In A Perfect World, Apple Buys Spotify

by Rocco PendolaSummary

- In a crowded field of sameness, Apple Music and Spotify have emerged as streaming's top dogs.

- From numbers to execution to revenue potential, nobody comes close to this duo's dominance.

- Whether they seize the opportunity together or apart, Apple Music and Spotify will remain leaders in the space.

- Investors can't go wrong with either name, based on straightforward streaming dominance alone.

Source: Author's Google Pixel 3a

Back in the day (not that long ago), I used Pandora and iTunes almost exclusively. iTunes when I knew exactly what I wanted to listen to, and Pandora when I was in that auditory wasteland of indecisiveness. As much as I hate to admit this, I stopped using iTunes shortly before Apple (AAPL) shut it down because I was tired of paying for music.

Apple had already blown up the record industry's model of forcing consumers to buy entire albums. Even still, it didn't make financial sense to drop a buck (or slightly more) per song when I could pay a nominal fee each month for unlimited listening. That's when I became an avid Spotify (SPOT) user.

Now, I split my listening between Sirius XM (NASDAQ:SIRI) and Spotify. Though, I probably use Spotify 65 to 75 percent of the time. But the amount of time I'm spending with Spotify continues to increase. This increase started because nobody executes the music component of streaming as well as Spotify. Spotify offers superior on-demand listening, curated playlists, and radio-like experiences. It has cultivated an environment (or an ecosystem?) that makes Pandora (sad as it is for me to say) and terrestrial radio (also sad) look weak.

As Spotify evolved over the last few years, it added other elements that continue to contribute to my increased time spent listening.

First, Spotify started putting news in front of me, via NPR. I took the bait and started listening regularly. Then Spotify began sneaking NPR News into the mostly music playlists it curates for me. Second, Spotify increasingly populated my home screen with podcasts. Now, I listen to more podcasts than I ever have. And, unlike other services, Spotify doesn't simply optimize my mobile experience. It does just as fantastic a job on my other primary listening platform, Roku (ROKU). That says a lot compared to the sad state of so many other apps on Roku, relative to their mobile brothers.

All around your island/There's a barricadeThat keeps out the danger/That holds in the pain - Tom Petty, Walls (Circus)

Spotify: A Service, Platform, And Ecosystem

Attract users to your service. Increase the time they spend with you. Make your service something bigger. Turn it into what starts to feel like its own platform or ecosystem. Build a wall (in the wholly positive sense of the word). Make it sticky:

A truly sticky service is a platform in its own right, one that's ecosystem agnostic but lets users pick up where they left off when they switch from device to device, and from work to home. But building sticky platforms isn't easy, as two recent examples show (emphasis added).

That's an excerpt from a 2014 ZDNet article. I liked the article so much at the time I saved it. It remains relevant today. However, great services such as Spotify have not only blurred the lines between, but redefined terms such as service, platform, and ecosystem.

In the above-linked article, the author, Simon Bisson, goes on to distinguish between BlackBerry's (NYSE:BB) failure to unbundle its messaging service, BBM, from its BlackBerry platform and Microsoft's (MSFT) success in offering its service, the suite of Office products, on a platform other than its own, Apple's iOS.

Let's - no pun intended - unbundle the meaning of service, platform, and ecosystem. The services are BBM, Office, and Spotify. The platforms are BlackBerry and Microsoft. The ecosystems encompass the entire walled off world of, say, all the BlackBerry services working in concert with all BlackBerry platforms and hardware devices. However, thinking in the present day, Spotify blows up any distinctions between those words.

You can call Spotify a service itself, but it's more like a collection of complementary services (e.g., music, news, podcasts). While you can access it from any number of independent platforms, Spotify has become a platform itself. I don't differentiate the source that delivers Spotify to me, whether it's my Android phone (Google Pixel), Android Auto (which I guess is a service or platform inside the Android ecosystem), or Roku. Similar to how Google is a verb, Spotify has emerged as its own audio entertainment ecosystem. All it lacks is its own hardware. But does it really need its own hardware?

