J. C. Penney Goes Bankrupt With No Recovery For Shareholders

by Elephant AnalyticsSummary

- J. C. Penney filed for bankruptcy and its restructuring support agreement includes no recovery for shareholders.

- It plans to split into a REIT and an operating retail company. It may liquidate if it can't secure financing or agreement on its business plan.

- J. C. Penney's online sales were down noticeably in April, very different from its department store peers. Other department stores registered strong online sales growth.

- This has put J. C. Penney's net sales down around 20% worse than its peers and may indicate that J. C. Penney's sales recovery will end up being considerably slower than its peers.

- A lagging sales recovery increases the chances of J. C. Penney liquidating.

I've written about J. C. Penney (OTCPK:JCPNQ) extensively over the years. Its path to survival was tough, likely requiring +2% or +3% comps in 2021 and 2022 even before the COVID-19 crisis hit it. The impact of COVID-19 demolished any chance it had at avoiding bankruptcy.

J. C. Penney is aiming to close around 30% of its stores and go forward with approximately 600 stores. The substantial cash burn it is expected to incur in 2020 and its potentially weaker sales recovery (compared to other department stores) may derail that plan and force it into liquidation.

Restructuring Plan

J. C. Penney's restructuring support agreement provides no recovery for shareholders. Other than that, there are still significant details that need to be worked out.

The plan is currently to split J. C. Penney into a REIT and an operating retail company. Up to 35% of the REIT may be sold to a third-party investor, while the first-lien lenders are to receive combination of take-back debt in the operating retail company and an unknown percentage of equity in the REIT. The details around what the unsecured notes and second-lien notes may get do not appear to be fleshed out yet.

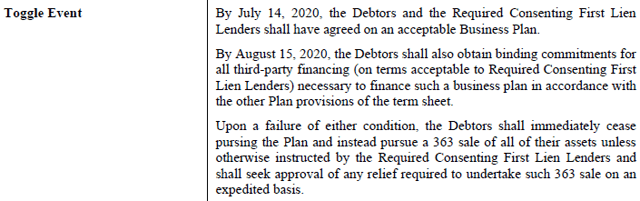

I believe there is a significant chance that J. C. Penney ends up liquidating and selling all its assets as WYCO Researcher had discussed as a possibility. J. C. Penney's current restructuring plan requires agreement on an acceptable business plan and binding commitments for financing.

Source: (Docket 25)

A sales recovery (as it reopens stores) that is considered too slow could derail potential financing and agreement on a business plan.

J. C. Penney's Potential Business Plan

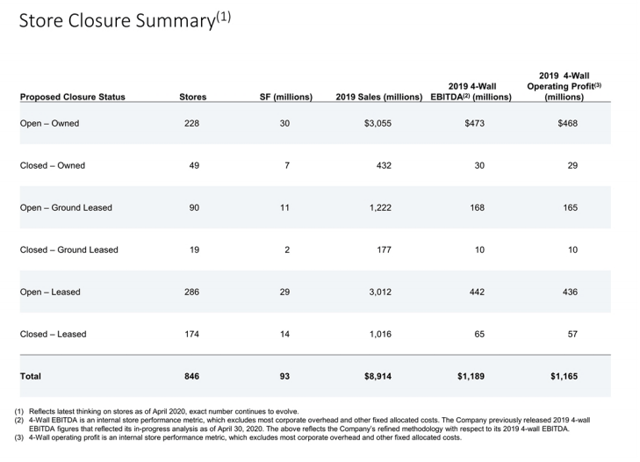

J. C. Penney is contemplating closing around 29% of its 846 stores, leaving it with 604 stores going forward. The closed stores represent around 18% of its 2019 store revenues and around 9% of its 2019 4-Wall EBITDA.

