Spotify: Don't Buy The Rogan Rally

by Manhole FinancialSummary

- The ad-supported segment of the company lost money in Q1.

- Podcast usage is lagging all other media while streaming surges from stay-at-home orders.

- User growth is strong but misleading.

- Technical setup implies downside potential.

Despite a noticeable pullback in share price this week, Spotify's (NYSE:SPOT) stock has been ripping lately. The majority of the gains in May have come from reaction to the streaming service landing an exclusivity agreement for the Joe Rogan Experience. Though the stock has already given a large chunk of those gains back, as of writing, it is still more than 10% above where it was before the Rogan news broke. And while I'm sure the Rogan Rally was an enjoyable elevator ride for bulls, taking profit at this juncture is the wise move at least for the near term.

My personal view of Spotify is that it's an interesting name for a variety of reasons. The core function of the business to this point has been as a music streaming provider. Unsurprisingly, there is a tremendous amount of competition in this space. Much of that competition coming from much bigger companies with diversified revenue buckets. Like other music providers, for the rights to stream music to end users, Spotify pays the owner/artist of the music on a per play basis. As I've stated in other articles, in a direct-to-consumer environment, the owners of the content figure to come out on top. Until recently, the problem for Spotify has been that the core business, striped down, is essentially a middleman in a DTC world. As a streamer, if you don't own the content, you better make a lot of money selling ads. To this point, Spotify does not do that. Just 10% of Spotify's revenue historically comes from the ad-supported segment.

| Revenue (millions) | 2019 | 2018 | 2017 |

| Premium | €6,086 | €4,717 | €3,674 |

| Ad-supported | €678 | €542 | €416 |

| Total | €6,764 | €5,259 | €4,090 |

| % from ad-supported | 10.0% | 10.3% | 10.2% |

Source: Company filing

Maybe of even more interest is the cost of revenue breakout in the company's latest quarterly report. The cost of revenue for the ad-supported segment was actually higher than the revenue for the ad-supported segment. Simply put, ad-supported streamers weren't a profitable customer base in Q1. Figures in millions:

| Q1 2020 | Revenue | Cost of Revenue | Margin |

| Premium | €1,700 | €1,219 | 28.3% |

| Ad-supported | €148 | €157 | (6.1%) |

| Total | €1,848 | €1,376 | 25.5% |

Source: Company filing

The increases in the cost of revenue from the same time period last year were attributed to higher-than-estimate royalty costs and unexpected changes in foreign exchange rates. Spotify's volatility in ad revenue and dependency on licensed content are likely key reasons why the company has taken such large strides to inject podcasting into the business. Before Rogan, Spotify spent just under $200 million to buy The Ringer and nearly $400 million combined to buy a handful of other podcasting entities. The point is the pivot to podcasting is very clearly of significant importance to Spotify's future plans.

The Coronavirus Consumption Surge

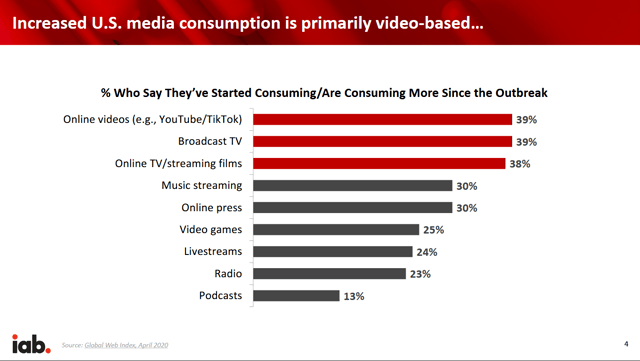

Media consumption has taken off as more people have been sheltering in their homes to avoid COVID-19. The good news for Spotify is music streaming has seen one of the largest jumps in usage at 30%.

Though music streaming is a big winner here, despite certainly being a part of that consumption surge, podcasting growth has lagged just about every other medium with just a 13% bump. A lag in podcast usage is something the company seemed to corroborate recently as commuter listening has been disrupted by the remote work movement.

It's clear from our data that morning routines have changed significantly. Every day now looks like the weekend. This trend was seen more significantly in Podcasts than in Music, likely due to the fact that Car and Commute use cases have changed quite dramatically.

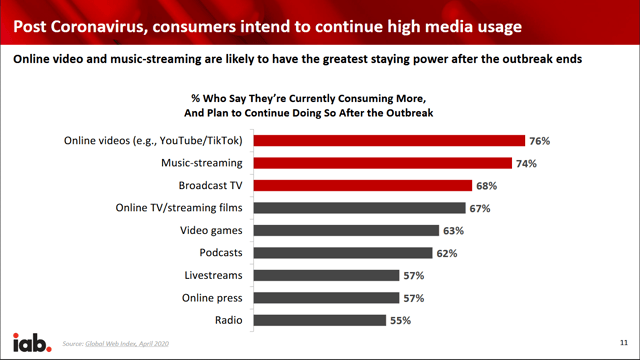

Despite podcasting lagging music growth, the good news is the April study from Global Web Index projects both music streaming and podcasting to hang onto more than half of their consumption boosts following the pandemic. Music streaming specifically is projected to hold 74% of the COVID-19 lift.

