Invesco Mortgage Capital: 3 Preferred Series Yielding Over 10%, Plus 2 Option Trades

by Double Dividend StocksSummary

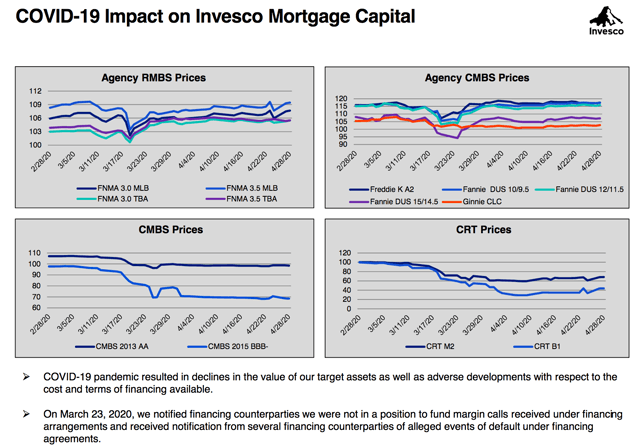

- The mortgage-backed securities market had a crisis in March, with values driven lower, and mREITs crashing in price.

- The Fed came to the rescue, buying billions in mortgage-backed securities from late March onward.

- IVR's price got pounded, as it initially announced it couldn't cover margin calls, and later cut its common dividend, but reinstated its preferreds.

- There's a lot of open interest on IVR's options, with very high yields.

Having trouble sleeping lately? Reading this article may help - it covers the arcane world of mortgage REITs, better known as mREITs; how they are affected by the repo market; what happened to mREITs in March 2020, and how the Fed seems to have saved the day. It's a bit of a dive into a bowl of acronym-laden soup, but we'll try to make some sense of it.

The focus REIT in question is Invesco Mortgage Capital, Inc. (NYSE:IVR), which, as an mREIT, primarily focuses on investing in, financing, and managing residential and commercial mortgage-backed securities and other mortgage-related assets.

IVR invests in residential mortgage-backed securities - RMBS - and commercial mortgage-backed securities - CMBS - that are guaranteed by a U.S. government agency or federally chartered corporation. It also invests in non-government agency RMBS and CMBS, credit risk transfer securities - CRTs - that are unsecured obligations issued by government-sponsored enterprises (GSEs) such as Fanny Mae and Freddy Mac; residential and commercial mortgage loans; and other real estate-related financing arrangements.

IVR's Operations

IVR funds its purchases of RMBS and CMBS and CRTs through the use of repurchase - REPO - agreements. Repurchase agreements are treated as collateralized financing transactions and are carried at their contractual amounts, including accrued interest, as specified in the respective agreements.

IVR records the mortgage-backed and credit risk transfer securities as assets, and the related repurchase agreement financing as liabilities on a gross basis in its consolidated balance sheets. It lists the corresponding interest income and interest expense on a gross basis in its consolidated statements of operations.

IVR also has a wholly-owned subsidiary, IAS Services LLC, which is a member of the Federal Home Loan Bank of Indianapolis ("FHLBI"). As a member of the FHLBI, IAS Services LLC has borrowed funds from the FHLBI in the form of secured advances. FHLBI advances are treated as secured financing transactions and are carried at their contractual amounts.

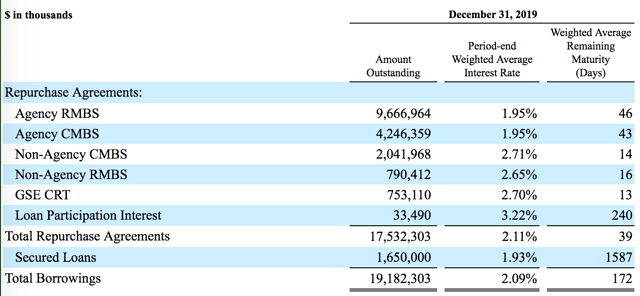

As of 12/31/19, IVR had $17.5B in borrowings on RMBS, CMBS, and GSE CRT securities, plus $1.65B on its secured loans, on a total mortgage-backed and credit risk transfer securities asset base of $21.77B:

