3M: Don't Buy This Dividend King And No, COVID-19 Is Not To Blame

by GrayBeard RetirementSummary

- MMM is a "Dividend King" with a 61-year streak of increasing dividends and has been a dividend growth investor favorite.

- First-quarter results were acceptable and do not appear to have been affected by COVID-19.

- MMM is responding to COVID-19 with cost savings initiatives and capital allocation strategy adjustments.

- Increasing debt and poor revenue growth over the last several years will lead to stunted dividend growth at best over the next few years.

Overview

3M (NYSE:MMM) has been a favorite among dividend-growth investors due to the company's history of raising dividends for 61 years. Over the last 10 years, the dividend growth had an outstanding CAGR of almost 11%. In this article, I take a look at MMM’s financial position and prospects for future dividend growth.

Company Description

CFRA has the following descriptive paragraph for 3M.

3M Co. is a global manufacturer operating a broadly diversified business. The firmclassifies its business into four reportable segments -- Safety & Industrial, Transportation & Electronics,Health Care, and Consumer. Most 3M products involve expertise in product development, manufacturing,and marketing, with many of the company's products involving some form of coating, sealant, adhesive,film or chemical additive that increases the product's overall functionality and usability for consumers.”

First-Quarter 2020 Earnings Call and Presentation

Recently MMM released first-quarter earnings and as you can imagine, the impacts and response to COVID-19 was one of the main topics.

COVID-19 Response

According to CEO Mike Roman, MMM doubled output of N95 respirators to about 100 million per month worldwide with 35 million of that being in the US. They were able to do this because they expanded capacity after the SARS in the early 2000s and were able to “turn on” unused capacity. They are also working to double annual production to 2 billion per year and 50 million in the US by June. They did not and will not raise prices during this time. As a citizen, I am pleased about that, as an investor, I have mixed feelings. I guess in the long term, the goodwill created by not raising prices will be better than a decimal point on this year’s revenue line.

Source: 2020 Q1 Earnings Presentation

MMM is taking actions to conserve cash. Additionally, at the time of the call, all critical sites were fully operational so if there is demand, MMM can respond. They embarked upon a cost reduction initiative that will garner $350-400 million in Q2 while share repurchases have been suspended. They also indicated the dividend a priority. They are adjusting capital expenditures by “prioritizing ‘organic’ investments” in R&D priority areas, and adjusting capital plans for projects experiencing slowdowns and intentionally delaying others.

First-quarter results

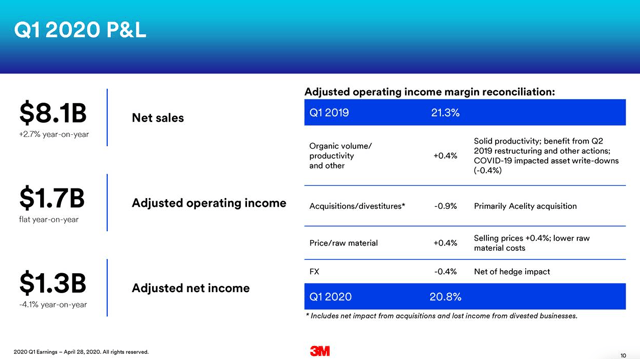

Source: 2020 Q1 Earnings Presentation

The discussion was led by CFO Nick Gangestad. He said diversity of the business in both end markets as well as geographically allowed for organic growth of 0.3% enterprise-wide with adjusted earnings of $2.16 per share and a 21% increase in cash flow. Company-wide Q1 sales were $8.1 billion and adjusted operating income was $1.7 billion for margin of almost 21%. It seems COVID-19 had minimal impact in Q1.

However, he said through late April revenue is down 13-17%. They expect ongoing weakness through Q2 in oral care, automotive, office supplies and general industry and are expecting Q2 to be the weakest of 2020. Due to the uncertainty, they withdrew 2020 guidance and will begin providing monthly updates in May. There was a subsequent announcement that sales were down 11% in April.

The cost savings actions for Q2 include reductions for items such as travel, external services, temporary workers and advertising. These are flexible savings actions that should carry through if sales remain depressed but could also be started back up if sales pick up and business needs warrant. Therefore, the impact of these is unknown beyond the second quarter.

2020 will not be a banner year, but MMM is responding operationally.

Debt and liquidity

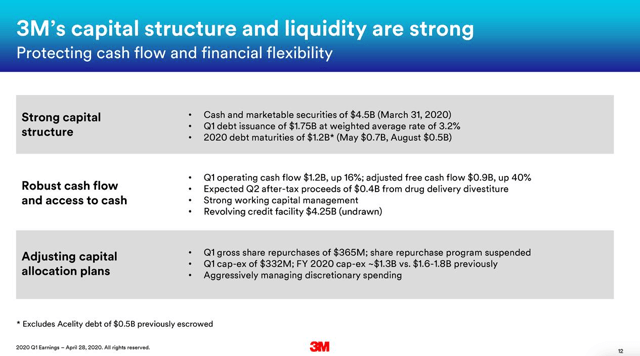

Here is the summary slide from the conference call presentation.

