Hidden Stock Market Gems: Waters Corporation

by Daniel SchönbergerSummary

- Waters Corporation is a technology company that is manufacturing and selling analytical laboratory instruments and software.

- Growth potential for the industry and a wide economic moat around Waters Corporation should lead to a stable long-term performance.

- With an intrinsic value of $163, Waters Corporation is still overvalued, and when looking at past bear markets, we still have a long way to go down.

A few days ago, I started my series “Hidden Stock Market Gems” in which I am describing several publicly traded companies that don’t get much attention on Seeking Alpha although these are companies with a stable business model and a wide economic moat around the business. This leads not only to high growth rates for the business - in most cases - but also to an outperformance of the stock compared to the major indices.

In this article, I will continue the series with Waters Corporation (WAT), which has a market capitalization of $11.5 billion and is listed in the S&P 500 (SPY).

Business Description

Waters Corporation is a technology company (sometimes also called a life science company), that is manufacturing and selling analytical laboratory instruments and software. It is located in the United States, was founded in 1958 by James Logan Waters and had its IPO in November 1995.

After an evaluation of the business in the recent past, Waters is now reporting in two operating segments:

- Waters - This segment is primarily designing, manufacturing and selling liquid chromatography (referred to as LC) and mass spectrometry (referred to as MS) technology systems. LC is a technique to detect, identify, monitor or measure the chemical, physical and biological composition of materials. MS is employed in drug discovery and development (for example, in clinical trial testing, nutritional safety analysis or environmental testing).

- TA - This segment focuses on designing, manufacturing and selling thermal analysis instruments, which are allowing the measurement of physical properties of substances as a function of temperature. The instruments can be split up into three categories: thermal analysis, rheometry and calorimetry machines.

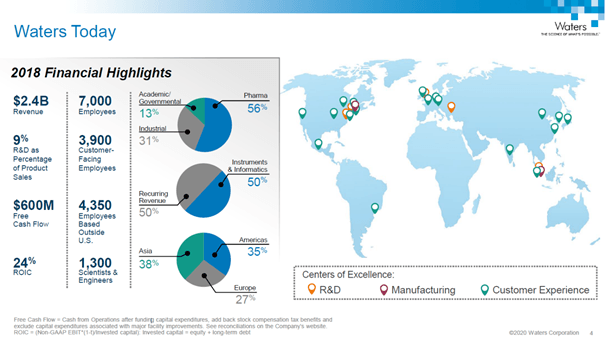

Waters Corp.’s customers are mostly pharmaceutical companies, which were responsible for 56% of its revenue in 2018. This includes multinational pharmaceutical companies, generic drug manufacturers, contract research organizations (CRO) and biotechnology companies. About 31% of revenue stemmed from other industrial organizations like chemical manufacturers, polymer manufacturers, food and beverage companies and environmental testing laboratories. And finally, 13% of revenue came from government agencies and academic institutions.

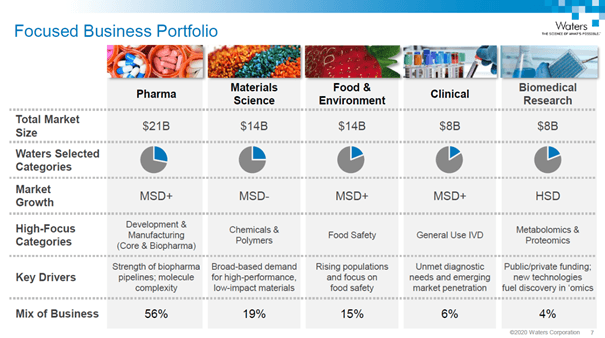

(Source: Waters Investor Presentation)

Today, the company has about 7,500 employees and about 1,300 of them are scientists and engineers. About 3,900 employees are field representatives and about half of the company’s revenue is recurring revenue as it stems from services. Water’s services are responsible for 30% of total revenue, and this is the sale of support plans, demand services, spare parts, customer performance validation or customer training. In the TA segment, service sales are primarily derived from the sale of support plans, replacement parts and billed labor fees associated with the repair, maintenance and upgrade of installed systems.

