Pound Sterling Price News and Forecast: GBP/USD – Falling on Friday? [Video]

by FXStreet TeamGBP/USD: Dollar weakness helps Cable bulls – The rally continues [Video]

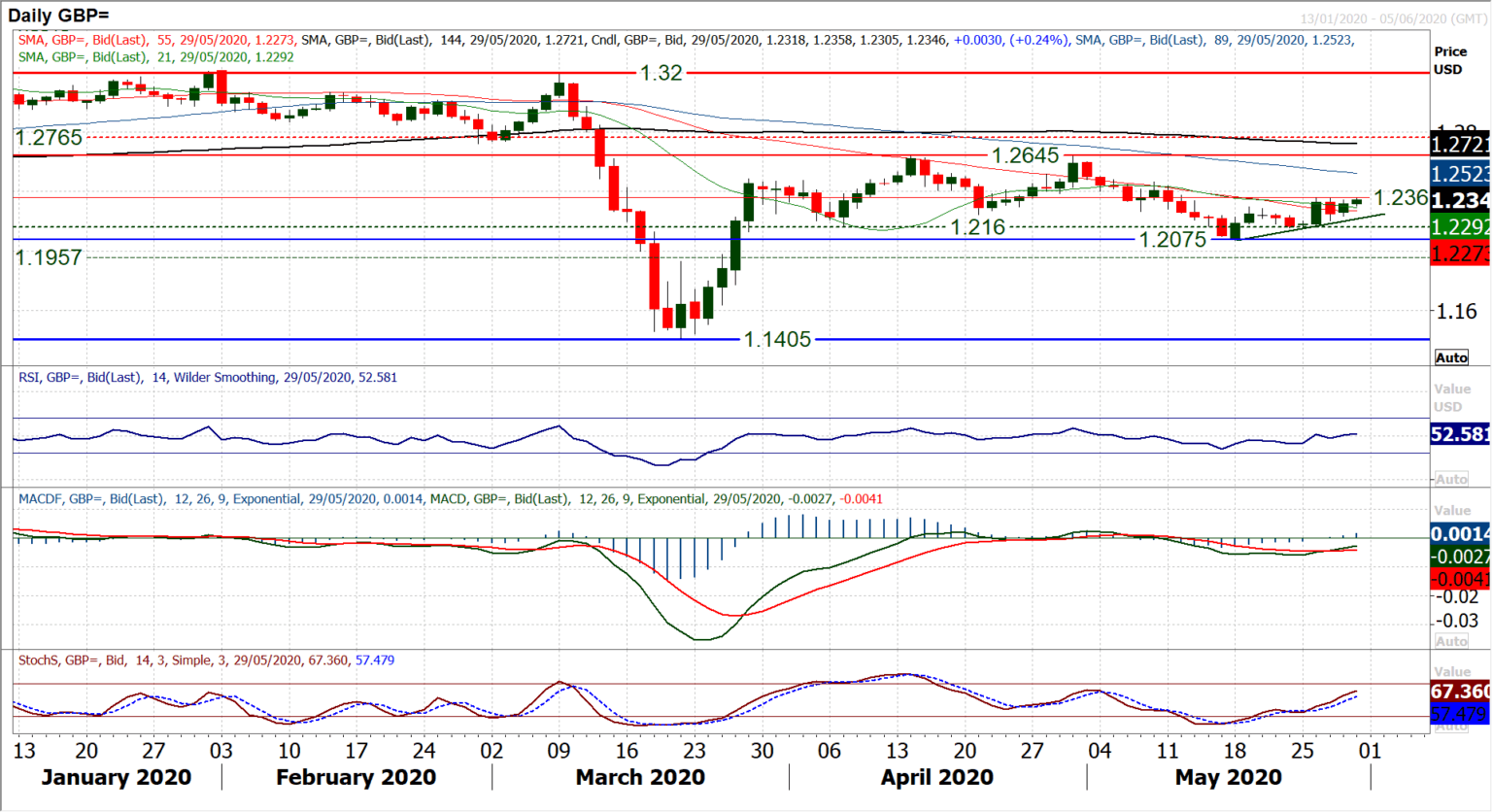

The broad dollar weakness is really helping Cable bulls at the moment, so much so that there is a renewed prospect of continued recovery. In the past couple of weeks, the market has been starting to pick up. Support at $1.2075 seems to now have a higher low at $1.2160 and a mini uptrend recovery is holding. With now three confirmed consecutive higher daily lows (and the prospect of a fourth now today) the market is pressuring recent resistance at $1.2360. Whilst as yet there is still no confirmation of the recovery being the dominant trend, a breakout above $1.2360 would then open a test of resistance at $1.2465 which is the first real lower high. If $1.2465 can be breached then there would be a decisive change in the outlook. Read More...

