, make a deal highly likely at this time. Cash concerns aren't currently a major concern for either Uber or Grubhub and regulators and political opponents might be more bark than bite. A current 17%-23% discount for Grubhub shares was enough for me to take the leap in selling my Uber shares to buy Grubhub to hopefully get back my Uber shares again post deal completion. I believe that both Uber and Grubhub have nice potential upside coming out of the pandemic regardless of a deal happening or not. I currently have an oversized position in Grubhub amongst my now 60+ individual stocks and mutual funds. Best of luck to all.

Disclosure: I am/we are long GRUB, AMZN. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.