As one might imagine at that point, research & development is playing an important role and is vital for the success of the company. Waters Corp. is also spending heavily on research and development, and in 2018, the expenditures on R&D were $143 million, which is almost 6% of the company’s revenue.

Balance Sheet and Debt

As I mentioned in several articles in the past, liquidity and solvency should always be an ingredient in a good financial analysis, but right now, those aspects are extremely important. When looking at liquidity, we see cash and cash equivalents of $390 million, which should be enough to weather turbulences in the coming quarters.

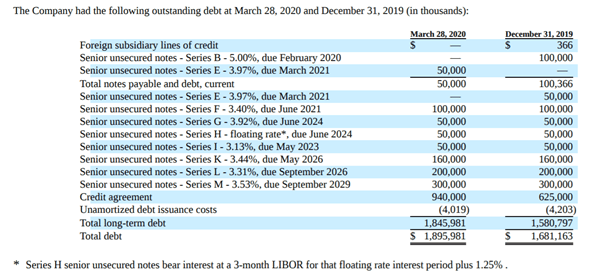

But when looking at the company's solvency, we have long-term debt of $1,846 million on its balance sheet as well as a total stockholders’ deficit of $338 million, which is far from great. We therefore can’t calculate a meaningful debt-equity-ratio for Waters Corp., but we can compare the outstanding debt to the annual operating income to get a feeling how long it would take to repay the debt. In the last four quarters, Waters Corp. generated about $650 million in operating income, and when also considering the cash on the balance sheet, it would take a little less than two and a half years to repay the debt, which is acceptable. In the next few years, the company has to repay outstanding debt in 2021 ($150 million) and in 2023 ($50 million), which should be manageable.

(Source: Waters Corp. 10-Q)

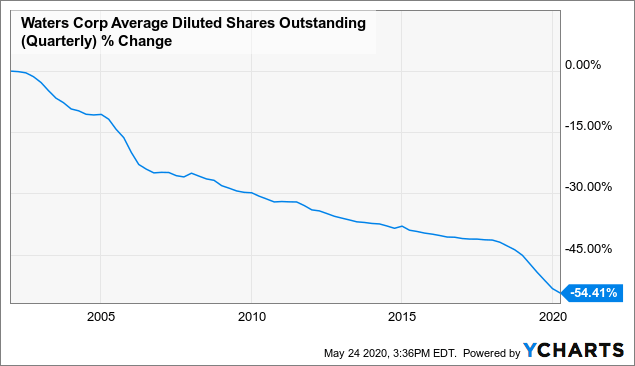

We also have to mention that Waters Corp. has treasury stock of $8,789 million on its balance sheet, which is the result of aggressive share buybacks over the past few years by management.

Share Buybacks

So far, the company is not paying a dividend, but we mentioned above that it is buying back shares at an aggressive pace. Since 2002, Waters Corp. decreased the number of outstanding shares almost 55%. In the last ten years, the number of outstanding shares decreased 33.5%, and especially in the last few years, the company decreased the number of outstanding shares from 78 million in 2018 to about 62 million right now.

Data by YCharts

In the first quarter of 2020, management still repurchased about 800,000 shares worth $187 million, but Waters Corp. management - as with many other companies - has temporarily paused share repurchases until it sees a more stable and predictable business environment.

