Defense Is Still A Viable Offense

by Kurt ReimanSummary

- Canadian stocks have made an impressive recovery off the late March lows, leaving the market susceptible to a slower reopening and earnings recovery than is currently reflected in estimates.

- We therefore favor defensive factor attributes, such as minimum volatility and quality, for their resilience during periods of heightened uncertainty.

- Since the start of the outbreak, equity analysts have revised down their near-term earnings forecasts, but they also expect a swift recovery with little permanent loss of profitability.

By Kurt Reiman, Daniel Donato

Canadian stocks have made an impressive recovery off the late March lows, leaving the market susceptible to a slower reopening and earnings recovery than is currently reflected in estimates. We therefore favor defensive factor attributes, such as minimum volatility and quality, for their resilience during periods of heightened uncertainty.

Canadian equities have partially recovered from their late March lows. As of May 22, the S&P/TSX Composite Index (TSX) had risen 34% since the March 23 trough, rising for eight of the past nine weeks. Extraordinary policy measures, the reopening of economies, optimism around an experimental vaccine, a rebound in oil prices from highly depressed levels, and strong tech sector gains are all driving the Canadian equity market higher.

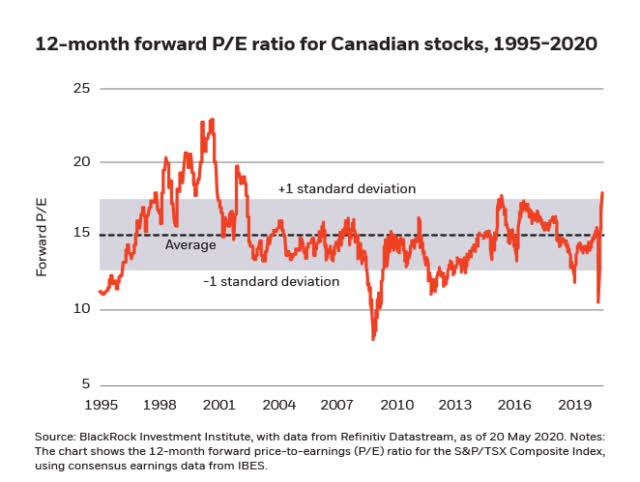

Although the TSX is still down 12% this year and 17% below the February highs, uncertainty over the path of the outbreak and the development of a vaccine, escalating U.S.-China tensions, and less forgiving valuations could make further gains more difficult. One reason equity valuations sit at historically elevated levels is that the gains in stocks have occurred alongside sharp earnings downgrades. Since the market topped in late February, fiscal year 2020 earnings estimates suffered a staggering 40% drop. Similarly, 2021 forecasts declined by nearly 20%, according to Refinitiv. As a result, The TSX currently trades at an 18x 12-month forward earnings multiple - the highest level in the past decade (see the chart below).

Two factors could potentially justify pricier stocks. First, 10-year Government of Canada bond yields have fallen to 0.51% from 1.35% in just three months, which in turn boosts the relative attractiveness of stocks and the value of the discounted future cash flow stream. Second, massive policy stimulus and recent moves to gradually lift lockdowns are prompting investors to look beyond the near-term earnings contraction and build confidence in an eventual recovery.

