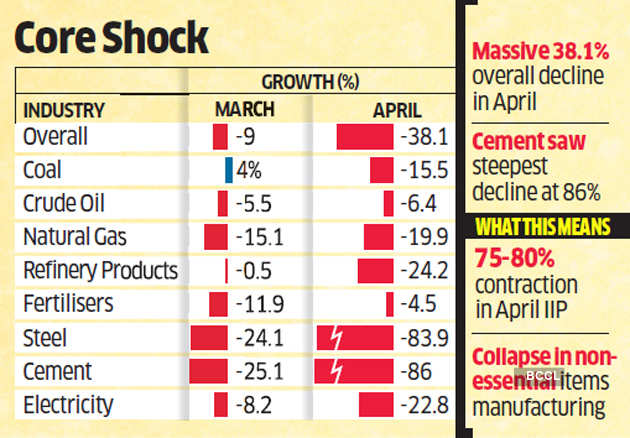

Core sector output contracts 38% in April owing to stalled economic activity

In March, the output of the core sector that includes eight infrastructure sectors — coal, crude oil, natural gas, refinery products, fertiliser, steel, cement, and electricity — had contracted 9%.

by ET Bureau

New Delhi: India’s core sector contracted a record 38% in April as the nationwide lockdown imposed since March 25 impacted all eight infrastructure sectors.

In March, the output of the core sector that includes eight infrastructure sectors — coal, crude oil, natural gas, refinery products, fertiliser, steel, cement, and electricity — had contracted 9%.

“In view of nationwide lockdown during April 2020 due to Covid-19 pandemic, various industries —Coal, Cement, Steel, Natural Gas, Refinery, Crude Oil etc experienced substantial loss of production," the commerce ministry said in a statement Friday.

The eight infrastructure sectors, which comprise 40.27% of the Index of Industrial Production (IIP), had grown 5.2% in April 2019.

“While the lockdown contributed to a broad-based contraction across all the eight core sectors, it had a differential impact on the extent to which activity was curtailed in the various constituents,” said Aditi Nayar, principal economist at ICRA.

The fall of 22.8% in electricity generation showed the sharp decline in industrial production although household consumption was higher than normal.

Labour migration dented mining activity in April - coal output shrank 15.5%. Lower imports of crude oil due to demand coming down meant that refinery products category was affected.

Fertilisers and crude oil production shrank 4.5% and 6.3%, respectively in April.

Given the large weight of core sector in the IIP, economists expect a sharp contraction in industrial output in April.

“This picture would be replicated in May too though not to this extent. IIP growth too would be in a similar range most probably given the high weight of these industries in the index,” said Madan Sabnavis, chief economist at CARE Ratings.