Source: 2020 Q1 Earnings Presentation

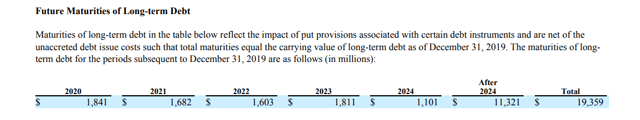

Let’s get into the details a bit. Here are the debt maturities listed in the 2019 10-K:

Source: MMM 2019 10-K

They also have another $0.8 billion drawn on expiring credit facilities. Let’s compare this to the sources of cash.

| As of the end of 2020 Q1 | $ Billions |

| Cash on hand | $4.25 |

| 5-year credit facility | $4.00 |

| Total funds available through 2021 | $8.25 |

| Drawn on expiring credit facilities | $0.80 |

| LTD due 2020 | $1.84 |

| LTD due 2021 | $1.68 |

| Total due now though 2021 | $4.32 |

| Excess cash available over debt due | $3.93 |

Source: Author calculation with information from 2019 10-K

MMM has $1.84 billion and $1.68 billion due in 2020 and 2021, respectively, for a total of $3.5 billion. Add another $0.8 billion in expiring credit facilities to bring the total due in 2020-2021 to $4.3 billion. Available funds to provide liquidity are $4.25 billion in cash and a $4.0 billion five-year credit revolver for a total of $8.25 billion. Additionally, there should be further cash from operations. MMM does not have a liquidity problem through at least 2021.

Financial statement review

| $ Millions | 2019 | 2018 | 2017 | 2016 | 2015 | Total |

| Cash From Operations | $7,070 | $6,439 | $6,240 | $6,662 | $6,420 | $32,831 |

| Dividends | ($3,316) | ($3,193) | ($2,803) | ($2,678) | ($2,561) | ($14,551) |

| CAPEX | ($1,699) | ($1,577) | ($1,373) | ($1,420) | ($1,461) | ($7,530) |

| Acquisitions | ($4,984) | $13 | ($2,023) | ($16) | ($2,914) | ($9,924) |

| Enterprise Cash Flow | $2,055 | $1,669 | $2,064 | $2,564 | $2,398 | $10,750 |

| Repurchase Stock | ($1,470) | ($4,780) | ($2,068) | ($3,753) | ($5,238) | ($17,309) |

| Change in cash | $585 | ($3,111) | ($4) | ($1,189) | ($2,840) | ($6,559) |

| Increase in LTD | $4,090 | $1,326 | $1,424 | $1,924 | $2,046 | $10,810 |

Data from financial statements on Seeking Alpha

5-year cash flow review. There has not been enough cash flow to fund CAPEX, dividends, acquisitions, and stock repurchases. By rough calculations, debt has been used to fund approximately 60% of share repurchases. If one has the opinion that acquisitions are funded by debt rather than repurchases, then about 110% of acquisitions are funded with debt. The debt increased by about 50% in 2019 with the acquisitions of M* Modal and Acelity.

Some more financial trends

| $ Millions | 2019 | 2018 | 2017 | 2016 | 2015 |

| Cash From Operations | $7,070 | $6,439 | $6,240 | $6,662 | $6,420 |

| Interest Expense | ($448) | ($350) | ($322) | ($199) | ($149) |

| CFO interest coverage | 15.8 | 18.4 | 19.4 | 33.5 | 43.1 |

Data from financial statements on Seeking Alpha

Interest coverage has decreased each year of the last 5 from 43.1x in 2015 down to 15.8x in 2019. This is not a good trend.

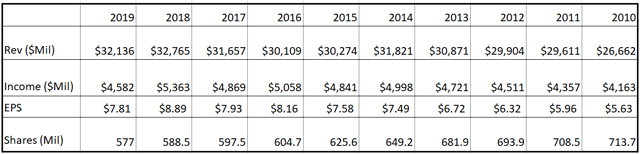

Data from the financial section of the MMM page on Seeking Alpha

Increases in revenue and net income have fallen short of increases in EPS.

| 9 yr increase in EPS | 39% |

| 9 yr increase in revenue | 21% |

| 9 yr increase in NI | 10% |

| 9 yr decrease in SO | 24% |

Source: Author Calculations

EPS percent increase has outpaced revenue increases by 100% and income increases by 200%. It seems the increases in EPS and dividends per share are driven mostly by share repurchases.

