Coca-Cola Hellenic Bottling Company: Revenue Growth With Margin Expansion

by Risk Research IncSummary

- Coca-Cola Hellenic Bottling Company is the fifth-largest Coca-Cola bottler by revenue and third largest by volume.

- The company operates under a 10-year agreement with The Coca-Cola Company, allowing it to distribute, sell and produce beverages in specified countries. The current agreement runs until 2023.

- CCHGY’s markets are Central and Eastern Europe, and Nigeria. The top five countries contribute over 60% of total volumes and Russia is the largest single market.

- Sparkling soft drinks make up 71% of total revenues. Coffee and energy drinks are some of the key growth categories for the company, and currently represent 5% and 3% of revenues, respectively.

This article was written by Artem Gramma in collaboration with Risk Research Inc.

Introduction

We study the top one percent of US public companies in terms of ability to compound free cash flow, generate a high and consistent return on assets and operate with little or no debt. Currently, thirty-nine companies qualify. We call them the Quality Compounders.

A central premise of our methodology is that over time, quarterly free cash flow growth closely resembles the three-quarter simple moving average of the stock price. The variations from that moving average represent buy and sell opportunities (buy at historically low relationships to the moving average, sell at high prices relative to the moving average).

To capitalize on these fluctuations we’ve created a software that compares the daily high lows to the moving averages over the last thirteen years, and identifies prices that have, on average, generated returns in excess of twenty percent a year, in some cases significantly in excess of twenty percent a year. The software is programmed to find the one or two prices a year that represent the optimum combination of price and likelihood that the price will be reached, although in some cases it finds more and, in some cases, less.

This analysis indicates that Coca-Cola Hellenic Bottling Company (OTCPK:CCHGY) is a buy below $17.25, or 31% below the May 27, 2020 price of $25.13. It last traded at that price in March. The indicated sell price is anything over $33.75.

Business description

CCHGY sells non-alcoholic ready-to-drink beverages (NARTDs) in Central and Eastern Europe, and in Nigeria. The company has a dominant market position across its geographies. The management has a strong operating track record with double-digit EPS growth and margin expansion. CCHGY’s recent profitability is significantly above the ten-year average. Margin and revenue growth trends are also positive. Operating expenses have come down substantially since 2015. Despite COVID-19 and the special dividend paid in July 2019, the balance sheet remains strong.

CCHGY’s total volume in 2019 was over 7% of the Coca-Cola Company’s (NYSE:KO) volumes worldwide. The company owns 52 bottling plants and 148 distribution centers and warehouses. It is split into three divisions - Established Markets, Developing Markets and Emerging Markets.

| Established Markets | Developing Markets | Emerging Markets |

| Austria, Cyprus, Greece, Italy, Northern Ireland, Republic of Ireland, Switzerland | Czech Republic, Croatia, Estonia, Hungary, Latvia, Lithuania, Poland, Slovakia, Slovenia | Armenia, Belarus, Bosnia and Herzegovina, Bulgaria, Moldova, Montenegro, Nigeria, North Macedonia, Romania, Russia, Serbia, Ukraine |

CCHGY enjoys a 40% market share in all of its 28 countries but Slovakia. Local brands typically account for another 40% of the market and PepsiCo (NASDAQ:PEP) the rest.

Operating performance

The pandemic has had an overall negative impact on CCHGY performance. April volumes were down 42% in its established markets and 20% in its emerging markets. On a recent call, management commented on the strong performance in other segments of the portfolio.

In recent years, the company has taken market share from local brands through the optimization of its route-to-market strategy. This trend is further supported by growing income per capita across CCHGY’s markets. Higher incomes tend to benefit global brands, at the expense of more value-oriented local producers. Management recently confirmed the company continued to gain share during the early stages of the COVID-19 pandemic. The company’s entire supply chain remains fully operational.

As a result of progress made over the last few years, management now anticipates currency-neutral revenue growth of 5-6% (previously 4-5%). After delivering revenue growth of 5.9% and 6% in 2017 and 2018, top-line growth slowed to 4.4% in 2019. Management attributed the decline to bad weather during the summer months and the negative impact from the discontinuance of Lavazza coffee. Despite the short-term disruption from the COVID-19 pandemic, the underlying fundamentals remain sound.