Growth

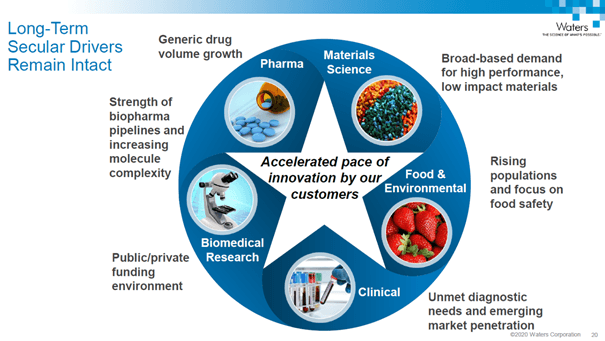

While debt levels are definitely important right now, many investors focus on one decisive aspect: the growth potential of a company. And the above-mentioned share buybacks are contributing to EPS growth, but we can be confident that Waters Corp. will be able to grow with a similar pace as in the past - and not only due to share buybacks. First of all, the company will profit by strong underlying trends, and so far, these long-term secular drivers remain intact. One of those strong drivers is the aging society - especially in the Western Hemisphere and in highly developed countries (like Japan, United States or many European countries). And an aging society will need more and more pharmaceuticals and drugs, and such an increasing demand will also increase the demand for Waters Corp.’s products, as pharmaceutical companies have to increase research & development and will need more laboratory equipment.

But growth can also stem from the emerging markets, which are responsible for almost 40% of total revenue. These countries will increase the spending on healthcare and regulations will increase with a much higher pace than in developed nations and this will lead to a higher demand for laboratory equipment. Especially China presents a huge opportunity for Waters Corporation and during the last five years the CAGR was 16% and management is confident that growth can continue with a similar high pace. Between 2013 and 2018, India has also been growing 9% annually on average.

An increased focus on food safety as well as a rising population will also increase the demand from the food & environmental segment. The generic drug volume growth might also be positive for Waters Corporation.

(Source: Waters Investor Presentation)

When looking at the five important business segments – pharma, materials science, food & environment, clinical and biomedical research – all markets are expected to grow at least in the mid-single digits (NYSE:MSD) and biomedical research is even expected to grow in the high-single digits (HSD). Aside from the total market growing, Waters Corporation can also grow by taking market share. Even in the pharma segment, which is responsible for 56% of the company’s revenue, the market share is only slightly above one fourth of the total market.

(Source: Waters Investor Presentation)

Economic Moat

But high growth potential alone is not enough as new competitors can enter the industry or existing competitors might gain market share. Therefore, a wide moat protecting the business is extremely important and in case of Waters Corporation it stems from switching costs and these switching costs stem from several different aspects. First of all, when researchers (for example of a pharmaceutical company) start working on a new drug and are for example using Water’s mass spectrometry or liquid chromatography equipment, they will most likely continue to use the same equipment during the entire development process. And for the successful development process of a drug, which can take as long as one decade, researchers will be working with the equipment for a long time. During this process, the instruments become ingrained in the drug-manufacturing process, which is automatically leading to high switching costs.

Additionally, these machines are rather expensive (a new LC machine can cost $100,000) and although this might seem like small amounts for big pharmaceutical companies, nobody will replace these machines if he doesn’t have to before the end of the life cycle or before substantially better instruments are on the market and this might take several years as the upgrade cycles for these products are rather long (about five to seven years).

And even more important than the financial costs that arise from buying new equipment are the procedural switching costs that arise from the steep learning costs and the time it would take to train several lab technicians on how to use a new machine. This is leading to high personal costs, especially if the lab equipment has a steep learning curve and it will also result in lost time and decreased productivity. These high switching costs that arise from high learning costs might not only prevent switching to the product of a competitor during the lifetime of the laboratory instrument, but might also lead to buying the next products from Waters Corporation again as the products might be similar and the learning curve for the new products might be not as steep as with a competitors product.

The high switching costs are not only leading to new purchases from Waters Corporation after the upgrade cycle is over. Much more important is the revenue Waters Corporation can generate during these five to seven years. We mentioned above that half of the company’s revenue is recurring and a big part of that recurring revenue is from services like maintenance, customer training, spare parts and the billed labor fees associated with repair and maintenance or the upgrade of installed systems. And for these services, Waters Corporation can easily increase the prices annually in the low single digits without losing customers. Even if customers are annoyed with these price increases, paying 2-3% higher fees every year is no comparison to buying a new laboratory equipment from a competitor. The switching costs are therefore simply too high and Waters Corporation won’t lose many customers.

Intrinsic Value Calculation

In order to decide at which price we can invest in Waters Corp, we have to calculate the intrinsic value of the company and the price at which we can invest in the stock. When using a discount cash flow analysis, we need assumptions for the free cash flow in the years to come. Therefore, we are looking at the numbers of the last decade and we are especially focusing on the last two recessions as they tell us how stable the business actually is in times of distress.

