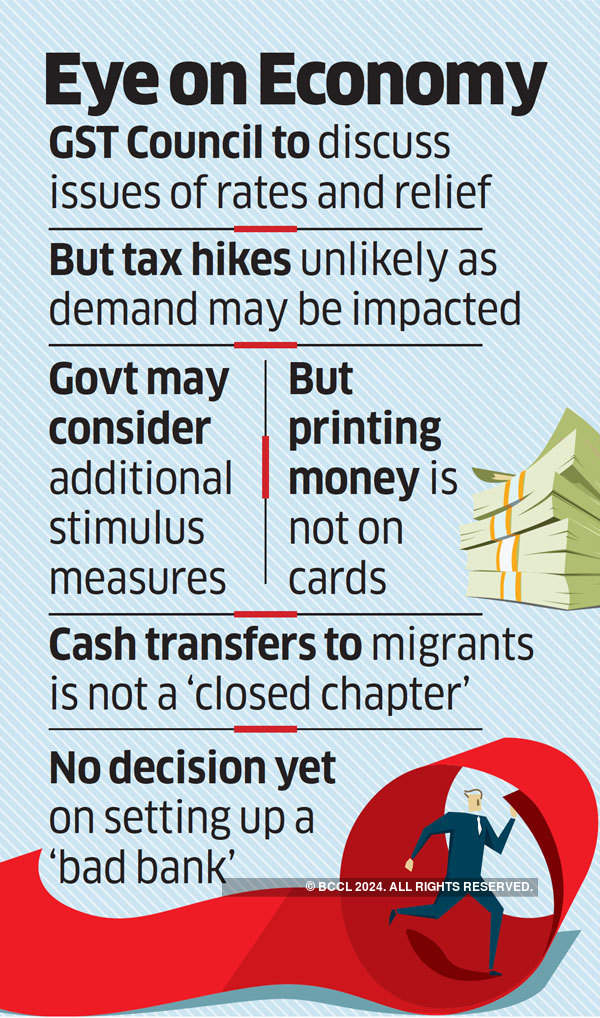

Hike in GST rates unlikely

If goods and services tax (GST) rates are increased on non-essential items, sources said it will further bring down their demand and impede the overall economic recovery.

by ET Bureau

New Delhi: India is unlikely to hike goods and services tax (GST) rates to shore up revenue, which has slumped because of Covid-19 and lockdown, a top government official said, while adding that the Centre could announce more measures to help revive the economy. The GST Council, the key decision-making body for the indirect tax, is to meet next month.

Economic activity was picking up as lockdown restrictions have been eased this month, with manufacturing having been restored to about 35% of pre-Covid levels, the official added. The possibility of additional stimulus measures was “not a closed chapter,” the official said suggesting the government will consider further steps if needed. The official was responding to criticism of the ₹20 lakh crore stimulus programme for not doing enough to revive the economy.

‘Demand Needs to be Induced’

The government has not considered monetisation of its fiscal deficit, the official said. There have been demands that government provide a bigger stimulus by doing this, essentially printing more money to finance spending.

There have also been suggestions that an additional cess be imposed on certain non-essential items to raise tax revenue, which has taken a hit because of the lockdown. The government is worried higher taxes will impact demand just as the economy is emerging from a two-month shutdown.

“Demand for all goods needs to be induced... The issue on rates and relief will be decided by the GST Council that is meeting next month,” the official said.

While acknowledging labour constraints, the official said some enterprises had begun to recast their businesses to employ local workers.

India imposed a nationwide lockdown on March 25 to contain the spread of Covid-19, prompting workers who had suddenly lost their livelihoods to leave for home, resulting in a mass reverse-migration. The lockdown has dented economic activity with State Bank of India research estimating a GDP contraction of over 40% in the April-June quarter.

CASH TRANSFER

Asked about cash transfers to migrants, the official said: “It is not a closed chapter.”

The Rs 20-lakh crore Atmanirbhar Bharat Abhiyaan was formulated after extensive consultations with industry, the Prime Minister’s Economic Advisory Council, various ministries and departments.

“It was not prepared by the finance ministry or Prime Minister’s Office (PMO) in isolation… It is a product of extensive consultations,” the official said.

The package has been criticised for not doing enough to lift demand. Experts have pegged the total fiscal stimulus at about 1% of GDP as most measures dealt with liquidity and credit flow.

The government is keeping close tabs on lending to the industry, the official said. While sanctions have been substantive, disbursements have been held back by public sector banks at the behest of industry.

MONETISATION, BAD BANK

Monetisation was not considered as an option. “We have not gone there… At this stage we have not done it and (are) not taking a call on it now,” the official said. Asked if it could happen in the future, the official said: “We will cross the bridge when we get there.”

The official said the Financial Sector Development Council (FSDC), which met on Thursday, discussed measures to provide liquidity in the equity markets to domestic as well as international investors. The FSDC also discussed a so-called bad bank, to take over banks’ bad debt, the official said, adding, “There is no decision on it.”

The State Bank of India has suggested a government-sponsored bad bank as non-performing assets are expected to rise in the wake of the Covid-19 crisis.

The government has not decided on curbs on foreign portfolio investment (FPI) from China and Hong Kong, the official said. India had last month made prior government clearance mandatory for all foreign direct investments from countries sharing a land border with it, including China.