Podcasting isn't too far behind that with 62% planning to continue consumption. This intention information is important insight into what we can expect when things return to normal. While intention and actual behavior are not synonymous, it's the best we have to go off when trying to make guesses about where the consumer intends to continue spending time. Furthermore, it's a half decent look at how much staying power user growth may have beyond late-first and early-second quarter numbers.

User Growth Is Strong, But Potentially Misleading

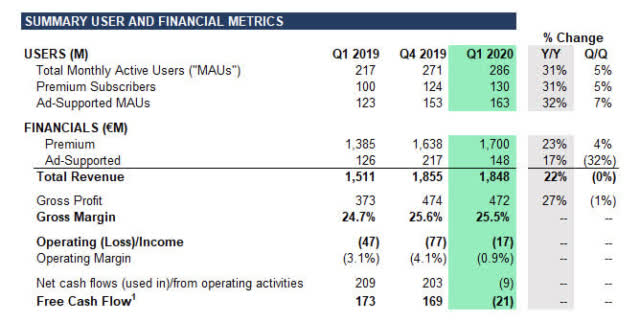

While many streaming services may tout reach or active users, Spotify uses "Monthly Active Users," or MAUs, as a key performance indicator. A quick glance at Spotify's most recent reported quarter shows massive 31% growth in total MAUs over the same quarter from 2019.

Source: Businesswire

Spotify's MAU number is a combination of the 130 million premium subscribers and the remaining free, ad-supported users who have "consumed content for greater than zero milliseconds in the last thirty days from the period-end indicated." Zero milliseconds being the barometer leaves a bit of ambiguity as to just how engaged the ad-supported users actually are. Because of this, I view premium subscribers as the more important number. But even there I'm a little cautious about how I view some of the figures based on how they're defined by Spotify.

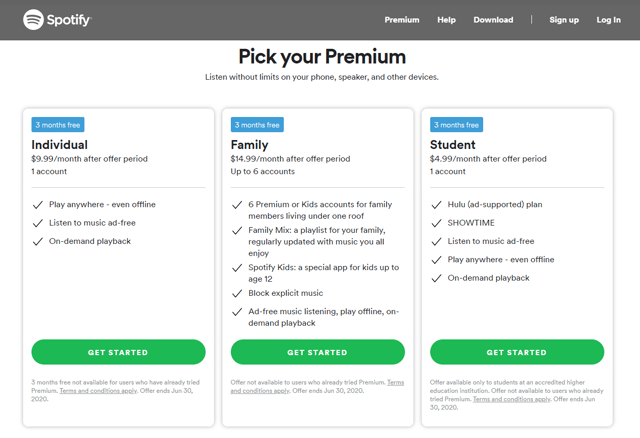

We define Premium Subscribers as users that have completed registration with Spotify and have activated a payment method for Premium Service. Our Premium Subscribers include all registered accounts in our Family Plan and Duo Plan. Our Family Plan consists of one primary subscriber and up to five additional sub-accounts, allowing up to six Premium Subscribers per Family Plan Subscription.

This is important because of the pricing of the plans. A family plan subscription will set a household back $15 per month while the individual option is just $10. It only takes three users on a family plan to throw off potential revenue projections for analysts. Three "subscribers" on one family account provide half the monthly revenue of three subscribers on individual accounts. This isn't a problem as long as the growth in the platform is coming from more individual subscribers. According to the company, that isn't the case.

The Family Plan was a meaningful contributor of total gross added Premium Subscribers, while our free trial offers and global campaigns also accounted for a significant portion of gross added Premium Subscribers.

The free trials are also of some importance as the current offer is now three months of the service on the house. This is a fresh offer that lasts through the end of June.

Source: Spotify

Given that family plans and free trials were a significant portion of user growth, it's no wonder that average revenue per user declined 6% in the latest quarter over the previous year. I don't think investors can reasonably expect a significant move back up in ARPU as true churn numbers from this latest offer likely won't be known until the company reports its third-quarter results later this year. Put simply, you have to take all of the subscriber numbers with a huge grain of salt going forward.

Reading the chart

I'm not a day trader and my technical analysis is intermediate at best. Having said that, I see a stock that rose too high too fast.

I see a stock that trades inverse to the traditional rules of the 50- and 200-day moving average crosses. Having just made another golden cross, the top could be in for the time being. I also see a stock that was more overbought on a daily RSI-14 seven days ago than it has been at any other point in its trading history. I could certainly be wrong and I have missed many trades in the past by waiting for a better entry, but on this one, I see a test of sub-$160 per share coming and potentially within the next few sessions.

Conclusion

I'm not against Spotify as a long-term investment by any means. I actually think the transition to podcasting makes a lot of sense for the company. It's a gamble, but it's one that I tend to lean could pay off down the line. From a consumer perspective, I like the idea of streaming all of my podcasts and favorite albums in the same app. There are numerous other articles on Seeking Alpha that focus on the potential for podcasting revenue growth in the years ahead and I'd recommend looking into those if you want to get an idea of what the market is for that part of the business. Beyond that, subscriber churn figures will be key to determining if I am to take a position later this year. Until then, the stock is due for a pullback.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not a professional investment advisor. Make your own decisions when allocating your investment capital.