Source: J. C. Penney

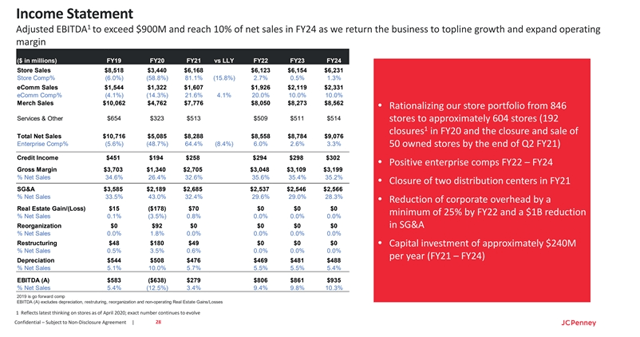

J. C. Penney's estimate that store sales will end up down -59% in 2020 seems pretty reasonable, and perhaps even somewhat conservative. Other department stores seem to be doing around 50% to 60% of normal business for re-opened stores and this should improve over time. J. C. Penney's estimated 2020 EBITDA would end up at negative $638 million in this scenario with -59% sales.

Source: J. C. Penney

J. C. Penney's 2021 sales estimates look more difficult to achieve. It is modeling go-forward store sales being down -11% versus 2019, while online sales are up +4%. This would result in total sales being down -8% versus 2019.

Fitch was assuming that J. C. Penney's sales (prior to its store closing plans) would be down -20% in 2021 versus 2019, compared to around -10% to -15% for its peers. J. C. Penney's online sales performance during the store closures suggests that performance gap versus peers may be warranted. At -8% total sales compared to 2019, J. C. Penney expects to deliver $279 million EBITDA in 2021. A performance that is 10% worse than that (at -18%) could push J. C. Penney's 2021 EBITDA down to around zero.

Weak Online Sales Performance

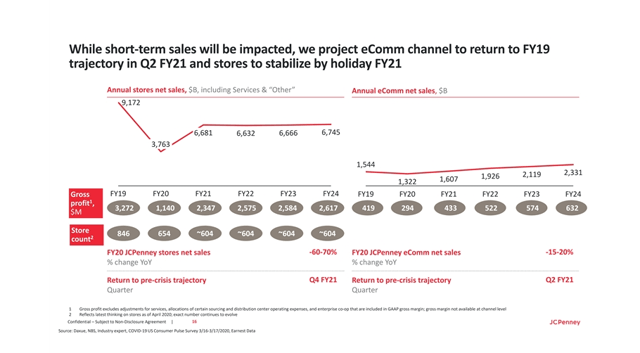

J. C. Penney mentioned (in Docket 25, which was linked earlier) that around 85% of its sales come from brick and mortar stores. It also mentioned that its net sales were down around 88% in April when all its stores were closed for the entire month. This suggests that online sales were potentially down around -20% in April.

The weak online sales performance is also reflected in J. C. Penney's estimate that its eCommerce sales will be down -15% to -20% in 2020.

Source: J. C. Penney

This compares poorly to other department stores. Kohl's (NYSE:KSS) mentioned that its online sales were up around +60% in April, which would result in its net sales being down around -66% for April. Macy's (NYSE:M) digital sales were apparently up around +80% during the first part of May.

J. C. Penney's inability to generate positive online sales results when its stores are closed bodes poorly for its results as its stores begin to reopen. J. C. Penney's customers may have been particularly affected by the economic effects of the COVID-19 crisis and/or consider J. C. Penney a relatively low priority shopping destination.

Conclusion

J. C. Penney's online sales performance during the store closure period was alarming. I was expecting online sales to be positive, to at least make up a small proportion of its overall sales loss. Instead, J. C. Penney's online sales declined, putting its total sales decline at around 20% worse than its peers. This performance gap indicates that J. C. Penney's customers may be particularly affected by the economic effects of the COVID-19 crisis and/or that its customers have J. C. Penney low down on the shopping priority list.

A relatively slow recovery increases the chances that J. C. Penney liquidates during 2020. Even if it does not liquidate during 2020, there continues to be a significant risk that J. C. Penney goes out of business permanently in upcoming years, as there have been a number of retailers that restructured, only to go bankrupt again within a few years.

Free Trial Offer

We are currently offering a free two-week trial to Distressed Value Investing. Join our community to receive exclusive research about various companies and other opportunities along with full access to my portfolio of historic research that now includes over 1,000 reports on over 100 companies.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.