Growth drivers

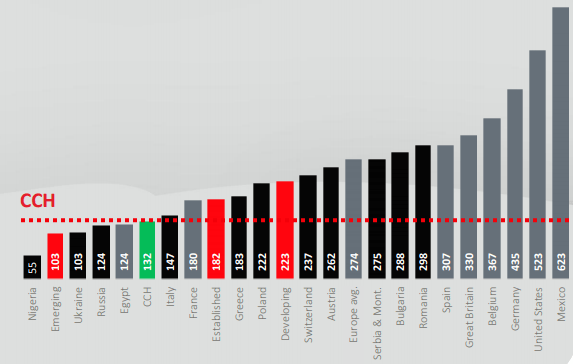

1. Since 2014, CCHGY has delivered consistent growth in annual net revenue in constant currency. Favorable demographics are a key driver of the ongoing revenue and volume growth. The population in CCHGY’s countries is expected to grow by 4.4% between 2019 and 2025. The majority of that growth is expected to come from Nigeria. On top of population growth, many of the company’s markets have low per capita consumption of NARTDs (particularly sparkling soft drinks).

Source: IHS, CCH. Serving is 8oz or 237ml.

2. Product innovation and favorable price mix can drive revenue growth going forward. Historically, CCHGY’s volumes have been skewed towards the slower-growing home channel and, because of that, multi-bottle packages. Shifting the mix towards single-serve packages offers a 1.7x higher price point. Furthermore, plant-based drinks (the AdeZ brand) generate 2x revenue per case than an average NARTD product.

The company’s out-of-home segment offers higher revenue per case and is generally faster-growing. In recent years, CCHGY expanded its presence in this segment and it now contributes over 40% of total group revenues. The recent addition of Costa Coffee will allow CCHGY to further increase its presence in the Hotel/Restaurant/Cafe and Convenience channels. For example, in Greece, CCHGY was able to increase its share of sales to a typical Hotel/Restaurant/Cafe customer from 50% to 75%, once Costa Coffee was added to the offer.

3. Energy drinks and Coca-Cola Zero are key growth engines for the company. Coke Zero has delivered double-digit volume growth in five of the last seven years. The energy drink category has grown by 20%+ in each of the past five years.

Outside of Coke Zero, the low and no sugar segment continues to grow. In 2019, the volumes in the segment grew by 7.3% in the Established Markets and by 9.1% and 80.9% in Developing and Emerging Markets, respectively. In Established Markets, in particular, the light segment makes up around 23% of total volumes sold. Increased consumer demand for healthy beverages and the introduction of sugar taxes are likely to drive volume growth.

Track record

Management has worked to increase warehouse efficiencies and improve distribution. Operating expenses as a percent of revenue are down 210bps since 2015. Improved logistics and reduction in admin costs contributed 160bps, with another 50bps due to the decline in FIFA World Cup marketing expenses in 2019.

The company has reduced the total number of manufacturing plants, particularly in the Emerging Markets segment. Despite growing populations and rising per capita incomes, opportunities for organic revenue growth have been limited. NARTD consumption trends are a challenge. While closing bottling plants, CCHGY has lifted the number of filling lines per plant. This has led to efficiency improvements and higher gross margins.

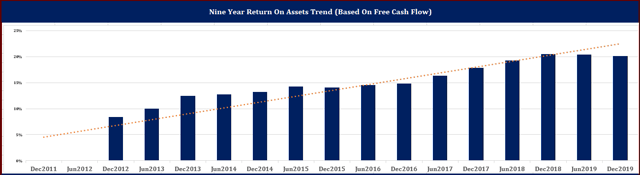

CCHGY’s return on assets rose 12.9% in 2019. Return on assets trend (based on free cash flow) has more than doubled to 20% since 2012. The expansion of the company’s EBIT margin between 2014-2019 contributed to the strong improvement in returns. Return on invested capital (ROIC) is included as a key metric in the annual performance share awards for senior management.

