Protecting the Dividend at Any Cost Is a Real Risk to Exxon Mobil Stock

Exxon Mobil will go to every length to avoid slashing dividends this year

Exxon Mobil (NYSE:XOM), the world’s largest energy producer, hasn’t had a great year. Exxon Mobil stock has shed 36.1% of its value since December, and it certainly isn’t alone.

The novel coronavirus pandemic has wreaked havoc across all markets, but perhaps the most severely affected sector is the oil industry. Plummeting oil prices and oversupply has resulted in a 37% reduction in the Dow Jones Oil & Gas index since December.

Exxon continues to pique the interest investors due to the consistent growth in its dividends and its long-term appeal. Unfortunately for Exxon’s investors, their dividend and long term perspectives about the XOM stock are likely to take a hit this year.

The company has already announced that it will be freezing its dividend for the first time in 13 years amidst the market uncertainty. Also, its significant debt load will significantly impact its long term outlook.

Recent Performance of Exxon Mobil Stock

For the first time in 32 years, Exxon reported a loss of $610 million, or $0.14 per share. Revenues were down 11.7% to the year-ago period and 16.4% for the past quarter.

Production volumes rose during the quarter due to its Permian Basin and Guyana Oil resources. However, the increase in the production volumes was partly offset by the lower oil prices and refining margins. Additionally, its depreciation and depletion expenses rose by 28% since the previous quarter.

These effects can be partly attributed to the crippling effects of the pandemic, but for the past five years, the company has been on a downward spiral as far as earnings are concerned.

Its EPS and revenues peaked in 2011, and in 2012 when we witnessed the highest oil prices of the decade. For the next five years, revenues reduced by a considerable margin after recovering in 2018. However, since then the downward trend continues and it seems that it will carry-on for the foreseeable future.

It seems as though, in maintaining its track record of increasing dividends, the company has compromised on its profitability and free cash flows. Therefore, there are several question marks about its growth, profitability, and sustainability of its dividend model.

The Dividend Problem

Exxon Mobil has a dividend history that is second to none, which has consistently grown in the past 37 years. However, the company recently announced that it was freezing its dividend for the first time in 13 years.

Royal Dutch Shell already announced that it would slash its dividend by 66%, which has investors concerned about the future.

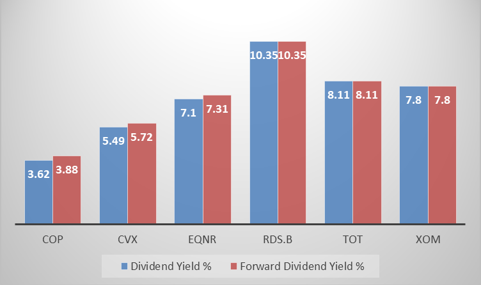

Dividend yields in the oil industry have dipped but are still impressive in comparison to other sectors.

XOM stock is currently ranked third in terms of its dividend yields in the industry. However, the main question that potential investors need to consider is how much of their dividend is being paid from cheap debt.

Financial leverage for Exxon increased by 3% in its latest quarter, after raising an additional $8.5 billion on March 17. It has raised another $9.5 billion on April 13, which represents a total increase of 38% in its debt load since December last year.

The majority of this debt is being used to cover its massive dividend payments. This a recipe for disaster considering how every company is looking to preserve its liquidity at this time.

Long Term Troubles

Exxon Mobil is a riskier company than it was a few years ago and been a consistent underperformer. The oil industry is in a rut, and a market pull-back is uncertain at this point. Therefore, there is a lot to contemplate about Exxon’s management in these testing times.

Perhaps the best place to start is for the company to preserve its financial flexibility. In doing so, CEO Darren Woods announced a 30% reduction in its capital spending and a 15% reduction in operational expenses.

Also, Exxon and Chevron Corp. (NYSE:CVX) have announced a collective shut-in of 800,000 barrels per day due to the depressed demand and plunging crude oil prices.

However, the company remains adamant about protecting its dividend, but in doing so, it would have to consider massive reductions in capital expenditures and to take up additional debt. This is a risky strategy that might significantly hamper its operational capabilities in the future.

Bottom Line on Exxon Mobil Stock

Exxon Mobil finds itself in a precarious position, heading into the second quarter. Analysts expect the loss per share to further drop to $0.62 in the upcoming quarter.

It seems that the company is still resolute about its dividend payouts, which continues to add to its debt load. Additionally, it’s sacrificing its capital spending, which is a crucial element for success in the industry. Therefore, I’m bearish on XOM stock, considering its riskiness at this point.

As of this writing, Muslim Farooque did not hold a position in any of the aforementioned securities.