(IVR 2019 10-K)

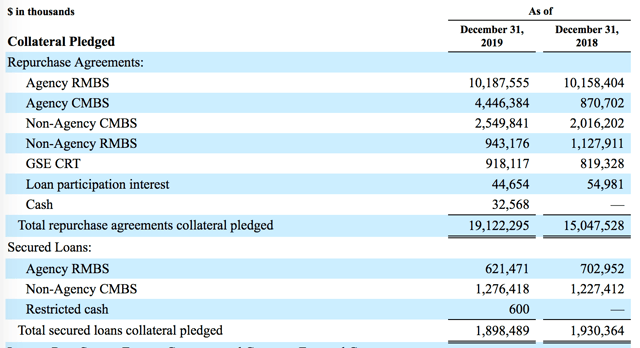

IVR pledged a total of $19.12B in collateral for the RMBS, CMBS, and CRTs, plus ~$1.9B for the secured loans:

(IVR 2019 10-K)

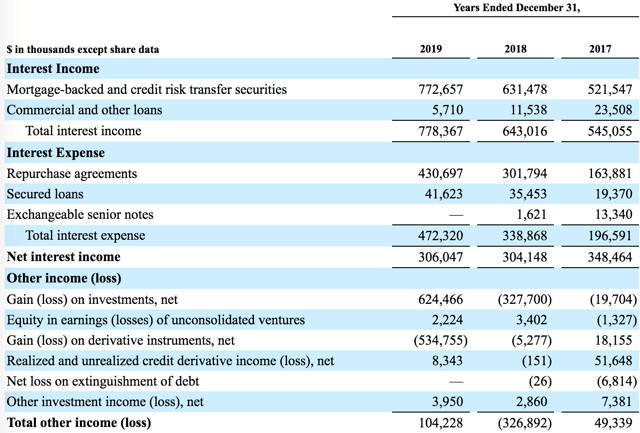

In 2019, IVR earned $778M in interest income from its holdings and paid $472M in interest on them, resulting in net interest income of $306M, which was remarkably similar to its 2018 net interest income of $304M.

It also earned $104M in other income in 2019, mainly via investment gains, vs. losing -$327M in 2018 in other income:

(IVR 2019 10-K)

The Repo Market

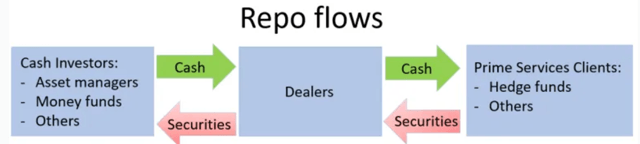

"The repo market is basically a 2-way intersection, with cash on one side and Treasury securities on the other side, with both trying to get to the other side. One firm sells securities to a second institution and agrees to purchase back those assets for a higher price by a certain date, typically overnight. The contract those two parties draw up is known as a repo. Essentially, it's a short-term collateralized loan. And just as most loans come with an interest payment, you can think of the difference between the original price and the second, higher price, as the 'interest' paid on that loan. It's also known as 'the repo rate.' Why would two parties want to participate in a process as antiquated as the repo market? Because it ultimately benefits them. Financial firms with large pools of cash would prefer to not just let that money sit around - it doesn't collect interest, meaning it doesn't make any money. On the other side, it allows financial institutions to borrow cheaply to fund short-term needs. There's also (typically) not much risk involved for either party. - Source

(Source)

So, there's (typically) not much risk involved for either party - the word "typically" first flew out the window back in the fall of 2019, when a technical timing issue caused the Fed to jump in and pump billions into the repo market. Things got back to normal...until they didn't, in March 2020.

Remember that tidy little $19.12B that IVR pledged in collateral for its RMBS, CMBS, and CRTs, plus ~$1.9B for the secured loans?

In March 2020, that collateral took a big markdown, and IVR announced that "in recent weeks, due to the turmoil in the financial markets resulting from the global pandemic of the COVID-19 virus, the Company and its subsidiaries have received an unusually high number of margin calls from financing counterparties."