Balance sheet strength

Before 2019, CCHGY was preserving balance sheet capacity for a potential acquisition of The Coca-Cola Company’s 54.5% stake in Coca-Cola Beverages Africa (CCBA). After the CCBA stake was taken off the market, CCHGY paid a large special dividend (2 euros per share) and indicated an interest in making an acquisition funded partially by debt.

There are no debt maturities coming up and the company has access to almost $2 billion of capital through credit facilities. In 2019, the company was able to refinance debt maturities at a lower rate. Since COVID-19, management has announced plans to reduce operating costs by $100 million and capital expenditures by $100 million.

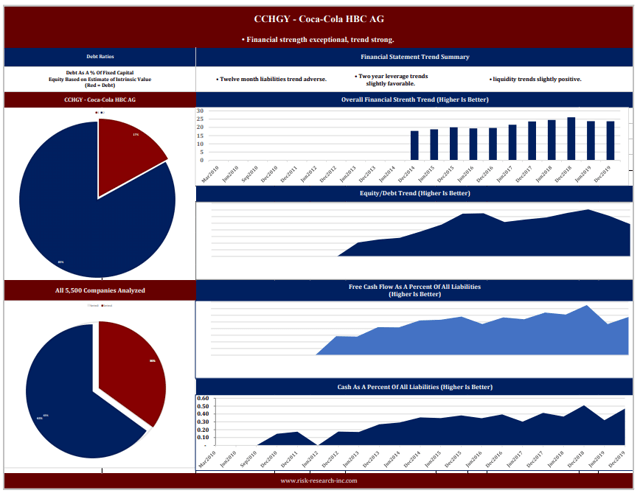

CCHGY’s long-term debt (including current maturities) represented 16% of fixed capital versus 39% for the average public company. It covered interest 16.8 times versus just under three for the average public company. As indicated in the graphs below, the company’s financial strength trends are overall strong, its balance sheet is strong and the company has plenty of liquidity.

Sugar taxes and incidence pricing

In CCHGY’s jurisdictions, sugar taxes have been introduced in Ireland and Hungary. In both countries, the costs have been passed onto the consumers with limited impact on revenue growth. Furthermore, CCHGY’s sparkling business is resilient and there has been a strong acceptance of low/no-sugar variants. Since 2009, sparkling volume growth has only turned negative twice, whereas Waters and Juices volumes were negative in 2009, 2010, 2011, 2012, 2013, 2016 and 2019 (juice only).

Incidence-based pricing is critical to the stability of CCHGY's margins. The Coca-Cola Company provides CCHGY with the concentrate or syrup used to manufacture the drinks. Before incidence pricing, KO charged a fixed price per unit. It benefited only from increased volumes sold by CCHGY. In a rising input cost environment, keeping prices low to maintain volume growth often led to a squeeze of CCHGY's margins. The incidence pricing agreement gives KO a fixed percentage of CCHGY's revenue. The deal better aligns incentives between KO and the bottler. CCHGY's management can now focus on more profitable growth from price/mix strategies. Specifically, improved packaging mix from multi-serve to single-serve and shifting channel mix to the faster-growing out-of-home channel both drive margin expansion.

Conclusion

Despite COVID-19 headwinds, the company’s outlook remains positive. Revenue growth should compound at 5-6%, with margin expansion. The sparkling soft drinks market is resilient to economic shocks. With cost out initiatives underway and a strong balance sheet, the company is in a strong position to gain market share.

The stock is currently trading at $25.13. Our pricing probability analysis indicates that prices of $17.25 would represent attractive pricing. The indicated sell price is anything over $33.75.

New Marketplace Service

On June 1, Risk Research Inc. will launch a new Marketplace service: Quality Compounders.

Quality Compounders will keep investors in the highest quality US companies (highest quality defined as exceptional return on assets, steadily improving free cash flow and little or no debt) aware of probabilities pricing – entry and exit levels that have historically generated returns of at least 20% per annum. This proprietary software calculates probabilities based on daily highs and lows in relation to moving averages over the last thirteen years, or a complete market cycle.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.