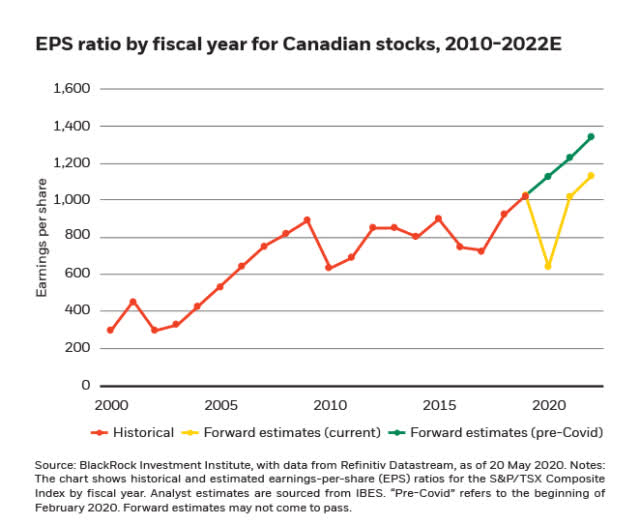

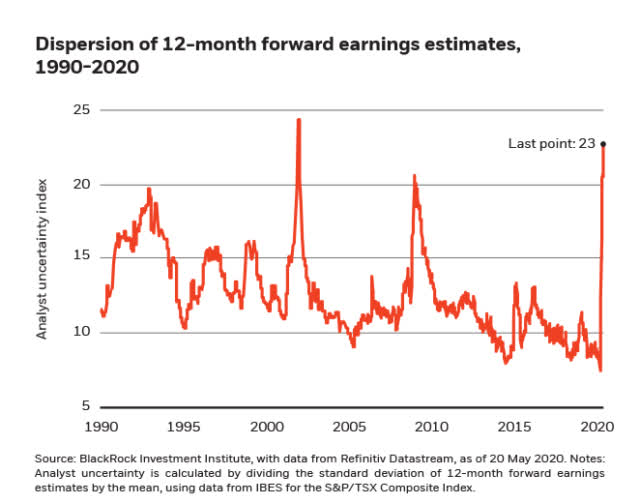

Since the start of the outbreak, equity analysts have revised down their near-term earnings forecasts, but they also expect a swift recovery with little permanent loss of profitability. For the current fiscal year, TSX earnings are expected to fall a whopping 40% (see the chart below) but then fully recover to 2019 levels by 2021. By 2022, the earnings shortfall relative to the "pre-COVID-19" growth trajectory is expected to narrow to ~15%, though average estimates should be taken with a grain of salt during periods of high uncertainty about the earnings path (see the chart below).

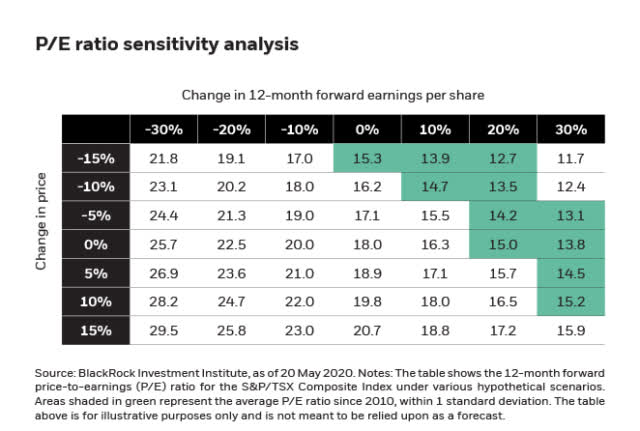

Asset prices and earnings estimates reflect a robust recovery. While the economy is arguably in a better position than it was a couple of months ago, thanks in part to coordinated policy efforts that help bridge cash flows and incomes, sharp multiple expansion makes it more challenging to generate future returns. For valuations to fall back in line with just average levels of 13-16x, 12-month forward earnings need to rise somewhere between 20-30% from here to justify current prices (see table below). Otherwise, prices would need to fall 15% to bring valuations in line with historical averages if earnings don't recover as rapidly as assumed in analyst expectations, in our view.

We prefer taking an up-in-quality stance within equities at a time of high macro uncertainty, specifically focusing on more defensive style factors, such as minimum volatility and quality, which tend to outperform during periods of economic slowdowns and elevated market volatility. These factor exposures are not cheap given their relative resilience during periods of financial market stress. However, they have cheapened relative to cyclicals since the March lows given that most of the multiple expansion in the TSX has come from the industrial, energy and consumer discretionary sectors. By contrast, we remain underweight the value factor, which focuses on companies with higher operating leverage that tend to perform better during decisive economic rebounds. From a regional lens, we are overweight U.S. equities for their relative quality bias and the strong policy response to date.

This post originally appeared on the BlackRock blog.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.