Elon Musk Awarded $800 Million For Doing His Job

He might seem crazy, but he knows what he's doing.

by Michael ButlerElon Musk has taken Tesla, the world's largest electric vehicle manufacturer, for a wild ride in the last couple of months. The revelation that he will be selling off all his possessions and major announcements regarding the upcoming Cybertruck has sent Tesla stocks on a winding road that has investors worried. But the latest news might settle the dust for a while until Musk decides to give away Tesla cars for free, or something equally ridiculous.

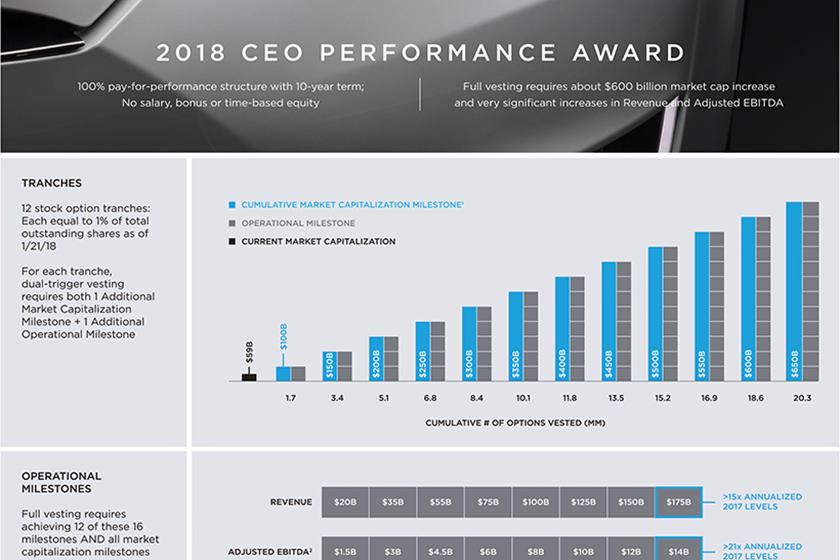

Tesla's massive $800 million CEO compensation plan has been vested and is linked to a serious increase in revenue, adjusted EBITDA, and an increase in Tesla's market valuation. And all this from a CEO who doesn't accept a single cent as salary payment (not that he needs the money anyway).

Elon Musk isn't being left completely dry, however: for every $50 billion increase in market capitalization, he receives around 1.69 million shares in the Californian based company at a set price of $350 a share. The good news for all involved is that it seems as if Tesla has checked off all the boxes for the first tranche to invest.

According to Tesla's 2020 shareholder's meeting, the 2018 CEO Performance Award vests upon the full achievement of specific milestones, making it even more challenging for Musk to realize value from such increases. "As of the date of this proxy statement, one of the 12 tranches under this award has vested and become exercisable, subject to Mr. Musk's payment of the exercise price of $350.02 per share," the statement reads.

The latest closing evaluation of $805 per share means that the first tranche is worth around $1.36 billion. When Must exercises his options at $350 per share, it will leave him with an income before taxes of $768.5 million. That's enough money to buy nearly 170 Rolls Royce Phantoms.

Musk will be forced to hold these shares for a minimum of five years after he exercises the options, after which he will be liable to pay any taxes on the gains. Historically, Musk has opted to borrow against his shares to pay his taxes, but those taxes have never been near as much as he will owe once he exercises these new shares. Tough life.