3 Recent Catalysts For Bitcoin

by Vincenzo FurcilloSummary

- The first involves Square (SQ), which made recurring Bitcoin purchases available to its Cash App customers.

- The second news involves Shopify (SHOP), which renewed its partnership with CoinPayments, the largest cryptocurrency payment processor.

- Lastly, the third news involves renewed interest and skepticism by institutions such as JPMorgan (JPM), now offering banking services to crypto exchanges, and Goldman Sachs (GS).

Introduction

In the past month, besides the halving event, Bitcoin (BTC-USD) was affected by three material news. The first involves Square (NYSE:SQ), which made recurring Bitcoin purchases available to its Cash App customers. The second news involves Shopify (NYSE:SHOP), which renewed its partnership with CoinPayments, the largest cryptocurrency payment processor. Lastly, the third news involves banks like JPMorgan (NYSE:JPM), now offering banking services to crypto exchanges, and Goldman Sachs (NYSE:GS), which is scheduled to host a client call discussing US economic outlook, inflation, Gold and Bitcoin.

Square and Bitcoin

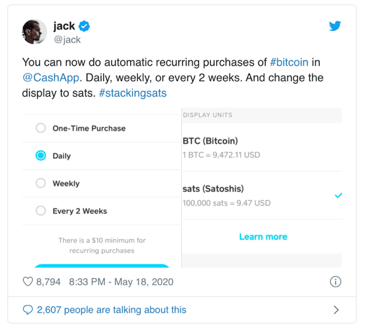

Square's CEO Jack Dorsey has been a well-known proponent of Bitcoin for years. He joined actions to his words when, in 2018, he allowed Bitcoin buying and selling to all users of Cash App. In a recent interview, he praised the Bitcoin whitepaper published in 2008 by Satoshi Nakamoto, describing it as "poetry" and "one of the most seminal works of computer science in the last 20-30 years". So a few days ago, he renewed its faith in the digital currency by unveiling a new Bitcoin automatic purchase feature (Figure 1).

Figure 1 - Source: Twitter

Let's analyze the possible implications of this new feature. Cash App had around 24 million users in Q4 19, up 60% YoY. Projecting the growth into Q1, an adding the pandemic boost, the app is likely to have already surpassed 30 million users.

With Square's Bitcoin revenue at $306 million, fees per user currently amount at 10.2$.

Square charges about 1.5% in fees per transaction, amounting to an average transaction size of $680 per user, and a total volume for the quarter of roughly $20 billion. Considered the Bitcoin's average daily volume is around $30 billion, Cash App is still not a big player in the Bitcoin market. However, the App user base is growing, and the new feature may push interested users into a slow and constant accumulation of the digital currency.

Since the halving, miners selling pressure amounts to 900 Bitcoin per day (6.25 BTC for 144 blocks), currently amounting to roughly $8.1 million. Hypothetically, it would then take only ¼ of Cash App users, purchasing $1 a day, to absorb the whole miners selling pressure.

Should this feature be widely accepted, it could represent a powerful, recurring, buying wall that could significantly contribute to Bitcoin's price appreciation.

Shopify And the Renewed Partnership with CoinPayments

On May 20th, Shopify, the Canadian multinational e-commerce, announced a partnership with CoinPayments. The two parties were previously running a beta trial, which was completed successfully. This partnership will allow Shopify over 1 million merchants to receive payments in digital currencies. The benefits highlighted were a reduction in transaction fees and faster payments. While, currently, the volumes generated by these transactions shouldn't be very high, the successful beta trial shows that digital currencies offer concrete benefits to businesses, and confirm the maturity of the technology supporting these transactions.

JPMorgan Offering Banking Services To Exchanges

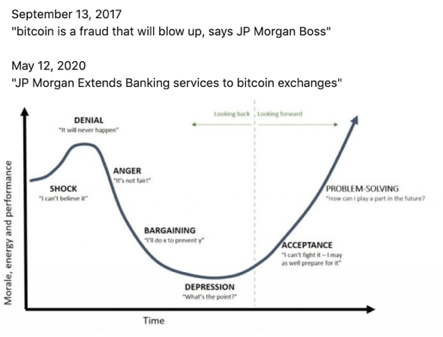

JPMorgan is now offering banking services to cryptocurrency exchanges. This follows Paul Tudor Jones's interest in Bitcoin, and confirms that institutions are slowly starting to accept Bitcoin and digital currencies as plausible assets as a hedge against the government-induces inflation ( you can read more about it here), and as a better way to transfer money.

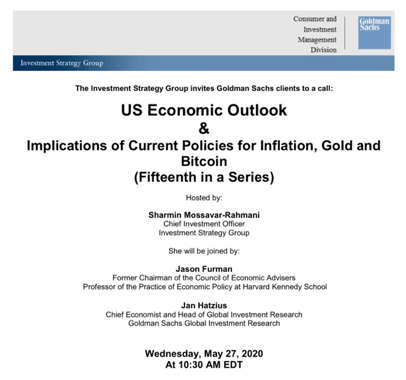

Figure 2 - Source: Twitter

On the other hand, a leaked image of a GS client call (Figure 2) shows that Goldman Sachs is just starting to dip its toes into the implications of inflation and Bitcoin. This indicates that the technology is yet to be fully understood by many and that, on the other hand, institutional money has yet to reach to the digital currencies market.

As per JPMorgan, should other institutions go through the same acceptance process pictured in the figure above (Figure 3), Bitcoin's rise in price could just be getting started.

If you found this article of value, please follow (near the title) and/or press "Like this article" just below.

Disclosure: I am/we are long BTC-USD, SQ, SHOP. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not a financial advisor. All articles are my opinion - they are not suggestions to buy or sell any securities. Perform your own due diligence and consult a financial professional before investing or trading.