The most difficult job probably is to estimate the free cash flow for 2020 and 2021 (the recession years) as we don’t really know how hard companies will be hit. In the first quarter, company sales declined about 8% in constant currency and adjusted earnings per share declined 28%. The biggest negative impact on the business came from China, where sales declined 45%. We have to assume the second quarter to be much worse and management is also expecting that purchasing activity in governmental and academic markets may lag corporate customers and it might take time, but management is also expecting higher growth after a return back to normal (maybe in 2021 or 2022) by the release of previously budgeted spending.

And when looking at the last two recessions, we also see a very stable business. During the financial crisis, revenue decreased only in one year – in 2009. But the decrease was “only” 4.9% YoY and in 2008, revenue could still increase 6.9% and in 2010, revenue could already increase 9.6% again. And although revenue declined in 2009, net income and earnings per share could be increased every single year – even in 2009 where EPS increased 0.6% YoY. When looking at the 2002/2003 recession (after the dotcom bubble busted), Waters Corporation could increase its revenue every single year between 1999 and 2003 with 2002 being the year with the slowest growth rate (only 3.6% growth YoY). Net income however declined pretty steep in 2001 as it actually declined 21.2% YoY.

Keeping the steep declines of the first quarter in mind and assuming the second quarter will be worse, I will assume a 50% decline in free cash flow for 2020 compared to 2019 ($479 million). For 2021 I expect 50% growth compared to 2020 as we can expect many institutions to buy and the deferred buying decisions to be fulfilled in 2021.

When trying to estimate what growth rates are realistic over the long run, we can look at the growth numbers in the past. When looking the long term, we have numbers going back to 1995 – the year of the IPO. Over the last 24 years, revenue increased about 8.6% annually on average and therefore much higher than in the last decade (during the last ten years, revenue increased 5.5% on average annually). When looking at earnings per share in the same timeframe, we see an impressive CAGR of 16.9% since 1995 (during the last ten years, earnings per share growth was 9.65% on average annually). And finally, free cash flow increased with a CAGR of 10.9% since 1995, in the last ten years free cash flow increased only with a CAGR of 5.1%.

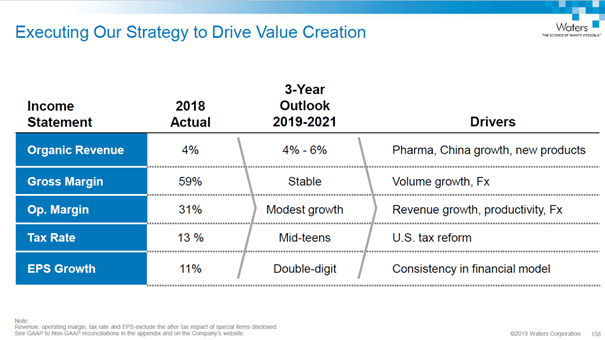

From 2022 going forward (till the end of the first decade), I will assume 9% free cash flow growth annually. Considering that revenue growth slowed down over the last few years, I would assume 5-6% revenue growth being realistic. However, after the steep decline we expect for 2020 and 2021, we can assume that growth rates might be a bit higher as we are starting from a “low basis”. And although the share repurchase program might be suspended for a few quarters, Waters Corporation will continue to repurchase shares as it has done in the past and about 2-3% additional growth will stem from buybacks. We can also assume about 1% growth coming from increased profitability and improved margins over time. Therefore 9% growth seems realistic and in 2019, management expected still double-digit growth for EPS. For perpetuity, I will assume 6% growth, which seems to be realistic as we never know what might happen over several decades.

(Source: Waters Investor Presentation)

This leads to an intrinsic value of $163.38 making Waters Corp still a bit overvalued right now. And assuming 20% margin of safety as always due to the high levels of uncertainty we are seeing right now, we get a preferred entry point of $130.70.