This Is Where Apple (Could) Come In

Admittedly, I once loved them. But, these days, I dislike <insert company name here> should buy <insert company name here> articles. My philosophy on these types of articles is the same as it is on anything I or anyone else, for that matter, writes. They have to:

- present a feasible real world proposition; and/or

- add theoretical value to the larger discussion; and/or

- further understanding of the larger matter at hand.

I think the notion of Apple buying Spotify, even if the respective companies would be hard-pressed to even discuss it, qualifies on all three counts. Because you can make a strong case that each company could benefit from combining or, at the very least, partnering. Sounds crazy to discuss two seemingly fierce competitors "partnering," but if the COVID-19 pandemic has taught me anything, it's to not discount any eventuality.

Let's consider what we know about Spotify and Apple Music's subscriber numbers.

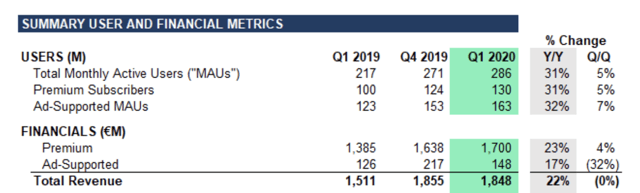

Source: Spotify Q1 2020 shareholder letter

Growing by leaps and bounds, Spotify now has roughly 286 million monthly active users and 130 million paid subscribers worldwide. We know less about Apple Music because Apple refuses to tell us as much as Spotify does. But here's what we do know, courtesy of 9to5Mac:

Spotify paid subscribers are likely not quite as far ahead of Apple as they appear. The Cupertino company only reports subscriber numbers for Apple Music when they hit increments of 10M: it previously reported 30M, 40M, 50M and 60M. From this, we can infer that the number has not yet hit 70M, though it is likely very close to this now - my money would be on an announcement from Apple very soon.

While Apple Music might be closer to Spotify than it appears, it's not growing nearly as fast. If Apple hits 70 million subscribers today, it took 11 months to grow that base by 16.7 percent. That's not a knock on Apple Music. After all, it certainly contributes to Apple's sick (in the wholly positive sense of the word) service revenue of $13.3 billion, as of FYQ2 2020.

In terms of revenue, a massive opportunity to generate more from streaming still exists, according to Spotify Founder and CEO Daniel Ek (via Rolling Stone):

When I look at all of the paid subscriptions combined today, the IFPI has that number at, call it, $12 billion. Then you look at radio and the entire US radio industry in 2017 or 2018, on just the ad side, was $18 billion - that's larger than the entire streaming [business] for the music industry (emphasis added).

And another thought from Ek excerpted in the same article:

After referencing AM/FM radio listeners and the "billion-user opportunity" they represent for Spotify around the world, Ek told Bloomberg: "All the people consuming radio in the US today [comprise] well north of 80% of the population. That's the opportunity we're going after, and we still think it's early days (emphasis added).

That last sentence from Ek is so important. It was, to the letter, Pandora's mantra before its founding members and other original executives exited and things, sadly, went south for the company. To go after the terrestrial radio advertising market. Pandora wasn't wrong about this. It did a formidable job going after this market. It simply wasn't able to finish the job for a whole host of reasons. (And I know Pandora still exists. I like it under the Sirius XM umbrella. I just don't see it competing effectively with Apple or Spotify going forward).

By signing massive deals for content, as it just did with podcaster Joe Rogan, Spotify continues to take significant steps towards capturing more of the radio advertising market. Even if the Rogan deal doesn't directly generate ad revenue (we don't know enough about the details of the contract to say for sure), it contributes to the objective. Rogan helps make Spotify's ecosystem stickier, opening the door to further subscription growth and an easier sale for Spotify's ad team.

Apple does the same or similar. Imagine if Apple and Spotify did it together, backed by, in my opinion, Spotify's superior service or platform (whatever you want to call it) and Apple's second-to-none (though I love my Pixel!) hardware meets services ecosystem. It's a deal ripe for a Presidential Twitter (TWTR) rant.