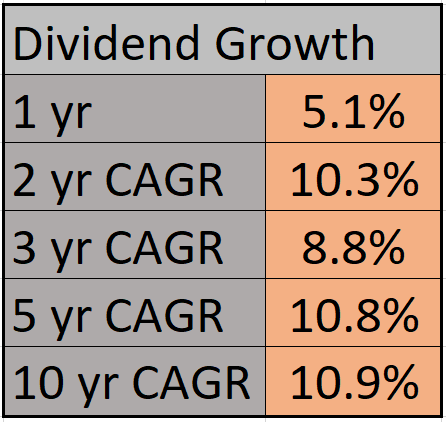

Dividend Growth

Source: Author

Over the last ten years, dividend growth has outpaced earnings growth, almost doubling the EPS payout ratio from 36.5% in 2010 to a projected 72% in 2020. Future dividend growth will be more in line with earnings growth, and perhaps lower if MMM is to bring the payout ratio closer to historical averages. The dividend was increased only 2% in 2020 after a 5% increase in 2019 as compared to almost 11% CAGR increase over the previous five and ten years. As noted in the section above, earnings increases have been driven by share purchases. Dividend increases have been driven by share purchases and payout expansion. The range of forward EPS estimates is anywhere from 1% to 8%. Now, couple this with the suspension of share purchases and if MMM does not achieve the higher end of that range for revenue and net income (historically they haven’t over the last 5-10 years), dividend growth will be stunted at best going forward. Dividend growth investors looking for dividend growth above 1-3% over the next five years should probably look elsewhere.

Valuation

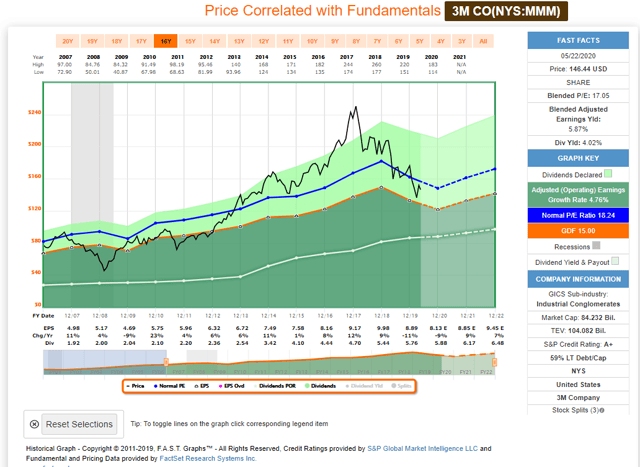

Source: FASTGraphs

The FASTGraphs chart above shows a valuation range between the orange and blue lines or somewhere between $121 and $148.

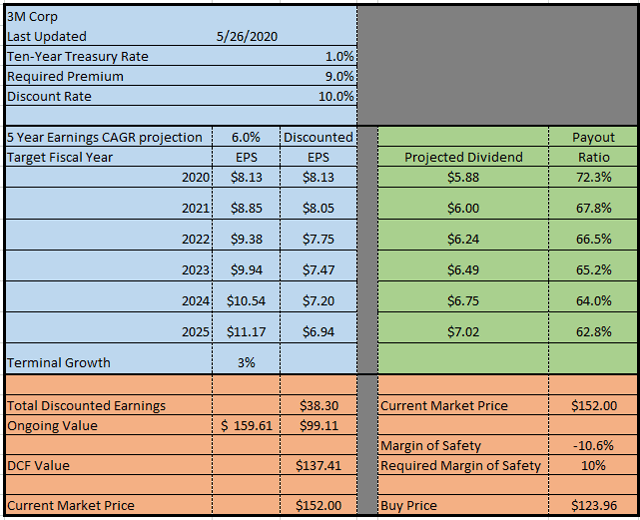

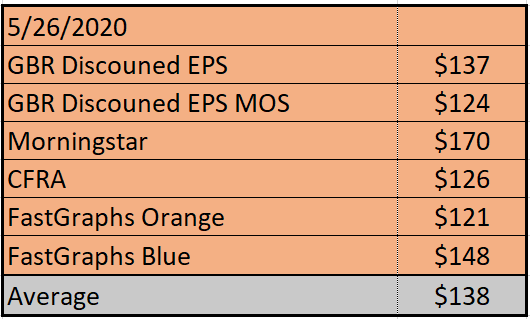

Source: Author

Using generous 6% annual increases in EPS after 2021 in the DCF valuation shows a fair value at about $138 and a margin of safety buy price of $123. Morningstar (5/11/2020) shows fair value of $170 and CFRA (5/11/2020) fair value is listed at $126.

Source: Author

Average valuation from the cited resources is $138. This may be a little skewed because the Morningstar valuation is much significantly higher than the rest. Earnings projections from Thomson Reuters are for about 2% over the next 5 years, so value investors should have a price target around $120 or lower.

Summary

MMM is an iconic American company with a 61-year streak of increasing dividends. However, over the last several years, increases in revenue have been meager. Earnings and dividends per share increases have been driven primarily by share repurchases. Additionally, those share repurchases were made in large part by the issuance of debt. Also, the payout ratio has almost doubled and is now high at 72%. MMM has suspended share purchases due to the COVID-19 pandemic, thus removing one driver (although an undesirable one) of dividend increases. While I do not expect MMM to cut or freeze the dividend, investors should expect only meager dividend increases in the low single-digit range. The shares are also overvalued, and I see no compelling reason to purchase shares of MMM. I will hold for now but will consider selling if the valuation continues to rise out of line with the fundamentals.

If you enjoyed this article and wish to receive updates on our latest research, click "Follow" next to GrayBeard Retirement at the top of this article.

Disclosure: I am/we are long MMM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.