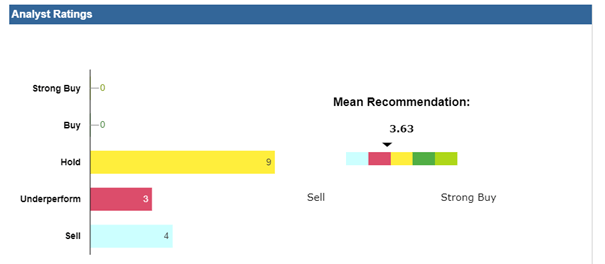

At this point, I also like to mention, that analysts seem to be rather bearish about Waters Corp right now. Out of 16 recommendations we find no “Buy” or “Strong Buy”, but instead 9 “Hold” (which is understandable given the current market conditions) and also 3 “Underperform” and even 4 “Sell” recommendations. Considering, that analysts are in most cases too optimistic and are assigning sell recommendations rather seldom, they seem to be very pessimistic about Waters Corp.

But we also know, that most ratings are intended for the short-term performance of a stock (about one year) and not really for the long term. And I would also expect that the stock is not a really good investment over the next few quarters (like many, many other stocks), but I would assume Waters Corp is a good investment over the long run – especially if the stock is dropping further.

(Source: Waters Investor Relations)

Technical Analysis

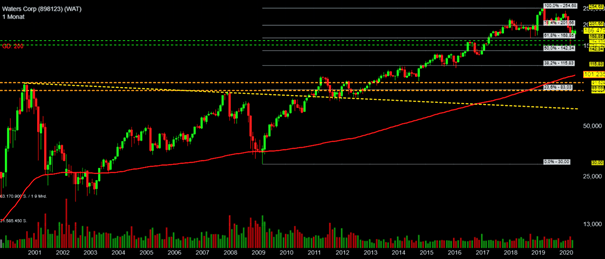

And aside from an intrinsic value calculation based on fundamental aspects, we are also looking closer at the stock’s chart and include a little bit of technical analysis. When looking at the chart, we find several support levels for the stock (and of course, this is also depending on the selection of indicators we are using).

One bigger support level can be found between $154 and $169. In this area we find the lows of March 2020 around $154 as well as the highs of 2016 around $163. And at $169 we also find the 61% Fibonacci retracement. And this support level would also go hand in hand with our intrinsic value calculation.

(Source: Own work created with Traderfox)

If that support level should not hold, we have the 50% Fibonacci retracement at around $142, and following that another strong support at $116 where we find several highs from 2014, the lows from 2015 and 2016 as well as the 38% Fibonacci retracement. We also have the 200-month simple moving average that is currently at $101.20 and is constantly moving higher. In about one year (depending on how long a potential bear market and decline might last), it would be closer to that level and providing additional support.

At this point, we would be already below our preferred entry point, but if the stock should drop lower, we find another strong support level between $83 and $92. In this area, we find the highs of 2000 (at $91.70) and the highs of 2007 (at $83), as well as the 23% Fibonacci retracement at $83. And finally, we have the golden trend line connecting the highs of 2000 and 2007 as well as the lows of 2012 and 2013.

While many might claim right now that it is completely unrealistic for the stock to drop so low, looking at the last two bear markets might help. During the Financial Crisis, the stock fell 64%, and in the bear market following the dotcom bubble, the stock declined even 80.5%. Considering a high of $255.50 for Waters Corp. several months ago, a decline of 64% would lead to a stock price of $92 and a decline of 80% would lead to a stock price around $50. And even if it seems extreme, double-digit stock prices for Waters Corp. are not unrealistic.

Conclusion

Waters Corp. doesn’t see the high growth rates of other companies, and we should not expect double-digit growth, for example (although high-single digit growth seems possible). But the company has a wide economic moat around its business and is performing with high stability and consistency, making it a good long-term investment. The balance sheet is not perfect, but we should also not be concerned about liquidity and solvency. And while the company doesn’t pay a dividend so far, it buys back shares with an aggressive pace and the stock is a bit overvalued at this point. However, a steep decline is not unlikely - especially when looking at the stock during past recessions.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.