"Through Friday, March 20, 2020, the Company had timely met all margin calls received. However, on Monday afternoon, March 23, 2020, the Company notified its financing counterparties that it was not in a position to fund the margin calls that it received on March 23, 2020, and that the Company did not expect to be in a position to fund the anticipated volume of future margin calls under its financing arrangements in the near term as a result of market disruptions created by the COVID-19 pandemic." (IVR site)

(IVR site)

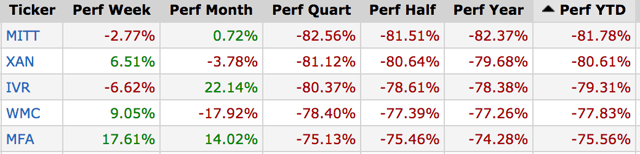

Several other REITs also had margin call issues, with the result that mREIT common shares got slammed. Here are the five biggest losers so far in 2020, with IVR coming in 3rd:

(Source)

The Fed Comes To The Rescue

After the repo market bloodbath, the Fed stepped in with a bazooka and said that it would not put a cap on its purchases of Treasury and mortgage securities. It also said that it would begin purchasing CMBS that are issued by the GSEs, keeping the flow of capital to apartment buildings open. This is the first time in history that the Fed's Open Market Operations has purchased agency multifamily CMBS.

"The Federal Reserve is projected to have purchased $3.5 trillion in government securities by the end of 2020 with newly created dollars." (Source)

"Gee Wally, that's a scary number, $3.5 trillion in newly created dollars."

"That's OK, Beav, you see, the US is still the world's reserve currency - it gives us a big edge in printing our way out of debt."

Wally is right, as ex-Fed chief Greenspan once explained - there's zero chance that US debt won't be paid, since we can't print more dollars.

However, future generations better keep an eye on that status, because if the US dollar someday is ousted as the world's reserve currency, and we still have mountains of debt from this or some other crisis, something not so nice will "hit the fan".