Together Or Apart, Apple And Spotify Are Great For The Music Industry And Investors

But I don't think the competition an Apple acquisition of Spotify (or some sort of partnership) would wipe out would hurt innovation at either company.

Apple and Spotify could help one another in so many ways. It's no different than Facebook (NASDAQ:FB) buying Instagram. You can leave Apple Music and Spotify separate (like Facebook and Instagram), or you could combine the two services (calling it Spotify by Apple). In either scenario, you give the combined Apple and Spotify sales teams the ability to package the two streaming services together in what would be the most powerful and endlessly creative sales pitches the advertising world has ever seen.

And, of course, Spotify could become one of the top features on Apple devices, side-by-by with or without Apple Music. Again, it doesn't matter.

Remember, in the early days of iPhone, Pandora and Apple, for all intents and purposes, partnered. If you recall, Steve Jobs welcomed Pandora co-founder Tim Westergren to the stage at a 2010 iPhone event to show how Pandora functions on the device and talk up the success of the partnership.

Competition might appear to suffer on the surface, but innovation certainly would not. It would flourish. And that's a good deal for everyone, particularly listeners. If nothing else, the ability these services have and will continue to develop to target and tailor advertising and promotions to subsets of users would be mind-blowing in scope, scale, and effectiveness.

Together or apart, Apple Music and Spotify also benefit the music industry. They do that today. And they'll continue to going forward. If the music industry was smart, it would have abandoned the royalty fight long ago in favor of an approach that leaves that money on the table in exchange for aggressive partnership and promotion.

Together, Apple Music and Spotify could not only command better royalty deals, but they could provide even more value to smaller and independent musicians than they already do. This in addition to what the combination could accomplish for the larger music industrial complex.

Ever since the days when I was covering and bullish Pandora, small and independent artist objections to streaming made me laugh. Indie artists have always had a weak argument.

In the old days of record sales and radio airplay, most were as poor as they are today and never received spins on broadcast radio. Thanks to Pandora initially and now, more so, Apple Music and Spotify, the opportunity indies stand to seize has never been greater. They act like they once took in a whole bunch of money and streaming took that away. Not the case. They were always poor.

Streaming gives them the exposure they never had. It's as tough of a racket as it has ever been, but at least, streaming affords independent acts the opportunity to actually be heard. Your chance at success if you make music your career has always been slim. Streaming didn't make that the case. Rather, streaming gives the dreamers a fighting chance. It gives the truly talented and/or savvy a viable platform from which they can attempt to use as a springboard for success.

That said, as part of their efforts to steal ad dollars from local radio markets across the globe (particularly in the U.S.), Apple Music and Spotify should do everything in their power to take local bands along for the ride. Pandora started doing exactly this before it hit obstacles it could not overcome. Pandora's acquisition of Ticketfly (which I predicted) was supposed to aid this process. It never materialized. But it can now.

In addition to advertising, Apple Music and Spotify have the ability (and I would argue a moral obligation) to wrestle the business of promotion and ticketing away from the major players. Tech companies can do more for artists - big, small, and everywhere in between - than old school bureaucracies such as Ticketmaster (LYV) ever would. It's not in the latter's culture. It is Apple Music and Spotify's culture.

Bottom line - opportunity abounds in myriad directions. I'm excited to watch Apple Music and Spotify battle over it. I would be even more excited to watch the two crush the opportunity together.

Conclusion

Today, I would buy Apple stock on the future potential of its Services segment alone. I would buy Spotify because, over the next year or two, it could make its current clip of 30-plus percent year-over-year subscriber growth seem small.

While it's never a good idea to buy a stock solely on its attractiveness as an M&A target, Spotify absolutely is one of those attractive targets. Apple doesn't make massive acquisitions all that often. However, Tim Cook would likely rue the day he let a competitor buy Spotify. It would be a shame because the best synergies exist in a marriage between Apple and Spotify.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.