GBP/USD Forecast: Falling on Friday? Failure to crack critical resistance and geopolitics point down

And then there were six – from Monday, relaxed restrictions will allow groups of six people to meet in England. However, this gradual reopening is of no solace to the pound, which is losing ground against the dollar, yen, and euro.

Brexit uncertainty looms over sterling – no news is bad news in this case. The UK's refusal to extend the transition period beyond year-end – with no deal on future relations in sight – raises the risk of falling back to World Trade Organization rules in 2021. Read More...

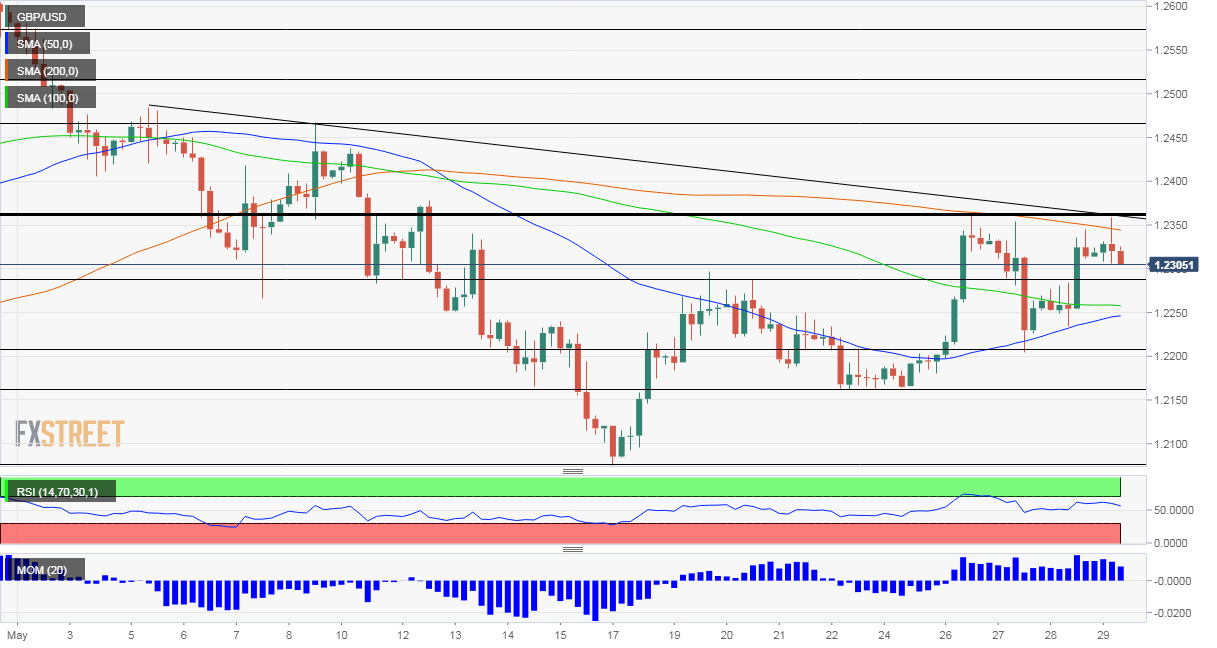

GBP/USD Forecast: Move beyond 1.2365 confluence hurdle to open room for additional gains

The GBP/USD pair regained positive traction on Thursday and reversed a major part of the previous day's negative move. The British pound remained depressed through the first half of Thursday's trading action and was pressured by some dovish comments by the Bank of England (BoE) policymaker Michael Saunders. Speaking about monetary policy, Saunders argued that it was less risky to ease the policy too much in the current environment and also did not rule out the possibility of negative interest rates. This comes on the back of fresh Brexit jitters and took its toll on the sterling, albeit the emergence of some fresh US dollar selling pressure extended some support to the major. Read More...

-637263307127222541-637263474807575294.png)