May 11th Update

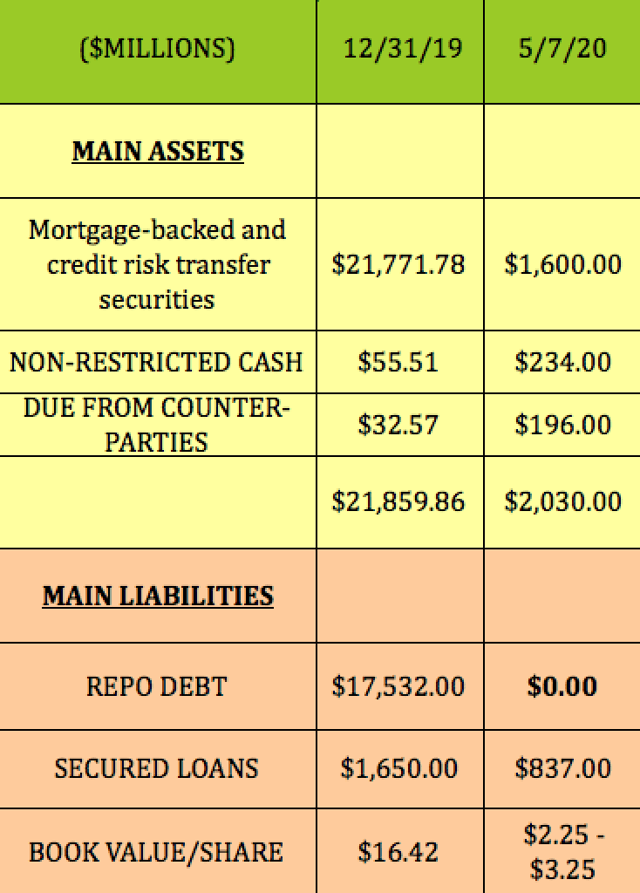

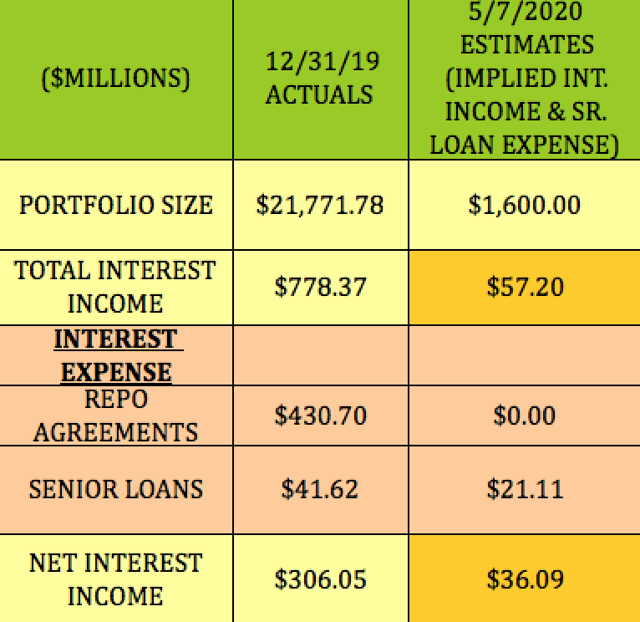

IVR's management did an initial progress report on April 15th and then another one on May 11th. It hasn't yet released its Q1 '20 earnings, but we took the figures from its May 7th release, and cobbled together some comps, in order to get a rough idea of how things stand. The 12/31/19 figures are actual, and some of the 5/7/20 figures are implied.

The company reported that it had paid off all $17.5B of its repo debt and that its senior loan debt now stood at $837M.

It also reported that its investment portfolio stood at $1.6B, with an additional $234M of non-restricted cash, and $196M due from the counterparties who had sold IVR's collateral during those nasty margin calls. They estimated that IVR's book value/share was now in a range of $2.25 to $3.25 vs. $16.41 at 12/31/19.

We won't get a true fix on that figure until IVR releases its Q1 '20 earnings report, which is yet to be announced:

That drop in assets is extreme - that $2.03B figure is ~9.3% of the 12/31/19 total for these main assets for IVR.

Fortunately, IVR's main liabilities dropped as well - $17.5B in repo debt is now zero, and only a "mere" $837M in secured loans left vs. a main liabilities total of $19.18B on 12/31/19:

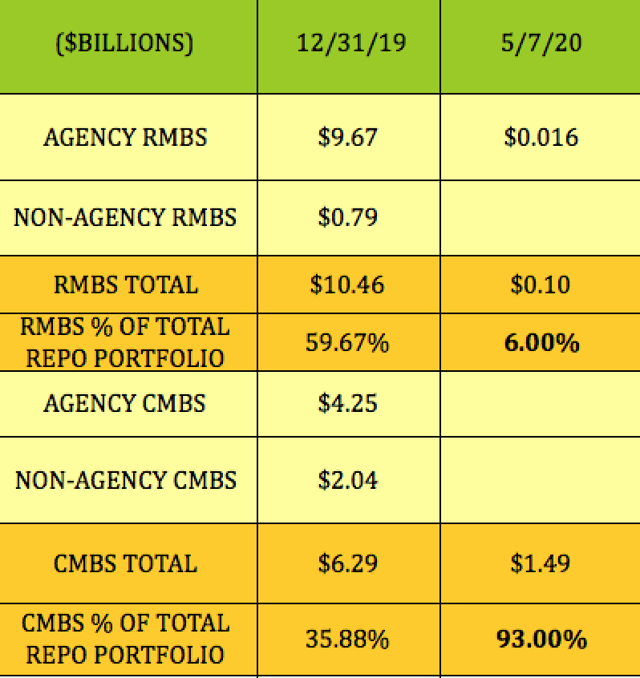

Management went on to detail its current holdings on the May 11th release, which showed a major shift to CMBS, away from RMBS. The CMBS is now 93% or IVR's holdings vs. 36% as of 12/31/19. The RMBS total, formerly 60%, shrank to just 6%, with the final 1% in agency RMBS:

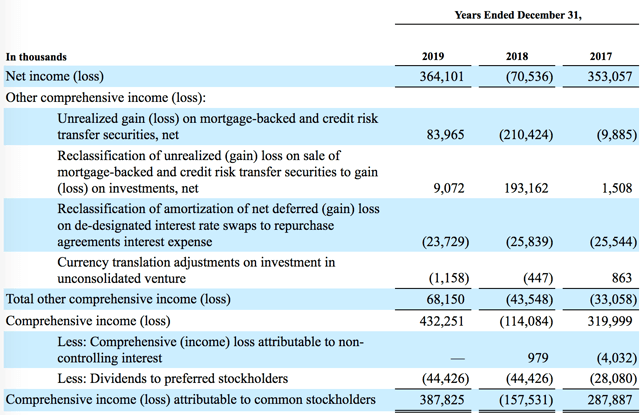

In 2019, IVR earned comprehensive income of $432M, which covered its $44.4M in preferred dividends by a factor of 9.73X. 2018 was dud in this respect, with net income of -$70M and comprehensive income of -$114M, while 2017 had a preferred coverage factor of 11.4X:

(IVR 10-K)

OK, but can it still make dollars now with such a smaller asset base?

These are very rough implied figures for total interest income and net interest income, and we pro-rated IVR's total interest income using the same % as it earned on its 2019 asset base in addition to pro-rating its senior loan interest costs via the same method. Management supplied the $1.6B portfolio size figure on May 7th.

Based solely on these guesstimates, it looks like IVR could potentially earn ~$57M in total annual interest income on a $1.6B portfolio, with annual net interest income totaling somewhere around ~$36M. Keep in mind that the portfolio total value is in flux and could be a lot different than $1.6B when IVR does report its earnings or gives a further update.

It also has $234M of unrestricted cash and $196M due from counter-parties from the sale of their collateral, so it may be able to borrow against those assets in order to increase its portfolio. It had an asset/liability ratio of ~2.43X, based only on its main assets and liabilities as of 5/7/20.

Clearly, IVR shareholders could use a look-see at a Q1 '20 earnings report, but most likely with things in such flux, management may be moving to get a solid footing from post-Q1 events, before releasing the Q1 report.

Common Dividend

Management initially declared the regular $.50 common quarterly dividend on 3/17/20, but then suspended it and IVR's three preferred dividends. However, it then reversed that decision and paid all 4 dividends, but the common dividends will mostly be comprised of shares of IVR common stock:

"On May 9, 2020, the Company's board of directors approved the payment of the Company's previously declared dividend for the first quarter of 2020 of $0.50 per share of common stock (the 'first quarter dividend'). The first quarter dividend will be paid on June 30, 2020 in a combination of cash and shares of the Company's common stock to stockholders of record as of May 21, 2020. Given the uncertain and rapidly changing financial markets resulting from the COVID-19 pandemic, the Company's board of directors has determined that the cash component of the first quarter dividend (other than cash paid in lieu of fractional shares) will not exceed 10% in the aggregate, or $0.05 per share, with the balance payable in shares of the Company's common stock. This will allow the Company to preserve capital and enhance the Company's financial flexibility. In accordance with the provisions of the applicable IRS Revenue Procedures, stockholders will be asked to make an election to receive the first quarter dividend all in cash or all in shares. To the extent that stockholders elect to receive more than 10% of the aggregate payment in cash, the cash portion of the payment will be prorated." - IVR site

Preferred Dividends

IVR has 3 preferred series - they're all cumulative, which gave investors a lifeline when IVR initially announced that they were suspended. They're also cumulative and senior to the common in a liquidation scenario. Due to the nature of preferred shares accounting, the preferreds have better coverage than the common. However, that coverage factor remains unknown until IVR issues its next earnings release.

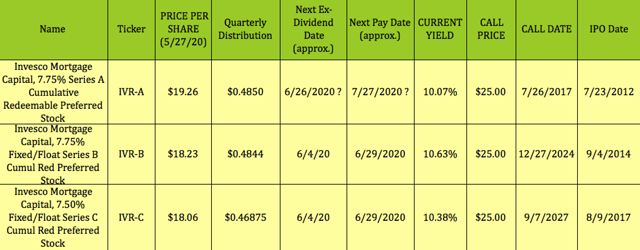

Two of the preferreds are floating rate hybrids: the Invesco Mortgage Capital 7.75% Fixed/Float Series B Cumulative Redeemable Preferred Stock (IVR.PB), and the Invesco Mortgage Capital 7.50% Fixed/Float Series C Cumulative Redeemable Preferred Stock (IVR.PC).

The oldest series, the Invesco Mortgage Capital 7.75% Series A Cumulative Redeemable Preferred Stock A (IVR.PA) shares, are fixed and have already moved past their call date. None of these shares has a maturity date.

On May 9, 2020, IVR's board of directors declared the following cash dividends on Series B and Series C Preferred Stock to its stockholders of record as of June 5, 2020: a Series B Preferred Stock dividend of $0.4844 per share payable on June 29, 2020, and a Series C Preferred Stock dividend of $0.46875 per share payable on June 29, 2020.

It hasn't yet declared the July dividend for the IVR.PA shares, which normally would go ex-dividend on ~6/26/20, but there's still time - it didn't declare this one until June 17th last year.

All three preferreds yield over 10%, with the B shares leading the pack at 10.63%.

The B shares future floating rate will start on 12/27/2024. It'll be based on the three-month LIBOR plus a spread of 5.18%. The C shares future floating rate will start on 9/7/2027; it'll be based on the three-month LIBOR plus a spread of 5.289%. The current three-month LIBOR rate is just .37% vs. 2.52% a year ago. Hmmm, will rates ever be high again, say, in 2027?

Options

As we witnessed in 2008-2009 and again in 2020, companies can and will cut dividends in extreme situations, but there's one payout that they can't cut - options.

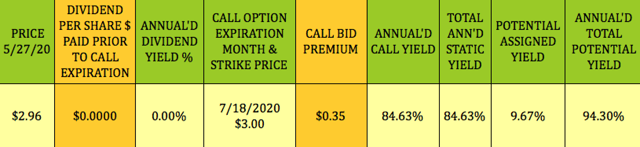

With its very low price/share, IVR has attracted some interest in option trading circles. There's over 2,000 contracts' worth of open interest for the following covered call option trade, and 4,800 for this put contract.

We added this July trade to our Covered Calls table. IVR's $3.00 call strike pays $.35, an 11.7% nominal yield in under two months, or 84.63% annualized.

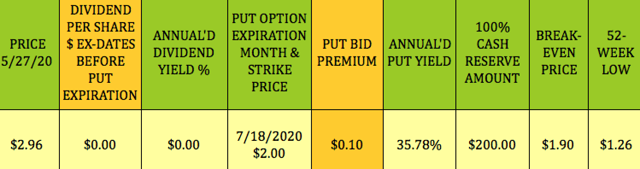

Conversely, if you want to get paid to wait and go for a much lower breakeven, we added this July put-selling trade to our Cash Secured Puts table. IVR's July $2.00 put strike pays $.10 for a 5% nominal yield in under two months, or 35.78% annualized.

Note: We use annualized yields in our options table solely so users can compare trades of differing lengths. Put sellers don't receive dividends.

We're guessing that there may be some veterans of the repo and mREIT world out there who can offer some additional insight in the comments section. That'd be appreciated.

All tables furnished by DoubleDividendStocks.com unless otherwise noted.

Our Marketplace service, Hidden Dividend Stocks Plus, focuses on undercovered, undervalued income vehicles, and special high yield situations.

We scour the US and world markets to find solid income opportunities with dividend yields ranging from 5% to 10%-plus, backed by strong earnings.

We publish exclusive articles each week with investing ideas for the HDS+ site that you won't see anywhere else.

We offer a wide range of income vehicles, some of which are also below their buyout prices.

Disclosure: I am/we are long IVR.PA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Our DoubleDividendStocks.com service features options selling for dividend stocks.

It's a separate service from our Seeking Alpha Hidden Dividend Stocks Plus service.

Disclaimer: This article was written for informational purposes only, and is not intended as personal investment advice. Please practice due diligence before investing in any investment vehicle mentioned in this article.